* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Understanding premiums and discounts in ETFs

Private equity secondary market wikipedia , lookup

Short (finance) wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Securities fraud wikipedia , lookup

Market (economics) wikipedia , lookup

Commodity market wikipedia , lookup

Hedge (finance) wikipedia , lookup

High-frequency trading wikipedia , lookup

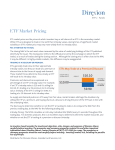

Algorithmic trading wikipedia , lookup

Understanding premiums and discounts in ETFs Unlike a mutual fund, an exchange-traded fund (“ETF”) trades like common stocks on a stock exchange and thus the value of an ETF can be reflected in its market price and net asset value (“NAV”). Ideally, the market price of an ETF should be close to its NAV though there are often factors driving them apart. When an ETF trades at a market price higher than its NAV, it is trading at a premium. On the contrary, it is trading at a discount when its market price is lower than its NAV. Below are a number of common factors which may lead to ETF premiums or discounts. 1. Difference in trading hours When an ETF and its underlying assets are trading in different markets, the difference in trading hours and time zones will lead to the market price of an ETF deviates from its NAV. For example, a US equity ETF listed in Hong Kong follows the trading hours of Hong Kong but its underlying equities are actually trading when New York market opens. With a time zone difference of 12 or 13 hours between Hong Kong and New York, it is difficult for an investor to exploit arbitrage opportunities arisen from ETF premiums or discounts. 2. Trading operation issues Trading restrictions in certain markets, such as China’s stockmarkets, could also lead to a difference between the market price and NAV of ETFs. For example, a large number of stocks were suspended from trading in the mainland A-share market in early August, hindering redemptions of ETFs in primary market. As investors can only sell ETFs through stock exchanges (i.e. the secondary market), market prices of ETFs were dragged down and hence creating discounts against NAVs. 3. Trading costs Some of the ETFs have higher trading costs because their underlying securities are trading in markets with capital control. If there are a lot of buying/selling orders in these restricted markets, it is likely that some of these orders cannot be digested, creating pressure on the market price of ETFs and hence ETF premiums/discounts. Similar to common stocks, the market price of an ETF is affected by demand and supply. When an ETF keeps on trading at a premium, this means that it is more welcomed in the market, and vice versa. While ETFs trade at a discount or premium from time to time, market makers and participating brokers will make use of arbitrage to align market prices and NAVs (especially for physical ETFs with abundant liquidity). Therefore, the trend of ETF premiums and discounts could be a barometer that investors can take reference to. Let’s take a look at two Hong Kong-listed physical A-share ETFs - CSOP FTSE China A50 ETF (2822.HK) (Figure 1) and ChinaAMC CSI 300 Index ETF (3188.HK) (Figure 2) - as examples. The two ETFs were trading at a premium or discount occasionally since early this year but the average for CSOP FTSE China A50 ETF was a 1% discount to NAV while that for ChinaAMC CSI 300 Index ETF was a 1.2% discount. As shown in the two figures below, the discounts surged beyond 10% in early July as a result of the suspension of a bunch of mainland A-shares, crippling the operations of the primary market. Major investors wanted to sell their holdings could only do so through stock exchanges (i.e. the secondary market), and thus creating steep discounts in the market prices of the ETFs. Currently, the discounts have been narrowed to normal level. If investors noticed the steep discounts back then, they could have taken advantage of the rare opportunity. But how could investors get such information? The Stock Exchange of Hong Kong requires ETF issuers to publish NAV data of the ETFs they offer on their company websites on a near real-time basis. This is an important piece of data that helps investors to evaluate the pricing of an ETF. However, the near real-time data is currently not available on some streaming quotes financial portals or mobile apps that are commonly used by local retail investors. On the contrary, these data suppliers only provide the closing NAV of the previous trading day. As ETFs are becoming increasingly popular, streaming quotes suppliers could consider providing near real-time NAV quotes to investors. Figure 1: CSOP FTSE China A50 ETF (year-to-date performance) Average discount of 1% Source: Bloomberg, data as of 1 September 2015 Figure 2: ChinaAMC CSI 300 Index ETF (year-to-date performance) Average discount of 1.2% Source: Bloomberg, data as of 1 September 2015 Value Partners ETF Business Team 8 September 2015 The views expressed are the views of Sensible Asset Management Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All material has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Investors should note that investment involves risk. This commentary has not been reviewed by the Securities and Futures Commission. Issuer: Sensible Asset Management Hong Kong Limited.