Bureau de change UNIVERSAL currency exchange inc.

... 1. The Buying and Selling of Foreign Currencies as a service - and2. The selling of a company cheque in a foreign currency - and – receiving payment from the client in the form of Interac card , Bank Draft or cheque; 3. The selling of a wire payment in a foreign currency – and – receiving payment vi ...

... 1. The Buying and Selling of Foreign Currencies as a service - and2. The selling of a company cheque in a foreign currency - and – receiving payment from the client in the form of Interac card , Bank Draft or cheque; 3. The selling of a wire payment in a foreign currency – and – receiving payment vi ...

Deutsche Equities India Investor Meet Hong Kong

... Deutsche Equities India Investor Meet Hong Kong - Singapore August 23 – 24, 2010 ...

... Deutsche Equities India Investor Meet Hong Kong - Singapore August 23 – 24, 2010 ...

Econ110: Principles of Economics TEST YOUR UNDERSTANDING

... If the reserve ratio is 100 percent, then a new deposit of $500 into a bank account a. eventually increases the money supply by $500. b. leaves the size of the money supply unchanged. c. eventually decreases the size of the money supply by $500. d. None of the above is correct. ...

... If the reserve ratio is 100 percent, then a new deposit of $500 into a bank account a. eventually increases the money supply by $500. b. leaves the size of the money supply unchanged. c. eventually decreases the size of the money supply by $500. d. None of the above is correct. ...

Statement by Mr. Svetoslav Gavriiski, Governor of the Bulgarian

... course, within the banking system. In any case, for the time being I have no information whatsoever about any existing problems with regard to the provision of banknotes or information on these banknotes. Anyway, some tension during the first months of introducing the Euro would seem quite normal to ...

... course, within the banking system. In any case, for the time being I have no information whatsoever about any existing problems with regard to the provision of banknotes or information on these banknotes. Anyway, some tension during the first months of introducing the Euro would seem quite normal to ...

How to avoid the next crash Financial Times 30-Jan

... We do not advocate doing away completely with a floor to capital adequacy requirements. ...

... We do not advocate doing away completely with a floor to capital adequacy requirements. ...

The Swedish Banking Crisis of 1991

... Credit losses increased from 0.25% of lending volume in 1989 to 8% of lending volume in 1992. 2 of the 5 major Swedish banks basically became bankrupt. “Finance companies”, less regulated intermediaries, majority went bankrupt during Nov. 1991-March 1992. Crisis management 1. The government re ...

... Credit losses increased from 0.25% of lending volume in 1989 to 8% of lending volume in 1992. 2 of the 5 major Swedish banks basically became bankrupt. “Finance companies”, less regulated intermediaries, majority went bankrupt during Nov. 1991-March 1992. Crisis management 1. The government re ...

Money and Banking

... money was unreliable Banks were independent, many worried that government would own banks (American tradition of distrust of central government) Late 1800’s gold standard gave money value It was in limited supply and paper money could be redeemed for it at any time Panic 1907 occurred because not en ...

... money was unreliable Banks were independent, many worried that government would own banks (American tradition of distrust of central government) Late 1800’s gold standard gave money value It was in limited supply and paper money could be redeemed for it at any time Panic 1907 occurred because not en ...

Creation of money

... The basis of credit money is the bank deposits. The bank deposits are of two kinds viz., (1) Primary deposits, and (2) Derivative deposits. 1.Primary Deposits: Primary deposits arise or formed when cash or cheque is deposited by customers. When a person deposits money or cheque, the bank will credit ...

... The basis of credit money is the bank deposits. The bank deposits are of two kinds viz., (1) Primary deposits, and (2) Derivative deposits. 1.Primary Deposits: Primary deposits arise or formed when cash or cheque is deposited by customers. When a person deposits money or cheque, the bank will credit ...

The Story of Gold Mystery, Magic,and Money!

... The opinions expressed are solely those of the presenters and do not reflect the opinions of the Federal Reserve Bank of Dallas or the Federal Reserve System. ...

... The opinions expressed are solely those of the presenters and do not reflect the opinions of the Federal Reserve Bank of Dallas or the Federal Reserve System. ...

Document

... sheets, where it was unmonitored by their regulators or even credit ratings agencies. Proprietary trading, even in the form of gathering assets for CDOs and other packaged products, has also created dangerous conflicts of interest, as banks compete for market advantage against their own customers (w ...

... sheets, where it was unmonitored by their regulators or even credit ratings agencies. Proprietary trading, even in the form of gathering assets for CDOs and other packaged products, has also created dangerous conflicts of interest, as banks compete for market advantage against their own customers (w ...

Activities which are permitted to “deposit banks”

... Activities separated to the “trading entity”: – Proprietary trading and market-making – Loans, loan commitments and unsecured credit exposure to hedge funds, SIVs, and private equity investments ...

... Activities separated to the “trading entity”: – Proprietary trading and market-making – Loans, loan commitments and unsecured credit exposure to hedge funds, SIVs, and private equity investments ...

Central Bank - Rahimullah Baryalai

... No need to keep 100% gold or silver against notes issued. The note issued in the country should be according to the needs of trade and industry. ...

... No need to keep 100% gold or silver against notes issued. The note issued in the country should be according to the needs of trade and industry. ...

Money and the Banking System

... The figure shows how an initial deposit of $1,000 can expand the money supply. The first three banks in the figure loaned out all their excess reserves and the borrowers deposited the full sum of their loans. In the real world, though, people hold part of their loans as cash and banks don’t necessar ...

... The figure shows how an initial deposit of $1,000 can expand the money supply. The first three banks in the figure loaned out all their excess reserves and the borrowers deposited the full sum of their loans. In the real world, though, people hold part of their loans as cash and banks don’t necessar ...

Money and Banking - Porterville College Home

... Example: 12 members contribute every month, and then every 12th month each member receives the full amount contributed by everyone. ...

... Example: 12 members contribute every month, and then every 12th month each member receives the full amount contributed by everyone. ...

Chapter15

... • Deposits into a bank are recorded as both assets and liabilities. Deposits that have been received but not lent out are called reserves. • Reserve Ratio: the fraction of deposits that banks hold as reserves • The supply of money in the economy is affected by the amount of deposits that are kept in ...

... • Deposits into a bank are recorded as both assets and liabilities. Deposits that have been received but not lent out are called reserves. • Reserve Ratio: the fraction of deposits that banks hold as reserves • The supply of money in the economy is affected by the amount of deposits that are kept in ...

Ch_ 22_ sec_1 - Pequannock Township High School

... Buying on margin – only paying for part of the stock ...

... Buying on margin – only paying for part of the stock ...

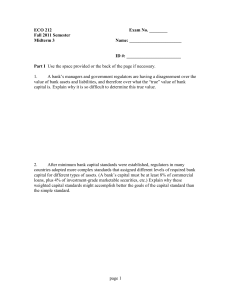

Midterm 3

... the bank want to list the 1000 of interest-bearing assets and 900 of debt on its balance sheet? Why? (Before setting up SPV) _____________Bank_____________ Reserves 200 | Deposits 1000 Securities 200 | Borrowing 800 Loans 1600 | Bank Capital 200 ...

... the bank want to list the 1000 of interest-bearing assets and 900 of debt on its balance sheet? Why? (Before setting up SPV) _____________Bank_____________ Reserves 200 | Deposits 1000 Securities 200 | Borrowing 800 Loans 1600 | Bank Capital 200 ...

Economics

... cash or kept on reserve as Federal Funds in the bank’s account with the Federal Reserve. The Required Reserve Ratio determines the money multiplier ( 1/reserve ratio) Decreasing the reserve ratio increases the rate of money creation in the banking system and is expansionary. Increasing the res ...

... cash or kept on reserve as Federal Funds in the bank’s account with the Federal Reserve. The Required Reserve Ratio determines the money multiplier ( 1/reserve ratio) Decreasing the reserve ratio increases the rate of money creation in the banking system and is expansionary. Increasing the res ...

bankrunsissues08-09short

... – The bank can divide into two parts. • Take half and keep it as reserves. • Take the other half and put it in the long term investment. ...

... – The bank can divide into two parts. • Take half and keep it as reserves. • Take the other half and put it in the long term investment. ...

Introduction to Monetary Policy

... percentage of peoples’ saving banks must store in their vaults instead of lending out. • For example, suppose that the reserve requirement is 50%. • This means that if I put $100 in the bank, they must hold on to $50 and are free to loan out $50 to somebody else. • If the requirement is 20%, they wo ...

... percentage of peoples’ saving banks must store in their vaults instead of lending out. • For example, suppose that the reserve requirement is 50%. • This means that if I put $100 in the bank, they must hold on to $50 and are free to loan out $50 to somebody else. • If the requirement is 20%, they wo ...