OCBSFFund1qtr2014 copy

... bond and emerging markets have been the beneficiaries of strong inflows while developed market equities have lagged. As a result of the withdrawal of the financial stimulus we saw the trend of flows reverse and this continued during the past quarter with inflows into global equities, specifically de ...

... bond and emerging markets have been the beneficiaries of strong inflows while developed market equities have lagged. As a result of the withdrawal of the financial stimulus we saw the trend of flows reverse and this continued during the past quarter with inflows into global equities, specifically de ...

Understanding the Bond Market

... Understanding the Bond Market Bonds are a well-established asset class holding trillions of dollars globally. Even though they pass for “boring” in the general public and with some novice investors, debt instruments are anything but. When you understand them in more depth, you will gain new insights ...

... Understanding the Bond Market Bonds are a well-established asset class holding trillions of dollars globally. Even though they pass for “boring” in the general public and with some novice investors, debt instruments are anything but. When you understand them in more depth, you will gain new insights ...

Eurizon EasyFund Azioni Strategia Flessibile R

... At least 45% of this Sub-Fund's net assets are invested, directly or through derivatives instruments, in equity and equity-related instruments listed on a regulated market in Europe and/or in the United States of America. Insofar the Sub-Fund's net assets are not invested in equity and equityrelated ...

... At least 45% of this Sub-Fund's net assets are invested, directly or through derivatives instruments, in equity and equity-related instruments listed on a regulated market in Europe and/or in the United States of America. Insofar the Sub-Fund's net assets are not invested in equity and equityrelated ...

9th Annual Korea Institutional Investment Forum 8 September 2015

... One of India’s top investment experts discusses how economic and market reforms and turning around the investment potential for the country. ...

... One of India’s top investment experts discusses how economic and market reforms and turning around the investment potential for the country. ...

Discovery Data compiled the rankings based on discretionary and

... listed on SEC Form ADV as of November 2016. To capture independent fee-only planning firms, every effort is made to exclude firms with broker-dealer and insurance company affiliations, and those with substantial outside ownership stakes held by private equity firms and some outside investors. The li ...

... listed on SEC Form ADV as of November 2016. To capture independent fee-only planning firms, every effort is made to exclude firms with broker-dealer and insurance company affiliations, and those with substantial outside ownership stakes held by private equity firms and some outside investors. The li ...

Cecilia Reyes | Chief Risk Officer | Zurich Insurance Group Ltd

... Cecilia Reyes has over 20 years’ experience in international financial markets. Ms. Reyes worked from 1990 until 1995 for Credit Suisse in Zurich in various roles in asset management, global treasury and securities trading. In 1995, she started working with ING Barings in London and in 1997 she beca ...

... Cecilia Reyes has over 20 years’ experience in international financial markets. Ms. Reyes worked from 1990 until 1995 for Credit Suisse in Zurich in various roles in asset management, global treasury and securities trading. In 1995, she started working with ING Barings in London and in 1997 she beca ...

Real versus Financial Assets All financial assets (owner of the claim)

... o Security selection & analysis Choosing specific securities w/in an asset class ...

... o Security selection & analysis Choosing specific securities w/in an asset class ...

newton`s paul brain: why the us could enter a

... defaults, as a number of smaller, highly leveraged US oil companies struggle to refinance amid low commodity pricing. For Brain this means that while the fund will remain cautious in its positioning in high yield debt it will also be looking to selectively deploy capital on attractively priced asset ...

... defaults, as a number of smaller, highly leveraged US oil companies struggle to refinance amid low commodity pricing. For Brain this means that while the fund will remain cautious in its positioning in high yield debt it will also be looking to selectively deploy capital on attractively priced asset ...

RVM Achieves Ninth “Top Gun” Ranking from Effron

... recognized again by Informa Investment Solutions (IIS) as one of the “Top Guns” in the 2-star category under IIS’ Plan Sponsor Network (PSN) database. The 2-star category is derived from performance for the latest full year. RVM was among ten managers recognized for the one-year period ending Septem ...

... recognized again by Informa Investment Solutions (IIS) as one of the “Top Guns” in the 2-star category under IIS’ Plan Sponsor Network (PSN) database. The 2-star category is derived from performance for the latest full year. RVM was among ten managers recognized for the one-year period ending Septem ...

Investing Against the Grain

... when the market is a good place to be but able to get out of the market when the risk to their assets is too great.” Guaranteed Income for the Retired and Nearly Retired One of Dubots Capital Management’s founding principles is financial education. He strongly advocates that clients understand their ...

... when the market is a good place to be but able to get out of the market when the risk to their assets is too great.” Guaranteed Income for the Retired and Nearly Retired One of Dubots Capital Management’s founding principles is financial education. He strongly advocates that clients understand their ...

Economics 434 Financial Markets - SHANTI Pages

... -- Returns -Instead of three (or any finite number of) states, there are an infinity of states possible with various probabilities of returns assigned September 18, 2014 ...

... -- Returns -Instead of three (or any finite number of) states, there are an infinity of states possible with various probabilities of returns assigned September 18, 2014 ...

download

... economy seems headed for a double-dip recession, and the world is on edge over Iraq. Contrarian money managers say it's a great time to buy, but their opinions are suspect. Investment superhero Warren Buffett wrote in his annual letter to Berkshire Hathaway shareholders at the end of February that d ...

... economy seems headed for a double-dip recession, and the world is on edge over Iraq. Contrarian money managers say it's a great time to buy, but their opinions are suspect. Investment superhero Warren Buffett wrote in his annual letter to Berkshire Hathaway shareholders at the end of February that d ...

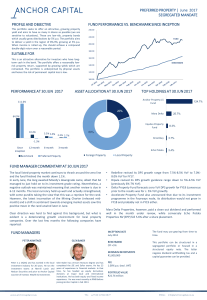

fund performance vs. benchmark since inception

... yield and aims to have as many A shares as possible (we are sensitive to valuations). These are low-risk, property bonds which usually grow distributions by 5% p.a. The portfolio aims to deliver a yield in the region of 8%-9%, growing at 5% p.a. When income is rolled up, this should achieve a compou ...

... yield and aims to have as many A shares as possible (we are sensitive to valuations). These are low-risk, property bonds which usually grow distributions by 5% p.a. The portfolio aims to deliver a yield in the region of 8%-9%, growing at 5% p.a. When income is rolled up, this should achieve a compou ...

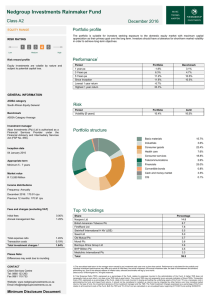

Fact sheets - Nedgroup Investments

... recovery that occurred during the balance of 2016. The rand ended the year 30% stronger versus the British pound and 18% versus the US dollar than it was in January 2016. This has proved to be a major headwind to many of our large industrial rand hedge positions – notably British American Tobacco, M ...

... recovery that occurred during the balance of 2016. The rand ended the year 30% stronger versus the British pound and 18% versus the US dollar than it was in January 2016. This has proved to be a major headwind to many of our large industrial rand hedge positions – notably British American Tobacco, M ...

professional bio

... General Agent. Larry ultimately became the Estate and Charitable Planning Specialist as well as the Investment Planning Specialist for the Southeast Region at Lutheran Brotherhood. In 1988, he started an independent firm known as Harvey Financial Group which was a fee-based financial planning and in ...

... General Agent. Larry ultimately became the Estate and Charitable Planning Specialist as well as the Investment Planning Specialist for the Southeast Region at Lutheran Brotherhood. In 1988, he started an independent firm known as Harvey Financial Group which was a fee-based financial planning and in ...

3Q2015 - Oak Ridge Investments

... sensitive to economic factors. The Funds may invest in foreign securities which involves certain risks such as currency volat ility, political and social instability and reduced market liquidity. Emerging markets may be more volatile and less liquid than more developed markets and therefore may invo ...

... sensitive to economic factors. The Funds may invest in foreign securities which involves certain risks such as currency volat ility, political and social instability and reduced market liquidity. Emerging markets may be more volatile and less liquid than more developed markets and therefore may invo ...

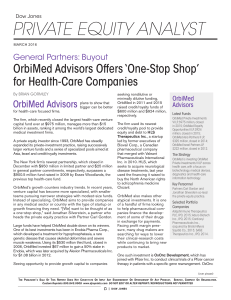

OrbiMed Advisors Offers `One-Stop Shop` for Health

... larger venture funds and a series of specialized pools aimed at Asia, Israel and credit/royalty investments. The New York firm’s newest partnership, which closed in December with $950 million in limited partner and $25 million in general partner commitments, respectively, surpasses a $900.5 million ...

... larger venture funds and a series of specialized pools aimed at Asia, Israel and credit/royalty investments. The New York firm’s newest partnership, which closed in December with $950 million in limited partner and $25 million in general partner commitments, respectively, surpasses a $900.5 million ...

Pioneers: Better be smart

... Last year, Lyxor, which has been in this area since 2008, joined forces with JP Morgan to launch a new range of risk-factor ETFs based on five factors that Lyxor research shows has a solid theoretical grounding. They include value, which it defines as a composite of book-toprice, earnings yield and ...

... Last year, Lyxor, which has been in this area since 2008, joined forces with JP Morgan to launch a new range of risk-factor ETFs based on five factors that Lyxor research shows has a solid theoretical grounding. They include value, which it defines as a composite of book-toprice, earnings yield and ...

Inflection Performance: January 2017

... Economic data continues to confirm global growth coming in above trend in the most synchronized upswing since 2011. This appears to be creating a self-reinforcing cycle with the consumption-led growth we have been seeing for the last year being met by growing business investment. Higher rates of gro ...

... Economic data continues to confirm global growth coming in above trend in the most synchronized upswing since 2011. This appears to be creating a self-reinforcing cycle with the consumption-led growth we have been seeing for the last year being met by growing business investment. Higher rates of gro ...

TIAA-CREF Emerging Markets Debt Fund

... Mutual fund investing involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Non-U.S. investments involve risks such as currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standard ...

... Mutual fund investing involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Non-U.S. investments involve risks such as currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standard ...

JPMorgan Funds - US High Yield Plus Bond Fund SICAV Range

... currency with income reinvested). Source of star rating: Morningstar, Inc. Source of bond rating: Moody’s. Risk ratings (if any) are based on J.P. Morgan Asset Management’s assessment of relative risk by asset class and historical volatility of the fund where applicable. The risk ratings are reviewe ...

... currency with income reinvested). Source of star rating: Morningstar, Inc. Source of bond rating: Moody’s. Risk ratings (if any) are based on J.P. Morgan Asset Management’s assessment of relative risk by asset class and historical volatility of the fund where applicable. The risk ratings are reviewe ...

Commonwealth Global Fund

... Investments in emerging markets involve even greater risks. Focus on a single country involves higher risk than a more geographically diverse international fund. Exposure to companies engaged in the natural resource and commodities markets may increase volatility. Small cap stocks are more susceptib ...

... Investments in emerging markets involve even greater risks. Focus on a single country involves higher risk than a more geographically diverse international fund. Exposure to companies engaged in the natural resource and commodities markets may increase volatility. Small cap stocks are more susceptib ...

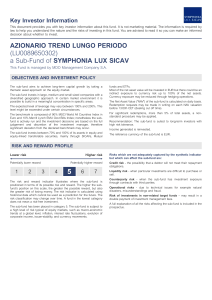

AZIONARIO TREND LUNGO PERIODO (LU0089650302) a Sub

... does not mean a risk-free investment. The sub-fund has been placed in category 5. The sub-fund is subject to a high level of risk typical of equity markets, such as macro-economic trends at a global level, inflation, interest rate fluctuations, evolution of corporate income, issuer-stability, and cu ...

... does not mean a risk-free investment. The sub-fund has been placed in category 5. The sub-fund is subject to a high level of risk typical of equity markets, such as macro-economic trends at a global level, inflation, interest rate fluctuations, evolution of corporate income, issuer-stability, and cu ...