* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Slide 1

Financial literacy wikipedia , lookup

United States housing bubble wikipedia , lookup

Trading room wikipedia , lookup

Syndicated loan wikipedia , lookup

Private equity secondary market wikipedia , lookup

Land banking wikipedia , lookup

Systemic risk wikipedia , lookup

Credit rating agencies and the subprime crisis wikipedia , lookup

Interbank lending market wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Financial economics wikipedia , lookup

Shadow banking system wikipedia , lookup

Investment fund wikipedia , lookup

Financialization wikipedia , lookup

Public finance wikipedia , lookup

Securities fraud wikipedia , lookup

Amman Stock Exchange wikipedia , lookup

Investment management wikipedia , lookup

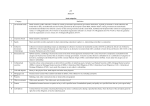

CHAPTER 1 McGraw-Hill/Irwin Investments Background and Issues © 2007 The McGraw-Hill Companies, Inc., All Rights Reserved. Financial Economics Why a special area of economics? – Time is essential: consumption today versus consumption tomorrow. Investment is the act of giving up consumption today in expectation of higher consumption in the future. – Risk is essential: purchase of a sure thing versus purchase of a risky chance of the same thing. Investment involves choosing among alternative risky assets, with different returns depending on the state of the world 1-2 Real Assets Versus Financial Assets • Essential nature of investment – Reduced current consumption – Planned later consumption • Real Assets – Assets used to produce goods and services • Financial Assets – Claims on real assets 1-3 Table 1.1 Balance Sheet of U.S. Households, 2007 1-4 Table 1.2 Domestic Net Worth 1-5 A Taxonomy of Financial Assets • Fixed income or debt – Money market instruments • Bank certificates of deposit – Capital market instruments • Bonds • Common stock or equity • Derivative securities 1-6 Financial Markets and the Economy • Information Role – The Google effect • Consumption Timing • Allocation of Risk • Separation of Ownership and Management – Agency Issues 1-7 Financial Markets and the Economy Continued • Corporate Governance and Corporate Ethics – Accounting Scandals • Examples – Enron, Rite Aid, HealthSouth – Auditors—watchdogs of the firms – Analyst Scandals • Arthur Andersen – Sarbanes-Oxley Act • Tighten the rules of corporate governance 1-8 The Investment Process • Asset allocation – Choice among broad asset classes • Security selection – Choice of which securities to hold within asset class • Security analysis 1-9 Markets are Competitive • Risk-Return Trade-Off • Efficient Markets – Active Management • Finding mispriced securities • Timing the market – Passive Management • No attempt to find undervalued securities • No attempt to time the market • Holding a highly diversified portfolio 1-10 The Players • Business Firms– net borrowers • Households – net savers • Governments – can be both borrowers and savers • Financial Intermediaries – Investment Companies – Banks – Insurance companies – Credit unions 1-11 The Players Continued • Investment Bankers – Perform specialized services for businesses – Markets in the primary market 1-12 Table 1.3 Balance Sheet of Commercial Banks, 2007 1-13 Table 1.4 Balance Sheet of Nonfinancial U.S. Business, 2007 1-14 Recent Trends—Globalization • • • • American Depository Receipts (ADRs) Foreign securities offered in dollars Mutual funds that invest internationally Instruments and vehicles continue to develop (WEBs) • Exchange Traded Funds (ETFs) 1-15 Figure 1.1 Globalization: A Debt Issue Denominated in Euros 1-16 Recent Trends—Securitization • Mortgage pass-through securities • Other pass-through arrangements – Car, student, home equity, credit card loans • Offers opportunities for investors and originators 1-17 Figure 1.2 Asset-backed Securities Outstanding 1-18 Recent Trends—Financial Engineering • Use of mathematical models and computerbased trading technology to synthesize new financial products • Bundling and unbundling of cash flows 1-19 Figure 1.3 Building Creates a Complex Security 1-20 Figure 1.4 Unbundling of Mortgages into Principal- and Interest-Only Securities 1-21 Recent Trends—Computer Networks • Online information dissemination • Information is made cheaply and widely available to the public • Automated trade crossing – Direct trading among investors 1-22