* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Commercialization of Life Sciences IP in the UK

Survey

Document related concepts

Transcript

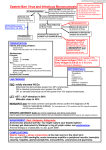

John McCulloch PhD Venture Group Advisor MaRS Discovery District Post-doc at UCL Medical School, London, UK Licensed monoclonal antibodies to US company Negotiation, license and transfer process Impressions ◦ Ease of funding vs. grant system ◦ Calculation of value and royalty rates ◦ Seeing our work make a difference in the outside world UK academic culture re. commercialization Drug Royalty Corporation in 1994 (DRI Capital) $1.0 billion under management Life sciences investor – acquires royalties on drugs, diagnostics, etc. Security = due diligence Reviewed hundreds of opportunities, many arising from academic labs in the US and UK Joined MaRS in 2007 MaRS is an international convergence centre based in Toronto Our mission is to create successful global businesses built from Canada’s science and technology We provide advisory services, entrepreneurship programs, conference space and office/lab facilities Wide range of tenants at MaRS: startups to Merck Recently launched MaRS Innovation ◦ Will commercialize innovations from 16 Toronto institutions ◦ Will select most promising inventions and provide funding for patent prosecution and pre-investment development (POP and “de-risking”) Government ◦ ◦ ◦ ◦ Medical Research Council $1.0 billion R&D 2007-8 130 patent families $152 million license revenue in 2007-8 Private ◦ Wellcome Trust ($23 billion endowment) Charities ◦ ◦ ◦ ◦ Cancer Research UK Arthritis Rheumatism Campaign National Heart Research Fund Diabetes UK National Research Development Corporation (1948) ◦ Mission: to commercialize publicly funded research Fused with National Enterprise Board in 1981 to create the British Technology Group (BTG) ◦ BTG became custodian of many NRDC assets ◦ 1992 – management buyout ◦ 1995 – LSE flotation = BTG plc Major BTG assets = MRI, BeneFIX, Campath Initially “de-risked” technologies and licensed out Evolved to product development focus Founded in 1913 Numerous landmark discoveries: ◦ ◦ ◦ ◦ ◦ ◦ Influenza virus Penicillin DNA Link between smoking & lung cancer Monoclonal antibodies C. elegans genome 35 MRC institutes across UK Founded in 1947 (Cambridge, UK) 13 Nobel laureates Basic molecular biology research led to a wealth of antibody technologies: ◦ Monoclonal antibodies (Milstein & Kohler, 1975) ◦ ◦ ◦ ◦ ◦ NRDC did not file patents! Chimeric antibodies (Neuberger & Rabbits 1984) Humanized antibodies (Winter 1986) Human antibodies (Winter 1990s) Human antibody genome mice (Neuberger 1990s) Single domain antibodies (Winter & Tomlinson 2000) Humira (Abbott) RA, Crohn’s, psoriasis US$1.54 billion sales Tysabri (Biogen Idec) MS Actemra (Roche/Chugai) RA Campath (Genzyme/Bayer) lymphoma, RA Vectibix (Amgen) Colorectal cancer Celltech acquired by UCB ($2.25 billion) Cambridge Antibody Technology acquired by AstraZeneca ($1.25 billion) Domantis acquired by GlaxoSmithKline ($411 million) Licenses to 37 other companies MRC-LMB has played a critical role in the development of powerful, selective drugs for autoimmune disease and cancer 2000-2006 ◦ Humanized antibodies = $150 million ◦ Human antibodies = $227 million MRC-sourced antibody products are still growing ◦ Humira is a blockbuster drug ◦ >$1.5 billion sales/year MRC uses the revenues from antibody technology to support basic research and expand research infrastructure The UK has been extremely successful in life sciences commercialization based on top tier research If you can’t patent an initial technology, keep innovating! ◦ LMB created five next generation technologies after mABs Get the technology out in the field as widely as possible via non-exclusive licenses Reinvest the proceeds in basic research ◦ Main driver of innovation in MRC-LMB case Importance of angels John McCulloch PhD 416-673-8127 [email protected]