* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Click to download DGHM ACV December 2015

Stock trader wikipedia , lookup

Private equity wikipedia , lookup

International investment agreement wikipedia , lookup

Corporate venture capital wikipedia , lookup

Special-purpose acquisition company wikipedia , lookup

Early history of private equity wikipedia , lookup

Investment banking wikipedia , lookup

Private equity secondary market wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

Money market fund wikipedia , lookup

Socially responsible investing wikipedia , lookup

Private money investing wikipedia , lookup

Mutual fund wikipedia , lookup

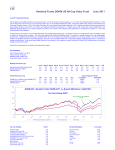

Hereford Funds DGHM US All-Cap Value Fund December 2015 Investment Review The Hereford Funds DGHM US All-Cap Value Fund Class A shares returned -3.5% for the month of December compared to a -2.4% return for the Russell 3000 Value Index. The S&P 500 returned -1.6% for the month. Sectors that added value during the month were led by Business Services (Omnicom +3%), Basic Materials (Glatfelter +4%), and Miscellaneous Financials (outperformance was driven by stocks we did not own in a down sector). Sectors that underperformed this month were Technology (Analog Devices -10%), Capital Goods (Regal Beloit -9%), and Retail (Bed Bath & Beyond -11%). Analog Devices was negatively impacted by concerns over their Apple consumer exposure. Regal Beloit was weak due to concerns over a weakening US economy. Bed Bath & Beyond was down as they preannounced a weaker than expected quarter. We continue to hold all three names as we are positive on their longer-term fundamentals. There were no new names added this month, while we did exit two positions in Energy. The remaining stub position in Baker Hughes was sold as their potential merger with Halliburton continues to be delayed by regulatory issues. Range Resources was sold due to a deteriorating natural gas oversupply situation. Cash averaged 3.0%. Thank you for your continued support. Investment Objective The investment objective of the ACV sub fund is to provide capital appreciation over a multi-year investment horizon by investing primarily in a diversified portfolio of publicly traded equity securities of US based companies, which the Investment Manager believes to be undervalued. The companies will generally have a market capitalizations of more than USD 1 billion. The sub fund may, on an ancillary basis, invest in US-based companies with higher or lower capitalizations as well as in non US-based companies. The Compartment may invest in American Depository Receipts and American Depository Shares. The indicative benchmarks are the Russell 3000 Value and the S&P 500 Indices. Key Information NAV A Shares: Total Fund Size: as of December 31, 2015 $713.025mil(a) July 31, 2009 Strategy Assets: Fund Launch Date: $180.79 $145.529mil Monthly Performance (%) HF DGHM US ACV (c) Russell 3000 Value Index (c) S&P 500 Index as of December 31, 2015 Jan-15 Feb-15 Mar-15 Apr-15 May-15 (3.8) 5.6 (0.1) 0.1 (0.0) (4.0) 4.8 (1.1) 0.7 1.2 (3.0) 5.8 (1.6) 1.0 1.3 Jun-15 (2.6) (1.8) (1.9) Jul-15 Aug-15 Sep-15 Oct-15 Nov-15 Dec-15 (0.1) (6.1) (4.0) 5.9 (0.5) (3.5) 0.2 (5.9) (3.1) 7.4 0.6 (2.4) 2.1 (6.0) (2.5) 8.4 0.3 (1.6) Period Performance (%) YTD (9.4) (4.1) 1.4 Since Inception (January 1, 1983 - December 31, 2015) DGHM ACV / HF DGHM US ACV (c) Russell 3000 Value Index (c) S&P 500 Index (b) YTD (9.4) (4.1) 1.4 1 yr (9.4) (4.1) 1.4 2 yr (0.6) 3.9 7.4 3 yr 10.2 12.8 15.1 4 yr 9.3 13.9 15.4 Value of a Dollar 5 yr 6.4 11.0 12.6 10 yr 5.9 6.1 7.3 Cumulative 3005.7 3553.9 3221.8 Annualized 11.0 11.5 11.2 Past Ten Years December 31, 2005 - December 31, 2015) DGHM ACV / Hereford Funds DGHM US ACV(b) vs. Russell 3000 Value(c) & S&P 500(c) 210 170 KEY DGHM ACV/Hereford Funds DGHM US ACV Russell 3000 Value S&P 500 130 Start of HF DGHM US ACV 31-Jul-09 90 50 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Dec-13 Dec-14 Dec-15 Hereford Funds DGHM US All-Cap Value Fund December 2015 Portfolio as of December 31, 2015 Sector Breakdown Industrial Cyclicals Consumer Cyclicals Technology Non-Cyclicals Financials Utilities [Cash] Total % 28.8 7.9 9.4 10.6 30.1 11.1 2.1 100.0 Top Ten Holdings Pfizer Inc. JPMorgan Chase & Co. AT&T Inc. Suncor Energy Inc. Halliburton Co. Cisco Systems, Inc. WEC Energy Group Inc PDC Energy Inc. Check Point Software Technologies Fluor Corp. % 4.8 4.7 4.6 3.7 3.6 3.6 3.5 3.3 3.2 3.1 Total Since Inception (January 1, 1983 - December 31, 2015) (d) Risk Statistics Volatility Sharpe Ratio Information Ratio Tracking Error Beta Alpha DGHM ACV 16.54 0.53 (listed below benchmark) (listed below benchmark) (listed below benchmark) (listed below benchmark) R3KV S&P 500 15.73 16.00 0.48 0.45 0.19 0.20 6.79 8.19 0.96 0.90 1.79 2.74 37.9 Fund Details Bloomberg: ISIN: Reuters: Sedol: Valoren: WKN: HERACVALX* LU0435791347 N/A B5MDN13 10269479 A0RPYP * Share Class A Dealing day: Dividends: Investment Manager: Management Company: Custodian: Legal Advisers: Auditor: Annual Management Charge (e) Share Class A Share Class D(f) Share Class B(g) 1.25% 1.75% 0.95% (capped TER at 1.20%) Daily None (income accumulated within the fund) Dalton, Greiner, Hartman, Maher & Co., LLC, 565 Fifth Avenue, #2101, NYC, 10017, USA BSI Fund Management S.A., 44F rue de la Vallée, L-2661 Luxembourg BSI Europe S.A., 122 rue Adolphe Fischer, L-1521 Luxembourg Elvinger, Hoss & Prussen, 2 Place Winston Churchill, L-1340 Luxembourg Deloitte Audit S.à.r.l. Minimum Investment Share Class A Share Class D Share Class B $100,000 initial; $10,000 subsequent $10,000 initial; $1,000 subsequent $10,000,000 initial; $100,000 subsequent Order Transmission / Information Original Applications to: UBS Fund Services Attn: Transfer Agent 33a, avenue J.F. Kennedy L-1855 Luxembourg Subsequent Applications only via Facsimile: UBS Fund Services Attn: Transfer Agent Fax: (+352) 4410106417 Tel: (+352) 4410106404 Email: [email protected] (a) This refers to the total assets invested in the reference strategy managed by the Investment Manager. Assets include third party platform assets for which DGHM does not have full conditional authority, and which have been excluded from the definition of the firm for GIPS purposes. The assets consist of direct wrap relationships estimated at $310 million and model portfolio relationships estimated at $21 million as of 31/12/15. (b) Data and graph depict DGHM composite through July 2009 and Hereford Funds DGHM US All-Cap Value Class A thereafter. Historical net performance of DGHM All-Cap Value Composite returns (the Reference Strategy) includes modelled fee and expense typical of Hereford Funds DGHM US All-Cap Value Fund Class A (1.25% fee + 0.25% expense). Fund follows same strategy. Performance presentation incomplete without accompanying footnotes as shown at www.dghm.com. (c) Total return including dividends. (d) Source: FactSet – All numbers are based on the DGHM AllCap Value composite and presented gross of fees and expenses. (e) Share Class A is registered with the BaFin for public distribution in Germany, registered with the AFM for public distribution in the Netherlands, registered with the AMF for public distribution in France, registered with Finma for public distribution in Switzerland, and has been granted Reporting Status by HMRC as of October 1st, 2010. (f) Share Class D is registered with the BaFin for public distribution in Germany, registered with the AFM for public distribution in the Netherlands. registered with the AMF for public distribution in France, and registered with Finma for public distribution in Switzerland. (g) Share Class B is registered with the BaFin for public distribution in Germany. France - Centralizing Correspondent as defined by French Regulation: Société Générale - Order Desk, 32, avenue du Champ de Tir, BP 81236, F-44312 Nantes Cedex 3; Phone: +33/2.51.85.66.40, Fax: +33/2.51.85.58.71 Germany – Paying Agent as defined by German Regulation: Marcard, Stein & Co – Ballindamm 36, 20095 Hamburg; Phone: +49/40.32.099.556, Fax: +49/40.32.099.206 Switzerland - Representative and Paying Agent as defined by Swiss Regulation: Société Générale, Zurich Branch - Talacker, 50, P.O. Box 1928, CH-8021 Zurich; Phone: +41/58.272.34.18 Fax: +41/58.272.35.49 This document is for information purposes and internal use only. It is neither an advice nor a recommendation to enter into any investment. Investment suitability must be determined individually for each investor, and the financial instruments described above may not be suitable for all investors. This information does not provide any accounting, legal, regulatory or tax advice. Please consult your own professional advisers in order to evaluate and judge the matters referred to herein. An investment should be made only on the basis of the prospectus, the annual and any subsequent semi-annual-reports of HEREFORD FUNDS (the "Fund"), a société d'investissement à capital variable, established in Luxembourg and registered under Part I of Luxembourg law of 20 December, approved by the Commission de Surveillance du Secteur Financier (CSSF). These can be obtained from the Fund, from BSí FUND MANAGEMENT S.A., 44F, rue de la Vallée, L- 2661 Luxembourg, and any distributor or intermediary appointed by the Fund. No warranty is given, in whole or in part, regarding performance of the Fund. There is no guarantee that its investment objectives will be achieved. Potential investors shall be aware that the value of investments can fall as well as rise and that they may not get back the full amount invested. Past performance is no guide to future performance. The information provided in this document may be subject to change without any warning or prior notice and should be read in conjunction with the most recent publication of the prospectus of the Fund. Whilst great care is taken to ensure that information contained herein is accurate, no responsibility can be accepted for any errors, mistakes or omission or for future returns. This document is intended for the use of the addressee or recipient only and may not be reproduced, redistributed, passed on or published, in whole or in part, for any purpose, without the prior written consent of HEREFORD FUNDS. Neither the CSSF nor any other regulator has approved this document.