* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download fund performance vs. benchmark since inception

Security interest wikipedia , lookup

Modified Dietz method wikipedia , lookup

Private equity wikipedia , lookup

Negative gearing wikipedia , lookup

Land banking wikipedia , lookup

Private equity secondary market wikipedia , lookup

Early history of private equity wikipedia , lookup

Fund governance wikipedia , lookup

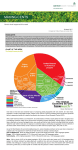

PREFERRED PROPERTY | June 2017 SEGREGATED MANDATE PROFILE AND OBJECTIVE FUND PERFORMANCE VS. BENCHMARK SINCE INCEPTION This portfolio seeks to offer an attractive, growing property yield and aims to have as many A shares as possible (we are sensitive to valuations). These are low-risk, property bonds which usually grow distributions by 5% p.a. The portfolio aims to deliver a yield in the region of 8%-9%, growing at 5% p.a. When income is rolled up, this should achieve a compound double-digit return over a reasonable period. 240.00 220.00 FUND 200.00 180.00 SUITABLE FOR 160.00 This is an attractive alternative for investors who have longterm cash in the bank. The portfolio offers a reasonably lowrisk property return, supported by growing yields which are reinvested. The portfolio is underpinned by physical assets and hence the risk of permanent capital loss is low. BENCHMARK 140.00 120.00 100.00 PERFORMANCE AT 30 JUN 2017 ASSET ALLOCATION AT 30 JUN 2017 TOP HOLDINGS AT 30 JUN 2017 Anchor Property LS Fund 111.6% 20% 64.9% Mara Delta Equites Property Fund 10.4% 5.5% 3.9% 12-month Benchmark 6-month 25.7% 8.3% 80% 2.2% 2.7% -1.3% Since inception 124.7% 3-month Foreign Property Preferred Property Greenbay 3.7% Echo Polska 3.4% Local Property FUND MANAGER COMMENTARY AT 30 JUN 2017 The local listed-property market continues to thrash around the zero line and the fund finished the month down 1.1%. In early June, the long awaited Moody’s downgrade came, albeit that SA managed to just hold on to its investment grade rating. Nevertheless, a negative outlook was maintained meaning that another review is due in 6-12 months. The local currency held up well and actually strengthened, with some pundits taking the view that this was a reprieve for the rand. However, the latest incarnation of the Mining Charter (released midmonth) and a shift in sentiment towards emerging market assets saw this positive move in the rand unwind later in June. Clear direction was hard to find against this background, but what is evident is a deteriorating growth environment for local property companies. Over the last few months the following companies have reported: FUND MANAGERS PETER ARMITAGE GLEN BAKER Redefine revised its DPS growth range from 7.5%-8.5% YoY to 7.0%8.0% YoY for FY17. Dipula revised its DPS growth guidance range down to 5%-6.5% YoY (previously 6%-7% YoY). Delta Property Fund forecasts zero YoY DPS growth for FY18 (consensus prior to the results was for c. 5% YoY growth). Accelerate Property Fund also announced that due to its investment programme in the Fourways node, its distribution would not grow in FY18 and probably not in FY19 either. • • • • Mara Delta Properties, however, paid a clean out dividend and performed well in the month under review, while conversely Echo Polska Properties NV (EPP) fell 5.6% after a share placement. INCEPTION DATE July 2012 The fund may use gearing from time to time. BENCHMARK CPI +5% This portfolio can be structured in a segregated portfolio or housed in a structured equity note. The latter negates dividend withholding tax and a capital guarantee can be provided. MINIMUM INVESTMENTS R1,000,000 Peter is a CA(SA) and has worked in the local investment industry for 20 years. He ran the investment teams at Merrill Lynch and Nedcor Securities and prior to Anchor Capital was CIO of Investec Wealth & Investment. www.anchorcapital.co.za Glen Baker has a B Com Honours degree and has completed the JSE and Safex exams. He has 25 years of experience in financial markets. In that time, he has headed up equity derivatives divisions at major local and international institutions. He has both equity and fixed income experience. He was most recently at RMB before joining Anchor Capital in Feb 2013. FEE 1.00% p.a. (excl. VAT) PORTFOLIO VALUE R22.76 million TEL: +27 (0) 11 591 0677 EMAIL: [email protected]