Banking Services

... The interest you earn on your money in a bank increases your purchasing power if over time there is inflation. Inflation is a sustained increase in the average level of prices. ...

... The interest you earn on your money in a bank increases your purchasing power if over time there is inflation. Inflation is a sustained increase in the average level of prices. ...

Lezione 6 L`offerta di moneta e gli strumenti di

... So far we have assumed that there exist only one asset and one interest rate. In reality there exist different financial assets (bonds, shares, short-term assets, long-term assets, etc.) There exist substitutability among the different assets: those who purchase one asset compare the return of alter ...

... So far we have assumed that there exist only one asset and one interest rate. In reality there exist different financial assets (bonds, shares, short-term assets, long-term assets, etc.) There exist substitutability among the different assets: those who purchase one asset compare the return of alter ...

SIUDY_SESSION_4_PresentationSouth_Bank

... of economic and social development, the reduction of assymmetries, poverty and social exclusion, towards the convergence and complementarity of the economic integration processes” and that the “organs that direct the South Bank will have an equal representation of each of the member South-American c ...

... of economic and social development, the reduction of assymmetries, poverty and social exclusion, towards the convergence and complementarity of the economic integration processes” and that the “organs that direct the South Bank will have an equal representation of each of the member South-American c ...

Chapter -4 Central Bank

... Foreign exchange operations such as forex swaps. These operations influence the foreign exchange market and hence the exchange rate of all currency pairs of that currency. ...

... Foreign exchange operations such as forex swaps. These operations influence the foreign exchange market and hence the exchange rate of all currency pairs of that currency. ...

Why the Federal Reserve

... Federal Reserve System • Federal Reserve acts as the central bank for the U.S. • Look at a $1 bill • After the panic of 1907 and the collapse of many banks, it was felt that a central bank was needed to stabilize our monetary system. • “Runs” on banks—banks had no where to turn for emergency cash. ...

... Federal Reserve System • Federal Reserve acts as the central bank for the U.S. • Look at a $1 bill • After the panic of 1907 and the collapse of many banks, it was felt that a central bank was needed to stabilize our monetary system. • “Runs” on banks—banks had no where to turn for emergency cash. ...

Time has value - Oman College of Management & Technology

... The Money Creation Process • The sum of bank deposits at the Fed and the bank’s cash vault is total bank reserves. • The Fed mandates member commercial banks to hold a certain fraction of their checkable deposits in reserve form. This fraction is called the required reserve ratio. • The difference ...

... The Money Creation Process • The sum of bank deposits at the Fed and the bank’s cash vault is total bank reserves. • The Fed mandates member commercial banks to hold a certain fraction of their checkable deposits in reserve form. This fraction is called the required reserve ratio. • The difference ...

Financial Crisis and Fed Policy Actions

... creates the Term Auction Facility (TAF) in which reserves are auctioned to depository institutions against a wide variety of collateral. – “By allowing the Federal Reserve to inject term funds through a broader range of counterparties and against a broader range of collateral than open market operat ...

... creates the Term Auction Facility (TAF) in which reserves are auctioned to depository institutions against a wide variety of collateral. – “By allowing the Federal Reserve to inject term funds through a broader range of counterparties and against a broader range of collateral than open market operat ...

Questions

... which makes them difficult to sell. There are readily available second-hand markets for cars and houses with plenty of buyers which make them easy to sell. There are likely to be few number plate buyers available at any time – the market is ‘thin’. This implies either taking some time to sell (e.g. ...

... which makes them difficult to sell. There are readily available second-hand markets for cars and houses with plenty of buyers which make them easy to sell. There are likely to be few number plate buyers available at any time – the market is ‘thin’. This implies either taking some time to sell (e.g. ...

Presentation to the Pasadena Business Community co-sponsored by

... Another critical step was to lower short-term interest rates. ...

... Another critical step was to lower short-term interest rates. ...

The Financial Crisis

... Privately owned, but implicit guaranteed by Uncle Sam Bought up bulk of MBSs Incentivized to purchase MBSs issued to low-income borrowers ...

... Privately owned, but implicit guaranteed by Uncle Sam Bought up bulk of MBSs Incentivized to purchase MBSs issued to low-income borrowers ...

Money and Banking

... d. Overseen by the Federal Reserve Board e. Federal Reserve notes: the national currency we use today in the United States ...

... d. Overseen by the Federal Reserve Board e. Federal Reserve notes: the national currency we use today in the United States ...

Macro Conference IV - University of Manchester

... and leads to higher interest rates. Higher cost of credit: increases the incidence of default and leads to a deterioration in the quality of bank portfolios. Thus: under any pegged rate regime, capital outflows affect the financial system through an expansion or contraction of bank balance sheets; ...

... and leads to higher interest rates. Higher cost of credit: increases the incidence of default and leads to a deterioration in the quality of bank portfolios. Thus: under any pegged rate regime, capital outflows affect the financial system through an expansion or contraction of bank balance sheets; ...

What do we know and not know about potential output in the

... Payoffs to better measurement of financial output • Measuring value added of banking system properly allows more accurate assessment of its economic contribution • Especially important now, when high risk premia artificially inflate BEA measure of bank value added (all else equal) • Future risk pre ...

... Payoffs to better measurement of financial output • Measuring value added of banking system properly allows more accurate assessment of its economic contribution • Especially important now, when high risk premia artificially inflate BEA measure of bank value added (all else equal) • Future risk pre ...

IFIN`s Basic Education

... Bank Rate: RBI lends to the commercial banks through its discount window to help the banks meet depositor’s demands and reserve requirements. The interest rate the RBI charges the banks for this purpose is called bank rate. If the RBI wants to increase the liquidity and money supply in the market, i ...

... Bank Rate: RBI lends to the commercial banks through its discount window to help the banks meet depositor’s demands and reserve requirements. The interest rate the RBI charges the banks for this purpose is called bank rate. If the RBI wants to increase the liquidity and money supply in the market, i ...

Sgouros Chap 3 Pt 3

... As we saw in "Borrowing" on page 58, another way the original bank can get more funds to loan is borrow them from other banks, and the multiplier can work on this money, too. For example, the original bank here might seek to borrow $900,000 from other banks to make up for its loans. This kind of bor ...

... As we saw in "Borrowing" on page 58, another way the original bank can get more funds to loan is borrow them from other banks, and the multiplier can work on this money, too. For example, the original bank here might seek to borrow $900,000 from other banks to make up for its loans. This kind of bor ...

Thema

... • In March 2009 MPC announced it starts to inject money directly into the economy by purchasing assets, known as Quantitative Easing – Why ? In recession you cant lower interest rates below zero, then quantitative easing is used to support demand. – BOE reduced Bank Rate by %0.5 to %0.5 and announce ...

... • In March 2009 MPC announced it starts to inject money directly into the economy by purchasing assets, known as Quantitative Easing – Why ? In recession you cant lower interest rates below zero, then quantitative easing is used to support demand. – BOE reduced Bank Rate by %0.5 to %0.5 and announce ...

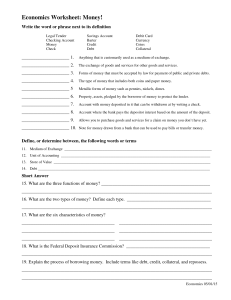

Economics Worksheet: Money!

... The percentage of money that all banks must keep on hand, of all their deposits. ...

... The percentage of money that all banks must keep on hand, of all their deposits. ...

and the sale of government bonds decreases the money supply. The

... action described in part (b)? Discuss another way for BSB to return to its original reserve ratio. 6. You take $100 you had kept under your pillow and deposit it in your bank account. If this $100 stays in the banking system as reserves and if banks hold reserves equal to 10 percent of deposits, by ...

... action described in part (b)? Discuss another way for BSB to return to its original reserve ratio. 6. You take $100 you had kept under your pillow and deposit it in your bank account. If this $100 stays in the banking system as reserves and if banks hold reserves equal to 10 percent of deposits, by ...