Hvordan den perfekte storm væltede de finansielle markeder

... Egypt. And Joseph went out from before the face of Pharaoh and went through all the land of Egypt. Now in the seven good years the earth gave fruit in masses. And Joseph got together all the food of those seven years, and made a store of food in the towns: the produce of the fields round every town ...

... Egypt. And Joseph went out from before the face of Pharaoh and went through all the land of Egypt. Now in the seven good years the earth gave fruit in masses. And Joseph got together all the food of those seven years, and made a store of food in the towns: the produce of the fields round every town ...

Economics 333

... Multiplier for each? Which has better capital adequacy? CAR for Bank of East Asia is 12.6% The equity multiplier is assets to equity is 12.940. The CAR for US Commercial Banks with assets greater than 10Billion is 11.85%. . The equity multiplier is 9.98 BEA has a stronger capital adequacy ratio but ...

... Multiplier for each? Which has better capital adequacy? CAR for Bank of East Asia is 12.6% The equity multiplier is assets to equity is 12.940. The CAR for US Commercial Banks with assets greater than 10Billion is 11.85%. . The equity multiplier is 9.98 BEA has a stronger capital adequacy ratio but ...

Recession 2009 Global Implications

... Beishoff Report Adair Turner Report HC Reports on Banking Crisis ...

... Beishoff Report Adair Turner Report HC Reports on Banking Crisis ...

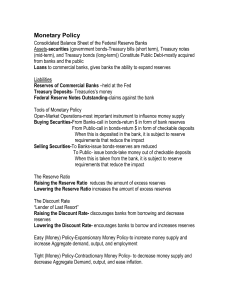

Monetary Policy

... The FOMC has recently used this rate to effect changes in monetary policy. But…the FED does not set the Federal Funds rate or prime rate. Each is established by the interaction of lenders and borrowers. The FED can change the supply of excess reserves in the banking system and so it can obtain the m ...

... The FOMC has recently used this rate to effect changes in monetary policy. But…the FED does not set the Federal Funds rate or prime rate. Each is established by the interaction of lenders and borrowers. The FED can change the supply of excess reserves in the banking system and so it can obtain the m ...

Banking

... • Bank Capital: is the source of funds supplied by the bank owners, either directly through purchase of ownership shares or indirectly through retention of earnings (retained earnings being the portion of funds which are earned as profits but not paid out as ownership dividends). This is about 6% of ...

... • Bank Capital: is the source of funds supplied by the bank owners, either directly through purchase of ownership shares or indirectly through retention of earnings (retained earnings being the portion of funds which are earned as profits but not paid out as ownership dividends). This is about 6% of ...

The Federal Reserve System (cont`d)

... – Composed of 12 district banks and 25 branch banks – District banks are owned by commercial banks that are members of the Federal Reserve system – Main function is to regulate the nation’s money supply by controlling bank reserves requirements, regulating the discount rate, and running openmarket o ...

... – Composed of 12 district banks and 25 branch banks – District banks are owned by commercial banks that are members of the Federal Reserve system – Main function is to regulate the nation’s money supply by controlling bank reserves requirements, regulating the discount rate, and running openmarket o ...

Chapter 5 File

... takes us into the secondary market dealing in the same equities and bonds The trading will take place in one of the modern dealing ...

... takes us into the secondary market dealing in the same equities and bonds The trading will take place in one of the modern dealing ...

Annexure-E

... Annexure-E PROFORMA FOR BANKER’S REPORT To be submitted on the Bankers’ Letterhead) NSIC Limited (name and address of the registering branch of NSIC) Subject: Financial credibility report in respect of M/s ...

... Annexure-E PROFORMA FOR BANKER’S REPORT To be submitted on the Bankers’ Letterhead) NSIC Limited (name and address of the registering branch of NSIC) Subject: Financial credibility report in respect of M/s ...

Chapter 10 Money and Banking

... The Saving and Loans Crisis -Deregulation or to remove restrictions on several industries that had ties to a class of banks known as S & L – long term loans at low rates In 2006, problems in the U.S. banking industries began to threaten the housing market and quickly spiraled us into a ...

... The Saving and Loans Crisis -Deregulation or to remove restrictions on several industries that had ties to a class of banks known as S & L – long term loans at low rates In 2006, problems in the U.S. banking industries began to threaten the housing market and quickly spiraled us into a ...

Direct Deposit Form - Cincinnati Federal

... Please have my payroll check automatically deposited into the following account as instructed below: Effective: ...

... Please have my payroll check automatically deposited into the following account as instructed below: Effective: ...

2016-2-3 - Guaranteed Losses

... loss when you invest in their bonds or otherwise lend them money. This unusual trend, which has been growing quietly in the background throughout Europe, became news last month when the Bank of Japan, the Japanese equivalent of the Federal Reserve banking system, announced that, starting February 16 ...

... loss when you invest in their bonds or otherwise lend them money. This unusual trend, which has been growing quietly in the background throughout Europe, became news last month when the Bank of Japan, the Japanese equivalent of the Federal Reserve banking system, announced that, starting February 16 ...

Money and Banking

... Why do we value and accept money? We are sure that others will accept its value It has value because we accept it has value In America, money used to be “backed” by gold or silver, but this went out in the 1930’s ...

... Why do we value and accept money? We are sure that others will accept its value It has value because we accept it has value In America, money used to be “backed” by gold or silver, but this went out in the 1930’s ...

Finanslobbyen i EU og krisen

... “What we do not need is to become captive of those with the biggest lobby budgets or the most persuasive lobbyists: We need to remember that it was many of those same lobbyists who in the past managed to convince legislators to insert clauses and provisions that contributed so much to the lax standa ...

... “What we do not need is to become captive of those with the biggest lobby budgets or the most persuasive lobbyists: We need to remember that it was many of those same lobbyists who in the past managed to convince legislators to insert clauses and provisions that contributed so much to the lax standa ...

Proposal title

... and local GAAP ► Experienced in loan portfolio reviews and internal control assessments. ...

... and local GAAP ► Experienced in loan portfolio reviews and internal control assessments. ...

week_6_assignment

... Chapter 15: Money Creation 1. The banking system used today is a (total, fractional) _______ reserve system, which means that (100%, less than 100%) _______ of the money deposited in a bank is kept on reserve. 2. When a person deposits cash in a commercial bank and receives a checkable deposit in re ...

... Chapter 15: Money Creation 1. The banking system used today is a (total, fractional) _______ reserve system, which means that (100%, less than 100%) _______ of the money deposited in a bank is kept on reserve. 2. When a person deposits cash in a commercial bank and receives a checkable deposit in re ...

- Fidelity Group

... Fidelity Bank & Trust International Limited is a bank holding company incorporated in The Bahamas and the majority shareholder of Fidelity Bank (Bahamas) Limited. It has licensed retail banking subsidiaries in The Bahamas and Cayman Islands where it operates primarily in the personal banking segment ...

... Fidelity Bank & Trust International Limited is a bank holding company incorporated in The Bahamas and the majority shareholder of Fidelity Bank (Bahamas) Limited. It has licensed retail banking subsidiaries in The Bahamas and Cayman Islands where it operates primarily in the personal banking segment ...

chapter_06_ - Homework Market

... their bank reserves at the Federal Reserve Transactions in the federal funds market allow banks with excess reserve balances to lend reserves to banks with deficient reserves These loans are usually made for one day only (‘overnight’). ...

... their bank reserves at the Federal Reserve Transactions in the federal funds market allow banks with excess reserve balances to lend reserves to banks with deficient reserves These loans are usually made for one day only (‘overnight’). ...

Regarding renewal of bank`s minimum paid

... Regarding renewal of bank’s minimum paid-in capital amount In accordance with the Article 35.2 of The Law on Central Bank (The Bank of Mongolia) and Article 2.1 of the Monetary Policy Guideline for the year 2015 approved by the Order of the Parliament of Mongolia, it is hereby decreed: 1. To set ban ...

... Regarding renewal of bank’s minimum paid-in capital amount In accordance with the Article 35.2 of The Law on Central Bank (The Bank of Mongolia) and Article 2.1 of the Monetary Policy Guideline for the year 2015 approved by the Order of the Parliament of Mongolia, it is hereby decreed: 1. To set ban ...

The Future Value of a Dollar (FVD)

... Bank account – record of the amount of money a customer has deposited into or withdrawn from a bank Deposit – money put in a bank account Withdrawal – money taken out of a bank account Interest – rate that the bank pays customers for keeping their money Electronic funds transfer – allows money to be ...

... Bank account – record of the amount of money a customer has deposited into or withdrawn from a bank Deposit – money put in a bank account Withdrawal – money taken out of a bank account Interest – rate that the bank pays customers for keeping their money Electronic funds transfer – allows money to be ...

Unit VI - Amazon S3

... o Money is the set of assets in an economy that people regularly use to buy goods and services from other people Functions of Money o Money has three functions in the economy: Medium of exchange Unit of account Store of value Medium of exchange o A medium of exchange is an item that buyers giv ...

... o Money is the set of assets in an economy that people regularly use to buy goods and services from other people Functions of Money o Money has three functions in the economy: Medium of exchange Unit of account Store of value Medium of exchange o A medium of exchange is an item that buyers giv ...

Banking Crises

... • Structural change is the enemy of sound banking – Managing risk is undermined – Mix of products / operations undermined ...

... • Structural change is the enemy of sound banking – Managing risk is undermined – Mix of products / operations undermined ...

Chinese financial markets

... • The primary role of a bank is to take in funds – called deposits – from those with money, pool them, and lend them to those who need funds. • They are intermediaries between depositors and borrowers. Deposits can be available on demand (such as a checking account) or with some restrictions (such a ...

... • The primary role of a bank is to take in funds – called deposits – from those with money, pool them, and lend them to those who need funds. • They are intermediaries between depositors and borrowers. Deposits can be available on demand (such as a checking account) or with some restrictions (such a ...

Icelandic banks 2008 in context

... has a long history of an overvalued currency 2007: Iceland’s per capita GDP had risen to 50% above US per capita GDP Clear sign that correction was due Even so, many households and firms borrowed in cheap foreign currencies at low interest even if their entire earnings were in domestic currency Ev ...

... has a long history of an overvalued currency 2007: Iceland’s per capita GDP had risen to 50% above US per capita GDP Clear sign that correction was due Even so, many households and firms borrowed in cheap foreign currencies at low interest even if their entire earnings were in domestic currency Ev ...