* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Economics 333

Survey

Document related concepts

Transcript

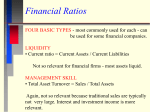

Homework Assignment #4, Economics 333 Money and Banking Assigned: November 25, 2008 Due: December 2, 2008 1. Peer Analysis One of the ways that we might analyze banks is by making a comparison with some peers. Use the internet to get financial information from year 2007 for Bank of East Asia and U.S. Commercial Banks with assets larger than US$10billion. Get the data: A. Bank of East Asia. The annual report for 2007 is available at BEA Annual and Interim Reports and the information you will need is in Financial Highlights on p. 3. B. Large U.S. Commercial Banks. Comparable information is available for the U.S. Commercial banks from the Federal Deposit Insurance Corporation. Statistics on Depositary Institutions SDI Enter the SDI and change the Select Number of 2 Columns Box to Select the number of Columns: View He2, Choose to get reports on Standard Peer Groups. Choose as your Peer Groups All Commercial Banks and Commercial Banks with Assets greater than 10 Billion. Set the date to December 31, 2007. Duplicate >>> <<< Duplicate Standard Peer Group Standard Peer Group Assets more than $10B All Commercial Banks National National Report Date: Report Date: December 31, 2007 December 31, 2007 Hit Next. Then select Performance and Conditions Ratios Reports Report Selection: View Performance and Condition Ratios Download Dollars Assets Column 1: Column 2: Hit Next. All Commercial Banks - Assets more than $10B - National All Commercial Banks - National Percent of Compare Bank of East Asia with its peers in the United States along the following lines 1) Capital Adequacy; 2) Asset Quality; 3) Earnings 4) Liquidity BofEA Assets Equity Earnings 393979 EM 30446 ROA 4144 ROE 12.94025 0.010518 0.13611 USA EM ROA ROE 9.978022 0.0091 0.0908 1) Capital Adequancy. What is the CAR for the Bank of East Asia and for US Commerical Banks with assets above US$10 Billion? What is the Equity Multiplier for each? Which has better capital adequacy? CAR for Bank of East Asia is 12.6% The equity multiplier is assets to equity is 12.940. The CAR for US Commercial Banks with assets greater than 10Billion is 11.85%. . The equity multiplier is 9.98 BEA has a stronger capital adequacy ratio but also a larger equity multiplier. It is ambiguous which is better capitalized. 2) Asset Quality. Compare Bank of East Asia’s Impaired Loan Ratio with the Large US Bank’s Non-current Loan Ratio. Which has better asset quality. BEA impaired Loan ratio is .6%; USA Non-current loans is 1.3%. Quality of assets is better in Hong Kong. 3) Earnings. Calculate ROA and ROE for BEA and US peers. Which is more profitable? ROA for Bank of East Asia is 1.05% and ROE is 13.611%. Return on Assets is .91% and Return on Equity is 9.08%. This indicates better earnings at BEA. 4) Liquidity. Calculate the Loan to Deposit Ratio for BEA and US peers. Which is more liquid? Loan to deposit ratio for BofEA is 73.6%; Loan to deposit ratio for US banks is 89%. As a higher fraction of deposits are in illiquid loans in the US, BEA has better liquidity. So arguably, in terms of CAMEL rating, Bank of East Asian is doing better than similar US banks. 2. Interest Rate Risk You are calculating the balance sheet risk faced by an individual bank. This bank has two types of assets: loans and government securities. The government securities have a face value of $50,000 and a maturity of T = 1 year. The bank has only constant payment loans with a remaining maturity of one, two, three and four years. The quantity that was lent and the interest rate at which these loans were made is available in the following table Banks Loan Book Remaining Maturity Quantity Lent 1 2 3 4 Interest Rate $100,000 $150,000 $250,000 $500,000 Annual Payment 10% 10% 10% 10% a. Calculate the annual payments that the bank will receive on each of these loans i LOAN Use this data to calculate the income using the formula C 1 1 (1 i )T that the bank’s assets will generate in each of the next 4 years. Remember include the face value of the bank securities in the income that the bank will receive in year 1. Payments Generated by Loans in year: 1 with 1 Maturity 2 Date → 3 4 Total 2 0 3 0 0 4 0 0 0 Payments Generated by Loans in year: with Maturity Date → 1 2 3 4 Securities duration Total PV MV w w*t Assets L/Assets Net Worth 1 2 3 $110,000.00 $0.00 $0.00 $86,428.57 $86,428.57 $0.00 $100,528.70 $100,528.70 $100,528.70 $157,735.40 $157,735.40 $157,735.40 $50,000.00 $504,692.67 $344,692.67 $258,264.10 $458,811.52 $284,869.98 $194,037.64 1048925.609 1048925.609 1048925.609 0.44 0.27 0.18 0.437410922 0.543165259 0.554961112 1.946378252 Liabilities 0.858020809 DGAP 148925.6092 EM DGAP*EM*-Δi/(1+i) - 0 . 0 6 9 6 8 7 3 8 4 $0.00 $0.00 $0.00 $157,735.40 $157,735.40 MV $107,735.40 $1,045,454.53 1048925.609 0.10 0.410840958 1 1.088357443 7.043285669 5 b. Calculate the present value, PVj, of the income generated in year j = 1 - 4, using a discount factor of 10%. Calculate the total market value of the banks assets. Calculate the fraction of that present value that comes from each of year j = 1…4, wj. Calculate the duration of the banks assets. c. The bank finances the assets with $900,000 of 1 year time deposits, so the duration of its liabilities is 1. Calculate the net worth of the bank as the difference between the present value of the assets and the quantity of deposits. What is the Equity Multiplier. What is the duration gap? Calculate the effect of an increase in the interest rate from 10% to 11% on the value of the net worth of the bank. An increase in the interest rate from 10% to 11% results in an approximately 7% decline in the Net Worth of the Bank.