The Central Bank with an expanded role in a purely

... In the absence of private sector “liquidity” creation, the central bank would have to provide financing for private sector investment trust liabilities, or a government development bank could finance innovation through the issue of debt monetized by the central bank. (...) such a system would have t ...

... In the absence of private sector “liquidity” creation, the central bank would have to provide financing for private sector investment trust liabilities, or a government development bank could finance innovation through the issue of debt monetized by the central bank. (...) such a system would have t ...

Chapter29

... reflects the Bank of Canada’s belief that monetary policy is neutral in the long run. The Bank believes that a change in the money supply will have short-run effects on output and employment that will get reversed by the economy’s automatic adjustment mechanism. The only long-run effect of the chang ...

... reflects the Bank of Canada’s belief that monetary policy is neutral in the long run. The Bank believes that a change in the money supply will have short-run effects on output and employment that will get reversed by the economy’s automatic adjustment mechanism. The only long-run effect of the chang ...

Reasons for cross-border cooperation (1/2)

... (1) In 2005 figures, Loans & Consignment Fund and Postal Saving Bank are included. The latter, in 2006 figures is treated as a commercial bank. (2) Including both branches and subsidiaries of Greek banks established abroad. ...

... (1) In 2005 figures, Loans & Consignment Fund and Postal Saving Bank are included. The latter, in 2006 figures is treated as a commercial bank. (2) Including both branches and subsidiaries of Greek banks established abroad. ...

Financial Times

... A loan to be paid by another loan, to be paid by another, etc. Each loan is an obligation that bank does not have ability to pay on time—“sale of what you don’t have” ...

... A loan to be paid by another loan, to be paid by another, etc. Each loan is an obligation that bank does not have ability to pay on time—“sale of what you don’t have” ...

Wall Street Journal

... invitation to speculators to attack the currency The Overvaluation Rule Sooner or later, an overvalued currency will fall The Distribution Rule • The distribution of income matters ...

... invitation to speculators to attack the currency The Overvaluation Rule Sooner or later, an overvalued currency will fall The Distribution Rule • The distribution of income matters ...

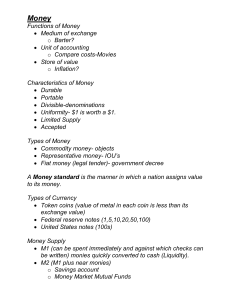

Characteristics of Money

... Functions of Money Medium of exchange o Barter? Unit of accounting o Compare costs-Movies Store of value o Inflation? Characteristics of Money Durable Portable Divisible-denominations Uniformity- $1 is worth a $1. Limited Supply Accepted Types of Money Commodity money- objects ...

... Functions of Money Medium of exchange o Barter? Unit of accounting o Compare costs-Movies Store of value o Inflation? Characteristics of Money Durable Portable Divisible-denominations Uniformity- $1 is worth a $1. Limited Supply Accepted Types of Money Commodity money- objects ...

FRBSF E L CONOMIC ETTER

... These developments in the banking sector all coincide with higher stock market capitalization rates for banks and lower stock return volatility. Indeed, bank stocks have outperformed the market since 1995, and particularly during the 2001 recession (see Figure 3); evidently, investors viewed banks a ...

... These developments in the banking sector all coincide with higher stock market capitalization rates for banks and lower stock return volatility. Indeed, bank stocks have outperformed the market since 1995, and particularly during the 2001 recession (see Figure 3); evidently, investors viewed banks a ...

Abstract

... economic growth by controlling inflation and stabilizing currency. Like any other central bank, Bangladesh Bank is performing the role to formulate monetary policy in Bangladesh. The control of money supply is an important policy tool in conducting monetary policy. The success of monetary policy dep ...

... economic growth by controlling inflation and stabilizing currency. Like any other central bank, Bangladesh Bank is performing the role to formulate monetary policy in Bangladesh. The control of money supply is an important policy tool in conducting monetary policy. The success of monetary policy dep ...

International Insolvency Law Organisational matters

... Monetary base is steered by the central bank via monetary policy instruments (open market operations, interest rates, reserve requirements). ...

... Monetary base is steered by the central bank via monetary policy instruments (open market operations, interest rates, reserve requirements). ...

Crash of 1929 vs the Crash of 1987

... The economy of 1987 had been expanding since 1982 Because of this expansion in 87’, the economy may have been more resilient and stronger ...

... The economy of 1987 had been expanding since 1982 Because of this expansion in 87’, the economy may have been more resilient and stronger ...

download soal

... unit is federally regulated, BankAtlantic eventually might have faced regulatory action if it didn't substantially beef up the unit's capital and reserve levels to cover the bad loans. Because the BankAtlantic subsidiary that holds the bad loans isn't regulated, it doesn't face the same capital requ ...

... unit is federally regulated, BankAtlantic eventually might have faced regulatory action if it didn't substantially beef up the unit's capital and reserve levels to cover the bad loans. Because the BankAtlantic subsidiary that holds the bad loans isn't regulated, it doesn't face the same capital requ ...

AP Macroeconomics Review sheet 1. The transactions demand for

... excess reserves. 9. Assume that the required reserve ratio for the commercial banks is 10 percent. If the Federal Reserve Banks buy $10 billion in government securities from commercial banks we can say that, as a result of this transaction, the lending ability of the commercial banking system will i ...

... excess reserves. 9. Assume that the required reserve ratio for the commercial banks is 10 percent. If the Federal Reserve Banks buy $10 billion in government securities from commercial banks we can say that, as a result of this transaction, the lending ability of the commercial banking system will i ...

BANKING

... The flow of money has a direct effect on how the economy performs. Liquidity is variable, depending on the nature of the asset. M1 is sometimes referred to as the “base” money supply. The agreed-upon value of money in the United States today is based on the government’s convention and has no ...

... The flow of money has a direct effect on how the economy performs. Liquidity is variable, depending on the nature of the asset. M1 is sometimes referred to as the “base” money supply. The agreed-upon value of money in the United States today is based on the government’s convention and has no ...

The Federal Reserve

... Fiscal and Monetary Policy Tools The federal government and the Federal Reserve both have tools to influence the nation’s economy. Fiscal and Monetary Policy Tools ...

... Fiscal and Monetary Policy Tools The federal government and the Federal Reserve both have tools to influence the nation’s economy. Fiscal and Monetary Policy Tools ...

MonetaryPolicyPractice

... 23. In Exhibit 1, if the required reserve ratio is raised to 15 percent, First Iliad State will have to convert loans worth: a. $9,000,000 to required reserves. b. $1,500,000 to required reserves. c. $500,000 to required reserves. d. $1,000,000 to required reserves. e. $450,000 to required reserves. ...

... 23. In Exhibit 1, if the required reserve ratio is raised to 15 percent, First Iliad State will have to convert loans worth: a. $9,000,000 to required reserves. b. $1,500,000 to required reserves. c. $500,000 to required reserves. d. $1,000,000 to required reserves. e. $450,000 to required reserves. ...

Money and Banks

... Checking accounts perform the same market functions as cash. Debit cards act much like a check, so they are money. Online payment systems and credit cards do not. They can be a medium of exchange but do not fulfill the other purposes. The essence of money is not its physical form, but its ability to ...

... Checking accounts perform the same market functions as cash. Debit cards act much like a check, so they are money. Online payment systems and credit cards do not. They can be a medium of exchange but do not fulfill the other purposes. The essence of money is not its physical form, but its ability to ...

Section 2

... Lender of Last Resort – Under normal circumstances, banks lend each other money on a day-to-day basis, using money from their reserve balances – These funds are called federal funds. The interest rate that banks charge each other for these loans is the Federal Funds Rate – Banks can also borrow fr ...

... Lender of Last Resort – Under normal circumstances, banks lend each other money on a day-to-day basis, using money from their reserve balances – These funds are called federal funds. The interest rate that banks charge each other for these loans is the Federal Funds Rate – Banks can also borrow fr ...

Transportation, Market, and Industrial Revolutions and Panic of

... Constructed British spinning mill with financial support of Moses Brown Soon shared mills with Brown all over Rhode Island and Massachusetts ...

... Constructed British spinning mill with financial support of Moses Brown Soon shared mills with Brown all over Rhode Island and Massachusetts ...

Macroeconomics

... sellers of corporate & government bonds (securities) Fed’s Open-market operations consist of buying bonds from or selling bonds to commercial banks & general public The most important instrument for influencing the money supply ...

... sellers of corporate & government bonds (securities) Fed’s Open-market operations consist of buying bonds from or selling bonds to commercial banks & general public The most important instrument for influencing the money supply ...

Non ERISA Collateral Schedule

... Corporate bonds issued by companies domiciled in one of the following countries where such corporate bond has an investment grade rating from at least one of Standard & Poor’s, Fitch, Moody’s or DBRS.* Australia Austria Belgium Canada Denmark Finland France Germany Ireland Italy Japan ...

... Corporate bonds issued by companies domiciled in one of the following countries where such corporate bond has an investment grade rating from at least one of Standard & Poor’s, Fitch, Moody’s or DBRS.* Australia Austria Belgium Canada Denmark Finland France Germany Ireland Italy Japan ...

Key

... loss that might result is comparatively small. This type of bank also has some short term fixed investments, but these do not change much in market value even when interest rates changed (because they will be paid off so soon). What is the discount rate? For a tight money policy, would the Federal R ...

... loss that might result is comparatively small. This type of bank also has some short term fixed investments, but these do not change much in market value even when interest rates changed (because they will be paid off so soon). What is the discount rate? For a tight money policy, would the Federal R ...