Kazyna - UN

... • The weighed taxation and budgetary policy owing to whom the system of public finances constantly becomes stronger. • Rich in natural resources, great demand on the basic export goods. • Significant volumes of budgetary, gold and exchange currency reserves. • Negative factors: • The increased risk ...

... • The weighed taxation and budgetary policy owing to whom the system of public finances constantly becomes stronger. • Rich in natural resources, great demand on the basic export goods. • Significant volumes of budgetary, gold and exchange currency reserves. • Negative factors: • The increased risk ...

Complexity of the global economy

... instruments. In reality, he pays more for the same investment. Because the classification and payment of commissions is like equity, and since equity commissions are higher, more commissions are doled out. It’s more effective to separate debt money from equity money. 6. Certain Real-estate funds ind ...

... instruments. In reality, he pays more for the same investment. Because the classification and payment of commissions is like equity, and since equity commissions are higher, more commissions are doled out. It’s more effective to separate debt money from equity money. 6. Certain Real-estate funds ind ...

TermPaper_PRES

... Reduce the risk of an individual asset by diversifying the portfolio Select a portfolio of various investments Maximize expected return at fixed level of risk Minimize risk at a fixed amount of expected return Choosing the right combination of stocks ...

... Reduce the risk of an individual asset by diversifying the portfolio Select a portfolio of various investments Maximize expected return at fixed level of risk Minimize risk at a fixed amount of expected return Choosing the right combination of stocks ...

North Carolina Large Cap Value Fund

... ■ The Delaware Large Cap Value Focus Equity Fund (33% of the Fund assets) is managed by Delaware Investments following their Large Cap Value Focus style. The portfolio seeks to achieve an annualized total rate of return that is above-median and preferably top-quartile among a universe of large cap v ...

... ■ The Delaware Large Cap Value Focus Equity Fund (33% of the Fund assets) is managed by Delaware Investments following their Large Cap Value Focus style. The portfolio seeks to achieve an annualized total rate of return that is above-median and preferably top-quartile among a universe of large cap v ...

FREE Sample Here - We can offer most test bank and

... I do little trading, so investment games are inconsistent with my investment philosophy and strategy. Although I do not discourage students from participating in a game, I also do nothing to encourage their use. I, however, have included two investment assignments at the end of the first chapter. Th ...

... I do little trading, so investment games are inconsistent with my investment philosophy and strategy. Although I do not discourage students from participating in a game, I also do nothing to encourage their use. I, however, have included two investment assignments at the end of the first chapter. Th ...

end of the golden age? - Virtus Investment Partners

... historical norm, what looks like a well-diversified portfolio may carry significant risk. If different assets sell off in tandem as global growth disappoints or U.S. interest rates rise unexpectedly, investors could discover just how diversified their portfolios are and if their investment strategie ...

... historical norm, what looks like a well-diversified portfolio may carry significant risk. If different assets sell off in tandem as global growth disappoints or U.S. interest rates rise unexpectedly, investors could discover just how diversified their portfolios are and if their investment strategie ...

Delaware Investments Global Value Fund - fund

... that combines quantitative, valuation-based screening followed by rigorous company and industry-specific research to seek the securities that it believes are the best investments for the Fund. Key points: • Consistency — disciplined application of bottom-up contrarian value approach through all mark ...

... that combines quantitative, valuation-based screening followed by rigorous company and industry-specific research to seek the securities that it believes are the best investments for the Fund. Key points: • Consistency — disciplined application of bottom-up contrarian value approach through all mark ...

investment policy - University of Arkansas at Pine Bluff

... funding needs (liquidity) so that current transactional requirements and obligations can be met. To accomplish this objective, cash is maintained in interest bearing checking accounts and excess cash is reduced and made available to generate investment income. Safety of university assets is also a p ...

... funding needs (liquidity) so that current transactional requirements and obligations can be met. To accomplish this objective, cash is maintained in interest bearing checking accounts and excess cash is reduced and made available to generate investment income. Safety of university assets is also a p ...

Stocks-Bonds - Model Capital Management LLC

... to the ETF sponsor or manager actions, market conditions, or other reasons beyond our control. One or more of the following risks may cause an ETF investment to deviate from the underlying index and to erode the value of a portfolio investment: high expenses, low liqui ...

... to the ETF sponsor or manager actions, market conditions, or other reasons beyond our control. One or more of the following risks may cause an ETF investment to deviate from the underlying index and to erode the value of a portfolio investment: high expenses, low liqui ...

факультета дистанционного обучения

... the total increase in value plus ant dividends or other payments. In this way, all investment instruments can be compared and evaluated by yield: their percentage increase in_______ over a given period of time. Inflation also has to be considered. Money is worth only what it will buy in goods and se ...

... the total increase in value plus ant dividends or other payments. In this way, all investment instruments can be compared and evaluated by yield: their percentage increase in_______ over a given period of time. Inflation also has to be considered. Money is worth only what it will buy in goods and se ...

RISK FACTORS As is the case with any type of investment, hedge

... RISK FACTORS As is the case with any type of investment, hedge funds and hedge fund investing can involve substantial risks. Below is a summary of certain risks involved in hedge fund investing, but by no means should this list be considered exhaustive. Potential loss of investment No guarantee or r ...

... RISK FACTORS As is the case with any type of investment, hedge funds and hedge fund investing can involve substantial risks. Below is a summary of certain risks involved in hedge fund investing, but by no means should this list be considered exhaustive. Potential loss of investment No guarantee or r ...

Newsletter

... GS Investments, Inc. utilizes a balanced approach for the majority of its accounts although each account is tailored to the individual needs of each client. Taxable or tax-exempt bonds are used along with a common stock component. The division between bonds and stocks is determined by the personal o ...

... GS Investments, Inc. utilizes a balanced approach for the majority of its accounts although each account is tailored to the individual needs of each client. Taxable or tax-exempt bonds are used along with a common stock component. The division between bonds and stocks is determined by the personal o ...

Invest NI Access to Finance February 2013

... Whiterock Capital Partners - a consortium led by Braveheart Investment Group are managing this Fund. ...

... Whiterock Capital Partners - a consortium led by Braveheart Investment Group are managing this Fund. ...

Class Outline - Villanova University

... -- Analyze different valuation and analytic techniques for equities -- Examine investments techniques for equity portfolios -- Look at mutual funds and other investment companies as vehicles for investment strategies. ...

... -- Analyze different valuation and analytic techniques for equities -- Examine investments techniques for equity portfolios -- Look at mutual funds and other investment companies as vehicles for investment strategies. ...

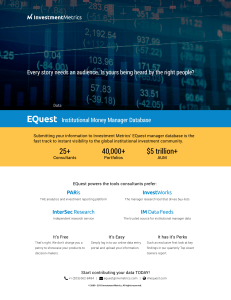

Every story needs an audience. Is yours being heard by the right

... Every story needs an audience. Is yours being heard by the right people? ...

... Every story needs an audience. Is yours being heard by the right people? ...

Allianz US Short Duration High Income Bond

... a market that is still pricing in a higher-than-likely realized default rate. Stress in select industries of the market has waned, and overall, balance sheets, leverage ratios and interest coverage ratios continue to support an investment in the asset class. The US economy is expected to expand at a ...

... a market that is still pricing in a higher-than-likely realized default rate. Stress in select industries of the market has waned, and overall, balance sheets, leverage ratios and interest coverage ratios continue to support an investment in the asset class. The US economy is expected to expand at a ...

The Point - Fieldpoint Private

... loss-making) consequences. Finally, they prevent the banking and financial system from operating normally, since policy uncertainty prevents consumers of capital and suppliers of capital from acting rationally. These are just a few of the reasons I am negative on the markets longer-term. Our asset a ...

... loss-making) consequences. Finally, they prevent the banking and financial system from operating normally, since policy uncertainty prevents consumers of capital and suppliers of capital from acting rationally. These are just a few of the reasons I am negative on the markets longer-term. Our asset a ...

DailyNewsTSIK

... Briarwood eighth in investment contest A team of four Briarwood Elementary School students took eighth place in the fall 2006 statewide Take Stock in Kentucky investment competition. More than 300 teams from across the state competed in the fall Take Stock in Kentucky competition in which teams of s ...

... Briarwood eighth in investment contest A team of four Briarwood Elementary School students took eighth place in the fall 2006 statewide Take Stock in Kentucky investment competition. More than 300 teams from across the state competed in the fall Take Stock in Kentucky competition in which teams of s ...

While investments always carry a certain amount of risk, the iStar

... While investments always carry a certain amount of risk, the iStar range of protected models are structured to help give you peace of mind. With the iStar range you can sacrifice a part of your return in order to protect your investments against a certain amount of downside risk. As an example, an i ...

... While investments always carry a certain amount of risk, the iStar range of protected models are structured to help give you peace of mind. With the iStar range you can sacrifice a part of your return in order to protect your investments against a certain amount of downside risk. As an example, an i ...

EDITOR`S CORNER Managing Investments for

... acknowledges that we must not fall too far behind our peer group lest their funding costs fall relative to ours. With this blended structure, the range of possible investments is many times larger than when we are locked into the conventional obsession with peer groups (or, for that matter, immuniza ...

... acknowledges that we must not fall too far behind our peer group lest their funding costs fall relative to ours. With this blended structure, the range of possible investments is many times larger than when we are locked into the conventional obsession with peer groups (or, for that matter, immuniza ...