* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Axis Long Term Equity Fund - Growth

Environmental, social and corporate governance wikipedia , lookup

Investment banking wikipedia , lookup

History of private equity and venture capital wikipedia , lookup

Leveraged buyout wikipedia , lookup

Socially responsible investing wikipedia , lookup

Private equity in the 1980s wikipedia , lookup

Private money investing wikipedia , lookup

Private equity wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Mutual fund wikipedia , lookup

Early history of private equity wikipedia , lookup

Private equity secondary market wikipedia , lookup

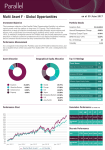

Factsheet as of March 2016 Axis Long Term Equity S&P Axis Fund Bse Long 200 - Growth Term Equity Fund Axis Long Term Equity Fund Equity - ELSS Equity - ELSS Important Information CRISIL Mutual Fund Rank Investment Objective 29-Dec-2009 6957.75 0.00 Fund Manager Jinesh Gopani Expense Ratio (%) 1.99 Designation Senior Fund Manager – Equity Min. Investment (Rs.) 500 Qualification B.Com, MMS Yrs of Experience 11 Key Portfolio Attributes Trailing Returns (%) 33.85 30.00 9.68 0.89 20.00 NAV as on 31/3/2016 29.19 0.00 No. of Total Holdings Benchmark Index Index P/E Index P/B 37 S&P BSE 200 21.21 2.55 -10.00 Portfolio P/E Portfolio P/B Dividend Yield (%) Value Blend N.A N.A N.A N.A N.A N.A Growth N.A capitalisation Inception Date Avg AUM: Jan-Mar 2016 (Rs Cr.) Exit Load (Max %) Investment Style To generate income and long term capital appreciation by investing in a diversified portfolio predominantly consisting of equity and equity related securities. 1 Large Cap Diversified N.A Small & Mid Cap SIP Returns Period 10.00 3 YR SIP Amt Invested Scheme 6ms 1Yr 2Yrs^ 3Yrs^ SI^ Fund -4.68 -6.04 23.35 27.16 18.67 S&P BSE 200 -2.76 -7.86 10.24 12.47 6.68 Benchmark 5 YR SIP 7 YR SIP 36000 60000 Value (Rs) 48293 102769 NA Returns (%) 20.01 40250 21.66 75955 NA NA 7.37 9.36 NA Value (Rs) Returns (%) 84000 ^ Annualized Concentration Analysis Important Ratios * Portfolio Beta R Squared (%) Standard Deviation (%) Sharpe Ratio Treynor Ratio Jenson's Alpha (%) 0.86 88.77 15.94 -0.79 -0.15 -0.29 Sortino Ratio * Annualized -1.58 % to NAV Exposure to Nifty 50 Exposure to Benchmark Top 5 Companies Exposure Top 5 Sectors Exposure 45.90 77.20 32.92 49.70 Market Captialisation Small Cap 1% Mid Cap 29% Large Cap 70% Top 10 Company Holdings Top 10 Sector Holdings Fund 10 8 6 4 2 0 Benchmark 20 Fund Benchmark 10 Houseware Engineering, Designing, Construction Chemicals Speciality Passenger/Uti lity Vehicles NBFC Auto Ancillaries Computers Software Housing Finance Pharmaceutic als Banks TTK Prestige Ltd. Motherson Sumi Systems Ltd. L&T Pidilite Industries Ltd. Maruti Suzuki India Ltd. Sun Pharma HDFC TCS Kotak Mahindra Bank Ltd. HDFC Bank 0 History Mar-16 Dec-15 Sep-15 Jun-15 Mar-15 Dec-14 Sep-14 CRISIL Mutual Fund Rank AUM (Rs. Cr.) Quarter End NAV 52 Weeks High NAV 52 Weeks Low NAV 1 6957.75 29.19 32.84 27.01 1 6479.59 30.61 32.84 28.53 1 5949.18 30.62 32.84 24.99 1 5129.74 30.69 32.35 22.79 1 4245.71 31.06 32.19 18.95 1 2983.00 28.69 28.69 16.65 1 2054.94 25.95 26.48 14.72 Fund vis-à-vis Benchmark Historic Performance Benchmark Fund Benchmark 20 10 All data as on March 31, 2016 Address Email Website Phone No Registrars Mar-16 Dec-15 Sep-15 Jun-15 Mar-15 Dec-14 Sep-14 Jun-14 Mar-14 Dec-13 Sep-13 -10 Jun-13 Mar-16 Oct-15 May-15 Dec-14 Jul-14 Feb-14 Sep-13 Apr-13 Nov-12 0 Jun-12 Jan-12 Aug-11 Oct-10 Mar-11 May-10 Dec-09 0 Quarter on Quarter Performance 30 3500 Fund 3000 2500 2000 1500 1000 500 Equity0Linked Savings Schemes (ELSS) Portfolio features equated with comparable NSE indices in place of S&P BSE indices Axis House, 1st Flr,Bombay Dyeing Mill Compound, Pandurang Budhkar Marg,Worli, Mumbai - 400025 [email protected] www.axismf.com 022-43255161 Karvy Computershare Pvt. Ltd. Disclaimer: CRISIL Research, a division of CRISIL Limited (CRISIL) has taken due care and caution in preparing this Report based on the information obtained by CRISIL from sources which it considers reliable (Data). However, CRISIL does not guarantee the accuracy, adequacy or completeness of the Data / Report and is not responsible for any errors or omissions or for the results obtained from the use of Data / Report. This Report is not a recommendation to invest / disinvest in any entity covered in the Report and no part of this report should be construed as an investment advice. CRISIL especially states that it has no financial liability whatsoever to the subscribers/ users/ transmitters/ distributors of this Report. CRISIL Research operates independently of, and does not have access to information obtained by CRISIL’s Ratings Division / CRISIL Risk and Infrastructure Solutions Limited (CRIS), which may, in their regular operations, obtain information of a confidential nature. The views expressed in this Report are that of CRISIL Research and not of CRISIL’s Ratings Division / CRIS. No part of this Report may be published / reproduced in any form without CRISIL’s prior written approval.