Why a new investment proposition?

... Elevate but may in the future decide on a different strategy should it be in the best interests of our clients. However, it is unlikely we would alter our strategy of an asset allocation approach. ...

... Elevate but may in the future decide on a different strategy should it be in the best interests of our clients. However, it is unlikely we would alter our strategy of an asset allocation approach. ...

Comments on : “The Greek Pension System

... Strategies likely to conform with legal restrictions rather than attaining good returns, reducing risk and other desirable objectives ...

... Strategies likely to conform with legal restrictions rather than attaining good returns, reducing risk and other desirable objectives ...

Class D Shares - Accumulating - USD

... Interest Rate Risk: The Sub-Fund's earnings or market value may be reduced by changes in interest rates. Risk of not achieving objective: There is no certainty that the SubFund's investment objective will actually be achieved. Term Risk: The shares should be viewed as long-term investments. ...

... Interest Rate Risk: The Sub-Fund's earnings or market value may be reduced by changes in interest rates. Risk of not achieving objective: There is no certainty that the SubFund's investment objective will actually be achieved. Term Risk: The shares should be viewed as long-term investments. ...

BlackRock Resources Model (BR0011) Model Portfolio

... Past performance is no indicator of future performance. Long term performance returns show the potential volatility of returns over time. The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested. Fluctuation ...

... Past performance is no indicator of future performance. Long term performance returns show the potential volatility of returns over time. The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested. Fluctuation ...

Notice concerning Impact of the Earthquake Occurred off the Coast

... damage to the buildings and facilities etc. that would have a significant impact on INV’s business outlook have been confirmed as of 09:35 am, May 7, 2014. Further announcements will be made promptly once any additional findings are confirmed. ...

... damage to the buildings and facilities etc. that would have a significant impact on INV’s business outlook have been confirmed as of 09:35 am, May 7, 2014. Further announcements will be made promptly once any additional findings are confirmed. ...

Slides - WordPress.com

... • A measure of ongoing value creation considering the ‘time value of money’. • Allows ready comparison of investment options. ...

... • A measure of ongoing value creation considering the ‘time value of money’. • Allows ready comparison of investment options. ...

Five-Year Ranking: Pimco Leads 10

... expense subsidies and waivers in effect during certain periods shown. Absent these waivers, results would have been less favorable. Risks: The Fund is non-diversified and include risks associated with concentration risk that results from the Funds' investments in a limited number of securities. Increa ...

... expense subsidies and waivers in effect during certain periods shown. Absent these waivers, results would have been less favorable. Risks: The Fund is non-diversified and include risks associated with concentration risk that results from the Funds' investments in a limited number of securities. Increa ...

Cidel Canadian Preferred Shares

... The Objective is to provide enhanced yield while seeking to reduce the key risks inherent in the Canadian preferred share market. The Investment Philosophy is to use fundamental research to take advantage of mispriced securities and identify opportunities with the best risk-return profile. ...

... The Objective is to provide enhanced yield while seeking to reduce the key risks inherent in the Canadian preferred share market. The Investment Philosophy is to use fundamental research to take advantage of mispriced securities and identify opportunities with the best risk-return profile. ...

D J AVID

... Created forecasting templates to project the Income Statements of 12 of AMCH’s subsidiary companies (used by the respective VP’s to make more diligent financial decisions) Conducted an internal audit of Heat Surge LLC (a subsidiary of AMCH) Learned methods of financial reporting and developed ...

... Created forecasting templates to project the Income Statements of 12 of AMCH’s subsidiary companies (used by the respective VP’s to make more diligent financial decisions) Conducted an internal audit of Heat Surge LLC (a subsidiary of AMCH) Learned methods of financial reporting and developed ...

Chapter 12 – Management Skills

... Horizontal organizations eliminated management levels and flattened the management structure into self managing teams. The idea is that the people actually doing the work are the best source of information about how processes should be completed. Teams are formed to manage themselves. They brainstor ...

... Horizontal organizations eliminated management levels and flattened the management structure into self managing teams. The idea is that the people actually doing the work are the best source of information about how processes should be completed. Teams are formed to manage themselves. They brainstor ...

Issues in Islamic Liquidity Management

... Islamic institutions can deal with conventional banks. Other instruments like Sukuk: problems of longer duration, price risk, lack of liquidity, etc. Trade finance deals with high quality parties and/or bank guarantee. Sukuk holdings to be held as part of investment portfolio of the Treasury to earn ...

... Islamic institutions can deal with conventional banks. Other instruments like Sukuk: problems of longer duration, price risk, lack of liquidity, etc. Trade finance deals with high quality parties and/or bank guarantee. Sukuk holdings to be held as part of investment portfolio of the Treasury to earn ...

(Attachment: 2)COMISAGENDA ITEM 4

... Trustees should ensure that they have sufficient in-house staff to support them in their investment responsibilities. ...

... Trustees should ensure that they have sufficient in-house staff to support them in their investment responsibilities. ...

Canadian Institute of Actuaries L`Institut canadien des actuaires

... Hedge Fund generates gross return of 10.0% Hedge fund fees: 2% + 20% above T-Bills ...

... Hedge Fund generates gross return of 10.0% Hedge fund fees: 2% + 20% above T-Bills ...

Investing in Bond Funds

... Now, keep in mind that these are only guidelines meant to give you insight into how you think and behave as an investor. Once you have discovered that you are, let’s say, aggressive, this certainly doesn’t mean that you now have to invest in highrisk stocks and emerging markets for the rest of your ...

... Now, keep in mind that these are only guidelines meant to give you insight into how you think and behave as an investor. Once you have discovered that you are, let’s say, aggressive, this certainly doesn’t mean that you now have to invest in highrisk stocks and emerging markets for the rest of your ...

SOVB Cambria Sovereign High Yield Bond ETF

... The Fund is actively managed using proprietary investment strategies and processes. There can be no guarantee that these strategies and processes will produce the intended results and no guarantee that the Fund will achieve its investment objective. This could result in the Fund’s underperformance c ...

... The Fund is actively managed using proprietary investment strategies and processes. There can be no guarantee that these strategies and processes will produce the intended results and no guarantee that the Fund will achieve its investment objective. This could result in the Fund’s underperformance c ...

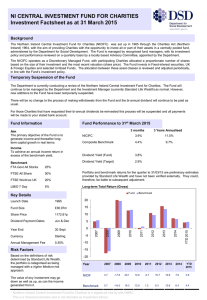

NORTHERN IRELAND CENTRAL INVESTMENT FUND FOR CHARITIES

... has been here before when a negative economic backdrop can result in a positive outcome for financial assets. The US economy ticks along nicely although growth forecasts have been trimmed. Unemployment continues to fall as does inflation (largely helped by the oil price decline) and speculation grow ...

... has been here before when a negative economic backdrop can result in a positive outcome for financial assets. The US economy ticks along nicely although growth forecasts have been trimmed. Unemployment continues to fall as does inflation (largely helped by the oil price decline) and speculation grow ...

Western Asset Corporate Bond Ladders 1-5 Years

... Separately Managed Accounts (SMAs) are investment services provided by Legg Mason Private Portfolio Group, LLC (LMPPG), a federally registered investment advisor. Client portfolios are managed based on investment instructions or advice provided by one or more of the following Legg Mason-affiliated ...

... Separately Managed Accounts (SMAs) are investment services provided by Legg Mason Private Portfolio Group, LLC (LMPPG), a federally registered investment advisor. Client portfolios are managed based on investment instructions or advice provided by one or more of the following Legg Mason-affiliated ...

fondsfactsheet berenberg renminbi bond opportunities ui

... tax or financial consultation. The information given in this document has not been revised by an outside party, in particular an independent audit firm. At any rate, you should take an investment decision on the basis of the selling documents (Key Investor Information Document and current semi-annua ...

... tax or financial consultation. The information given in this document has not been revised by an outside party, in particular an independent audit firm. At any rate, you should take an investment decision on the basis of the selling documents (Key Investor Information Document and current semi-annua ...

One of the biggest strategic questions facing any

... the foundation’s leadership to address near term social challenges more aggressively. Either path has strategic benefits and pitfalls: in the one case stepping back from big opportunities where funds at hand are too limited; in the other case missing chances to take your time or act at a small scale ...

... the foundation’s leadership to address near term social challenges more aggressively. Either path has strategic benefits and pitfalls: in the one case stepping back from big opportunities where funds at hand are too limited; in the other case missing chances to take your time or act at a small scale ...

The City of Neenah Municipal Museum Fund

... Foreign equities are allowable to the extent they are in a well-diversified foreign equity fund and represent a range of 5% to 15% of total equities. Should the equity exposure exceed the maximum limitation at the end of any quarter, the equity exposure will be reviewed and reduced where appropriat ...

... Foreign equities are allowable to the extent they are in a well-diversified foreign equity fund and represent a range of 5% to 15% of total equities. Should the equity exposure exceed the maximum limitation at the end of any quarter, the equity exposure will be reviewed and reduced where appropriat ...

ETF Strategists: The Next Generation of Asset Allocation

... performance numbers is a must. Some asset allocators built their track record on the basis of one or two great years of performance around the financial crisis, but have delivered less inspiring returns since (see the bar graph above). Also, size is often the enemy of investment performance, and man ...

... performance numbers is a must. Some asset allocators built their track record on the basis of one or two great years of performance around the financial crisis, but have delivered less inspiring returns since (see the bar graph above). Also, size is often the enemy of investment performance, and man ...

Present - Nuffield International

... Management capability and accountability Corporate governance and reporting Structure – separate land from operations Lack of understanding of agricultural investment Lack of investment grade product and track record RISK!! ...

... Management capability and accountability Corporate governance and reporting Structure – separate land from operations Lack of understanding of agricultural investment Lack of investment grade product and track record RISK!! ...