* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download DEBT INSTRUMENTS Government Debt Securities (GDS

Investment fund wikipedia , lookup

Financialization wikipedia , lookup

Syndicated loan wikipedia , lookup

Household debt wikipedia , lookup

Investment management wikipedia , lookup

Federal takeover of Fannie Mae and Freddie Mac wikipedia , lookup

Short (finance) wikipedia , lookup

Government debt wikipedia , lookup

Quantitative easing wikipedia , lookup

Interbank lending market wikipedia , lookup

First Report on the Public Credit wikipedia , lookup

Credit rating agencies and the subprime crisis wikipedia , lookup

Public finance wikipedia , lookup

Geneva Securities Convention wikipedia , lookup

Securities fraud wikipedia , lookup

United States Treasury security wikipedia , lookup

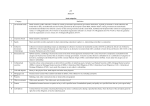

DEBT INSTRUMENTS Government Debt Securities (GDS) Government debt securities are borrowing instruments issued by the Turkish Treasury in the domestic market. The government is indebted, and pays back the holders of Government Debt Securities the borrowed amount on coupon payment days and at the end of maturity. During their maturity term, government debt securities may be traded by real and legal persons in secondary markets. Government debt securities are classified on the basis of their maturity term, issue method, the currency in which they are denominated, interest payment method, and whether they carry coupons or not. According to their maturities: - Government debt securities with maturity terms of 1 year and more are called “Government Bonds”, and - Government debt securities with maturity terms of less than 1 year are called “Treasury Bills”. Central Bank of the Republic of Turkey (CBRT) Liquidity Bills Liquidity bills are used as monetary policy tools issued by the Central Bank of the Republic of Turkey for managing the market liquidity and contributing to the efficiency of open market trading. Liquidity bills are discounted securities, which are issued by the Central Bank of the Republic of Turkey on its own name and account with maturities less than 91 days. Revenue Sharing Certificates Revenue sharing certificates are those securities entitling their real/legal person holders to the revenues of publicly held infrastructure facilities such as transportation, communication and energy, such as bridges, dams, electricity generators, highways, railroads, telecommunication systems, civil seaports and airports, etc. Revenue sharing certificate holders have no ownership or operation rights on such facilities. Revenue sharing certificates are, by nature, bonds with varying interest. Revenue Indexed Bonds Turkish Treasury realized its first issue of revenue indexed bonds on January 28, 2009 in order to encourage domestic saving, diversify Government Debt Securities and widen the investor base. The yield of these instruments are indexed to the revenues of the state owned enterprises including Turkish Petroleum Corporation (Türkiye Petrolleri Anonim Ortaklığı-TPAO), State Procurement Office (Devlet Malzeme Ofisi -DMO), General Directorate of State Airports Authority (Devlet Hava Meydanları İşletmeleri-DHMİ) and General Directorate of Coast Safety (Kıyı Emniyeti Genel Müdürlüğü- KIYEM), which are transferred to the state’s budget. The yields of the revenue indexed bonds are related to the state’s income and coupon payments are guaranteed within a minimum and maximum range. Private Sector Bonds Bonds are debt securities issued by the government or joint stock corporations for borrowing purposes. The maturity terms of private sector bonds can be one year or more and may be issued with fixed or variable interest rates. Private sector bonds are mostly sold through a consortium consisting of more than one intermediary institution. The bond holder is a long term creditor of the issuing company. The only right that the bond holder has over the company is merely his credit, and has no right to participate in the company management. The legal relationship between the bond holder and the company ends at the end of maturity. Bond holder is not exposed to the profit/loss risk of the bond issuing company and shall receive his principal and interest, regardless the company makes profits or not. The most important factors that influence the proceeds of bonds are their liquidity and risk. Since company bonds carry higher risk compared to government bonds in consideration of bankruptcy and default in repayment of interest and capital, they mostly offer higher interest. In the case of bankruptcy or liquidation of companies, company debt is repaid first, and therefore, bond holders will have priority of payment over the company shareholders. With the exception of public debt securities, bond issues are subject to the arrangements of the Capital Markets Board of Turkey. Private sector bonds may be offered to the public or sold without being offered to the public. Commercial Papers Commercial papers are discounted short-term borrowing instruments, which are subject to the arrangements of the Capital Markets Board of Turkey. The maturity term of commercial papers may not be longer than one year. Commercial papers are discounted on the basis of their maturity term. Bank Bills Bank bills are securities issued by banks as debtor in order to raise funds, subject to the arrangements of the Capital Markets Board of Turkey. The discount rates of such bills, are determined freely by the issuing bank. The maturity term of bank bills to be offered to the public must be between 60 days and 1 year. The maturity of bank bills to be sold by allocation method, on the other hand, must be between 15 days and 1 year. In the case of bank bills sold by public offering, the discount rates on the basis of maturity will be calculated on an annual basis and announced by the issuing bank within the sales period. Asset-backed Securities Asset backed securities are debt instruments issued by institutions authorized to establish asset financing funds, collateralized by the assets in the financed portfolio. Asset backed securities may be traded on exchanges. Institutions authorized to establish asset financing funds are banks, leasing and financing companies, mortgage companies and brokerage houses. Asset backed securities may be issued by asset financing funds only. Asset backed securities may be sold to qualified investors with allocation method or by public offering. An asset financing fund is an asset with no legal personality, created by asset backed security holders on account basis, and may be established for a definite or indefinite period. Consumer loans (excluding mortgage housing loans) and mortgage loans, loans for motor vehicles, project finance and corporate loans, receivables from leasing contracts, and receivables of the Housing Development Administration of Turkey from real estate sales may be transferred to the portfolios of asset financing funds and asset backed securities may be issued under the collateral of such receivables. Asset-based Securities Asset-based securities are issued by banks, financing companies and companies authorized to carry out financial leasing, real estate investment trusts, and public institutions authorized to issue securities, and which are collateralized by the assets in their balance-sheets. Asset-based securities are under the general liability of the issuers. Assets and receivables that may be subject to asset-based securities issuance are consumer loans, commercial loans, receivables from financial and operational leasing agreements, receivables from export transactions, receivables from banks’ specialized loans given to craftsmen and artisans and small enterprises, notes receivables originating from real estate investment companies from the sales of real estate or agreements representing a promise to sell property, receivables originating from the sales of real estate of the Housing Development Administration of Turkey, substitute assets, notes receivables originating from installment sales of goods and service producing joint stock companies other than banks and state owned enterprises including those to be privatized according to the related regulation, and other assets whose features will be determined by the Capital Markets Board of Turkey. Collateral assets must be available for written and/or electronic monitoring in order to allow discriminating from the issuer’s other assets. These assets shall not be used for any other purposes, shall not be pledged, shall not be used as collateral, shall not be subject to injunction decisions of courts, and shall not be included in the bankruptcy process, even for the purpose of collecting public claims until the asset-based securities are redeemed. Asset-based securities may be offered to the public or sold to qualified investors without being offered to the public. SOURCE: http://borsaistanbul.com/en/products-and-markets/products/debt-instruments