money supply

... Increasing required reserve ratio reduces the lending base. The instrument is not without its limitations: If their cash reserves are swollen, commercial banks will not care at all for the increase in the minimum legal cash reserves ratio requirement unless the increase is very high. They might also ...

... Increasing required reserve ratio reduces the lending base. The instrument is not without its limitations: If their cash reserves are swollen, commercial banks will not care at all for the increase in the minimum legal cash reserves ratio requirement unless the increase is very high. They might also ...

HKMA column 251

... risks. And it is not just credit risks that are of concern to banks. When they choose to invest money in financial assets denominated in foreign currencies, they incur exchange risk as well. When investing in debt securities that pay a fixed rate of interest, they additionally incur interest rate r ...

... risks. And it is not just credit risks that are of concern to banks. When they choose to invest money in financial assets denominated in foreign currencies, they incur exchange risk as well. When investing in debt securities that pay a fixed rate of interest, they additionally incur interest rate r ...

Simple Notes Explaining Intuition Behind the Paper

... deposits and equity as liabilities. When a bank provides a loan to a potential borrower, that bank is effectively granting credit in the form of checks, electronic checks or electronic credit lines.1 Credit is a fantastic innovation of modern economies. Credit enables borrowers to perform transactio ...

... deposits and equity as liabilities. When a bank provides a loan to a potential borrower, that bank is effectively granting credit in the form of checks, electronic checks or electronic credit lines.1 Credit is a fantastic innovation of modern economies. Credit enables borrowers to perform transactio ...

MONETARY POLICY IMPLEMENTATION Class Notes By Saki Bigio

... deposits and equity as liabilities. When a bank provides a loan to a potential borrower, that bank is effectively granting credit in the form of checks, electronic checks or electronic credit lines.1 Credit is a fantastic innovation of modern economies. Credit enables borrowers to perform transactio ...

... deposits and equity as liabilities. When a bank provides a loan to a potential borrower, that bank is effectively granting credit in the form of checks, electronic checks or electronic credit lines.1 Credit is a fantastic innovation of modern economies. Credit enables borrowers to perform transactio ...

Britain`s banks: a bargain for value hunters

... In a bank such as Hang Seng, the difference between loans and deposits is a cushion against disaster – a strong bank has lots of scope to meet a run on deposits or to absorb bad debts. But during the good times, it’s hard to be conservative – shareholders demand their capital is worked harder and a ...

... In a bank such as Hang Seng, the difference between loans and deposits is a cushion against disaster – a strong bank has lots of scope to meet a run on deposits or to absorb bad debts. But during the good times, it’s hard to be conservative – shareholders demand their capital is worked harder and a ...

Who creates money? - ABC de l`économie

... other customers. In other words, deposits always precede loans. This theory, which in the past held true for some banks, no longer corresponds to the reality. By a simple bank account entry, a loan immediately becomes a deposit, and this accounting entry expands the money in circulation in the econo ...

... other customers. In other words, deposits always precede loans. This theory, which in the past held true for some banks, no longer corresponds to the reality. By a simple bank account entry, a loan immediately becomes a deposit, and this accounting entry expands the money in circulation in the econo ...

Chapter 13

... narrowest definition of the money supply? Currency in circulation Transactions account balances → Credit card balances Traveler's checks ...

... narrowest definition of the money supply? Currency in circulation Transactions account balances → Credit card balances Traveler's checks ...

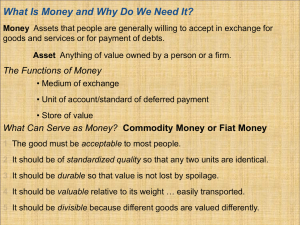

Money

... Many Iraqis continued to use currency with Saddam’s picture on it, even after he was forced from power. ...

... Many Iraqis continued to use currency with Saddam’s picture on it, even after he was forced from power. ...

Large Business Success Story - Upper Missouri District Health Unit

... Although these activities sound too good to be true, they’re not. They are an example of how an employer can create a work site environment that supports healthy living for its workers. In this case, the managers at American State Bank routinely buy healthy snacks for their employees. Duane, the ban ...

... Although these activities sound too good to be true, they’re not. They are an example of how an employer can create a work site environment that supports healthy living for its workers. In this case, the managers at American State Bank routinely buy healthy snacks for their employees. Duane, the ban ...

solution

... macroeconomic imbalance may be equally problematic in the long run regardless of whether it is a deficit or surplus, large external deficits involve the risk that the market will fix the problem quickly by ceasing to fund the external deficit. In this case, there may have to be rapid adjustment that ...

... macroeconomic imbalance may be equally problematic in the long run regardless of whether it is a deficit or surplus, large external deficits involve the risk that the market will fix the problem quickly by ceasing to fund the external deficit. In this case, there may have to be rapid adjustment that ...

D. The US Government`s Bailout Plan

... 1. Banks make a profit by charging a ____________ interest rate than they pay on deposits. 2. Banks may loan out 95% of the money they have deposited. If all of the people who deposited money in the bank went to collect it on the same day, the bank would ___________. We call this a “________ on the ...

... 1. Banks make a profit by charging a ____________ interest rate than they pay on deposits. 2. Banks may loan out 95% of the money they have deposited. If all of the people who deposited money in the bank went to collect it on the same day, the bank would ___________. We call this a “________ on the ...

Lessons from American Bank Supervision Before the Great

... • Key function of examination to “prevent too constant or too large use of borrowing facilities.” • [Troubled banks] “bring all their good paper to the Federal Reserve Bank to rediscount. Shall the Reserve Bank take it and lend them the money? If the Reserve Bank refuses, failure may follow. If it m ...

... • Key function of examination to “prevent too constant or too large use of borrowing facilities.” • [Troubled banks] “bring all their good paper to the Federal Reserve Bank to rediscount. Shall the Reserve Bank take it and lend them the money? If the Reserve Bank refuses, failure may follow. If it m ...

Diapositive 1 - University of Ottawa

... was hidden before: central banks passively try to provide the reserves being demanded by the banking system. – The «unconventional» operating procedures introduced during the subprime financial crisis have shown that central banks could impose excess reserves while keeping the overnight rate at its ...

... was hidden before: central banks passively try to provide the reserves being demanded by the banking system. – The «unconventional» operating procedures introduced during the subprime financial crisis have shown that central banks could impose excess reserves while keeping the overnight rate at its ...

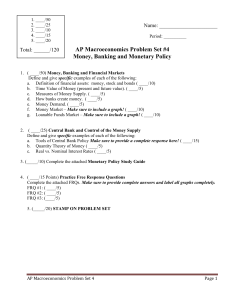

MACRO Unit 4 Problem Set

... ~. (a) Assume that businesses are granted a tax credit on spending for machinery. Using a correctly labeled graph of the loanable funds market, show the effect of the business sector's response on the real interest rate. (b) Now assume instead that the tax rate on interest income from household savi ...

... ~. (a) Assume that businesses are granted a tax credit on spending for machinery. Using a correctly labeled graph of the loanable funds market, show the effect of the business sector's response on the real interest rate. (b) Now assume instead that the tax rate on interest income from household savi ...

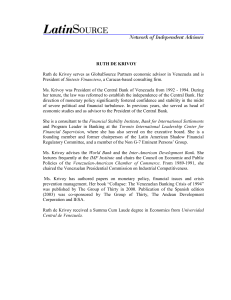

ruth de krivoy

... Ms. Krivoy was President of the Central Bank of Venezuela from 1992 - 1994. During her tenure, the law was reformed to establish the independence of the Central Bank. Her direction of monetary policy significantly fostered confidence and stability in the midst of severe political and financial turbu ...

... Ms. Krivoy was President of the Central Bank of Venezuela from 1992 - 1994. During her tenure, the law was reformed to establish the independence of the Central Bank. Her direction of monetary policy significantly fostered confidence and stability in the midst of severe political and financial turbu ...

reserve requirment

... moving again or to address inflation **Congressional Responsibility Monetary Policy = a central bank’s control over the money supply and interest rates ** no government involvement ...

... moving again or to address inflation **Congressional Responsibility Monetary Policy = a central bank’s control over the money supply and interest rates ** no government involvement ...

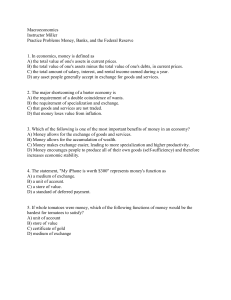

Macroeconomics Instructor Miller Practice Problems

... C) M1 plus savings account balances plus small-denomination time deposits. D) M1 plus savings account balances plus small-denomination time deposits plus noninstitutional money market fund shares. ...

... C) M1 plus savings account balances plus small-denomination time deposits. D) M1 plus savings account balances plus small-denomination time deposits plus noninstitutional money market fund shares. ...

Bank Management of Assets and Liabilities

... A life insurance companies can predict quite accurately the dollar claims that it will pay each year. Thus these liabilities have a cash flow resembling long-term debt. To avoid risk, the life insurance company matches its assets to these liabilities, by buying long-term bonds and mortgage loans. ...

... A life insurance companies can predict quite accurately the dollar claims that it will pay each year. Thus these liabilities have a cash flow resembling long-term debt. To avoid risk, the life insurance company matches its assets to these liabilities, by buying long-term bonds and mortgage loans. ...

multiple choice

... included in M1, but not M2 included in both M1 and M2 included in M2, but not M1 not part of the nation’s money supply ...

... included in M1, but not M2 included in both M1 and M2 included in M2, but not M1 not part of the nation’s money supply ...

تحميل الملف المرفق

... ABSTRACT. The author defines each term in the title of the discussion forum, especially the terms of murabahah, ‛inah and tawarruq, both from the shariah aspect as well as their contemporary applied forms, pointing out their distinguishing features. In this regard he also examines the positions towa ...

... ABSTRACT. The author defines each term in the title of the discussion forum, especially the terms of murabahah, ‛inah and tawarruq, both from the shariah aspect as well as their contemporary applied forms, pointing out their distinguishing features. In this regard he also examines the positions towa ...

14.02 Principles of Macroeconomics Problem Set 2 Fall 2005

... Keep the same money demand and the nominal income as initially given in Exercise II. Now imagine that there is a banking sector collecting deposits. The central bank requires a reserve ratio of ϑ = 50% . People want to keep one third of their money demand as currency, and the rest as deposits. The s ...

... Keep the same money demand and the nominal income as initially given in Exercise II. Now imagine that there is a banking sector collecting deposits. The central bank requires a reserve ratio of ϑ = 50% . People want to keep one third of their money demand as currency, and the rest as deposits. The s ...

Chap. 15 - Angelfire

... reserves a bank must hold against its deposits as mandated by the Fed. – A reserve requirement is a Fed regulation, requiring a bank to keep a certain percentage of its deposits in its reserve account with the Fed or in its vault as vault cash. For example, if the Fed requires a bank to hold 20 perc ...

... reserves a bank must hold against its deposits as mandated by the Fed. – A reserve requirement is a Fed regulation, requiring a bank to keep a certain percentage of its deposits in its reserve account with the Fed or in its vault as vault cash. For example, if the Fed requires a bank to hold 20 perc ...

FRBSF E L CONOMIC ETTER

... In the current banking environment, there already is some evidence of a tightening of conditions as reported in the Federal Reserve’s senior loan officer survey (see Federal Reserve Board of Governors 2001). The percentage of domestic banks reporting a tightening of standards for commercial loans st ...

... In the current banking environment, there already is some evidence of a tightening of conditions as reported in the Federal Reserve’s senior loan officer survey (see Federal Reserve Board of Governors 2001). The percentage of domestic banks reporting a tightening of standards for commercial loans st ...

20 20 20 20 40 40 40 40 60 60 60 60 80 80 80 80 100 100 100 100

... inflation. Which one of the following FED tools could be employed to put a damper on prices? a. Increase the reserve requirement b. Increase the discount rate c. FED purchase of bonds on the open market a and b only ...

... inflation. Which one of the following FED tools could be employed to put a damper on prices? a. Increase the reserve requirement b. Increase the discount rate c. FED purchase of bonds on the open market a and b only ...