Monetary Policy

... HOW DO WE PROTECT OUR MONEY? FDIC-Federal Deposit Insurance Company-when financial institutions fail, they will protect your money up to 100,000 dollars ...

... HOW DO WE PROTECT OUR MONEY? FDIC-Federal Deposit Insurance Company-when financial institutions fail, they will protect your money up to 100,000 dollars ...

Practice Exam 3

... A) are experts in the production of information about firms so that it can sort good risks from bad ones. B) overcome the free-rider problem by primarily making private loans, rather than purchasing securities that are traded in the open market. C) play a greater role in moving funds to corporations ...

... A) are experts in the production of information about firms so that it can sort good risks from bad ones. B) overcome the free-rider problem by primarily making private loans, rather than purchasing securities that are traded in the open market. C) play a greater role in moving funds to corporations ...

bank - Oman College of Management & Technology

... • The federal funds market is the where banks lend excess reserves to other banks desiring additional reserves • The interest rate charged on these inter-bank loans is the federal funds rate • If a bank has any amount in deposit at the Fed, it will usually loan in the federal funds market • Small ba ...

... • The federal funds market is the where banks lend excess reserves to other banks desiring additional reserves • The interest rate charged on these inter-bank loans is the federal funds rate • If a bank has any amount in deposit at the Fed, it will usually loan in the federal funds market • Small ba ...

Money

... Duration gap management Measure ave. time for payments (in or out)… -- if positive and interest rates fall, bank profits rise. -- if negative and interest rates rise, profits rise. ...

... Duration gap management Measure ave. time for payments (in or out)… -- if positive and interest rates fall, bank profits rise. -- if negative and interest rates rise, profits rise. ...

1930: The Federal Reserve during the Great Depression

... Liberty Bonds: Certificates of debt issued by the government during WWI. These bonds promised to repay money borrowed from the lender at a fixed rate of interest and at a specific time. ...

... Liberty Bonds: Certificates of debt issued by the government during WWI. These bonds promised to repay money borrowed from the lender at a fixed rate of interest and at a specific time. ...

Book Review - Ronnie J. Phillips

... their liabilities function as money, or were payable on demand. They tended to proliferate after financial crises, which elevated industrial unemployment and put financial stress on already stretched household budgets. Very few of these institutions survive to the present day. As Phillips insightful ...

... their liabilities function as money, or were payable on demand. They tended to proliferate after financial crises, which elevated industrial unemployment and put financial stress on already stretched household budgets. Very few of these institutions survive to the present day. As Phillips insightful ...

The Bank of the US

... Since the Constitution empowered the government to regulate trade and to collect taxes, and since a national bank would be necessary for these functions, it was well within the scope of the Constitution according to Hamilton. Hamilton was using the liberal interpretation of the Constitution - a ...

... Since the Constitution empowered the government to regulate trade and to collect taxes, and since a national bank would be necessary for these functions, it was well within the scope of the Constitution according to Hamilton. Hamilton was using the liberal interpretation of the Constitution - a ...

Adam Czerniak, Ph.D. Department of Economics II - E-SGH

... The central bank issues cash worth $10M and buys bonds from the commercial bank for it. a) Answer what would the bank do with this money, knowing that it doesn’t want to hold more than 10% of deposits in cash? What would the public do then? b) Calculate the new balance sheet? c) Derive the formula f ...

... The central bank issues cash worth $10M and buys bonds from the commercial bank for it. a) Answer what would the bank do with this money, knowing that it doesn’t want to hold more than 10% of deposits in cash? What would the public do then? b) Calculate the new balance sheet? c) Derive the formula f ...

Chapter 5 Power Point Presentation

... 1. Example, if a bank grants a borrower a loan of $90, what effect does it have on the following? a) A depositor – No effect (1)The depositor can demand money at any time b) The bank (1) The bank acquires the asset (loan) and the liability of the demand deposit c) The borrower (1) The borrower acqui ...

... 1. Example, if a bank grants a borrower a loan of $90, what effect does it have on the following? a) A depositor – No effect (1)The depositor can demand money at any time b) The bank (1) The bank acquires the asset (loan) and the liability of the demand deposit c) The borrower (1) The borrower acqui ...

5/10/06 Warm Up

... The Cost-Push Theory Employers paying higher wages, costs go up, employees demand higher wages ...

... The Cost-Push Theory Employers paying higher wages, costs go up, employees demand higher wages ...

The Bank Regulatory Environment

... power to regulate the rate of interest paid by member banks on time and savings deposits (Regulation Q). – The act also marked the end of easy entry into banking Office of the Comptroller of the Currency (OCC) given expanded powers over granting new national bank charters. New applicants for banks m ...

... power to regulate the rate of interest paid by member banks on time and savings deposits (Regulation Q). – The act also marked the end of easy entry into banking Office of the Comptroller of the Currency (OCC) given expanded powers over granting new national bank charters. New applicants for banks m ...

MULTIPLE CHOICE: Please select the best answer for the following

... The calculation of GDP would include profits on the sale of a 25-year-old house. the monetary value of someone babysitting in exchange for a room. the income of a high school English teacher. the price of the steel used to build a new hotel. ...

... The calculation of GDP would include profits on the sale of a 25-year-old house. the monetary value of someone babysitting in exchange for a room. the income of a high school English teacher. the price of the steel used to build a new hotel. ...

Financial Sector Reform - The Swiss Global Economics

... By end 2004, the 4 AMCs had written off or sold assets worth around $80 billion but had recovered only about 20 percent of face value of the loans ...

... By end 2004, the 4 AMCs had written off or sold assets worth around $80 billion but had recovered only about 20 percent of face value of the loans ...

Of the Subprime Mess and Securitization

... Offers corporate clients access to foreign markets and manages financial exposures and risks Offers trading capabilities in different currencies in established and emerging markets worldwide—giving organizations ready access to the world’s currency markets Asset Liability Management Coordina ...

... Offers corporate clients access to foreign markets and manages financial exposures and risks Offers trading capabilities in different currencies in established and emerging markets worldwide—giving organizations ready access to the world’s currency markets Asset Liability Management Coordina ...

The essentials of T

... – To relate this distinction to the fundamental relations in macroeconomics between the Government and Non-government sectors. – To understand the nature of vertical transactions and their relation to the creation of net financial assets. ...

... – To relate this distinction to the fundamental relations in macroeconomics between the Government and Non-government sectors. – To understand the nature of vertical transactions and their relation to the creation of net financial assets. ...

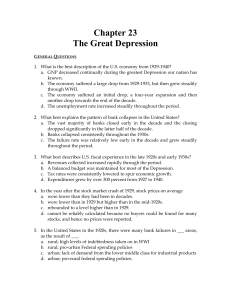

Chapter 23 - Weber State University

... b. the tendency of people to cut wages slowly while looking for a job. c. the tendency of employers to ruthlessly replace long-time employees with the unemployed. d. resistance by workers, especially unionized workers, to wage cuts. 15. According to the Keynesian interpretation of the 1930s, the mai ...

... b. the tendency of people to cut wages slowly while looking for a job. c. the tendency of employers to ruthlessly replace long-time employees with the unemployed. d. resistance by workers, especially unionized workers, to wage cuts. 15. According to the Keynesian interpretation of the 1930s, the mai ...

File - Aerosona.Tec

... the central bank besides performing the traditional functions also performs developmental and promotional functions. The central bank undertakes the responsibility of economic growth with stability in the economy. It ensures that the funds available flow to the various priority sectors such as agric ...

... the central bank besides performing the traditional functions also performs developmental and promotional functions. The central bank undertakes the responsibility of economic growth with stability in the economy. It ensures that the funds available flow to the various priority sectors such as agric ...

Lecture 10 Chapter 11 PPT

... • State banking system developed in the US rather than the typical national banking system in other countries. ...

... • State banking system developed in the US rather than the typical national banking system in other countries. ...

ECONOMICS PRE-TEST Matching: 1. Products where the use of

... B) dividends are calculated on the mature value C) interest on stocks must always be paid D) they get paid more than stockholders E) interest on bonds must always be paid 42. Which of the following correctly describes the reason why banks are able to create new money? A) the federal government requi ...

... B) dividends are calculated on the mature value C) interest on stocks must always be paid D) they get paid more than stockholders E) interest on bonds must always be paid 42. Which of the following correctly describes the reason why banks are able to create new money? A) the federal government requi ...