NUK- Money and Banking

... The price level and the money supply move closely a continuing increase in M might be an important factor in causing a continuing increase in P ...

... The price level and the money supply move closely a continuing increase in M might be an important factor in causing a continuing increase in P ...

Bank regulation - KROS College Kohima

... Financial reporting and disclosure requirements[edit] Among the most important regulations that are placed on banking institutions is the requirement for disclosure of the bank's finances. Particularly for banks that trade on the public market, in the US for example the Securities and Exchange Commi ...

... Financial reporting and disclosure requirements[edit] Among the most important regulations that are placed on banking institutions is the requirement for disclosure of the bank's finances. Particularly for banks that trade on the public market, in the US for example the Securities and Exchange Commi ...

1 Multiple Deposit Creation and the Money Supply Process

... • OMOs always affect MB, one to one. (OMO = UMB) and (UMB = UR + UC) • However, whether the OMO increases or decreases R or C depends on the public's ...

... • OMOs always affect MB, one to one. (OMO = UMB) and (UMB = UR + UC) • However, whether the OMO increases or decreases R or C depends on the public's ...

What the Federal Reserve Can Learn from the Bank of Israel The

... obscured as a deferred asset account is one case in point. Yes, this will prevent a future FR from showing negative equity, but it will do nothing to hide the fact that the FR will be running losses and that the FR has ceased transferring profit to the Treasury. Better that provisions for this event ...

... obscured as a deferred asset account is one case in point. Yes, this will prevent a future FR from showing negative equity, but it will do nothing to hide the fact that the FR will be running losses and that the FR has ceased transferring profit to the Treasury. Better that provisions for this event ...

HO 7 - Ferda HALICIOGLU

... Banks and the money supply While cleaning your apartment, you look under the sofa cushion and find a $50 bill (and a half-eaten taco). You deposit the bill in your checking account. The Fed’s reserve requirement is 20% of deposits. A. What is the maximum amount that the money supply could increase? ...

... Banks and the money supply While cleaning your apartment, you look under the sofa cushion and find a $50 bill (and a half-eaten taco). You deposit the bill in your checking account. The Fed’s reserve requirement is 20% of deposits. A. What is the maximum amount that the money supply could increase? ...

Transcript

... The Federal Reserve reduced interest rates 11 times in 2001! What tools are available to the FED for influencing interest rates and for controlling the nation’s money supply? The FED has three major, sometimes called quantitative, monetary policy tools at its disposal. One is the discount rate. This ...

... The Federal Reserve reduced interest rates 11 times in 2001! What tools are available to the FED for influencing interest rates and for controlling the nation’s money supply? The FED has three major, sometimes called quantitative, monetary policy tools at its disposal. One is the discount rate. This ...

Customer Relations Officer

... (M/F) FULL TIME Advanzia Bank S.A. is a Luxembourg-based bank providing compelling products to individuals and partners across Europe. Specialising in credit cards and deposit accounts, we are one of the fastest growing credit card issuers in Europe with a strong presence in Germany, Luxembourg, Fra ...

... (M/F) FULL TIME Advanzia Bank S.A. is a Luxembourg-based bank providing compelling products to individuals and partners across Europe. Specialising in credit cards and deposit accounts, we are one of the fastest growing credit card issuers in Europe with a strong presence in Germany, Luxembourg, Fra ...

Monetary Policy - Coach Wilkinson`s AP Government Class

... 30%, and most economists agree that this was a major cause of the Great Depression. • The Federal Reserve controls the money supply through monetary policy. Monetary policy works through encouraging or discouraging banks from making loans. ...

... 30%, and most economists agree that this was a major cause of the Great Depression. • The Federal Reserve controls the money supply through monetary policy. Monetary policy works through encouraging or discouraging banks from making loans. ...

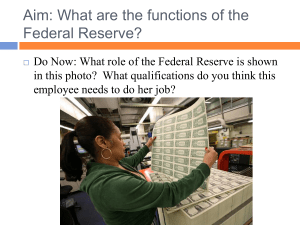

Aim: How does the Federal Reserve regulate the money supply?

... in this photo? What qualifications do you think this employee needs to do her job? ...

... in this photo? What qualifications do you think this employee needs to do her job? ...

Hold the Frankincense and Myrrh

... First, the scale of the intervention is huge. 80 trillion yen works out to be around 700 billion dollars. This is almost the same size as the US Federal Reserve’s quantitative easing scheme at its height, but considering that the Japanese economy is less than half the size of the American economy, t ...

... First, the scale of the intervention is huge. 80 trillion yen works out to be around 700 billion dollars. This is almost the same size as the US Federal Reserve’s quantitative easing scheme at its height, but considering that the Japanese economy is less than half the size of the American economy, t ...

Problem Sheet 1

... which decreases the money supply. c. If the Fed raises the reserve requirement, banks will have to hold more of their deposits as reserves and so will have less to lend out. With less to lend out, deposits and the money supply ...

... which decreases the money supply. c. If the Fed raises the reserve requirement, banks will have to hold more of their deposits as reserves and so will have less to lend out. With less to lend out, deposits and the money supply ...

Press Release - Nasdaq Dubai

... Bank and President & Chief Executive of Al Baraka Banking Group Mr. Adnan Ahmed Yousif said: "Given the difficult political and economic conditions prevailed the banks environment in the previous period, we are very pleased with the excellent results that the Bank achieved in first six months of 201 ...

... Bank and President & Chief Executive of Al Baraka Banking Group Mr. Adnan Ahmed Yousif said: "Given the difficult political and economic conditions prevailed the banks environment in the previous period, we are very pleased with the excellent results that the Bank achieved in first six months of 201 ...

On June 23 the ECB allowed European banks and

... This week’s infusion of credit is of course not unwelcome, following the ECB’s June 2009 Financial Stability Review which estimates that European banks will be forced to accept losses on an additional $283 billion in bad assets due to US and EU consumers defaulting on mortgages and other loans. Bas ...

... This week’s infusion of credit is of course not unwelcome, following the ECB’s June 2009 Financial Stability Review which estimates that European banks will be forced to accept losses on an additional $283 billion in bad assets due to US and EU consumers defaulting on mortgages and other loans. Bas ...

creation of money

... Options b) and c) result in an expansion of monetary base („printing money”). If such situation persists, according to the quantity theory of money it will lead to inflation. No inflation if the overall money supply does not grow (in case of credit contraction). In such case the increase in the mone ...

... Options b) and c) result in an expansion of monetary base („printing money”). If such situation persists, according to the quantity theory of money it will lead to inflation. No inflation if the overall money supply does not grow (in case of credit contraction). In such case the increase in the mone ...

14-5_GOUNEV - Bank of Greece

... • Issuing recommendation for non-distribution of dividends by banks; • Raising the minimum guaranteed amount of customer deposits to 50,000 EUR in 2009 • Widening the scope of supervision – introduction of registration requirements for other financial institutions (e.g. leasing, cash credit, etc.) • ...

... • Issuing recommendation for non-distribution of dividends by banks; • Raising the minimum guaranteed amount of customer deposits to 50,000 EUR in 2009 • Widening the scope of supervision – introduction of registration requirements for other financial institutions (e.g. leasing, cash credit, etc.) • ...

The Fed Assignment AP

... responsibilities or duties. (Board of Gov. / F.O.M.C. / F.AC.) 2. Explain the duties or functions of the Federal Reserve? 3. When would the Fed use expansionary or contractionary policy. (You could draw a diagram like the business cycle to explain this.) 4. Explain the three main policy tools (monet ...

... responsibilities or duties. (Board of Gov. / F.O.M.C. / F.AC.) 2. Explain the duties or functions of the Federal Reserve? 3. When would the Fed use expansionary or contractionary policy. (You could draw a diagram like the business cycle to explain this.) 4. Explain the three main policy tools (monet ...