* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download ETF Trading and Execution in the European MarketsPDF

Survey

Document related concepts

Business valuation wikipedia , lookup

Financialization wikipedia , lookup

Financial economics wikipedia , lookup

Investment management wikipedia , lookup

Syndicated loan wikipedia , lookup

Trading room wikipedia , lookup

Private equity secondary market wikipedia , lookup

High-frequency trading wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Interbank lending market wikipedia , lookup

Market (economics) wikipedia , lookup

Stock selection criterion wikipedia , lookup

Algorithmic trading wikipedia , lookup

Stock trader wikipedia , lookup

Short (finance) wikipedia , lookup

Transcript

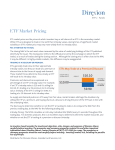

ssga.com | spdrseurope.com ETF Trading & Execution in the European Markets ETF Trading and Execution in the European Markets As the European ETF market continues to expand, it is important for investors to understand the mechanics behind ETF trading and execution. While the fragmentation of European equity markets has long been a reality for European equity investors, the impact of this fragmentation on ETF trading is often unclear. In this paper we highlight the distinctive characteristics of European ETF trading and how investors can effectively leverage the ETF structure to their advantage. We also explore the different avenues, common tools, and best practices an investor can use when buying and selling ETFs. ETF Market Structure: An Overview Individual investors buy and sell ETFs in the secondary market, either through a stock exchange or over-thecounter (OTC) directly with broker-dealers or other investors. However, the creation and redemption of ETF units in the primary market underpins this activity. This process occurs between the ETF manager (known as the sponsor) and authorised participants (APs), who are the only parties allowed to transact directly with the ETF. APs regulate the supply of ETF shares in the secondary market to meet demand from investors and are therefore key liquidity providers in the secondary market. Sometimes an institution needs to trade a larger block of ETF units than is available in the secondary market. The overall demand for ETF units could also be greater than the supply. In these cases, the AP can step in to address this by submitting a creation order for a block of new shares in exchange for a basket of the underlying securities or cash. The process works in reverse if there is a large seller or an oversupply of ETF units. Primary Market: The primary market is where securities are created. In ETF terms, this is where the contract between the AP and the ETF sponsor to create or redeem ETF shares takes place. Secondary Market: The ‘stock market’, i.e. the New York Stock Exchange (NYSE), the London Stock Exchange (LSE) and other major stock exchanges around the world, and the OTC market where investors deal directly with each other at an agreed price. ETF Liquidity: Understanding the True Measure The staggering growth of the European ETF market has become hard to ignore. Over the past five years, assets under management in Europe have almost doubled from $827 billion at the end of 2009 to $1,486 billion year to date,1 keeping pace with growth in the more mature US ETF market. Despite this impressive growth, investors looking to their domestic exchange expecting to see remarkable trading volumes are often disappointed with typically low Average Daily Volume (ADV) figures and at times unattractive bid/ask spreads. Two factors unique to the European market make this common gauge of liquidity a misrepresentation: Market fragmentation through multiple ETF exchange listings (and sometimes multiple currency listings at each exchange), and the lack of trade reporting requirements. Market Fragmentation ETF post-trade processing and settlement in Europe is currently a fragmented model. All cross-exchange listed ETFs in Europe are issued and traded on one or more national stock exchanges and settle in the central securities depositary (CSD) of the exchange where the trade is executed (see Section II for more detail this process). For example, ETFs with a listing on Borsa Italiana would typically settle and be held via the Italian domestic CSD — Monte Titoli. Given this historic domestic bias and the fact that a majority of European ETFs are cross-listed over multiple exchanges, liquidity providers often need to transfer or cross-border the underlying ETF shares from one domestic CSD to another, in order to re-align their inventory to satisfy client activity. This post-trade re-alignment creates numerous operational inefficiencies. Importantly for investors, this cross-border process can add settlement risk and additional transactional costs. 1 2 Source: ETFGI.com as at 30 April 2015. This is just one step towards reducing ETF market fragmentation in Europe. For example, the ECB’s new securities settlement platform, T2S, is set to launch in June 2015 and seeks to provide a “single pan-European platform for securities settlement in central bank money.”2 Meanwhile, the European Union’s Markets in Financial Instruments Directive (MiFID) has made great strides towards harmonising European equity markets for the benefit of investors and the next version is keenly awaited. Solutions, however, are beginning to appear. The first of these is Euroclear Bank’s new ‘international ETF structure’, which seeks to provide a centralised, simpler and more efficient settlement system. In this new structure, Euroclear Bank acts as an International Central Securities Depository (ICSD). This means that the underlying ETF shares are centralised in a single inventory pool held within the ICSD, removing the need for inventory management across domestic CSDs. By simplifying the issuance and post-trade structures across Europe, liquidity providers will be able to service their clients more easily whilst ultimately reducing overall transactional costs. Figure 1: Executed Trade Price/Trade Amount Total Volume in € Price in € 41.40 11,000,000 41.30 800,000 41.20 600,000 41.10 400,000 41.00 200,000 40.90 0 On Exchange Volume in € Trade Price OTC Volume in € It is difficult to use Average Daily Volume (ADV) as the only indicator of an ETF’s overall liquidity. Given the fragmentation and lack of trade reporting requirements in Europe, ADV only represents the number of shares traded on exchange in the secondary market. Investors should also consider the liquidity of the primary market and understand the intricacies of the European secondary markets. Lack of ETF Trade Reporting Requirements Currently ETFs are not subject to the same pre-trade and post-trade requirements as other exchange traded instruments, such as equities, and in most markets there is no requirement for executed trades to be reported. In terms of pre-trade work, one benefit ETF investors currently do not have is a consolidated European order book. This means that investors are not easily able to see aggregate ADV for ETFs cross-listed on multiple exchanges. It also means that the onus of on-exchange pre-trade analytical work and finding the best price is borne by the ETF investor. For example, an investor is looking to purchase shares of an ETF on his local exchange. If the ETF is also listed on other exchanges, there is a possibility that shares are being offered on another exchange for a better price. There are a wide variety of reasons why prices vary between exchanges, but it’s important that investors understand that their exchange of choice might not show the full picture of an ETF’s on-exchange market from a spread and volume perspective. Figure 2: SPDR S&P US Dividend Aristocrat UCITS ETF Consolidated On-Exchange Volume Ticker Volume Bid / Ask Europe (GBP) SPYDGBP EU 84.236k 28.836 / 28.761 USDV LN 84.236k 28.692 / 28.805 SPYDUSD EU 107.94k 28.669 / 28.774 UDVD LN 107.94k 28.744 / 28.789 SPYD EU 13.07k 28.740 / 28.775 USDV IM 1.337k 28.740 / 28.775 Europe (USD) Europe (EUR) Source: Bloomberg, as of 1 September 2014. For illustrative purposes only. Information are of date indicated, subject to change and cannot be relied on thereafter. This information should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security. 2 Source: ECB.com as of 30 September 2014. State Street Global Advisors | SPDR ETFs 3 ETF Trading and Execution in the European Markets One useful tool that investors can use to see a fund’s consolidated ADV and relevant bid/ask spreads is through the quote montage (QM) function on Bloomberg (see Figure 2). This function aggregates each exchange listing of a particular ETF and lists the volume traded on each exchange as well as the relevant bid/ask spreads in each market. Otherwise, investors can access ETF listing information via most fund provider’s websites. Nevertheless, a further consideration is that while there is no indisputable way to calculate the amount of ETF trading that goes unreported, industry experts estimate that anywhere from 50 – 90% of ETF activity occurs over-the-counter (OTC), one reason why looking at a fund’s ADV as a gauge for liquidity is flawed. Moreover, the fact that ETFs trade OTC means that the spreads/depth shown on-exchange may be inferior to those off screen. However, it is widely expected that a broadly mandated ETF post-trade reporting requirement will be included in the next iteration of MiFID, which has the potential to dramatically increase visible volumes and potentially improve price competition. MiFID has a wide scope but in its simplest form seeks to provide protection to European investors. Generally speaking, it sets forth rules surrounding the European pre-trade and post-trade environment in order to ensure clients are given access to the best available price before trading and the appropriate transparency regarding their executions after trading. But for now, looking beyond the ADV is vital in understanding the true picture of an ETF’s liquidity. Investors must look at the available liquidity of the primary market and underlying securities of the ETF. To get a full picture, investors must first understand the creation/redemption process, one of the most fundamental and unique aspects of the exchange traded fund structure. ETF Execution: The Mechanics How are ETFs Created and Redeemed? Understanding the creation/redemption process is key to understanding the true extent of an ETF’s overall liquidity. Creation and redemption take place in the primary market and is facilitated by Authorised Participants (APs) in order to regulate supply of ETF shares in the secondary market. In Europe, APs are regulated investment firms that have executed dealing agreements in place with the ETF fund provider as well as the ETF fund administrator (the counterparty appointed by an ETF provider responsible for overseeing the operational workflow of creations and redemptions, among other things). These are the following steps an AP takes to create ETF shares: 1. On each business day, APs are provided with an ETF portfolio composition file (PCF) from the ETF fund provider which contains details of the securities and/or cash elements that are required for ETF creation/redemption. 2. APs typically source the underlying PCF constituents via internal inventory, acquiring them in the market or borrowing the underlying names from third party sources. 3. APs then create fund shares in increments that meet a minimum creation unit size set by the fund provider — known as creation units (‘units‘ being the minimum number of shares that can be transacted in the primary market.) They do this by assembling the underlying securities of the fund in their appropriate weightings to reach creation unit size. 4. APs then deliver those securities to the fund provider’s home CSD in-kind (sometimes used for smaller, liquid indices) or in cash (which offers greater settlement flexibility and transactional risk control for both the fund provider and the AP). 5. In return, the AP receives fund shares which are then introduced to the secondary market where they are traded between buyers and sellers through the exchange. 4 PRIMARY MARKET Figure 3: Creation/Redemption Process SPDR ETF Sponsor Underlying Securities ETF Units SECONDARY MARKET Authorised Participants (AP) ETF Shares Buyers Stock Exchange Sellers To illustrate the process, let’s walk through a specific example. Suppose an AP wants to create shares of the SPDR S&P 500 Low Volatility UCITS ETF. First, the AP would reference a list of the exact securities and their weightings within the fund using the PCF list from the ETF fund provider. The AP would gather those same securities in their appropriate weightings into a creation unit. Next, the AP would transfer the creation unit in-kind or in cash to State Street Global Advisors in exchange for shares of the SPDR S&P 500 Low Volatility UCITS ETF. To complete the creation process, the AP would introduce these newly created ETF shares into the secondary market where they would be traded between buyers and sellers through the exchange. When the AP wants to redeem fund shares of the SPDR S&P 500 Low Volatility UCITS ETF, they would follow the same process in reverse. In the secondary market, the AP would gather increments of fund shares into a redemption unit. Then in the primary market, the AP would deliver the redemption units to State Street Global Advisors in-kind or cash in exchange for the underlying securities in the appropriate weightings equal to that of the redemption unit. Only APs are able to create or redeem ETF shares in the primary market. The redemption process is the same, but in reverse. Increments of fund shares — known as redemption units — are collected in the secondary market by the AP and then delivered to the fund provider’s home CSD in-kind or in cash in exchange for the underlying securities in the appropriate weighting equalling that redemption unit. As Europe’s secondary markets mature, ETF fund provider and APs alike have recognised the need for an efficient and controlled primary market that provides flexibility to meet client requirements across multiple exchanges and CSDs. Given the primary market can act as a main source of liquidity for client orders (discussed further in Section III), fund provider have begun to put considerable time and attention into ensuring that their primary markets function as efficiently as possible. For example, many fund providers have tried to innovate in the creation/redemption process, allowing APs to create or redeem via multiple options – cash, in-specie, or hybrid. From an investor standpoint, as long as the ETF provider is properly protecting and managing the fund to its selected benchmark, flexibility for the AP in the primary market will ultimately benefit the end investor with more competitive prices and readily available liquidity. This ability to introduce additional shares into the marketplace on a daily basis demonstrates precisely why ETF trading volume is not an all-encompassing measure of the fund’s overall liquidity. In order to understand the full liquidity of an ETF, investors must also consider the liquidity of the underlying securities. Central Security Depositories (CSDS) The creation process is facilitated by different clearing systems. These depend upon an ETF’s primary CSD and where the AP would like to settle their transaction (and as we have seen in Section I, there is now the option of the ICSD). CSDs vary by exchange, and a fund’s primary CSD typically corresponds with a fund’s primary exchange listing. For example: Clearstream is the CSD associated with the Deutsche Börse; Crest is the CSD associated with the London Stock Exchange; and Euroclear is the CSD associated with NYSE Euronext. As ETF administrators have become more sophisticated in settling shares across systems, this complicated process has become less onerous than it once was, allowing APs to create and redeem shares with maximum flexibility of where they would like their ETF proceeds delivered, in order to align with client requirements. For example, an AP looking to create shares via Clearstream has a unique account in which underlying shares or cash are exchanged with the fund provider in varying block sizes depending upon the ETF. State Street Global Advisors | SPDR ETFs 5 ETF Trading and Execution in the European Markets In-kind and Cash Dealing Models In-kind deliveries remain popular for smaller, liquid indices but the market has seen a huge shift to ’cash‘ creation/redemption dealing models which offer greater flexibility aligned with the ever-expanding number of products on offer that cover broader and more illiquid indices, especially those based upon emerging market and fixed income benchmarks. Cash dealing models also offer the ability for delivery versus payment (DVP) settlement, which gives both the provider and the AP greater risk control over the transaction. Under both models, the provider is responsible for delivering the ETF shares to the designated CSD account indicated by the AP at the time of order placement. For the in-kind model, this is typically only executed when all in-kind deliveries have been confirmed as received by the provider’s custodian. Premiums/Discounts and Why They Occur In some cases, a differential between the trading price and fair value of an ETF may arise. This discrepancy is known as a premium or discount in the fund. In the example of the ETF above, one variable that may serve as an impediment to keeping an ETF’s market price in line with its fair value is high transaction costs to obtain the underlying securities. Transaction costs tend to be higher for APs when creating or redeeming ETFs that represent esoteric, less liquid asset classes. If an AP needs to spend €5.00 per share to accumulate the underlying basket for a creation unit in previously mentioned ETF XYZ, profit margins disappear, thus, there is no longer an arbitrage incentive for the AP to create. In this case, shares of XYZ will most likely trade at a €5.00 premium to their fair value due to the nature of the underlying market. Why does an AP Create or Redeem ETF Shares? There are a number of reasons why an AP creates or redeems ETF shares including arbitrage, inventory management, customer facilitation, and equity finance/stock loan. The two reasons most applicable to investors are: In fast-moving markets where volatility increases, ETFs can sometimes trade at larger-than-usual premiums or discounts to their net asset value. This is particularly true where some of the underlying markets are closed or, as with some segments of the fixed income market, trade infrequently. Because ETFs need to price on exchange they act, in effect, as a ‘price discovery‘ mechanism and therefore tend to reflect a more realistic value for the underlying basket. Customer Facilitation: APs have the ability to create or redeem ETF shares for large investors in order to access additional liquidity beyond what might be shown in the secondary market. For example, if a pension fund is interested in acquiring €50 million of ETF XYZ, they may consider working with an AP to facilitate a creation. Arbitrage: APs can create or redeem ETF shares in order to take advantage of arbitrage opportunities in the market. To give a simple example, if shares of ETF XYZ are trading at €55.00 in the secondary market and the value of the underlying basket of securities of the ETF is €50.00 per share, there is an inherent arbitrage opportunity. In order to realise this opportunity, the AP would sell ETF shares at €55 per share and hedge their position by buying the corresponding underlying basket of securities for €50 per share, thus locking in the €5 per share profit. The AP then has the ability to create shares of the ETF at the end of the day with their long position in the corresponding underlying securities of the ETF. The AP would then close out their short position in the ETF using these newly created shares. This hypothetical example results in a €5.00 profit per share for the AP. Arbitrage is important for ETF investors because it keeps premiums and discounts in check which keeps the ETF’s market price in line with its underlying components. 6 Bid/Ask Spreads and Depth What is a Bid/Ask Spread? The bid is the price at which a buyer is willing to buy ETF shares, and the ask is the price at which a seller is willing to sell ETF shares. The difference between the bid and the ask is the spread, which indicates the overall cost of transacting in any security (plus any applicable brokerage commission costs). Theoretically, the difference between the bid/ask spread midpoint and ask plus commissions is the transaction cost of buying ETF shares: The difference between the bid/ask spread midpoint and bid plus commissions is the transaction cost of selling ETF shares. When using an exchange website or another data provider (such as Bloomberg or Reuters) to see the publicly available market in an ETF, you see what is known as the ‘top of the market’ for that particular exchange’s listing. This quote consists of the best bid and best ask available and may come from two different market makers or other investors. The best bid/best offer is a quote limited by a specific amount of shares, so understanding the depth of market is also important. The ‘depth of market’ refers to the number and size of pending orders on both the bid and ask quote. Generally, a market is considered ’deep’ if pending orders are enough to prevent any single order from significantly moving the price of the ETF. Investors can see the depth of a particular ETF by examining the full order book. High volume does not necessarily mean a market is deep and a deep market does not necessarily mean a market is highly traded. For a practical example of market depth, see Section III. Who are the Players? Many of the terms below are used interchangeably to refer to the different firms that trade ETFs. Although many of the terms are similar, there are also many key differences. ETF Fund Provider The investment firm that originates and manages the ETF. Authorised Participant APs are regulated investment firms that have fully executed legal documentation which gives them the ability to create new ETF shares or redeem existing ETF shares. Every ETF providers has different document requirements and at times providers may have different requirements depending upon the fund. Market Maker An all-encompassing term referring to a firm that is willing to provide a price to a buyer or a seller of an ETF. A market maker may or may not be an Authorised Participant. On-Exchange Market Maker A firm that provides buy and sell prices for ETFs on a stock exchange. This includes market makers who are providing prices in an official capacity (with signed exchange documentation and certain spread, depth, presence requirements), as well as market makers who are providing prices unofficially without any exchange-imposed requirements. Designated Sponsor A firm responsible for providing prices for an ETF on the Deutsche Börse’s Xetra segment. There may be multiple Designated Sponsors per fund — all are subject to predetermined, exchange-imposed spread/depth requirements. Liquidity Provider One or more firms responsible for providing prices in an ETF on the NYSE Euronext. There may be multiple liquidity providers (LPs) per fund — all are subject to predetermined, exchange-imposed spread/depth requirements. Outside of the exchange context, this term can be used broadly to describe any counterparty who will work with a client to help execute a trade. An LP can also refer to a firm providing liquidity on the Borsa Italiana without any obligation in terms of minimum quantity and maximum spread. Specialist The one firm responsible for providing prices in an ETF on the Borsa Italiana. This firm is subject to spread and depth requirements. What does the Bid/Ask Spread Represent? To better understand what an investor is paying for in a bid/ask spread, it is helpful to have an understanding of how the trading firms that specialise in buying and selling ETF shares operate. Like most businesses, cost to the end consumer is highly correlated to input costs, plus a profit. In this respect, ETF trading is no different from any other business. As such, ETF traders generally need to account for four different categories of cost when facilitating ETF trades. Risk: At times, risk can be the highest cost component of spreads, especially during periods of elevated market volatility. Most traders who facilitate ETF orders aim to remain market neutral since they generate their revenues through order execution, not investment appreciation. What most investors would call ‘investment exposure’, ETF traders call ‘risk’. In order to manage this risk, traders will hedge investment exposure with the use of underlying securities, options, futures contracts, or even other ETFs. Depending upon the liquidity of the underlying instruments used to initiate a hedge, it can be costly to maintain market neutrality when trading ETFs. This hedging cost will be included in an ETF’s spread and passed through to any investors that trade the ETF in the secondary market. Traders are often unable to be completely market neutral so will pass on any remaining market exposure risk through wider spreads. Additionally, market makers rely heavily upon the information provided to them in the daily portfolio composition files (PCF) provided by PCF calculation agents. As some ETF providers have PCF files that are less reliable than others, market makers may widen spreads in light of uncertainty regarding a fund’s components and thus its true price. Cost of Buying/Selling Basket Securities: One major variable cost that ETF traders often encounter is the cost of gathering the underlying securities in an ETF basket. For less liquid, esoteric asset classes, such as the high yield or municipal markets, this cost is greater, thus spreads tend to be wider for ETFs with more thinly traded underlying markets. In the case where an AP chooses to exchange cash for ETF shares, it is the provider’s responsibility to charge the AP any and all execution costs associated with their creation or redemption in order to protect the fund from assuming execution costs. This fee typically includes all relevant taxes, commissions and any other costs assumed in executing the underlying basket. State Street Global Advisors | SPDR ETFs 7 ETF Trading and Execution in the European Markets Business Cost: As the business of ETF trading continues to be closely tied to rapidly moving markets and the ever-growing need for lightning-quick technology, trading firms must constantly reinvest in order to stay competitive. Moreover, the requirement of multiple exchange memberships and the associated costs in Europe can quickly add up and these costs often find their way into the spread of an ETF. Creation/Redemption Fee: Otherwise known as third party administrator (TPA) charges, or custody charges, this is a fee passed on by the ETF administrator that represents the cost of settling the underlying stock of an ETF on a line by line basis. These costs tend to be higher for more esoteric, thinly traded securities in emerging markets. Since this charge is per line of stock regardless of creation or redemption size, costs diminish (in percentage terms) as order sizes increase. If any of these four cost categories rise, this is reflected in an ETF’s spread, meaning investors transacting in an ETF pay higher fees to participate. Much like a farmer who raises prices after an increase in the price of fertiliser, water or equipment, an ETF trader will widen spreads if any of his/her costs or risks rise. What is the Difference Between an AP and a Market Maker? APs have the ability to create or redeem ETF shares for the funds with which they have the properly executed legal documentation. If a client were to contact an AP and inquire about trading an ETF, the AP would be able to make a market in that specific ETF for the client. There is a distinct and important difference between making a market when asked, as the AP in this example has done, and being an exchange market maker with publicly available prices posted. Most times (though not always) market makers are also APs. Throughout most exchanges in Europe, an ETF must have at least one market maker who is required by the exchange to provide prices at all times throughout the trading day. Typically called an official market maker, designated sponsor, specialist or lead market maker (nomenclature varies by exchange), these particular market makers are different from market makers who make prices whenever and at whatever spread/size they deem appropriate. The spread and depth of the official market maker’s quotes are subject to the exchange imposed and often defined maximum spread/size requirements by the ETF provider. Please contact your local SPDR ETF representative for further details on the different APs/Market Markers/Official Market Makers for each SPDR ETF. 8 How does the Spread of an ETF Change Over Time? Although there are certainly a number of factors that contribute to the spread of an ETF, studies have shown there is one main factor that tends to compress spreads: secondary market trading volume. Over time, as secondary market trading volumes increase, this leads to more efficient trading and lower costs for liquidity providers, which can lead to tighter bid/ask spreads (as demonstrated in Figure 4 below). As volume in an ETF rises, competition and economies of scale lower spreads and allow investors to transact in a more cost-efficient manner in the secondary market. Often, significant secondary market trading volume can trump the other costs. This means that at a certain point an ETF may hit a tipping point where it becomes more liquid than the underlying securities that compose it. Figure 4: Spreads and Trading Volumes ($ million) % 150 0.48 125 0.40 100 0.32 75 0.24 50 0.16 25 0.08 0 Mar 2012 Sep 2012 n $ Value Traded Mar 2012 Sep 2013 Mar 2015 Sep 2014 0 1M Average Spreads Source: Bloomberg, as of 1 September 2014, in USD. Example above shows the SPDR S&P US Dividend Aristocrat UCITS ETF (UDVD LN). Buying and Selling an ETF: Getting Best Execution Now that we have discussed the mechanics of the ETF structure and the parties involved in providing liquidity, let’s discuss how investors can efficiently buy and sell ETFs. There are two layers of liquidity with an ETF: the first is available liquidity in the secondary market, the second is the liquidity of the underlying securities. In order to access all available liquidity of an ETF, investors must understand and evaluate the various ways they can buy and sell ETFs. On Exchange On stock exchanges, participants post bids and offers at price levels they are willing to buy or sell a particular number of shares of a given ETF. There are a number of different order types which can be used to introduce ETF orders in the secondary market. The most appropriate order type for ETF orders may be the marketable limit order. A marketable limit order is a limit order to buy or sell at or below/above the consolidated best offer/bid for the security. In order to get a better sense of why investors should utilise limit orders when buying or selling an ETF, let’s look at the quote below for the hypothetical ETF (XYZ). (If your systems do not provide access to the full order book, we recommend speaking with your dealing desk to get a full picture of the depth of quote for a given ETF.) XYZ bid XYZ ask Shares Price Shares Price 1,000 €36.11 1,000 €36.25 1,000 €36.10 3,000 €36.30 10,000 €35.96 12,000 €36.35 3,000 €35.95 4,000 €36.39 Let’s consider the impact of a market order versus a limit order for an investor who wants to purchase 20,000 shares of XYZ. The average execution price for a 20,000 share market order would be €36.35 or €.10 from the best offer available. This is because only 1,000 shares are offered at the best offer price of €36.25. The remainder of the trade is then executed at subsequent price levels until it has been fully executed. As a result, a market order for 20,000 shares would sweep through the available liquidity, in this case, at all four levels shown. In order to maintain greater control over the execution price, the investor could place a marketable limit order at the national best offer of €36.25, which would immediately execute 1,000 shares at that price. The market maker would then have the chance to post additional shares at this price level. This example highlights why market orders should generally be avoided with ETFs, especially with those that are more thinly traded. Although market orders provide faster execution of the entire order, the lack of control over the price can lead to unintended trading slippage. With limit orders, the trade-off is less immediate execution, but greater control over price. One risk with limit orders is that the entire trade will not be filled. In order to increase the probability that the entire trade will be filled, investors can enter more aggressive limit orders, for instance at a price which is higher than the national best offer available when buying. Pros Cons Market Order Order is usually filled quickly No control over execution price Limit Order Control over execution price Chance order will not be filled One way that investors determine the prices at which to enter their limit orders is based upon the iNAV — the intraday net asset value of the basket of securities which underlies the ETF. The iNAV is disseminated every 15 seconds by a third party data provider who has been selected by the fund provider. Since the iNAV is calculated based on the underlying securities, it is an accurate measure for domestic equities; however, it is less accurate for markets that are closed during domestic hours as well as markets which are not as transparent, such as fixed income. It is also worth noting that the iNAV does not take into account any of the costs associated with buying or selling an ETF’s underlying basket or the other costs associated with trading an ETF as highlighted in Section II. Consider speaking with your dealing desk or ETF provider about how to most efficiently enter an ETF order if you are unsure. OTC Trading The fact that investors have the ability to trade ETFs over-thecounter (OTC) introduces an entirely new and unique venue by which to implement trades. Despite the transparency of the secondary market, investors may face certain situations where the size, intricacy, or sensitivity of a trade might not make the most sense to execute directly via exchange. In these circumstances, it may make sense to execute trades via a liquidity provider. Liquidity providers for ETFs are most often APs as they are able to seamlessly create or redeem shares of the ETF. Liquidity providers who are not APs do tend to have relationships with firms that are APs and can create or redeem on their behalf. Below are two common ways to execute large ETF trades with a liquidity provider. Risk Trade One way investors can interact with a liquidity provider is through a risk trade. With a risk trade, a liquidity provider will quote a market for a given ETF at a given size. For example, if a client is looking to buy 125,000 shares of ETF XYZ, the liquidity provider will calculate its risk and offer the client a price at which they are willing to sell the 125,000 shares to the client. If the client finds the price agreeable, then the trade is executed OTC. The reason this is referred to as a risk trade is because once the trade is executed, the liquidity provider assumes the market risk of the position and will work to hedge their position in order to limit their risk. In the event the trade is large enough, the liquidity provider may create or redeem shares to complete the trade. This is of little concern to the client as their trade has been executed at a pre-determined price regardless of how the shares are obtained. For instance, a liquidity provider may have existing inventory in a fund, could go to an exchange to gather shares, or might be in contact with another AP who has existing inventory they are willing to pass along at a mutually agreeable price. In Europe, this broker-to-broker network is quite active, and is something ETF providers can help to facilitate where appropriate. State Street Global Advisors | SPDR ETFs 9 ETF Trading and Execution in the European Markets Nav + Trade Another way that investors can interact with a liquidity provider is through a NAV + transaction, also known as a creation or redemption. The majority of these transactions take place between clients and liquidity providers who are set up as APs in the specific funds they are looking to trade. In this scenario, an investor arranges to create or redeem shares with an AP. The end price the client pays or receives for the shares is based on the closing NAV as well as any implicit costs which the AP incurs in the process of creating or redeeming the shares. As previously discussed, these costs include many of the trading costs outlined in Section II. Given the nature of a NAV + trade, market risk is accepted by the client until an order’s NAV is determined. Since any market risk is taken on by the client, this tends to be the more cost-efficient way of transacting in a fund. It is extremely important to note, however, that any market risk assumed by a client in a NAV+ trade, although difficult to quantify, can translate into significant unintended market movement costs. For example, certain ETFs are unable to confirm NAV until one day after an order has been accepted. This tends to happen with ETFs tracking global benchmarks that might have securities in the underlying basket that are closed for trading at the time an order is received. As such, the market can potentially move significantly (either positively or negatively) between the time a client places an order in their ETF of choice and the NAV is confirmed the next day. For clients with a shorter term, more tactical view on their ETF choices, this market risk tends to be less than ideal given the nature of their investment goals. Each of the above scenarios allows investors to access deeper pools of liquidity than offered by the ETF itself in the secondary market. The main difference between the two is that the investor transfers market risk to the AP and receives an immediate price and execution in a risk trade while maintaining market risk until the NAV is confirmed for a NAV + trade. The reason for using one over the other is based on the investor’s goals. If you are unsure how to access liquidity providers, speak with your dealing desk or ETF provider. 10 How Do I Know if I Got ‘Good’ OTC Execution? Print your Trade Just because a trade is facilitated OTC does not mean that it can’t be printed to an exchange. Asking your liquidity provider to print your ETF order on exchange is a transparent way to benchmark your trade relative to any other orders at that time. It is important to note that there is a difference between ‘reporting’ a trade (typically at the end of day and is less helpful for benchmarking your execution) and ‘printing’ a trade (real time). iNAV You can use the iNAV as a rough estimate for the real time value of the ETF you are purchasing. It is important to note that this is only a rough estimate as iNAVs do not include any sort of transaction cost embedded in them. Moreover, iNAVs become less reliable in more opaque, thinly traded (and sometimes closed) markets. Engage your Liquidity Provider There are a number of highly talented ETF liquidity providers throughout Europe who pride themselves on attention to detail and transparency with clients. As the ETF market continues to evolve, many trading firms have developed analytical tools as well as the proper expertise to clearly demonstrate an ETF’s underlying market liquidity. If asked, an ETF trader should be able to elaborate on market liquidity in the context of an ETF order and the related costs of execution. We highly recommend engaging with multiple liquidity providers in order to understand your ETF executions. Conclusion ETF use continues to accelerate as investors increasingly appreciate the inherent benefits of ETFs such as low cost, liquidity, and transparency. Understanding the unique structure of these vehicles will allow investors to buy and sell ETFs more efficiently and with greater confidence. We strongly encourage all investors to undertake the proper due diligence in order to understand all of the execution solutions available to them in the rapidly developing European ETF capital markets. Further reading: ‘How ETFs are Created and Redeemed’ and ‘The International ETF Structure: Centralised Settlement for Europe’, available on spdrseurope.com For more Information The SPDR ETF Capital Markets Group (CMG) supports an open architecture liquidity platform, engaging with various market participants including Authorised Participants, market making firms and exchanges in order to ensure liquidity and competitive pricing for SPDR ETFs. The group also works directly with both institutional and intermediary clients to provide guidance on best practices for ETF trading and execution. For more information on SPDR ETF liquidity providers, and help navigating the nuances of ETF trading, please contact the SPDR Capital Markets Group at [email protected] or +44 (0)20 3395 6888. State Street Global Advisors | SPDR ETFs 11 ssga.com | spdrseurope.com For investment professional use only. Not for use with the public. SSGA SPDR ETFs Europe II plc (“the Company”) issue SPDR ETFs, and is an open-ended investment company with variable capital having segregated liability between its sub-funds. The Company is organised as an Undertaking for Collective Investments in Transferable Securities (UCITS) under the laws of Ireland and authorised as a UCITS by the Central Bank of Ireland. For Investors in Finland: The offering of funds by the Company has been notified to the Financial Supervision Authority in accordance with Section 127 of the Act on Common Funds (29.1.1999/48) and by virtue of confirmation from the Financial Supervision Authority the Company may publicly distribute its Shares in Finland. Certain information and documents that the Company must publish in Ireland pursuant to applicable Irish law are translated into Finnish and are available for Finnish investors by contacting State Street Custodial Services (Ireland) Limited, 78 Sir John Rogerson’s Quay, Dublin 2, Ireland. This document is not, and under no circumstances is to be construed as, an offer or any other step in furtherance of a public offering in the United States, Canada or any province or territory thereof, where the Company is not authorised or registered for distribution and where the Company’s Prospectus have not been filed with any securities commission or regulatory authority. Neither this document nor any copy hereof should be taken, transmitted or distributed (directly or indirectly) into the United States. The Company has not and will not be registered under the Investment Company Act of 1940 or qualified under any applicable state securities statutes. For Investors in France: This document does not constitute an offer or request to purchase shares in the Company. Any subscription for shares shall be made in accordance with the terms and conditions specified in the complete Prospectus, the KIIDs, the addenda as well as the Company’s Supplements. These documents are available from the Company’s centralizing correspondent: State Street Banque S.A., 23-25 rue Delariviere- Lefoullon, 92064 Paris La Defense Cedex or on the French part of the site www.spdrseurope. com. The Company is an undertaking for collective investment in transferable securities (UCITS) governed by Irish law and accredited by the Central Bank of Ireland as a UCITS in accordance with European Regulations. European Directive no. 2009/65/CE dated 13 July 2009 on UCITS, as amended, established common rules pursuant to the cross-border marketing of UCITS with which they duly comply. This common base does not exclude differentiated implementation. This is why a European UCITS can be sold in France even though its activity does not comply with rules identical to those governing the approval of this type of product in France. The offering of these compartments has been notified to the Autorité des Marchés Financiers (AMF) in accordance with article L214-2-2 of the French Monetary and Financial Code. For Investors in Germany: The offering of SPDR ETFs by the Company has been notified to the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) in accordance with section 132 of the German Investment Act. Prospective investors may obtain the current sales Prospectus, the articles of incorporation, the KIIDs as well as the latest annual and semi-annual report free of charge from State Street Global Advisors GmbH, Brienner Strasse 59, D-80333 Munich. Telephone +49 (0)89-55878-400. Facsimile +49 (0)89-55878-440. For Investors in Luxembourg: The Company has been notified to the Commission de Surveillance du Secteur Financier in Luxembourg in order to market its shares for sale to the public in Luxembourg and the Company is a notified Undertaking in Collective Investment for Transferable Securities (UCITS). For Investors in the Netherlands: This communication is directed at qualified investors within the meaning of Section 2:72 of the Dutch Financial Markets Supervision Act (Wet op het financieel toezicht) as amended. The products and services to which this communication relates are only available to such persons and persons of any other description should not rely on this communication. Distribution of this document does not trigger a licence requirement for the Company or SSGA in the Netherlands and consequently no prudential and conduct of business supervision will be exercised over the Company or SSGA by the Dutch Central Bank (De Nederlandsche Bank N.V.) and the Dutch Authority for the Financial Markets (Stichting Autoriteit Financiële Markten). The Company has completed its notification to the Authority Financial Markets in the Netherlands in order to market its shares for sale to the public in the Netherlands and the Company is, accordingly, an investment institution (beleggingsinstellingen) according to Section 2:72 Dutch Financial Markets Supervision Act of Investment Institutions. For Investors in Norway: The offering of SPDR ETFs by the Company has been notified to the Financial Supervisory Authority of Norway (Kredittilsynet) in accordance with applicable Norwegian Securities Funds legislation. By virtue of a confirmation letter from the Financial Supervisory Authority dated 16 October 2013 the Company may market and sell its shares in Norway. For Investors in Spain: SSGA SPDR ETFs Europe II plc has been authorised for public distribution in Spain and is registered with the Spanish Securities Market Commission (Comisión Nacional del Mercado de Valores) under no.1242. A copy of the Prospectus and Key Investor Information Documents, the Marketing Memoranda, the fund rules or instruments of incorporation as well as the annual and semi-annual reports of SSGA SPDR ETFs Europe II plc may be obtained from the Spanish distributors. The complete lists of the authorised Spanish distributors of SSGA SPDR ETFs Europe II plc is available on the website of the Securities Market Commission (Comisión Nacional del Mercado de Valores). For Investors in Switzerland: This document is directed at qualified investors only, as defined by Article 10(3) of the Swiss Act on Collective Investment Schemes (CISA) and Article 6 of the Swiss Ordinance on Collective Investment Schemes (CISO). Certain of the funds are not registered with the Swiss Financial Market Supervisory Authority (FINMA) which acts as supervisory authority in investment fund matters. Certain of the funds referenced herein have not been authorised by the FINMA as a foreign Collective Investment Scheme under Article 120 of the Collective Investment Schemes Act of June 23, 2006. Accordingly, the shares of these funds may not be offered to the public in or from Switzerland unless they are placed without public solicitation as such term is defined by FINMA from time to time. In relation to those funds which are registered with FINMA, prospective investors may obtain the current sales Prospectuses, the articles of incorporation, the KIIDs as well as the latest annual and semi-annual reports free of charge from the Swiss representative, State Street Fund Management Ltd., Beethovenstrasse 19, 8027 Zurich, from the Swiss paying agent, State Street Bank GmbH Munich, Zurich Branch, Beethovenstrasse 19, 8027 Zurich as well as from the main distributor in Switzerland, State Street Global Advisors AG , Beethovenstrasse 19, 8027 Zurich. Before investing please read the Prospectuses and KIIDs, copies of which can be obtained from the Swiss representative, or at www.spdrseurope.com. For Investors in the UK: The Company is a recognised schemes under Section 264 of the Financial Services and Markets Act 2000 (“the Act”) and is directed at ‘professional clients’ in the UK (within the meaning of the rules of the Act) who are deemed both knowledgeable and experienced in matters relating to investments. The products and services to which this communication relates are only available to such persons and persons of any other description should not rely on this communication. Many of the protections provided by the UK regulatory system do not apply to the operation of the Company, and compensation will not be available under the UK Financial Services Compensation Scheme. Important Information This document has been issued by State Street Global Advisors Limited (“SSGA”). Authorised and regulated by the Financial Conduct Registered No. 2509928. VAT No. 5776591 81. Registered office: 20 Churchill Place, Canary Wharf, London, E14 5HJ. Telephone: 020 3395 6000. Facsimile: 020 3395 6350 Web: ssga.com The information provided does not constitute investment advice as such term is defined under the Markets in Financial Instruments Directive (2004/39/EC) and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell any investment. It does not take into account any investor’s or potential investor’s particular investment objectives, strategies, tax status, risk appetite or investment horizon. If you require investment advice you should consult your tax and financial or other professional advisor. All material has been obtained from sources believed to be reliable. There is no representation or warranty as to the accuracy of the information and State Street shall have no liability for decisions based on such information. Exchange traded funds (ETFs) trade like stocks, are subject to investment risk and will fluctuate in market value. The value of the investment can go down as well as up and the return upon the investment will therefore be variable. Changes in exchange rates may have an adverse effect on the value, price or income of an investment. Further, there is no guarantee an ETF will achieve its investment objective. There are risks associated with investing in Real Assets and the Real Assets sector, including real estate, precious metals and natural resources. Investments can be significantly affected by events relating to these industries. Diversification does not ensure a profit or guarantee against loss. There can be no assurance that a liquid market will be maintained for ETF shares. Frequent trading of ETF’s could significantly increase commissions and other costs such that they may offset any savings from low fees or costs. Investments in asset backed and mortgage backed securities are subject to prepayment risk which can limit the potential for gain during a declining interest rate environment and increases the potential for loss in a rising interest rate environment. All the index performance results referred to are provided exclusively for comparison purposes only. It should not be assumed that they represent the performance of any particular investment. The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent. The views expressed in this material are the views of the Intermediary Business Group through the period ended 31 March 2015 and are subject to change based on market and other conditions. TThe information provided does not constitute investment advice as such term is defined under the Markets in Financial Instruments Directive (2004/39/EC) and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell any investment. It does not take into account any investor’s or potential investor?s particular investment objectives, strategies, tax status, risk appetite or investment horizon. If you require investment advice you should consult your tax and financial or other professional advisor. All material has been obtained from sources believed to be reliable. There is no representation or warranty as to the accuracy of the information and State Street shall have no liability for decisions based on such information. This document contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Past performance is not a guarantee of future results. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such. Investing involves risk including the risk of loss of principal. Risks associated with equity investing include stock values which may fluctuate in response to the activities of individual companies and general market and economic conditions. Bonds generally present less short-term risk and volatility than stocks, but contain interest rate risk (as interest rates rise, bond prices usually fall); issuer default risk; issuer credit risk; liquidity risk; and inflation risk. These effects are usually pronounced for longer-term securities. Any fixed income security sold or redeemed prior to maturity may be subject to a substantial gain or loss. State Street Global Advisors has licensed the Morningstar Global Multi-Asset Infrastructure Index to serve as the tracking index for the SPDR Morningstar Multi-Asset Global Infrastructure UCITS ETF. This ETF is not sponsored, endorsed, sold or promoted by Morningstar or any of its affiliates (collectively, “Morningstar”), and Morningstar makes no representation regarding the advisability of investing in this ETF. Standard & Poor’s, S&P and SPDR are registered trademarks of Standard & Poor’s Financial Services LLC (S&P); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones); and these trademarks have been licensed for use by S&P Dow Jones Indices LLC (SPDJI) and sublicensed for certain purposes by State Street Corporation. State Street Corporation’s financial products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and third party licensors and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability in relation thereto, including for any errors, omissions, or interruptions of any index. You should obtain and read the Company’s Prospectus prior to investing. Prospective investors may obtain the current Prospectus, the articles of incorporation, the Key Investor Information Documents (KIIDs) as well as the latest annual and semi-annual reports free of charge from State Street Global Advisors, or from spdrseurope.com SPDR ETFs is the exchange traded funds (“ETF”) platform of State Street Global Advisors and is comprised of funds that have been authorised by European regulatory authorities as open-ended UCITS investment companies (“the Company”). © 2015 State Street Corporation. All Rights Reserved. ID4110-IBGE-1620 0615 Exp. Date: 31/12/2015