Chen_uta_2502D_12115

... oscillating. Thus, volatilities will increase with trading volume. Of all the potential explanations for reasons of trading, the aim of this study is to explore the contribution of investor confidence. Specifically, this study examines whether investors become overconfident if they have experienced ...

... oscillating. Thus, volatilities will increase with trading volume. Of all the potential explanations for reasons of trading, the aim of this study is to explore the contribution of investor confidence. Specifically, this study examines whether investors become overconfident if they have experienced ...

The Impact of Hidden Liquidity in Limit Order Books

... the probability that a randomly selected order book has an iceberg order will exceed their share of orders submitted. ...

... the probability that a randomly selected order book has an iceberg order will exceed their share of orders submitted. ...

Decimals and Liquidity: A study of the NYSE

... at any time has the BBO quotes. The fraction of time that any exchange has the BBO is an indication of its dominance in terms of liquidity supply and price discovery. We begin by investigating the fraction of total trading time that a BBO is in effect across the regional exchanges for decimal and co ...

... at any time has the BBO quotes. The fraction of time that any exchange has the BBO is an indication of its dominance in terms of liquidity supply and price discovery. We begin by investigating the fraction of total trading time that a BBO is in effect across the regional exchanges for decimal and co ...

MultiFractality in Foreign Currency Markets

... and the classical random walk. Note that we do not claim that foreign currency markets are inefficient nor do we assert that the EMH does not hold. We acknowledge that market efficiency is currently the central theory of financial economics, at least until a new theory is proposed as a better explan ...

... and the classical random walk. Note that we do not claim that foreign currency markets are inefficient nor do we assert that the EMH does not hold. We acknowledge that market efficiency is currently the central theory of financial economics, at least until a new theory is proposed as a better explan ...

A Study of Implied Risk-Neutral Density Functions in

... Market participants and policy-makers working in the financial markets use information embedded in prices on financial assets to analyse economic and financial development. In recent years, there has been a remarkable growth in the derivative markets and products such as futures and options are gain ...

... Market participants and policy-makers working in the financial markets use information embedded in prices on financial assets to analyse economic and financial development. In recent years, there has been a remarkable growth in the derivative markets and products such as futures and options are gain ...

Predicting Returns and Volatilities with Ultra

... http://gsbwww.uchicago.edu/fac/jeffrey.russell/research/ http://weber.ucsd.edu/~mbacci/engle/ ...

... http://gsbwww.uchicago.edu/fac/jeffrey.russell/research/ http://weber.ucsd.edu/~mbacci/engle/ ...

Do Noise Traders Move Markets?

... The central question in the debate over market efficiency is whether small noise traders significantly distort asset prices. Three things are necessary for this to happen. First, noise traders must misinterpret available information or trade for non-informational reasons. Second, noise trades must ...

... The central question in the debate over market efficiency is whether small noise traders significantly distort asset prices. Three things are necessary for this to happen. First, noise traders must misinterpret available information or trade for non-informational reasons. Second, noise trades must ...

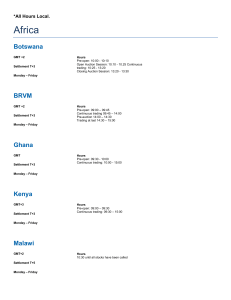

Global Trading Hours

... Activated when the maximum price range deviation is exceeded, decided by the exchange. Generally ends after 3 or 5 minutes, depending on security. The change to the next scheduled trading phase is carried out whether or not a price occurs. Single volatility interruption occurs if the expected auctio ...

... Activated when the maximum price range deviation is exceeded, decided by the exchange. Generally ends after 3 or 5 minutes, depending on security. The change to the next scheduled trading phase is carried out whether or not a price occurs. Single volatility interruption occurs if the expected auctio ...

Quote Stuffing - Mississippi State University`s College of Business

... According to their model, high frequency traders increase the price impact of liquidity trades, increasing (decreasing) the price at which liquidity traders buy (sell). These costs increase with the size of the trade, suggesting that large liquidity traders (i.e. large institutional traders making s ...

... According to their model, high frequency traders increase the price impact of liquidity trades, increasing (decreasing) the price at which liquidity traders buy (sell). These costs increase with the size of the trade, suggesting that large liquidity traders (i.e. large institutional traders making s ...

"Leverage Effect" a Leverage Effect?

... implied volatility (IV) derived from market option prices is commonly thought of as "the market's" volatility forecast. If so, one may see directly what impact investors anticipate that a given event will have on future stock volatility under Black-Scholes assumptions. If stock volatility were actua ...

... implied volatility (IV) derived from market option prices is commonly thought of as "the market's" volatility forecast. If so, one may see directly what impact investors anticipate that a given event will have on future stock volatility under Black-Scholes assumptions. If stock volatility were actua ...

Gains from Stock Exchange Integration: The

... This paper seeks to quantify these efficiency gains and their impact on users by studying the evidence from the integration between the French, Belgian, Dutch and Portuguese stock exchanges to form Euronext, which took place between September 2000 and November 2003. This experiment makes it possible ...

... This paper seeks to quantify these efficiency gains and their impact on users by studying the evidence from the integration between the French, Belgian, Dutch and Portuguese stock exchanges to form Euronext, which took place between September 2000 and November 2003. This experiment makes it possible ...

Optimal Option Portfolio Strategies: Deepening the Puzzle of Index

... derivatives are driven mostly by a myopic component. Our results show low predictability of returns of the optimal strategy and little correlation with the stock market. These two features imply that there would be no hedging demand and thus little loss from our myopic approach. ...

... derivatives are driven mostly by a myopic component. Our results show low predictability of returns of the optimal strategy and little correlation with the stock market. These two features imply that there would be no hedging demand and thus little loss from our myopic approach. ...

Intermarket Technical Analysis

... commodity markets in much the same way that equity analysts used the Dow Jones Industrial Average in their analysis of common stocks. However, I began to notice some interesting correlations with markets outside the commodity field, most notably the bond market, that piqued my interest. The simple o ...

... commodity markets in much the same way that equity analysts used the Dow Jones Industrial Average in their analysis of common stocks. However, I began to notice some interesting correlations with markets outside the commodity field, most notably the bond market, that piqued my interest. The simple o ...

The Impact of the French Securities Transaction Tax on Market

... finds a negative impact on volumes. Pomeranets and Weaver (2012) analyze nine changes in the New York state STT between 1932 and 1981 that affected stocks traded on the New York Stock Exchange. They find that the STT has a negative impact on traded volumes, but no statistically significant impact on ...

... finds a negative impact on volumes. Pomeranets and Weaver (2012) analyze nine changes in the New York state STT between 1932 and 1981 that affected stocks traded on the New York Stock Exchange. They find that the STT has a negative impact on traded volumes, but no statistically significant impact on ...

Momentum and Investor Sentiment

... the optimistic and mild periods. Further solidifying the failure of momentum strategy during pessimistic times, there are instances where returns for the pessimistic period are outright negative whereas optimistic periods have strong positive returns. For example, the strategy in the Japanese market ...

... the optimistic and mild periods. Further solidifying the failure of momentum strategy during pessimistic times, there are instances where returns for the pessimistic period are outright negative whereas optimistic periods have strong positive returns. For example, the strategy in the Japanese market ...

salmon trout

... If a = 0 and b = 1, then the two prices are equal. If a 0 but b =1, the prices have a proportional relationship. If b 1, the prices are not proportional. ...

... If a = 0 and b = 1, then the two prices are equal. If a 0 but b =1, the prices have a proportional relationship. If b 1, the prices are not proportional. ...

Decimalization, trading costs, and information transmission between

... increases in the S&P 500 futures bid–ask spreads, but the spreads remain low relative to those of S&P 500 ETFs, which is consistent with the empirical results here. DeJong and Donders (1998) examine the relations between futures, options, and index levels, and find that futures significantly lead opt ...

... increases in the S&P 500 futures bid–ask spreads, but the spreads remain low relative to those of S&P 500 ETFs, which is consistent with the empirical results here. DeJong and Donders (1998) examine the relations between futures, options, and index levels, and find that futures significantly lead opt ...

Market Sentiment and Paradigm Shifts in Equity Premium

... and low sentiment regimes could be a strong restriction and yield some potentially misleading implications. For instance, this will lead to a message that both ECON variables and NONFUND variables can offer comparable predictability given that either ECON variables or NONFUND variables can only pred ...

... and low sentiment regimes could be a strong restriction and yield some potentially misleading implications. For instance, this will lead to a message that both ECON variables and NONFUND variables can offer comparable predictability given that either ECON variables or NONFUND variables can only pred ...

Since Slonczewski calculated [1] interfacial exchange - cerge-ei

... 1992), forecasting based on ARCH models (Bollerslev, 1994), and forecasting based on implied volatility indices. These prior studies have analyzed the contemporaneous relationship between the US stock market volatility index and returns to its underlying assets. However, to our knowledge no work has ...

... 1992), forecasting based on ARCH models (Bollerslev, 1994), and forecasting based on implied volatility indices. These prior studies have analyzed the contemporaneous relationship between the US stock market volatility index and returns to its underlying assets. However, to our knowledge no work has ...

The Impact of Short-Selling in Financial Markets

... quality of stocks. While short-selling has long been a contentious issue, relatively little or no empirical evidence is available on the impact of short-sale restrictions on market quality. The results indicate that restrictions on short-selling lead to artificially inflated prices, indicated by pos ...

... quality of stocks. While short-selling has long been a contentious issue, relatively little or no empirical evidence is available on the impact of short-sale restrictions on market quality. The results indicate that restrictions on short-selling lead to artificially inflated prices, indicated by pos ...

A monthly effect in stock returns - DSpace@MIT

... The mean return for stocks is positive only for days immediately before and during the first half of calendar months, and indistinguishable from zero for days during the last half of the month. During the 1963-1981 period all of the market's cumulative advance occurred just before and during the fir ...

... The mean return for stocks is positive only for days immediately before and during the first half of calendar months, and indistinguishable from zero for days during the last half of the month. During the 1963-1981 period all of the market's cumulative advance occurred just before and during the fir ...

Limit Order Markets: A Survey 1

... Information aggregation: Given the risk of being adversely picked off and of costly nonexecution, limit order books should impound forward-looking information about future price volatility, the intensity of future adverse selection, and future order flow. This has been confirmed empirically. A riche ...

... Information aggregation: Given the risk of being adversely picked off and of costly nonexecution, limit order books should impound forward-looking information about future price volatility, the intensity of future adverse selection, and future order flow. This has been confirmed empirically. A riche ...

Automated Trading Desk and Price Prediction in High

... market are an inherently unpredictable random walk. (‘Efficiency’ is a model, not an empirical reality, but much of the time the US stock market seems reasonably efficient, in the sense that predicting prices or ‘beating the market’ is very hard.) For profitable price prediction to be possible, pock ...

... market are an inherently unpredictable random walk. (‘Efficiency’ is a model, not an empirical reality, but much of the time the US stock market seems reasonably efficient, in the sense that predicting prices or ‘beating the market’ is very hard.) For profitable price prediction to be possible, pock ...

Commodity Markets and Futures prices - Farmdoc

... implications of a hedging program. Papers in Section 4 are concerned with price relationships, with one paper each on pricing over time, space, or form. Comments at the beginning of each section provide a brief summary and attempt to link the papers in that section with other investigations. As will ...

... implications of a hedging program. Papers in Section 4 are concerned with price relationships, with one paper each on pricing over time, space, or form. Comments at the beginning of each section provide a brief summary and attempt to link the papers in that section with other investigations. As will ...

The impact of dark trading and visible fragmentation on market quality

... of monitoring multiple markets, or high variable and fixed trading fees and clearing and settlement costs. Gresse (2006) finds that trading activity on a crossing network improves quoted spreads in the dealer market, especially when the dealers also trade on the crossing network. Next to competitio ...

... of monitoring multiple markets, or high variable and fixed trading fees and clearing and settlement costs. Gresse (2006) finds that trading activity on a crossing network improves quoted spreads in the dealer market, especially when the dealers also trade on the crossing network. Next to competitio ...

![Since Slonczewski calculated [1] interfacial exchange - cerge-ei](http://s1.studyres.com/store/data/005381392_1-e9747be9e01b230768e0b5cde433f905-300x300.png)