* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Thema

Present value wikipedia , lookup

Pensions crisis wikipedia , lookup

Bank of England wikipedia , lookup

Credit card interest wikipedia , lookup

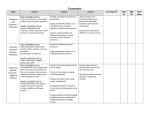

Monetary policy wikipedia , lookup

Money supply wikipedia , lookup

History of the Federal Reserve System wikipedia , lookup

Fractional-reserve banking wikipedia , lookup

Central Bank Liquidity Management Techniques in crisis times Bank of England (BOE) 2007-2010 Yonca Kumsar 1 Topics to cover : 1.Monetary Policy of BOE – Interest Rate – Quantitative Easing 2.Reserve Requirements 3.Operational Standing Facilities 4.Balance Sheets of BOE 2 1.Monetary Policy Operations • Monetary Policy Committee decides on Bank Rate • In March 2009 MPC announced it starts to inject money directly into the economy by purchasing assets, known as Quantitative Easing – Why ? In recession you cant lower interest rates below zero, then quantitative easing is used to support demand. – BOE reduced Bank Rate by %0.5 to %0.5 and announced £75 Billion Asset Purchase Programme (5 March 2009) 3 Interest Rates • Bank Rate: interest rate which bank lends to financial institutions • SONIA: Sterling Overnight Interbank Average rate • The Bank seeks to meet the inflation target(%2) by setting Bank rate. • In crisis: Bank rate is lowered to prevent contraction in the economy. • BOE reduced bank rate by 0.5 to %0.5. (March 2009) 4 Quantitative Easing • In Jan2009, Asset Purchase Facility (APF) is authorised to buy high-quality assets • Purchase of assets are financed by the Bank creating money • In 5 March, MPC is authorised to use the APF for monetary policy purpose • In crisis: BOE announced £75 Billion Asset Purchase Programe 5 UK policy rates and o/n rate (SONIA) 6 2.Reserve Requirements • voluntary reserve ratio system, with no minimum reserve requirement • reserves averaged over a monthly maintenance period during which they are remunerated at Bank Rate • How can we explain these changes in average cash reserve ratio across the entire United Kingdom banking system ? * Country 1968 1978 1988 1998 2010 United Kingdom 20.5 15.9 5.0 3.1 43.1 7 • Answer: • In 2010 it was very high, with a 43.1% average this reflects the impact of Quantitative Easing . • From 1968 to 1998 it has been declining for many years 8 3.Operational Standing Facilities • Aim : to prevent money market rates moving away from Bank rate • Corridor is symmetric with the deposit rate of 25bps below Bank Rate and the lending rate 25bps above Bank Rate. • Banks are encouraged to transfer colleteral into the Bank • They have weekly intermeetings. 9 Symmetric Corridor Approach 10 In crisis times: • But , In March 2009 : deposit rate was set to zero and lending rate to 25bps above Bank rate. • Also , they enlarged their colleteral demand to be more productive. 11 4.Balance Sheets of BOE Why do Balance sheet percentages of annual nominal GDP increase after crisis times ? 12 Balance Sheet as % of GDP It reflects an expansion of both the Bank’s liquidity insurance operations, and more recently the addition of asset purchases as an operating objective of the Monetary Policy Committee. 13 Assets : 14 Liabilities: 15 In Crisis: • Dollar reverse repo operations increased , because Federal Reserve Bank of New York provided $ after Lehman Bankruptcy and in return BOE lended sterling • In case of long term need of liquidity long term reverse repos increased. • Loan to asset purchase facility : Quantitative easing 16 Leanness Indicator : • When AF- BN is zero , when Balance Sheet only displays MPI , than BS is lean • Indicator :1-(AF in assets+AF in liab –BN) /( 2* BS Length) • In crisis: BN remained almost same but since AF as FX and assets increased, leanness decreased. 17 BS pre and after crisis 18 Thank you! 19