* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download I. “Active” Small/Mid Cap US Equity (SMID) Should Play Second

Survey

Document related concepts

Trading room wikipedia , lookup

Private equity in the 1980s wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Short (finance) wikipedia , lookup

Leveraged buyout wikipedia , lookup

Securities fraud wikipedia , lookup

Early history of private equity wikipedia , lookup

Financial crisis wikipedia , lookup

Socially responsible investing wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

Investment banking wikipedia , lookup

Investment fund wikipedia , lookup

Transcript

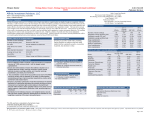

I. “Active” Small/Mid Cap US Equity (SMID) Should Play Second Stage of Economic Recovery The GIC believes that the second stage of economic recovery usually means rising rates and stocks. As the US economy recovers, focus on “stock pickers;” managers with proven records of generating alpha and making "active" bets. Context Correlations Collapse, Making Active Management More Attractive • As the global economy grows stronger, correlations are falling between asset classes and securities • The US economy is moving into a more mature phase of recovery and the Fed's decision to end QE supports this view • Mario Draghi’s commitment to “do whatever it takes” reduced systemic risk and helped to drive correlations lower • Active‐manager outperformance made a notable push higher in 2013 after three years of below‐average performance (11% more fund managers outperformed equity indexes compared to 2012) • The outperformance in 2013 is more impressive if we just look at 2Q 2013 through 4Q 2013 (54% of managers outperformed from 2Q through 4Q, while 47% outperformed for full‐year 2013) • Small‐ and mid‐cap stocks have offered more fertile ground for stock picking given their relatively idiosyncratic characteristics As of September 12, 2014 Investment Thesis • As a result of falling asset correlations, it makes sense to consider a more active investing approach in equities • Small‐ and mid‐cap equities should offer opportunities as they are more exposed to an accelerating US economy and less exposed to decelerating emerging market economies • Use stock market pullbacks as an opportunity to increase exposure to SMID US equities (average market cap <$10 billion) Mario Draghi Commits to “Do Whatever it Takes” 75 65 55 45 35 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Morgan Stanley & Co. Asset Co‐Movement Indicator 1 10‐Year Average Rising Active Manager Outperformance Vs. Passive Equity Indexes As of December 31, 2013 (annual data) 65% 55% 45% 35% 25% 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Active Mutual Fund Manager Outperformance 10‐Year Average Source: Morningstar, Morgan Stanley & Co., Morgan Stanley Wealth Management GIC; (1) Morgan Stanley’s Asset Co‐Movement Indicator Index tracks weekly returns of 16 different asset classes, (e.g., equities, fixed income, commodities, etc.) and how much of their cross‐variation can be explained by a single factor. Past performance is no guarantee of future results. Estimates of future performance are based on assumptions that may not be realized. This material is not a solicitation of any offer to buy or sell any security or other financial instrument or to participate in any trading strategy. Please refer to important information, disclosures and qualifications at the end of this material. GLOBAL INVESTMENT COMMITTEE Page 1 I. “Active” Small/Mid Cap US Equity (SMID) Should Play Second Stage of Economic Recovery Investment Ideas Low Performance Dispersion Should Help Stock Pickers • We favor portfolios and securities that are levered toward the US economic recovery and that have high and growing free cash flow and return on invested capital • Our view that the US economy is entering a more mature phase of recovery suggests that "late‐cycle" sectors should outperform within the US equity market • We prefer energy, domestic industrials, select health care and select technology • Please contact your Financial Advisor for specific investment ideas As of August 29, 2014 Key Risks 30% 20% 10% 0% 1972 1976 1980 1984 1988 1992 1996 2000 2004 2008 2012 S&P 500 Performance Dispersion • A rapid increase in rates could have negative implications for small‐ and mid‐cap stocks • Multiples have expanded, making stronger earnings growth critical in 2014 • Change in Fed leadership and confusion surrounding forward guidance may lead to increased volatility in equity markets • A string of disappointing economic data could raise questions about the strength of the US economic recovery Source: Russell, FactSet, Morgan Stanley Wealth Management GIC Past performance is no guarantee of future results. Estimates of future performance are based on assumptions that may not be realized. This material is not a solicitation of any offer to buy or sell any security or other financial instrument or to participate in any trading strategy. Please refer to important information, disclosures and qualifications at the end of this material. GLOBAL INVESTMENT COMMITTEE Page 2 Index Definitions S&P 500 INDEX Regarded as the best single gauge of the US equities market, this capitalization‐weighted index includes a representative sample of 500 leading companies in leading industries of the US economy. Risk Considerations International investing entails greater risk, as well as greater potential rewards compared to U.S. investing. These risks include political and economic uncertainties of foreign countries as well as the risk of currency fluctuations. These risks are magnified in countries with emerging markets, since these countries may have relatively unstable governments and less established markets and economies. Equity securities may fluctuate in response to news on companies, industries, market conditions and general economic environment. Investing in smaller companies involves greater risks not associated with investing in more established companies, such as business risk, significant stock price fluctuations and illiquidity. Stocks of medium‐sized companies entail special risks, such as limited product lines, markets, and financial resources, and greater market volatility than securities of larger, more‐ established companies. Because of their narrow focus, sector investments tend to be more volatile than investments that diversify across many sectors and companies. Investing in foreign emerging markets entails greater risks than those normally associated with domestic markets, such as political, currency, economic and market risks. Disclosures Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker‐dealer in the United States. This material has been prepared for informational purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any security or other financial instrument or to participate in any trading strategy. Past performance is not necessarily a guide to future performance. The securities/instruments discussed in this material may not be suitable for all investors. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives. Morgan Stanley Wealth Management recommends that investors independently evaluate specific investments and strategies, and encourages investors to seek the advice of a financial advisor. This material is based on public information as of the specified date, and may be stale thereafter. We have no obligation to tell you when information herein may change. We and our third‐ party data providers make no representation or warranty with respect to the accuracy or completeness of this material. Past performance is no guarantee of future results. This material should not be viewed as advice or recommendations with respect to asset allocation or any particular investment. This information is not intended to, and should not, form a primary basis for any investment decisions that you may make. Morgan Stanley Wealth Management is not acting as a fiduciary under either the Employee Retirement Income Security Act of 1974, as amended or under section 4975 of the Internal Revenue Code of 1986 as amended in providing this material. Morgan Stanley Wealth Management and its affiliates do not render advice on tax and tax accounting matters to clients. This material was not intended or written to be used, and it cannot be used or relied upon by any recipient, for any purpose, including the purpose of avoiding penalties that may be imposed on the taxpayer under U.S. federal tax laws. Each client should consult his/her personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation. Asset allocation and diversification do not assure a profit or protect against loss in declining financial markets. The indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes only and do not represent the performance of any specific investment. The indices selected by Morgan Stanley Wealth Management to measure performance are representative of broad asset classes. Morgan Stanley Smith Barney LLC retains the right to change representative indices at any time. This material is disseminated in the United States of America by Morgan Stanley Smith Barney LLC. Third‐party data providers make no warranties or representations of any kind relating to the accuracy, completeness, or timeliness of the data they provide and shall not have liability for any damages of any kind relating to such data. Morgan Stanley Wealth Management research, or any portion thereof, may not be reprinted, sold or redistributed without the written consent of Morgan Stanley Smith Barney LLC. © 2014 Morgan Stanley Smith Barney LLC. Member SIPC. Past performance is no guarantee of future results. Estimates of future performance are based on assumptions that may not be realized. This material is not a solicitation of any offer to buy or sell any security or other financial instrument or to participate in any trading strategy. Please refer to important information, disclosures and qualifications at the end of this material. GLOBAL INVESTMENT COMMITTEE Page 3