* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Chapter 23 - Weber State University

Survey

Document related concepts

Transcript

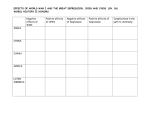

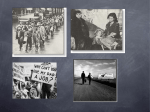

Chapter 23 The Great Depression GENERAL QUESTIONS 1. What is the best description of the U.S. economy from 1929-1940? a. GNP decreased continually during the greatest Depression our nation has known. b. The economy suffered a large drop from 1929-1933, but then grew steadily through WWII. c. The economy suffered an initial drop, a four-year expansion and then another drop towards the end of the decade. d. The unemployment rate increased steadily throughout the period. 2. What best explains the pattern of bank collapses in the United States? a. The vast majority of banks closed early in the decade and the closing dropped significantly in the latter half of the decade. b. Banks collapsed consistently throughout the 1930s. c. The failure rate was relatively low early in the decade and grew steadily throughout the period. 3. What best describes U.S. fiscal experience in the late 1920s and early 1930s? a. Revenues collected increased rapidly through the period. b. A balanced budget was maintained for most of the Depression. c. Tax rates were consistently lowered to spur economic growth. d. Expenditures grew by over 300 percent from 1927 to 1940. 4. In the year after the stock market crash of 1929, stock prices on average a. were lower than they had been in decades. b. were lower than in 1929 but higher than in the mid-1920s. c. rebounded to a level higher than in 1929. d. cannot be reliably calculated because no buyers could be found for many stocks, and hence no prices were reported. 5. In the United States in the 1920s, there were many bank failures in ___ areas, as the result of ___. a. rural; high levels of indebtedness taken on in WWI b. rural; pro-urban Federal spending policies c. urban; lack of demand from the lower middle class for industrial products d. urban; pro-rural federal spending policies. 6. One reason the Federal Reserve Board in Washington, D.C., did not act as a lender of last resort during the early years of the Great Depression, was its power struggle with a. U.S. Treasury. b. foreign central banks. c. the Federal Reserve Bank of New York. d. President Roosevelt. 7. The Stock Market Crash of 1929 probably contributed ____ to the Great Depression because _____. a. little; it did no more than wipe out the speculative gains made earlier b. little; the Fed responded by increasing the money supply c. a good deal; corporations could no longer raise investment funds d. a good deal; consumer confidence and spending on durables were reduced 8. Between 1929 and 1933, nominal interest rates ___, and real interest rates ___. a. rose; rose b. rose; fell c. fell; rose d. fell; fell 9. At its maximum during the Great Depression unemployment reached approximately ___ percent of the labor force. a. 15 b. 25 c. 50 d. 75 10. During the Federal Bank Holiday ordered by President Roosevelt, a. new supplies of gold were distributed to the banks. b. a national monetary commission was set up. c. the banks were inspected. d. the leadership of the Federal Reserve System was replaced. 11. During the 1930s, banks found it hard to solve the asymmetric information problem between borrowers and lenders, because a. many borrowers lacked adequate collateral. b. changing federal bank regulations created uncertainty. c. the fall in the stock of money reduced aggregate demand. d. interest rates had fallen to “liquidity trap” levels. 12. Milton Friedman has argued that the Great Depression was caused by the a. b. c. d. fall in the stock of money. fall in consumer durable spending. fall in investment spending. increase in nominal wages. 13. The aspect of the Second Banking Crisis of the 1930s that distinguished it from the First Banking Crisis was that during the second crisis a. the Federal Reserve finally decided to act as lender of last resort. b. the stock market boom finally came to an end with the crash. c. banks in all regions of the country failed. d. President Roosevelt asked Congress to establish Federal deposit insurance. 14. John Maynard Keynes attributed the “stickiness” of real wages in the early years of the Depression to a. the fall in the money supply. b. the tendency of people to cut wages slowly while looking for a job. c. the tendency of employers to ruthlessly replace long-time employees with the unemployed. d. resistance by workers, especially unionized workers, to wage cuts. 15. According to the Keynesian interpretation of the 1930s, the main reason we still had double-digit unemployment in 1939 was that a. interest rates were too high. b. federal budget deficits were too small. c. the stock of money was too small. d. investment spending was too high. 16. Monetarists such as Milton Friedman blame the Great Depression primarily (although not completely) on the a. stock market crash. b. Bank Holiday. c. decline in investment spending. d. waves of bank failures. 17. During the Great Depression, one reason the Federal Reserve did not respond forcefully was the “free gold problem,” which refers to the idea that a. gold was fleeing Nazi Germany, thus undermining the Fed's attempt to control the money supply. b. gold was essentially free because people had excess supplies of currency that could be converted into gold. c. the Fed claimed that almost all its gold was tied up by reserve requirements (there was little free so it could not increase the money supply). d. gold was essentially free because silver, which existed in abundance, could be converted into gold at the fixed rate of 16:1. 18. The failure of the Bank of the United States in December 1930 probably intensified the banking panic for each of the following reasons except that it proved that a. the Fed might fail to act as a lender of last resort. b. big banks could fail. c. New York banks could fail. d. that Wall Street banks could fail. 19. According to Walton and Rockoff, which of the following was the most important in bringing the banking crises of the 1930s to an end? a. the elimination of many weak banks through bankruptcy (survival of the fittest). b. the promise of federal bank deposit insurance. c. New Deal spending programs. d. World War II. 20. According to Walton and Rockoff, the recession of 1937 and 1938 could be attributed to what? a. the decline in world trade fostered by German and Japanese policies of self sufficiency and open market gold sales by the Federal Reserve b. increases in taxes and open market gold sales by the Federal Reserve c. increases in taxes and increases in bank required reserve ratios d. the decline in world trade fostered by German and Japanese policies of self sufficiency and increases in bank required reserve ratios 21. Which of the following “quotations,” according to Chapter 23, best summarizes Keynes conclusions about the lessons of the Depression for the nature of capitalism. a. “It is in determining the volume, not the direction, of actual employment that the existing system has broken down.” b. “An economic system that forgets to find work for millions of men and women, cannot be trusted to perform any task in an intelligent fashion.” c. “The depression is essentially a problem of reliance on a private banking system for the provision of an inherently public good, money.” d. “The rules of sound finance, namely stable prices and balanced budgets, apply as much to the present crisis, as they do in more pleasant times.” 22. Walton and Rockoff contend that the likelihood of a Great Depression happening again is _______ because (among other reasons) _______. a. substantial; our continued dependence on a highly volatile stock market b. substantial; of our reliance on a fractional reserve banking system c. remote; policy makers are unlikely to repeat the mistakes of the 1930s. d. remote; industry now makes up a much larger share of GNP than it did in the 1930s ECONOMIC INSIGHTS 1. What is the most compelling evidence for the Keynesian interpretation of the Great Depression? a. increases in both the interest rate and the quantity of money b. decreases in both the interest rate and the quantity of money c. an increase in the interest rate and a decrease in the quantity of money d. a decrease in the interest rate and an increase in the quantity of money Return to Economics 1740 Announcement/Practice Exam Page