Combining active and passive managements in a portfolio

... pension funds has more than doubled recently, from 10% in 2006 to 24% in 20132. Despite a period of great volatility in asset markets and negative headlines associated with some hedge funds, investors continue to be attracted by alternatives’ ability to generate attractive risk-adjusted returns. Ove ...

... pension funds has more than doubled recently, from 10% in 2006 to 24% in 20132. Despite a period of great volatility in asset markets and negative headlines associated with some hedge funds, investors continue to be attracted by alternatives’ ability to generate attractive risk-adjusted returns. Ove ...

Assumptions - Absa Investment Account 28 Aug 14

... any information or result provided or obtained through the use of this Calculator. Holding an investment for a short-term may result in a partial or full loss of an initial investment amount if the investment was exposed to high unfavourable price volatility and not enough recovery time was allowed ...

... any information or result provided or obtained through the use of this Calculator. Holding an investment for a short-term may result in a partial or full loss of an initial investment amount if the investment was exposed to high unfavourable price volatility and not enough recovery time was allowed ...

Effective Portfolio Management: Making Strategy a Reality

... of whether those “things” are products, services, projects or programmes. If they are not “right” then they should be closed or stopped, as assets need to be allocated appropriately. ...

... of whether those “things” are products, services, projects or programmes. If they are not “right” then they should be closed or stopped, as assets need to be allocated appropriately. ...

EIB GEEREF and REPIN ppt

... REPIN bridges between short-term lenders and long-term institutional investors ...

... REPIN bridges between short-term lenders and long-term institutional investors ...

principles of finance

... Below is a list of reference publications that were either used as a reference to create the exam, or were used as textbooks in college courses of the same or similar title at the time the test was developed. You may reference either the current edition of these titles or textbooks currently used at ...

... Below is a list of reference publications that were either used as a reference to create the exam, or were used as textbooks in college courses of the same or similar title at the time the test was developed. You may reference either the current edition of these titles or textbooks currently used at ...

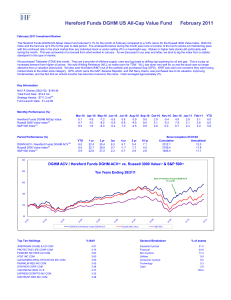

Click to download DGHM ACV FEBRUARY 2011

... This document is for information purposes and internal use only. It is neither an advice nor a recommendation to enter into any investment. Investment suitability must be determined individually for each investor, and the financial instruments described above may not be suitable for all investors. T ...

... This document is for information purposes and internal use only. It is neither an advice nor a recommendation to enter into any investment. Investment suitability must be determined individually for each investor, and the financial instruments described above may not be suitable for all investors. T ...

Dividend Strategies Drive Returns

... market’s latest move, we’ve done quite a bit better than that. Stock prices can fluctuate – even dramatically – in short periods of time without any fundamental changes for the individual businesses. During the first quarter, we obviously saw some significant dislocations in valuations in a compress ...

... market’s latest move, we’ve done quite a bit better than that. Stock prices can fluctuate – even dramatically – in short periods of time without any fundamental changes for the individual businesses. During the first quarter, we obviously saw some significant dislocations in valuations in a compress ...

Introduction to segregated funds - Client

... With segregated fund contracts, you can: Save for the future with the added protection of guarantees, Protect yourself from outliving your money in retirement, Maximize growth potential for your beneficiaries, and Choose flexible investment options. ...

... With segregated fund contracts, you can: Save for the future with the added protection of guarantees, Protect yourself from outliving your money in retirement, Maximize growth potential for your beneficiaries, and Choose flexible investment options. ...

Schroder Singapore Trust A Distribution Share Class June 2016

... S$20,000.00 in the CPF-OA and the first S$40,000.00 in the CPF-SA are not allowed to be invested under the CPFIS. Investors should note that the applicable interest rates for each of the CPF accounts may be varied by the CPF Board from time to time. The Fund offers free personal accident insurance. ...

... S$20,000.00 in the CPF-OA and the first S$40,000.00 in the CPF-SA are not allowed to be invested under the CPFIS. Investors should note that the applicable interest rates for each of the CPF accounts may be varied by the CPF Board from time to time. The Fund offers free personal accident insurance. ...

Module 22 Financial Sector

... • Reducing Risk • Providing Liquidity (The ease by which an asset can be converted to cash) ...

... • Reducing Risk • Providing Liquidity (The ease by which an asset can be converted to cash) ...

Last Updated: April 4, 2014 Trumark Hires Veteran Developer for

... Dublin, CA, known as Wallis Ranch. Groundbreaking for the project could begin in May, and local media reports indicate that the deal involves an investment of more than $175 million. The ...

... Dublin, CA, known as Wallis Ranch. Groundbreaking for the project could begin in May, and local media reports indicate that the deal involves an investment of more than $175 million. The ...

July 16, 2014 - Morgan Stanley Locator

... There is no guarantee that this investment strategy will work under all market conditions. Holdings are subject to change daily, so any securities discussed in this profile may or may not be included in your account if you invest in this investment strategy. Do not assume that any holdings mentioned ...

... There is no guarantee that this investment strategy will work under all market conditions. Holdings are subject to change daily, so any securities discussed in this profile may or may not be included in your account if you invest in this investment strategy. Do not assume that any holdings mentioned ...

Hitting Home Runs - Global Financial Private Capital

... 1. Huge Gains: The Russell 3000 increased over 1,800% from 1980 to 2014, which is a strong return over a 35-year time period. 2. Catastrophic Losses: Over the same time periods, roughly 40% of all stocks suffered a permanent 70%+ decline from their peak value. 3. More Losers Than Winners: Two-thi ...

... 1. Huge Gains: The Russell 3000 increased over 1,800% from 1980 to 2014, which is a strong return over a 35-year time period. 2. Catastrophic Losses: Over the same time periods, roughly 40% of all stocks suffered a permanent 70%+ decline from their peak value. 3. More Losers Than Winners: Two-thi ...

Bailout Bill

... Other countries are experiencing credit crunches and declines in equity as well. If US companies have less accesse to funding they will not be able to conduct business or invest in other parts of the world to the same extent, which will hurt foreign markets. Because of US businesses slowing producti ...

... Other countries are experiencing credit crunches and declines in equity as well. If US companies have less accesse to funding they will not be able to conduct business or invest in other parts of the world to the same extent, which will hurt foreign markets. Because of US businesses slowing producti ...

Round Table 3 Can Agricultural Investment Co

... Round Table 3 Can Agricultural Investment Co-exist with Climate Change Policies? ...

... Round Table 3 Can Agricultural Investment Co-exist with Climate Change Policies? ...

Recent Portfolio Theory - Advice in a Multifactor World John H

... Never forget that for every investor who is buying a stock or asset class for its risk premium, there is another investor who is avoiding it because he feels that the risk is too high. This is an issue that is really on the front edge of the index investing debate. Current data tends to indicate tha ...

... Never forget that for every investor who is buying a stock or asset class for its risk premium, there is another investor who is avoiding it because he feels that the risk is too high. This is an issue that is really on the front edge of the index investing debate. Current data tends to indicate tha ...

ab large cap growth fund

... hopes faded for a broad tax cut that would benefit smaller companies. Continuing their first-quarter trend, growth stocks outperformed their value counterparts across the market spectrum. Technology and healthcare stocks were strong in the quarter, although sharp swings in technology shares in the l ...

... hopes faded for a broad tax cut that would benefit smaller companies. Continuing their first-quarter trend, growth stocks outperformed their value counterparts across the market spectrum. Technology and healthcare stocks were strong in the quarter, although sharp swings in technology shares in the l ...

Title: INVESTMENTS Policy No. 102

... The Executive Director will recommend to the Foundation Board an investment policy and standards that a reasonable and prudent person would apply in respect of a portfolio of investments in order to avoid undue risk and obtain a reasonable return for the portfolio. All I ...

... The Executive Director will recommend to the Foundation Board an investment policy and standards that a reasonable and prudent person would apply in respect of a portfolio of investments in order to avoid undue risk and obtain a reasonable return for the portfolio. All I ...

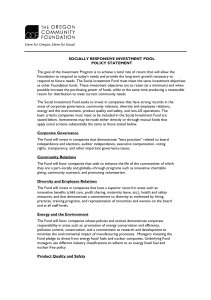

Socially Responsive Investment Fund

... The Fund will favor companies that seek to enhance the life of the communities of which they are a part--locally and globally--through programs such as innovative charitable giving, community outreach, and promoting volunteerism. Diversity and Employee Relations The Fund will invest in companies tha ...

... The Fund will favor companies that seek to enhance the life of the communities of which they are a part--locally and globally--through programs such as innovative charitable giving, community outreach, and promoting volunteerism. Diversity and Employee Relations The Fund will invest in companies tha ...

Top margin 1

... parts of the firm appear to have compromised analysts’ work. This group will advise the Commission on how best to ensure high standards of analyst integrity and objectivity so that investors throughout the EU can benefit from high quality research.” In today’s financial markets, investment research ...

... parts of the firm appear to have compromised analysts’ work. This group will advise the Commission on how best to ensure high standards of analyst integrity and objectivity so that investors throughout the EU can benefit from high quality research.” In today’s financial markets, investment research ...