Slide 1 - Saracen Fund Managers

... The distribution of this document in certain jurisdictions may be restricted by law, therefore, people into whose possession this document comes should inform themselves about and observe any such restrictions. Any such distribution could result in a violation of the law of such jurisdiction. Invest ...

... The distribution of this document in certain jurisdictions may be restricted by law, therefore, people into whose possession this document comes should inform themselves about and observe any such restrictions. Any such distribution could result in a violation of the law of such jurisdiction. Invest ...

How Sharpe is Your Fund?

... you know your investment objectives and risk appetite. If you are after high, longterm returns and willing to take a significant amount of risk on your money, then stock market investing is right for you. And since you know little about it, be wise and just hire fund managers to do the “dirty work” ...

... you know your investment objectives and risk appetite. If you are after high, longterm returns and willing to take a significant amount of risk on your money, then stock market investing is right for you. And since you know little about it, be wise and just hire fund managers to do the “dirty work” ...

Steward Balanced Strategy

... to political systems which can be expected to have less stability than those of more developed countries. Emerging market securities may be less liquid and more volatile than U.S. and longer-established non-U.S. markets. Bond investors should carefully consider risks such as interest rate risk, cred ...

... to political systems which can be expected to have less stability than those of more developed countries. Emerging market securities may be less liquid and more volatile than U.S. and longer-established non-U.S. markets. Bond investors should carefully consider risks such as interest rate risk, cred ...

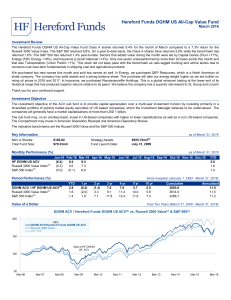

Commentary by Skylands Capital LLC, Sub-Investment

... The economy has been stubbornly lethargic since the recession six years ago, only posting 2.1% annualized GDP growth compared to long-term trend growth closer to 3.0%. This is particularly disappointing considering the best GDP growth is typically found in the immediate aftermath of recessions as th ...

... The economy has been stubbornly lethargic since the recession six years ago, only posting 2.1% annualized GDP growth compared to long-term trend growth closer to 3.0%. This is particularly disappointing considering the best GDP growth is typically found in the immediate aftermath of recessions as th ...

Boyang Sun

... Prepared financial reports, including annual budget, quarterly forecasts, and quarterly earnings release documents. Conducted presentation preparations pertaining to key business developments and operations, as well as other similar ad hoc projects Joined brainstorming and training meetings wi ...

... Prepared financial reports, including annual budget, quarterly forecasts, and quarterly earnings release documents. Conducted presentation preparations pertaining to key business developments and operations, as well as other similar ad hoc projects Joined brainstorming and training meetings wi ...

INVESTMENT OPPORTUNITIES

... Money Market Funds Savings accounts that yield a percentage of return based on interest rates and investments made by the money market manager. Low risk, low interest, low yield Example: Treasury Bills (T-Bills) Mature in 1 year or less. usually issued in denominations of $1,000, $5,000, $10,00 ...

... Money Market Funds Savings accounts that yield a percentage of return based on interest rates and investments made by the money market manager. Low risk, low interest, low yield Example: Treasury Bills (T-Bills) Mature in 1 year or less. usually issued in denominations of $1,000, $5,000, $10,00 ...

Alternative Investments Global Macro Strategy

... that markets were efficient and investors were rational, non-emotional, decision makers. In that controlled environment, optimal portfolio performance and diversification was largely achieved by using the traditional asset allocation mix of 60% stocks and 40% bonds. The past decade revealed that cor ...

... that markets were efficient and investors were rational, non-emotional, decision makers. In that controlled environment, optimal portfolio performance and diversification was largely achieved by using the traditional asset allocation mix of 60% stocks and 40% bonds. The past decade revealed that cor ...

August 2016 FUND NAME ESTIMATED PRICE ESTIMATED

... other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. Past performance is not indicative of future results. The price of this Fund(s) or any investment and any income from it can go down as well as up and may ...

... other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. Past performance is not indicative of future results. The price of this Fund(s) or any investment and any income from it can go down as well as up and may ...

Your global investment challenges answered

... segregated mandates to commingled funds. Through our multi-manager team you can also access the infrastructure and private equity market. They invest in the best-in-class, global managers in this field, offering significant diversification and vintage year benefits. Access can be made via fund solut ...

... segregated mandates to commingled funds. Through our multi-manager team you can also access the infrastructure and private equity market. They invest in the best-in-class, global managers in this field, offering significant diversification and vintage year benefits. Access can be made via fund solut ...

Developed market equities

... to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and determine, together with thei ...

... to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and determine, together with thei ...

I. “Active” Small/Mid Cap US Equity (SMID) Should Play Second

... informational purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any security or other financial instrument or to participate in any trading strategy. Past performance is not necessarily a guide to future performance. The securities/instruments discussed ...

... informational purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any security or other financial instrument or to participate in any trading strategy. Past performance is not necessarily a guide to future performance. The securities/instruments discussed ...

Preparing and Planning to Manage

... Concerned with keeping the operation running smoothly rather than accomplishing other goals. ...

... Concerned with keeping the operation running smoothly rather than accomplishing other goals. ...

JPM Europe Strategic Value X (acc) - EUR

... The value of your investment may fall as well as rise and you may get back less than you originally invested. Q The value of equity securities may go down as well as up in response to the performance of individual companies and general market conditions. Q The Sub-Fund may have greater volatility co ...

... The value of your investment may fall as well as rise and you may get back less than you originally invested. Q The value of equity securities may go down as well as up in response to the performance of individual companies and general market conditions. Q The Sub-Fund may have greater volatility co ...

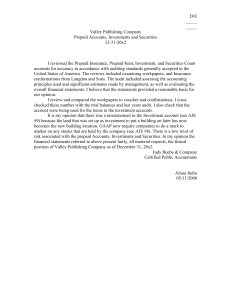

Valley Publishing Company

... conformations from Langdon and Sons. The audit included assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statements; I believe that the statements provided a reasonable basis for our opinion. I review and compared the ...

... conformations from Langdon and Sons. The audit included assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statements; I believe that the statements provided a reasonable basis for our opinion. I review and compared the ...

United Emerging Markets Bond Fund

... invest in any company mentioned herein. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by UOB, UOBAM, or any affiliates or distributors. The Fund may use or invest in financial derivative instruments and you should be aware of the risks associated with inves ...

... invest in any company mentioned herein. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by UOB, UOBAM, or any affiliates or distributors. The Fund may use or invest in financial derivative instruments and you should be aware of the risks associated with inves ...

International Investment

... higher E(R) than the US market and can substantially diversify US portfolio. Asset pricing models do not argue that risk factors have geographically different E(R). In the US market, value and size explain the difference in E(R) across equity portfolio International value stocks and small stoc ...

... higher E(R) than the US market and can substantially diversify US portfolio. Asset pricing models do not argue that risk factors have geographically different E(R). In the US market, value and size explain the difference in E(R) across equity portfolio International value stocks and small stoc ...

Cash Flow Capital Preservation Moderate Growth Wealth Building

... Through a balancing process of the potential risk return trade-off, the portfolio objectives can be achieved. All investment strategies used to achieve the objectives must focus on these two important portfolio elements. “Risk & Return.” ...

... Through a balancing process of the potential risk return trade-off, the portfolio objectives can be achieved. All investment strategies used to achieve the objectives must focus on these two important portfolio elements. “Risk & Return.” ...

April 2015 Factsheet - Electric and General Investment Fund

... shares. Investments in a currency other than your own currency will be subject to movements in foreign exchange rates. Reference to any specific securities should not be construed as a recommendation to buy or sell these securities but is included for the purposes of illustration only. Investors sho ...

... shares. Investments in a currency other than your own currency will be subject to movements in foreign exchange rates. Reference to any specific securities should not be construed as a recommendation to buy or sell these securities but is included for the purposes of illustration only. Investors sho ...

Active Management: Andrew Slimmon Shares His

... securities. Their account shows only one line item representing an interest in the fund. With a separate account, it’s different: The investor has direct ownership of individual securities, and their account statement shows a separate line item for each security in the account. This direct ownership ...

... securities. Their account shows only one line item representing an interest in the fund. With a separate account, it’s different: The investor has direct ownership of individual securities, and their account statement shows a separate line item for each security in the account. This direct ownership ...

Pan African Asset Management Company

... Participation in presentations to clients (presentations, phone calls and roadshows). ...

... Participation in presentations to clients (presentations, phone calls and roadshows). ...

VictoryShares US Multi-Factor Minimum Volatility ETF

... be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call the Fund at 1-866-376-7890. ETF shares are b ...

... be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call the Fund at 1-866-376-7890. ETF shares are b ...