* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Chapter 12 Bluffers

Technical analysis wikipedia , lookup

Stock market wikipedia , lookup

Securities fraud wikipedia , lookup

Derivative (finance) wikipedia , lookup

High-frequency trading wikipedia , lookup

Gasoline and diesel usage and pricing wikipedia , lookup

Efficient-market hypothesis wikipedia , lookup

Stock selection criterion wikipedia , lookup

Algorithmic trading wikipedia , lookup

Short (finance) wikipedia , lookup

2010 Flash Crash wikipedia , lookup

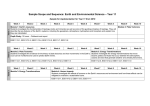

Chapter 12 Bluffers and Market Manipulation Bluffers & Market Manipulation Fool other traders into trading unwisely. Rumormongers spread rumors Price manipulators Use example! Fundamentals of Bluffing Bluffers and informed speculators – They are different! The latter has information and the other not. Bluffers create their (false) information. Bluffers and value traders – They compete with each other. Bluffers target illiquid stocks as they are difficult to value. Prosecuting market manipulators – Very difficult because bluffers always claim to be wellinformed speculators. Bluffers Discipline Liquidity Providers Bluffers can trade profitably when the price impact of their purchases is different from the price impact of their sales. If selling has less price impact than buying, bluffers will buy first and then sell. See Figure 12-1. If buying has less price impact than selling, bluffers will sell first and then buy. See Figure 12.2. Figure 12-1 Figure 12-2 Bluffers Discipline Liquidity Providers-Continued To avoid losing to bluffers, liquidity suppliers must be disciplined when they adjust their prices in response to trades. Must adjust prices so that buy and sell orders have equal (but opposite) price impact. See Figure 12-3. Figure 12-3