Document 1 - Hallandale Beach

... No part of this presentation may be reproduced or used in any form or by any means, electronic or mechanical, including photocopying or recording, or by any information storage and retrieval system, without prior written permission from the Principal Financial Group®. Information provided by Princip ...

... No part of this presentation may be reproduced or used in any form or by any means, electronic or mechanical, including photocopying or recording, or by any information storage and retrieval system, without prior written permission from the Principal Financial Group®. Information provided by Princip ...

A Framework for Social Investment Practice (Rough

... Movement and church groups in South Africa ...

... Movement and church groups in South Africa ...

Minnesota 9-12 Personal Finance Standards

... Personal and financial goals can be achieved by applying economic concepts and principles to personal financial planning, budgeting, spending, saving, investing, borrowing and insuring decisions. 9.2.2.2.1 Establish financial goals; make a financial plan considering budgeting and asset building to m ...

... Personal and financial goals can be achieved by applying economic concepts and principles to personal financial planning, budgeting, spending, saving, investing, borrowing and insuring decisions. 9.2.2.2.1 Establish financial goals; make a financial plan considering budgeting and asset building to m ...

CF Canlife Portfolio Funds

... markets. Asset allocations are kept within predetermined limits, ensuring the funds do not deviate from the agreed risk profile. There are five funds, numbered III through VII, each offering a different risk level. The higher the number, the higher the risk. If your attitude towards risk or your cir ...

... markets. Asset allocations are kept within predetermined limits, ensuring the funds do not deviate from the agreed risk profile. There are five funds, numbered III through VII, each offering a different risk level. The higher the number, the higher the risk. If your attitude towards risk or your cir ...

Test Presentation Line 2

... Epworth range of funds • Common Investment and Common Deposit Funds ◦ Affirmative Equity Fund ◦ Affirmative Fixed Interest Fund ◦ Affirmative Corporate Bond Fund ◦ Affirmative Deposit Fund • UCITS Umbrella Unit Trust Scheme ◦ Epworth UK Equity Fund ◦ Epworth European Fund ...

... Epworth range of funds • Common Investment and Common Deposit Funds ◦ Affirmative Equity Fund ◦ Affirmative Fixed Interest Fund ◦ Affirmative Corporate Bond Fund ◦ Affirmative Deposit Fund • UCITS Umbrella Unit Trust Scheme ◦ Epworth UK Equity Fund ◦ Epworth European Fund ...

Royce Opportunity Fund

... This material is not authorized for distribution unless preceded or accompanied by a current prospectus. Please read the prospectus carefully before investing or sending money. The Fund invests primarily in smallcap stocks, which may involve considerably more risk than investing in larger-cap stocks ...

... This material is not authorized for distribution unless preceded or accompanied by a current prospectus. Please read the prospectus carefully before investing or sending money. The Fund invests primarily in smallcap stocks, which may involve considerably more risk than investing in larger-cap stocks ...

Shenkman Capital Management, Inc - Profile

... performance and trends, including liquidity, cash flow and a break-even analysis. Shenkman Capital also focuses on capital structure, covenants, management track record, relative value, and a comparative industry analysis. The objective of this detailed review is to identify “money-good” bonds, ones ...

... performance and trends, including liquidity, cash flow and a break-even analysis. Shenkman Capital also focuses on capital structure, covenants, management track record, relative value, and a comparative industry analysis. The objective of this detailed review is to identify “money-good” bonds, ones ...

Document

... objectives, financial situation or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. Although taken from reliable sources, ClearArc ...

... objectives, financial situation or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. Although taken from reliable sources, ClearArc ...

Finance Policy Supporting Organization

... (4) The portfolios need not maintain a cash balance among the assets, except as may be dictated for investment or operational reasons. All capital gains, interest, and dividends paid can be reinvested. G. In any separately managed accounts customized for HCCFSO, short sales, commodities transactions ...

... (4) The portfolios need not maintain a cash balance among the assets, except as may be dictated for investment or operational reasons. All capital gains, interest, and dividends paid can be reinvested. G. In any separately managed accounts customized for HCCFSO, short sales, commodities transactions ...

Portfolio Management Analyzing Historical Stock Examples

... • Mixing a wide selection of investments within a portfolio – By industry, sizes, geographic locations, or other characteristics ...

... • Mixing a wide selection of investments within a portfolio – By industry, sizes, geographic locations, or other characteristics ...

Investment Policy Beaufort County Open Land Trust (BCOLT

... for consistency of investment philosophy, and for investment risk (as measured by asset concentration, exposure to extreme economic conditions and market volatility). Individually managed portfolios shall be monitored and reviewed by the Finance Committee periodically, but not less frequently than e ...

... for consistency of investment philosophy, and for investment risk (as measured by asset concentration, exposure to extreme economic conditions and market volatility). Individually managed portfolios shall be monitored and reviewed by the Finance Committee periodically, but not less frequently than e ...

Chapter 13

... Investment represents demand for loanable funds The supply and demand for loanable funds depends on the real interest rate Equilibrium determines the real interest rate in the economy ...

... Investment represents demand for loanable funds The supply and demand for loanable funds depends on the real interest rate Equilibrium determines the real interest rate in the economy ...

Outsourced investment management: what it offers the long

... because it is difficult to go from standard manager due diligence to aggregating position level data from multiple managers and quantitatively measuring portfolio risks on an ongoing basis. They also have to work with multiple client custodians, so there may be no unified approach to this important ...

... because it is difficult to go from standard manager due diligence to aggregating position level data from multiple managers and quantitatively measuring portfolio risks on an ongoing basis. They also have to work with multiple client custodians, so there may be no unified approach to this important ...

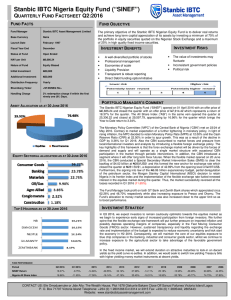

Nigerian Equity Fund - Stanbic IBTC Asset Management

... of the petroleum sector, the Morgan Stanley Capital International (MSCI) decision to retain Nigeria in its frontier index and the implementation of the flexible exchange rate fueled renewed interest in the equities market during the quarter. Thus, the market successfully reversed all the losses reco ...

... of the petroleum sector, the Morgan Stanley Capital International (MSCI) decision to retain Nigeria in its frontier index and the implementation of the flexible exchange rate fueled renewed interest in the equities market during the quarter. Thus, the market successfully reversed all the losses reco ...

Business Ethics - FIU College of Business

... Home prices were rising to record levels. These elevated home prices warranted more borrowing (loans). Many investors were convinced that real estate value would continue to appreciate and would never depreciate. They saw this as an opportunity to invest in these popular securities (mortgage backed ...

... Home prices were rising to record levels. These elevated home prices warranted more borrowing (loans). Many investors were convinced that real estate value would continue to appreciate and would never depreciate. They saw this as an opportunity to invest in these popular securities (mortgage backed ...

MESSAGE TO INVESTORS Year 2003 in Review The year 2003

... to participate in the attractive income trust sector on a lower cost basis while still benefiting from Middlefield’s expertise in this sector. The addition of this new class brings to eight the number of classes across which investors can switch on a tax-free basis, providing enhanced flexibility to ...

... to participate in the attractive income trust sector on a lower cost basis while still benefiting from Middlefield’s expertise in this sector. The addition of this new class brings to eight the number of classes across which investors can switch on a tax-free basis, providing enhanced flexibility to ...

Suitability report

... Walls & Futures London Growth Fund Suitability report Before giving advice to your clients, you will have carefully considered their financial needs, their attitude to risk and their own individual circumstances, as all these factors will influence the recommendations that you make to them. This doc ...

... Walls & Futures London Growth Fund Suitability report Before giving advice to your clients, you will have carefully considered their financial needs, their attitude to risk and their own individual circumstances, as all these factors will influence the recommendations that you make to them. This doc ...

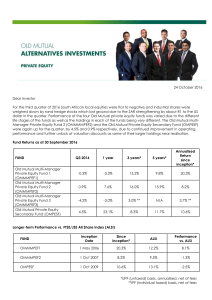

24 October 2016 Dear Investor For the third quarter of 2016 South

... OMMMPEF1 was down 0.3% for the quarter and 3.3% down over the last year. Despite the recent pullback, the fund is up 13.2% per year over the last three years and has been a superb creator of wealth for investors by outperforming inflation by 14.1% per annum since inception in May 2006. OMMMPEF1 has ...

... OMMMPEF1 was down 0.3% for the quarter and 3.3% down over the last year. Despite the recent pullback, the fund is up 13.2% per year over the last three years and has been a superb creator of wealth for investors by outperforming inflation by 14.1% per annum since inception in May 2006. OMMMPEF1 has ...

Of the Subprime Mess and Securitization

... Provide trade finance solutions that enhance organizations global competitiveness and maximize trading partner relationships Working Capital Management To ensure that the firm is able to continue its operations and that it has sufficient cash flow to satisfy both maturing short-term debt and upc ...

... Provide trade finance solutions that enhance organizations global competitiveness and maximize trading partner relationships Working Capital Management To ensure that the firm is able to continue its operations and that it has sufficient cash flow to satisfy both maturing short-term debt and upc ...

Focused Dynamic Growth - American Century Investments

... The Russell 1000® Index measures the performance of the 1,000 largest companies in the Russell 3000® Index (the 3,000 largest publicly traded U.S. companies based on total market capitalization). The Russell 1000® Growth Index measures the performance of those Russell 1000® companies with higher pri ...

... The Russell 1000® Index measures the performance of the 1,000 largest companies in the Russell 3000® Index (the 3,000 largest publicly traded U.S. companies based on total market capitalization). The Russell 1000® Growth Index measures the performance of those Russell 1000® companies with higher pri ...

$doc.title

... cap holdings. As we reduced our cash, an increasing proportion has been invested in medium and small capitalization stocks. Our top priority in the fall was cash management over capitalization size. During the spring semester, with cash under control, the fund became more aggressive about selling do ...

... cap holdings. As we reduced our cash, an increasing proportion has been invested in medium and small capitalization stocks. Our top priority in the fall was cash management over capitalization size. During the spring semester, with cash under control, the fund became more aggressive about selling do ...

Opportunistic Portfolios

... less liquid than the securities of larger companies. Smaller companies typically have a higher risk of failure and are not as well established as larger blue-chip companies. Historically, smaller company stocks have experienced a greater degree of market volatility than the overall market average. F ...

... less liquid than the securities of larger companies. Smaller companies typically have a higher risk of failure and are not as well established as larger blue-chip companies. Historically, smaller company stocks have experienced a greater degree of market volatility than the overall market average. F ...

f450_04sp - California State University, Long Beach

... Using these building blocks, the students are expected to gain an advanced understanding of the investment process, which they must apply to a simulated, group-managed portfolio that satisfies a specific risk-return objective. Furthermore, the students must develop their empirical skills to apply in ...

... Using these building blocks, the students are expected to gain an advanced understanding of the investment process, which they must apply to a simulated, group-managed portfolio that satisfies a specific risk-return objective. Furthermore, the students must develop their empirical skills to apply in ...