* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Climate Change Impacts

Low-carbon economy wikipedia , lookup

Climate change adaptation wikipedia , lookup

Scientific opinion on climate change wikipedia , lookup

Mitigation of global warming in Australia wikipedia , lookup

Climate governance wikipedia , lookup

German Climate Action Plan 2050 wikipedia , lookup

Citizens' Climate Lobby wikipedia , lookup

Politics of global warming wikipedia , lookup

Climate engineering wikipedia , lookup

Climate change and agriculture wikipedia , lookup

Media coverage of global warming wikipedia , lookup

Effects of global warming on human health wikipedia , lookup

Solar radiation management wikipedia , lookup

Economics of climate change mitigation wikipedia , lookup

Public opinion on global warming wikipedia , lookup

Surveys of scientists' views on climate change wikipedia , lookup

Climate change in Canada wikipedia , lookup

Climate change, industry and society wikipedia , lookup

Climate change and poverty wikipedia , lookup

Economics of global warming wikipedia , lookup

Carbon Pollution Reduction Scheme wikipedia , lookup

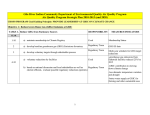

Climate Change Impacts on Banks Where Sustainability and Risk Management Meet June 16, 2007 Sandra Odendahl, Senior Director CIBC Environmental Risk Management Corporate Risk and Insurance Services, TRM Outline • Environmental Risk Management at CIBC • Risks Arising from Environmental issues • Case Study: Climate Change – Credit Risk – Operational Risk – Reputational Risk • Lessons Learned Greening of Industry Network June 2007 2 Environmental Risk Management at CIBC Environmental Aspects of Banking Supply Chain Operations Products & Services Electricity Furniture Carpet Paper Services etc. Loans Project Finance Mortgages Mutual Funds Investment Banking etc. Energy and water use Solid waste Paper Use etc • Environmental Risk Management (ERM) Group has oversight responsibility for Environmental Management at CIBC – Corporate Environmental Affairs (policy, external liaison, opportunities…) – Environmental footprint (supply chain, facilities and operations) – Environmental credit risk management (lending and other products and services) Greening of Industry Network June 2007 3 Risks Arising from Environmental Aspects • Credit Risk – Ability of borrower to repay debt is impacted by environmental problems, for example: • Revenue or net income affected by clean up costs, fines and penalties • Business operation curtailed due to regulatory orders • Value of collateral security much lower than appraised value, • Operational Risk – Risk of loss due to inadequate environmental management in bank’s own operations • Reputation Risk – Damage to bank reputation caused by association with environmentally damaging company or sensitive environmental issue • Legal Risk – Direct liability of bank for clean-up costs, possibly exceeding the amount of the loan or investment, following foreclosure or bankruptcy Greening of Industry Network June 2007 4 Some Environmental Issues Facing Banks • Boreal forest and biodiversity conservation • Urban brownfield redevelopment • Greening the Supply Chain • Environmental and social impacts from project finance • Climate change Greening of Industry Network June 2007 5 Climate Change A Case Study in Applying Risk Management to an Environmental Issue Climate Change will impact banks, their suppliers and clients as a result of: • Physical effects • Regulations to mitigate Climate Change impacts give rise to risks: Credit Risk Operational Risk Reputation Risk Greening of Industry Network June 2007 6 Physical Aspects of Climate Change In general: • Extreme temperatures • Change in precipitation • Increased storm frequency and intensity • Rising sea levels In Canada: • Shifting permafrost, • Hotter & drier summers, • Wetter winters, • Stormier coastline, • Rising sea levels The climate is becoming more extreme and less predictable Greening of Industry Network June 2007 7 Regulatory Aspects of Climate Change • International • National • Regional • Provincial State • Objective is to stabilize concentrations of GHGs at levels that will stabilize humaninduced climate change Targets at international, national, regional and/or provincial level Most systems embrace emissions trading, which allows reduction targets to be met at lowest cost Participants are issued allowances to cover targeted amount of emissions To meet targets, participants can: – Reduce emissions internally – Buy the right to emit more GHGs (allowances) Installation – Buy proof that GHGs have been reduced somewhere else (credits) Emitting CO2 will now cost money Greening of Industry Network June 2007 8 Impacts of Climate Change on Banks Impacts People Operations & Supply Chain Products and Services Physical Aspects Adverse health effects on employees • Higher insurance premiums • Increased credit risk of clients in certain weather-dependent sectors • Operational Risk: Physical damage from storms • Higher cooling needs; lower heating needs • Higher business continuity management costs Regulatory Aspects • Higher cost for energy – Business interruption – Capital & operating costs – Revenues • Increased credit risk if clients face new costs or penalties associated with regulations • Reputational risk if bank lends to client perceived as not meeting regulations or “community standards” Greening of Industry Network June 2007 9 Credit and Operational Risk Assessment Impacts People Operations & Supply Chain Products and Services Physical Aspects Adverse health effects on employees • Higher insurance premiums • Increased credit risk of clients in certain weather-dependent sectors • Operational Risk: Physical damage from storms • Higher business continuity management costs • Higher cooling needs; lower heating needs Regulatory Aspects • Higher cost for energy – Business interruption – Capital & operating costs – Revenues • Increased credit risk if clients face new costs or penalties associated with regulations • Reputational risk if bank lends to client perceived as not meeting regulations or “community standards” Greening of Industry Network June 2007 10 I. Credit Risk Associated with GHG Regulations • • Client companies will need to select one or a combination of strategies to meet carbon dioxide targets, including: – investment in internal abatement measures, – the purchase of credits on national or international carbon markets, and – investment in projects that will offset carbon dioxide emissions Completed a study in 2006 to look at the impacts of GHG regulations on 3 levels: 1. Industries 2. Clients 3. Portfolio Greening of Industry Network June 2007 11 Credit Risk Associated with GHG Regulations Impact on Industries Key factors that determine how much a sector will be affected by new regulations: 1. Government policy 2. Energy Intensity 3. Emissions Intensity (emissions per unit output) 4. Ability to pass along costs 5. Opportunities to abate Greening of Industry Network June 2007 12 CIBC WM Carbon Cap Vulnerability Index Elect.-coal Oil sands Metal smelting/ refining Crude oil Aluminum Steel Cement Chemicals Petrol.refining Elect.-nat gas Glass Pulp & paper Metal mining Oil gas pipelines -1 Greening of Industry Network 0 1 2 June 2007 3 4 13 Credit Risk Associated with GHG Regulations Impact on CIBC Clients • Identified companies likely to face GHG regulation • Forecasted Emissions – Probable target = CO2 asset or liability • Calculated cost of compliance for companies in a liability position (i.e. unable to meet their regulated target) – abatement through new technology – buy CO2 allowances in the marketplace under different price scenarios • Assessed ability of sectors and firms to pass on costs of compliance to customers Majority faced some costs to meet GHG regulations, but 18% of firms were likely to face no cost to comply with GHG regulations Carbon compliance costs represented under 1% of profit in 90% of cases Analysis will be updated using details of new federal GHG regulations Greening of Industry Network June 2007 14 Credit Risk Associated with GHG Regulations Impact on CIBC’s Portfolio Risk assessment showed very, very small impacts on portfolio Exposure to sub-investment grade clients facing GHG regs is less than 0.7% • Percentage of loans in portfolio that are to all clients in industrial sectors likely to be regulated is less than 7% • 90% of these loans are to investment grade clients (i.e. clients likely to have financial means to meet new regulatory targets for GHGs) Climate change-related loan losses, under our worst-case scenario, were estimated to be <0.009% of total portfolio (9 ¢ on $1000) Analysis must be updated when details of new regulations are released Greening of Industry Network June 2007 15 II. Operational Risk from Physical Impacts Greening of Industry Network June 2007 16 Operational Risk from Physical Impacts Study of Impacts on CIBC Operations • Completed a literature review in November 2006 as first step in risk assessment of physical impacts on our 100 locations in Caribbean – Damage from storm events or flooding; – Business interruption; – Increased insurance costs; or – Additional cooling requirements • Impacts of climate change on the Caribbean will likely include: – Infrastructure damage, coastal erosion, more frequent flooding, landslides, and reduced availability of freshwater • Sparse information on island or sub-region-specific impacts, but several initiatives underway in Caribbean to improve predictions • CIBC developing an island-by-island physical risk database • Will need to use insurance company models to predict the magnitude of financial losses or additional costs in each sub-region. • Assessment of impact of physical risk on loan portfolio also contemplated Greening of Industry Network June 2007 17 III. Reputation Risk and Climate Change Don’t fund global warming. Stop investment in all new coalburning power plants. There are over 150 new coal-burning power plants currently on the drawing board. Let’s keep them there. Coal-burning power plants are the world’s largest greenhouse gas polluters and a direct threat to our future. Yet prominent financial institutions, including JPMorgan Chase, Goldman Sachs, Citigroup, Morgan Stanley, Merrill Lynch, Credit Suisse and Lehman Brothers, are eager to finance their construction. The truth is, every dollar invested in coal is a dollar that could be invested in energy efficiency and wind and solar power. Help us make sure these coal-burning power plants are never built. Tell Wall Street that investing in coal is simply too risky. Visit www.ran.org to join the fight. (from New York Times, March 23, 2007) Greening of Industry Network June 2007 18 Reputation Risk and Climate Change A Role for Stakeholder Relations and Genuine Change • Proactive meetings and consultation with environmental NGOs – Rainforest Action Network, Forest Ethics, WWF, Canadian Boreal Initiative • Consultation with shareholder activists – Ethical Funds Company, Carbon Disclosure Project • Demonstrable progress – Green power purchasing – Reductions in direct and indirect CO2 emissions – Policy updates and revisions • Environmentally responsible procurement Standard • Environmental credit risk management Standard • How do we measure success? – Shareholder resolutions = 0 – Targeted campaigns against CIBC = 0 But don’t get too comfortable! Greening of Industry Network June 2007 19 Summary & Conclusion What we’ve learned so far • • Global climate change is a pressing environmental issue that poses risks and opportunities for business CIBC and its clients will be affected by: – Physical impacts of unpredictable and extreme weather, and – Costs to comply with new policies intended to help mitigate climate change – The actions of stakeholders who expect us to take certain actions • • • • • Step #1 in thorough risk assessment is to understand how climate change (physical and regulations) impacts business inputs, operations, and outputs Credit risk associated with Climate Change regulations (that we have seen so far) is relatively small Operational risk associated with physical effects of Climate Change will be challenging to quantify because of poor data and changing models Reputational risk management requires multi-pronged approach, but most important is to (1) listen to external stakeholders, (2) make some real changes Risk assessment and risk management approaches must be constantly revised as regulations evolve, physical impact data improves, and stakeholders ask new questions Greening of Industry Network June 2007 20