Article 11 - IBIS Associates

... Once the strategic decision has been made to re-organise in this fashion, the accompanying new job descriptions and authority for IT management can be clarified. IT senior management now take financial responsibility for project management and delivery; they control outsourcing programmes; they beco ...

... Once the strategic decision has been made to re-organise in this fashion, the accompanying new job descriptions and authority for IT management can be clarified. IT senior management now take financial responsibility for project management and delivery; they control outsourcing programmes; they beco ...

The New Neutral for bond investors

... smoother ride than assets such as stocks. Diversification – investors can potentially increase returns and reduce risk by broadening their portfolios across asset classes. Certain asset classes perform better under different market conditions, and there’s no way of knowing when conditions will cha ...

... smoother ride than assets such as stocks. Diversification – investors can potentially increase returns and reduce risk by broadening their portfolios across asset classes. Certain asset classes perform better under different market conditions, and there’s no way of knowing when conditions will cha ...

Niagara Falls Urban Renewal Agency Investment Guidelines

... The Agency’s investment activities shall have as their first and foremost objective the safeguarding of the principal amount of the Investment Funds. Additional considerations regarding the Agency’s investment activities shall be liquidity of investments, realization of a reasonable return on invest ...

... The Agency’s investment activities shall have as their first and foremost objective the safeguarding of the principal amount of the Investment Funds. Additional considerations regarding the Agency’s investment activities shall be liquidity of investments, realization of a reasonable return on invest ...

finding value in bonds. - The Institute of Financial Planning

... quantities is difficult, but for reasonably-sized funds with flexible mandates the problem is manageable. To be successful in this environment it helps to have a flexible approach that can benefit from a broader investment universe. THE IMPORTANCE OF FLEXIBILITY. ...

... quantities is difficult, but for reasonably-sized funds with flexible mandates the problem is manageable. To be successful in this environment it helps to have a flexible approach that can benefit from a broader investment universe. THE IMPORTANCE OF FLEXIBILITY. ...

presentation - European Corporate Governance Institute

... What are management’s responsibilities in relation to information systems? ...

... What are management’s responsibilities in relation to information systems? ...

Prudential Short Duration High Yield Income Fund

... Source: The statistics stated above are derived from Morningstar Direct and Bloomberg Barclays, as of 6/30/2017. Calculated by PGIM Investments using data from Morningstar. All rights reserved. Used with permission. Source of default data: Moody’s as of 12/31/2016. Annualized returns and standard de ...

... Source: The statistics stated above are derived from Morningstar Direct and Bloomberg Barclays, as of 6/30/2017. Calculated by PGIM Investments using data from Morningstar. All rights reserved. Used with permission. Source of default data: Moody’s as of 12/31/2016. Annualized returns and standard de ...

ch20 - Csulb.edu

... Using the trade date : AIMR recommends that all calculations be done on the basis of the trade date rather than the settlement date. ...

... Using the trade date : AIMR recommends that all calculations be done on the basis of the trade date rather than the settlement date. ...

Presentation - Kerns Capital Management, Inc.

... Return measure that accounts for variation in a fund’s monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of the funds in each category received 5 stars, the next 22. ...

... Return measure that accounts for variation in a fund’s monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of the funds in each category received 5 stars, the next 22. ...

Book review by S L Rao: “The Case of the Bonsai Manager” by R

... process is building of close relationships and encouraging team work. The best management training schemes try to practice such techniques, providing the trainee with a variety of experiences. He praises the value of competition (in markets and in life) for improving this learning. Learning also com ...

... process is building of close relationships and encouraging team work. The best management training schemes try to practice such techniques, providing the trainee with a variety of experiences. He praises the value of competition (in markets and in life) for improving this learning. Learning also com ...

Ext Use Main title (22 pt) Subtitle (22 pt)

... UK Property has outperformed equities and gilts over 1,3,5,10 and 15 year time horizons.* Fantastic but potentially unhealthy and it should be remembered that past performance is not a guide to future ...

... UK Property has outperformed equities and gilts over 1,3,5,10 and 15 year time horizons.* Fantastic but potentially unhealthy and it should be remembered that past performance is not a guide to future ...

Prudential Jennison 20/20 Focus Fund Fact Sheet

... Enhanced cash strategies are variations on traditional money market vehicles. They are designed to provide liquidity and principal preservation, but with more of an emphasis on seeking returns that are superior to those of traditional money market offerings. Average weighted market cap is the averag ...

... Enhanced cash strategies are variations on traditional money market vehicles. They are designed to provide liquidity and principal preservation, but with more of an emphasis on seeking returns that are superior to those of traditional money market offerings. Average weighted market cap is the averag ...

March 2015 AULIEN S.C.A., Sicav

... kicking the debt can further down the road will not permit any sustainable and sound economical recovery. Europe needs to reduce its unnecessary large social wealth fare. Japan is struggling to escape from its low growth and deflationary environment. Finally, the “soft landing” of the Chinese econom ...

... kicking the debt can further down the road will not permit any sustainable and sound economical recovery. Europe needs to reduce its unnecessary large social wealth fare. Japan is struggling to escape from its low growth and deflationary environment. Finally, the “soft landing” of the Chinese econom ...

FIN421 - BrainMass

... c) If returns on two stocks are perfectly positively correlated, you can build a riskless portfolio with those stocks when short-selling is not allowed. d) A risk-free security has a variance of zero. e) A security with a beta of zero is risk free. f) The CAPM implies that investors demand high retu ...

... c) If returns on two stocks are perfectly positively correlated, you can build a riskless portfolio with those stocks when short-selling is not allowed. d) A risk-free security has a variance of zero. e) A security with a beta of zero is risk free. f) The CAPM implies that investors demand high retu ...

4. Return And Risk

... Sometimes an investment will generate multiple rates of return; that is, more than one (r) value will equate NPV with zero. This will occur when that investment has associated with it more than one negative cash flow. When multiple rates are generated, there is often no method to determine which is ...

... Sometimes an investment will generate multiple rates of return; that is, more than one (r) value will equate NPV with zero. This will occur when that investment has associated with it more than one negative cash flow. When multiple rates are generated, there is often no method to determine which is ...

30 June 2007 Balance Nature strives for balance. In the wild, lions

... subject to different fees and charges. Unit trust prices are calculated on a net asset value basis, which is the total value of all assets in the portfolio including any income accruals and less ...

... subject to different fees and charges. Unit trust prices are calculated on a net asset value basis, which is the total value of all assets in the portfolio including any income accruals and less ...

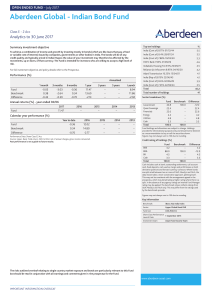

Aberdeen Global - Indian Bond Fund

... Variable (a “SICAV”). The information contained in this marketing document is intended to be of general interest only and should not be considered as an offer, or solicitation, to deal in the shares of any securities or financial instruments. Aberdeen Global has been authorized for public sale in ce ...

... Variable (a “SICAV”). The information contained in this marketing document is intended to be of general interest only and should not be considered as an offer, or solicitation, to deal in the shares of any securities or financial instruments. Aberdeen Global has been authorized for public sale in ce ...

Click to download DGHM ACV December 2015

... This document is for information purposes and internal use only. It is neither an advice nor a recommendation to enter into any investment. Investment suitability must be determined individually for each investor, and the financial instruments described above may not be suitable for all investors. T ...

... This document is for information purposes and internal use only. It is neither an advice nor a recommendation to enter into any investment. Investment suitability must be determined individually for each investor, and the financial instruments described above may not be suitable for all investors. T ...

Second Half Outlook 2014

... marginally higher interest rates. I have also expected the gradual and continual rotation of investor dollars away from bonds and into stocks. Interest rates have remained abnormally low due to the U.S. Federal Reserve’s (The Fed’s) massive bondbuying program, slated for a gradual end later this yea ...

... marginally higher interest rates. I have also expected the gradual and continual rotation of investor dollars away from bonds and into stocks. Interest rates have remained abnormally low due to the U.S. Federal Reserve’s (The Fed’s) massive bondbuying program, slated for a gradual end later this yea ...

Short Duration Income Y Share Fund Fact Sheet

... sensitive the fund is to shifts in interest rates. Standard deviation measures how widely a set of values varies from the mean. It is a historical measure of the variability of return earned by an investment portfolio over a 3-year period. Consider these risks before investing: Putnam Short Duration ...

... sensitive the fund is to shifts in interest rates. Standard deviation measures how widely a set of values varies from the mean. It is a historical measure of the variability of return earned by an investment portfolio over a 3-year period. Consider these risks before investing: Putnam Short Duration ...

FINANCIAL PLANN ING PRACTICE N OV 2011 SOLUTIO NS

... must be well spread so that an investor does not lose out completely because of adverse movements in one particular market or portfolio. 1. Risk versus term – long term investment usually carry low risk 2. Liquidity – emphasis on highly liquid investments will yield low returns 3. Equity vs Cash or ...

... must be well spread so that an investor does not lose out completely because of adverse movements in one particular market or portfolio. 1. Risk versus term – long term investment usually carry low risk 2. Liquidity – emphasis on highly liquid investments will yield low returns 3. Equity vs Cash or ...

4.32kWp on Student let in Huddersfield : World Of Renewables

... Average annual return on investment expected -17.9% Mr Clifton asked us to review his portfolio of his student let investment properties to ascertain which would be suitable for solar PV. Mr Clifton selected the property that was capable of accommodating the largest system. The reasons behind Mr Cli ...

... Average annual return on investment expected -17.9% Mr Clifton asked us to review his portfolio of his student let investment properties to ascertain which would be suitable for solar PV. Mr Clifton selected the property that was capable of accommodating the largest system. The reasons behind Mr Cli ...

global equity fund

... time periods of more than one year are historical annual compounded total returns while returns for time periods of one year or less are cumulative figures and are not annualized. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The compound g ...

... time periods of more than one year are historical annual compounded total returns while returns for time periods of one year or less are cumulative figures and are not annualized. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The compound g ...