* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Chapter Seven

Environmental, social and corporate governance wikipedia , lookup

Venture capital financing wikipedia , lookup

Private money investing wikipedia , lookup

Investment management wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Short (finance) wikipedia , lookup

Capital gains tax in Australia wikipedia , lookup

Project finance wikipedia , lookup

Investment banking wikipedia , lookup

Corporate venture capital wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

History of private equity and venture capital wikipedia , lookup

Security (finance) wikipedia , lookup

Financial crisis wikipedia , lookup

Private equity secondary market wikipedia , lookup

Private equity wikipedia , lookup

Private equity in the 1980s wikipedia , lookup

Securitization wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

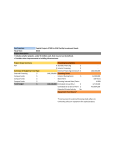

University of Bahrain College of Business Administration MGT 239: Small Business Chapter 7 Obtaining the Right Financing for Your Business MGT239 1 Estimating Financial Needs Insufficient financing is one of the major problems facing SB Estimating financial needs: • For existing business the financial needs can be estimated with relative accuracy. Fixed Assets vs. Current Assets Fixed Assets: Long lived assets (buildings, large machines and equipments) should be financed with long-term loans the maturity of loans should be equal to the productive life of the assets. Current Assets: cash, account receivables and inventories MGT239 2 Estimating Financial Needs 100% debts financing – Risky for creditors and the business. • Working capital = Current assets (cash, account receivable, inventories) – current liabilities (Accounts payable, money owed to suppliers; note payable short-term loans; unpaid expenses) • Working capital: is the capital used to produce goods and services and also to finance the temporary credits to customers. MGT239 3 Estimating Financial Needs Using Cash budget to estimate working capital • • • A cash budget estimates the out of pocket expenses that will be used to produce a product and when the revenue from the sales of the product will be collected (for a given period). In general, when sales are made on credit (which is very likely to happen) the firm must carry the cost of production itself for an extended period. A cash budget can help the manager predict when these financing needs will be the greatest, and plan accordingly. MGT239 4 Reasons for Using Equity and Debt Financing • • • • • • • Reasons for using equity and debt financing: Only two sources of financing: Equity and debt financing. Equity: the owner’s share of the assets. Shares - common vs. preferred stocks Common shareholder: are the real owns of the corporation. Their claim to profit is distributed after all other claims against the business have been met. They basically maintain control over the business because of their right to vote. Preferred stock holders: get their dividend before common stockholders. This is a compensation for giving up their right to vote. The other type of financing is debt financing which comes from lenders who charge interest. MGT239 5 Role of Equity and Debt Financing • • • • • • Role of equity financing: Equity financing serves as a collateral to creditors in case the business fails to repay its debts. The role of debts financing: the cost of (i) paid on debts financing is lower than the cost of outside equity financing (which means that you have outsiders sharing the business with you). Also (i) paid on capital is tax deductible. the entrepreneur can raise more capital from debts than from equity sources alone. Since debts payment is fixed cost, any remaining profit goes solely to the owner. This strategy is referred to as financial leverage. MGT239 6 • Financial leverage: is using debts (or any other fixed-charge financing) to finance a business operation • One type of debt financing is leasing • A lease: is a contract that permits use of someone else’s property for a specific time period. From the owner point of view, the benefit of leasing include: payments are tax deductible when business cannot secure funds to buy equipment, leasing becomes the best option equipments can go out of date very quickly with rapid changes in technology. MGT239 7 Types of debts and equity security • If you have a reliable business plan, financing can be obtained from many different sources. These include: Equity securities: • Common stocks: give its holder the right to vote. • Preferred stocks: with a fixed value usually $ 100. It entails its holder to a fix dividend payment usually expressed as % of the share value . • This dividend is not enforceable but no payment to common stockholders can be made before the dividend to preferred stocks can be paid. • Small Company Offering Registration (SCOR) - allows small businesses to sell stocks to the public. MGT239 8 Debts securities: • • • Bonds or loans. Bonds usually used for large businesses, small businesses rely on loans. Bonds: it’s a business’s written pledge that it will repay a specific amount of money with interest, on certain maturity date. • • • Types of debts securities: Short term: matures in one year or less Intermediate-term: securities mature in 1-5 yrs Long-term securities: matures in more than 5 yrs. Long-term debts secured by real estate property called mortgage loans. A chattel loan is a loan that is secured against some physical assets such as machinery, transportation equipments, or inventory. Unsecured loans extended to small businesses required personal guarantees by the managers of the firm. Such loans are secured against the personal assets of the individual. • MGT239 9 Sources of equity financing Self Others • • • • Small Business Investment Companies (SBIC): Private firms licensed by SBA to make venture investment in small companies. SBIC make equity type investment with SB, by owning part of the firm’s equity security. Venture capitalist: Wealthy individuals who provide equity investment in small businesses. Angel capitalists or business angels: Friends, family or wealthy local business people and other investors who are interested in investing in high risk, highreturn ventures . MGT239 10 Other sources: • Business incubators: nurture young firms and help them to survive during the start-up period when they are most vulnerable. • • • Employee stock ownership: selling shares to worker. The business rise financing as well as increase employee’s commitment. Customers: Paying in advance. Bartering: Barter consists of two companies exchanging items of roughly equal values. MGT239 11 Sources of Debt Financing: • • • • • • Trade credit: purchases of inventories, equipment and/or supply on an open account in accordance with terms and conditions of retailers. Some businesses make use of consignment selling: where payments to suppliers are made after products are sold. Commercial Banks Successful business owners can open a line of credit with their banks. This allows the owner to borrow, for example up to $ 50,000 a year (a line of credit) Credit Cards Small business Administration: help businesses locate sources, offer guarantees on loans. • Specialized Small Business Investment Companies SSBIC: specialized in serving the socially and economically disadvantaged business people. MGT239 12 What lenders look for • • • • • The ability to repay your loans. Collateral previous record. your character Read fig 6.3 steps used in developing a good relationship with invertors. MGT239 13