* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download The Pull of Active Management - Market Strategies International

Survey

Document related concepts

Business valuation wikipedia , lookup

Beta (finance) wikipedia , lookup

Securitization wikipedia , lookup

Private equity wikipedia , lookup

Public finance wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Syndicated loan wikipedia , lookup

Stock selection criterion wikipedia , lookup

Private equity in the 1980s wikipedia , lookup

Financial economics wikipedia , lookup

Investment fund wikipedia , lookup

Private equity secondary market wikipedia , lookup

Economic bubble wikipedia , lookup

Pensions crisis wikipedia , lookup

Transcript

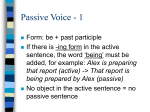

The Pull of Active Management Examining the Use of Active vs. Passive Strategies in the Institutional Marketplace April 2016 Table of Contents Introduction. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 Key Findings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2–5 Usage of Active vs. Passive Strategies Allocation to Active vs. Passive Strategies Institutions Shunning Passive Management Strategic Implications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 Methodology . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 Copyright © 2016 by Market Strategies International. All rights reserved. Reproduction of any part of this report is illegal under Federal Copyright law (17 USC 10 et seq.) and is prohibited. Photocopying or transmission of the information in any electronic or mechanical fashion outside of the purchasing organization is strictly forbidden, unless the user has purchased an annual usage license from Market Strategies International that allows the user the capability to quote directly from the content with attribution to the firm. This report is intended exclusively for distribution within the purchasing firm. Distribution to or use by any other firm, subsidiary, affiliate, external agent or client is prohibited. Contact Market Strategies International to learn more about redistribution/attribution permissions. Analysis relies on data from primary research and third-party sources deemed to be reliable. Although believed to be accurate, this information is not guaranteed. Publication date: April 2016 Introduction Pressure is mounting on institutional investors to support their organizations with a balance of risk management and growth, fueling interest in asset classes with a higher return potential in addition to the more traditional areas of focus. Many institutional consultants are encouraging clients to focus on alpha as a way to add value to their portfolios, given that most market predictions for 2016 are lackluster at best. Overall, institutional investors appear to be heeding the call and have their sights set on active management for the near future. Yet allocation to actively-managed strategies declines as asset size grows, with the largest institutions clearly preferring less traditional asset classes such as private equity, real assets/commodities, real estate/REITs and alternatives. This research paper examines trends in the usage of and allocation to active and passive strategies among institutional investors over the past three years. Specifically, we analyze the asset allocation practices of defined-benefit (DB) pensions (corporate pensions as well as public and Taft-Hartley plans) and non-profits (endowments, foundations and other tax-exempt organizations—TEO,) by organization type as well as by asset size. We begin with an assessment of the proportion of institutional investors that are using active and passive strategies. We then turn to an analysis of asset allocation, providing a view of the percentage of assets institutional investors are directing to active vs. passive investments. We conclude by taking a look at the proportion of institutional investors that are shunning passive management altogether in favor of active management, private equity and alternative strategies. SOURCE: US INSTITUTIONAL INVESTOR BRANDSCAPE®. JANUARY 2016. 1 Definitions: The “Active” category includes: The “Passive” category includes: The “Other” category includes: • • • • • • • • • • • • • US public equities (actively-managed) US fixed income (actively-managed) International public equities (actively-managed) International fixed income (activelymanaged) Key Findings Usage of Active vs. Passive Strategies Pensions The vast majority of pension investors, over nine in ten (95%), incorporate actively-managed strategies in their institutional portfolios. In fact, use of active management varies little by asset size, ranging from 93% among pensions managing $250 million to less than $1 billion in assets to 100% of the $1 billion-plus pensions. By category, 90% of corporate pensions report using actively-managed strategies, compared with 100% of their public defined-benefit and Taft-Hartley pension peers. The story is quite different for passivelymanaged strategies, for which 68% of pensions report to be using, down from 81% in 2014. Notably, use of passive investments is lowest among the smallest-pension cohort, as just 54% of pensions managing less than $100 million in assets invest in passive instruments. Conversely, pensions managing larger asset pools are much more likely to be allocating at least a portion of their assets to passive strategies (90% of pensions managing $250 million to just under $1 billion in assets and 82% of $1 billion-plus pensions). • US public equities (passively-managed) US fixed income (passively-managed) International public equities (passivelymanaged) International fixed income (passivelymanaged) Corporate pensions appear to be driving the decrease in use of passive investments, perhaps a reflection of the reliance on liabilitydriven investment (LDI) strategies among this cohort of the pension market. Finally, the proportion of pensions using other asset classes that cannot be accurately categorized as either active or passive and has remained relatively consistent year over year. One exception is corporate pensions, which have decreased their use of private equity and cash. EXHIBIT 1 Private equity Cash/cash equivalents Real assets/commodities Real estate (including REITs) Other alternatives Any other asset categories compared with 2013, and are the only segment of the non-profit market to have boosted their use of passive management over the past three years. The use of other asset classes is more prevalent among non-profits (88%) than among pensions (78%) and is noticeably higher among the $1 billion-plus segment. In addition, 95% of foundations incorporate these asset classes in their portfolios—higher than any other type of institution. EXHIBIT 2 Non-Profits Nearly nine in ten (89%) non-profits overall utilize actively-managed strategies, a proportion that increases with the size of the asset pool. Virtually all non-profits managing $250 million or more in assets are using active management, compared with just 85% of their peers managing less than $100 million. Endowments report the highest usage level at 93%, while foundations show slightly weaker interest at 86%. The use of passive management has decreased among non-profits overall, and this decrease appears to be driven by the smaller institutions managing less than $250 million in assets. Interestingly, foundations report an increase in their use of passive strategies Nearly nine in ten non-profits overall utilize actively-managed strategies, a proportion that increases with the size of the asset pool. 2 THE PULL OF ACTIVE MANAGEMENT EXHIBIT 1 USAGE OF ACTIVE VS. PASSIVE STRATEGIES PENSIONS BY ASSET SIZE AND CATEGORY EXHIBIT 1 USAGE OF ACTIVE VS. PASSIVE STRATEGIES Pensions by Asset Size and Category $20M– <$100M $100M– <$250M $250M– <$1B $1B+ Corporate DB Public DB & Taft-Hartley Active 95% 94% 98% 93% 100% 90% 100% Passive 68%▼‘14 54% 64% 90% 82% 67% ▼‘14 73% 73% 73% 83% 91% 75% ▼‘14 83% Other 78%▼‘14 Low Key High ≤ 63% 64% to 72% 73% to 82% 83% to 91% ≥92% /= Significant change from stated year /= Significant change observed in 2014 sustained in 2015 Base: All pensions Source: Market Strategies International. Cogent Reports™. US Institutional Investor Brandscape®. January 2016. EXHIBIT 2 USAGE OF ACTIVE VS. PASSIVE STRATEGIES EXHIBIT 2 NON-PROFITS BYcash/cash ASSETequivalents, SIZE AND CATEGORY * Other includes private real assets, real estate, other alternatives, and any other asset categories USAGE OFequity, ACTIVE VS. PASSIVE STRATEGIES Q11A. What proportions of your [category] assets are allocated across each of the following asset categories? ▲/▼ = Significant change from stated year / = Significant change observed in 2014 sustained in 2015 Base: All Pensions $20M– $100M– $250M– Non-Profits by Asset Size and Category Active 89% Passive 59%▼‘14 Other 88%▼‘14 <$100M <$250M 85% 95% <$1B $1B+ 99% Endowment Foundation TEO 100% 93% 86% 89% 56%▼‘14 63%▼‘14 66% 67% 63% 75%▲‘13 48% 88% 97% 95% 85% 84% 90% 85% ▼‘14‘13 Low Key High ≤ 58% 59% to 69% 70% to 79% 80% to 90% ≥91% /= Significant change from stated year /= Significant change observed in 2014 sustained in 2015 Base: All non-profits Source: Market Strategies International. Cogent Reports™. US Institutional Investor Brandscape®. January 2016. *Other includes private equity, cash/cash equivalents, real assets, real estate, other alternatives, and any other asset categories Q11A. What proportions of your [category] assets are allocated across each of the following asset categories? ▲/▼ = Significant change from stated year / = Significant change observed in 2014 sustained in 2015 Base: All Non-Profits SOURCE: US INSTITUTIONAL INVESTOR BRANDSCAPE®. JANUARY 2016. 3 Allocation to Active vs. Passive Strategies their assets with active managers and allocate 31% of assets to other (non-passive) asset classes, while their non-profit counterparts direct just 44% to active strategies and hold 41% of their assets in categories outside of traditional active and passive management. The proportion of institutional assets allocated to actively-managed strategies declines by asset size, with the largest institutions clearly preferring less traditional asset classes including private equity, real assets/ commodities, real estate/REITs and alternatives. The $1 billion-plus pensions have just 51% of are passively-managed, along with one-quarter of the assets held by smaller pensions and non-profits. Corporate pensions report greater use of passive management than do their public DB and Taft-Hartley peers (29% compared with 20%), while roughly one-quarter of endowment, foundation and tax-exempt assets are passively managed. EXHIBITS 3 & 4 Institutions managing less than $1 billion in assets continue to prefer active management. That said, one-third of assets held by pensions managing $250 million to less than $1 billion EXHIBIT 3 ASSET ALLOCATION: PROPORTION OF ACTIVE VS. PASSIVE EXHIBIT 3 PENSIONS BY ASSET SIZE AND CATEGORY ASSET ALLOCATION: PROPORTION OF ACTIVE VS. PASSIVE Pensions by Asset Size and Category Other $20M– <$100M $100M– <$250M 11% 11% 24% 25% $250M– <$1B 13% $1B+ 31% 33% Corp. DB Public DB & Taft-Hartley 11%▼‘14 17% 29% 20% 60% 63% 19% Passive 65% 63% Active 54% 51% /= Significant change from stated year /= Significant change observed in 2014 sustained in 2015 Base: All pensions Source: Market Strategies International. Cogent Reports™. US Institutional Investor Brandscape®. January 2016. EXHIBIT 4 ASSET ALLOCATION: PROPORTION OF ACTIVE VS. PASSIVE EXHIBIT 4 NON-PROFITS BY ASSET SIZE AND CATEGORY ASSET ALLOCATION: PROPORTION OF ACTIVE VS. PASSIVE Non-Profits by Asset Size and Category Q11A. What proportions of your [category] assets are allocated across each of the following asset categories? ▲/▼ = Significant change from stated year / = Significant change observed in 2014 sustained in$100M– 2015 $20M– $250M– EndowBase: All Pensions <$100M <$250M <$1B $1B+ Foundation TEO 25% 27% 21% 23% 25% 52% 49% ment Other 23% 20% 27% ▼‘13 25% 23% 41% 18% ▼‘13 23% 15% Passive 52% Active 57% 55% 44% /= Significant change from stated year /= Significant change observed in 2014 sustained in 2015 Base: All non-profits Source: Market Strategies International. Cogent Reports™. US Institutional Investor Brandscape®. January 2016. 4 THE PULL OF ACTIVE MANAGEMENT 56% Institutions Shunning Passive Management category, compared with just 18% of $1 billion-plus pensions and 33% of the largest non-profits. In addition, the proportion of institutions shunning passive management fluctuates substantially year over year in the smaller end of the market, while the larger institutions appear to be more steadfast in their convictions and are less likely to make dramatic shifts in their asset allocation strategies. An analysis of the proportion of institutions that hold 100% of their assets in actively-managed and “other” strategies, and consequently are directing 0% of their assets to passive investments, further emphasizes the popularity of active management in the smaller end of the market. More than 4 in 10 institutions managing less than $100 million in assets (46% of pensions and 44% of non-profits) fall into this driven by corporate defined-benefit plans in the pension market and tax-exempt organizations in the non-profit space. As noted earlier, corporate pensions are increasingly dependent on LDI, which may be effectively shifting their allocation to active management. Meanwhile, tax-exempt organizations are expressing the need for higher returns and diversification opportunities, which may explain the shift away from passive management in this segment of the institutional market. EXHIBITS 5 & 6 A view by organization type shows that the drive away from passive management is being EXHIBIT 5 PROPORTION WITH 0% OF ASSETS ALLOCATED TO PASSIVE STRATEGIES EXHIBIT 5BY ASSET SIZE AND CATEGORY PENSIONS PROPORTION WITH 0% OF ASSETS ALLOCATED TO PASSIVE STRATEGIES Pensions by Asset Size and Category Total $20M– <$100M $100M– <$250M $250M– <$1B $1B+ Corporate DB Public DB & Taft-Hartley 2015 31%▲‘14 46% 36% 10% 18% 33%▲‘14 27% 2014 19% 15% 29% 21% 8% 17% 16% 2013 38% 43% 47% 41% 27% 28% 42% /= Significant change from stated year /= Significant change observed in 2014 sustained in 2015 Base: All pensions Source: Market Strategies International. Cogent Reports™. US Institutional Investor Brandscape®. January 2016. EXHIBIT 6 PROPORTION WITH 0% OF ASSETS ALLOCATED TO PASSIVE STRATEGIES EXHIBIT 6BY ASSET SIZE AND CATEGORY NON-PROFITS PROPORTION WITH 0% OF ASSETS ALLOCATED TO PASSIVE STRATEGIES Non-Profits by Asset Size and Category Total $20M– <$100M $100M– <$250M $250M– <$1B $1B+ Endowment ▲‘14 41% 44%▲‘14 34%each of the 33% 2015 37% Q11A. What proportions of▲‘14 your [category] assets37% are allocated across following asset categories? ▲/▼ = Significant change from stated year / = Significant change observed in 2014 sustained in 2015 15% 11% 17% 35% 36% Base: All Pensions 2014 24% 2013 44% 48% 39% 43% 42% 37% Foundation TEO 25%▼‘13 52%▲‘14 16% 11% 50% 45% /= Significant change from stated year /= Significant change observed in 2014 sustained in 2015 Base: All non-profits Source: Market Strategies International. Cogent Reports™. US Institutional Investor Brandscape®. January 2016. SOURCE: US INSTITUTIONAL INVESTOR BRANDSCAPE®. JANUARY 2016. 5 Strategic Implications The allocation of institutional assets across asset classes and product types has remained fairly stable over the past year, with smaller institutions concentrating their assets in US equities and US fixed income and larger organizations employing a more diversified approach. Yet, as US institutional investors are challenged to support their organizational obligations with the appropriate balance of risk management and return, we are seeing increased interest in investing in asset classes with a higher return potential, such as private equity, real estate and alternatives. Overall, institutional investors appear to have their sights set on active management for the near future, but allocation to activelymanaged strategies declines as asset size grows, suggesting positive growth potential for passive management over the longer term. In addition to a solid understanding of asset allocation trends and behaviors, the factors driving anticipated asset allocation changes are critical for asset managers to appreciate in order to effectively position their capabilities to meet the needs of their target market. The focus of pensions is clearly on de-risking, although this aspect declines slightly in importance as asset size grows. Pensions, particularly the smallest organizations, report a near-equal focus on seeking higher returns, which may explain their interest in private equity and alternatives. The $1 billion-plus pensions are more likely than their smaller-asset peers to point to the need of increasing diversification, suggesting these institutional investors feel the need to monitor their exposure particularly within the fixed income category. In contrast, non-profits of all asset sizes continue to strive for higher returns and further diversification. For asset managers serving the institutional market, the need for focus has never been greater. Determining the right business strategy, product offering and competitive positioning is to a great extent dictated by the segment of the market being targeted. Insights shared in this white paper are derived from our US Institutional Investor Brandscape® report. The full report examines the behaviors and attitudes of senior investment professionals across defined-benefit pension plans, and private and public foundations and endowments. Conducted since 2010, this study covers overall trends in asset allocation and investment strategies, the variables that lead to selection, and the current state of brand equity, differentiation and loyalty in this critical market. 6 THE PULL OF ACTIVE MANAGEMENT Methodology Cogent Reports conducted an online survey of a representative cross section of 405 investors managing $20 million or more in institutional investable assets from October 1 to December 10, 2015. Survey participants were required to play a direct role in the evaluation and selection of investments or asset managers within their organizations. Linda York Senior Vice President, Syndicated Research & Consulting For more information, contact us at [email protected] or 617.441.9944 About Market Strategies International Market Strategies International is a market research consultancy with deep expertise in consumer/retail, energy, financial services, healthcare, technology and telecommunications. The firm is ISO 20252 certified, reflecting its commitment to providing intelligent research, designed to the highest levels of accuracy, with meaningful results that help companies make confident business decisions. Market Strategies conducts qualitative and quantitative research in 75 countries, and its specialties include brand, communications, customer experience, product development, segmentation and syndicated. Its syndicated products, known as Cogent Reports, help clients understand the market environment, explore industry trends and evaluate and monitor their brand and products within the competitive landscape. Founded in 1989, Market Strategies is one of the largest market research firms in the world, with offices in the US, Canada and China. Visit us: cogent-reports.com Read our blog: freshmr.com