Sales Quiz

... 11. No. 2-206(1) provides that an offer may be accepted in any reasonable manner “unless otherwise unambiguously indicated by the language.” Here, the language unambiguously states that in order to get the commission-free service, the customer must place the electronic order over the web. Joe placed ...

... 11. No. 2-206(1) provides that an offer may be accepted in any reasonable manner “unless otherwise unambiguously indicated by the language.” Here, the language unambiguously states that in order to get the commission-free service, the customer must place the electronic order over the web. Joe placed ...

Micro_Class11_Ch7_Surplus

... Evaluating the Market Equilibrium • Because the equilibrium outcome is an efficient allocation of resources, the social planner can leave the market outcome as he/she finds it. • This policy of leaving well enough alone goes by the French expression laissez faire. ...

... Evaluating the Market Equilibrium • Because the equilibrium outcome is an efficient allocation of resources, the social planner can leave the market outcome as he/she finds it. • This policy of leaving well enough alone goes by the French expression laissez faire. ...

Decimalization, trading costs, and information transmission between

... increases in the S&P 500 futures bid–ask spreads, but the spreads remain low relative to those of S&P 500 ETFs, which is consistent with the empirical results here. DeJong and Donders (1998) examine the relations between futures, options, and index levels, and find that futures significantly lead opt ...

... increases in the S&P 500 futures bid–ask spreads, but the spreads remain low relative to those of S&P 500 ETFs, which is consistent with the empirical results here. DeJong and Donders (1998) examine the relations between futures, options, and index levels, and find that futures significantly lead opt ...

Spot Market Competition and Long-Term

... feature of the new industry is the electricity wholesale market - or pool - which was designed to establish short run price competition in generation. There are three dominant generators in the system: National Power and PowerGen which are privately owned and account for approximately 60% and 30% of ...

... feature of the new industry is the electricity wholesale market - or pool - which was designed to establish short run price competition in generation. There are three dominant generators in the system: National Power and PowerGen which are privately owned and account for approximately 60% and 30% of ...

Commodity Market Capital Flow and Asset Return Predictability ∗ Harrison Hong

... which starts in November 1978. Data for crude oil are available only since March 1983. Livestock consists of five commodities, and metals consists of six commodities. A potential concern with using a broad set of commodities is that not all contracts are liquid. In results that are not reported here, ...

... which starts in November 1978. Data for crude oil are available only since March 1983. Livestock consists of five commodities, and metals consists of six commodities. A potential concern with using a broad set of commodities is that not all contracts are liquid. In results that are not reported here, ...

Consumer surplus

... resources affects economic well-being. Buyers and sellers receive benefits from taking part in the market. The equilibrium in a market maximizes the total welfare of buyers and sellers. ...

... resources affects economic well-being. Buyers and sellers receive benefits from taking part in the market. The equilibrium in a market maximizes the total welfare of buyers and sellers. ...

CHPT7

... In panel (a), the price is P1, the quantity supplied is Q1, and producer surplus equals the area of the triangle ABC. When the price rises from P1 to P2, as in panel (b), the quantity supplied rises from Q1 to Q2, and the producer surplus rises to the area of the triangle ADF. The increase in produc ...

... In panel (a), the price is P1, the quantity supplied is Q1, and producer surplus equals the area of the triangle ABC. When the price rises from P1 to P2, as in panel (b), the quantity supplied rises from Q1 to Q2, and the producer surplus rises to the area of the triangle ADF. The increase in produc ...

Slide 1

... In panel (a), the price is P1, the quantity supplied is Q1, and producer surplus equals the area of the triangle ABC. When the price rises from P1 to P2, as in panel (b), the quantity supplied rises from Q1 to Q2, and the producer surplus rises to the area of the triangle ADF. The increase in produc ...

... In panel (a), the price is P1, the quantity supplied is Q1, and producer surplus equals the area of the triangle ABC. When the price rises from P1 to P2, as in panel (b), the quantity supplied rises from Q1 to Q2, and the producer surplus rises to the area of the triangle ADF. The increase in produc ...

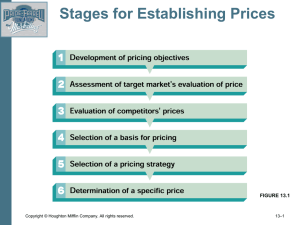

Pricing Objectives

... – Customers pay a higher price when demand for a product is strong and and a lower price when ...

... – Customers pay a higher price when demand for a product is strong and and a lower price when ...

Contango

Contango is a situation where the futures price (or forward price) of a commodity is higher than the expected spot price. In a contango situation, hedgers (commodity producers and commodity users) or arbitrageurs/speculators (non-commercial investors), are ""willing to pay more [now] for a commodity at some point in the future than the actual expected price of the commodity [at that future point]. This may be due to people's desire to pay a premium to have the commodity in the future rather than paying the costs of storage and carry costs of buying the commodity today.""The opposite market condition to contango is known as normal backwardation. ""A market is 'in backwardation' when the futures price is below the expected future spot price for a particular commodity. This is favorable for investors who have long positions since they want the futures price to rise.""The Commission of the European Communities (CEC & 2008 6) described backwardation and contango in relation to futures prices: ""The futures price may be either higher or lower than the spot price. When the spot price is higher than the futures price, the market is said to be in backwardation. It is often called 'normal backwardation' as the futures buyer is rewarded for risk he takes off the producer. If the spot price is lower than the futures price, the market is in contango.""The futures or forward curve would typically be upward sloping (i.e. ""normal""), since contracts for further dates would typically trade at even higher prices. (The curves in question plot market prices for various contracts at different maturities—cf. term structure of interest rates) ""In broad terms, backwardation reflects the majority market view that spot prices will move down, and contango that they will move up. Both situations allow speculators (non-commercial traders) to earn a profit.""A contango is normal for a non-perishable commodity that has a cost of carry. Such costs include warehousing fees and interest forgone on money tied up (or the time-value-of money, etc.), less income from leasing out the commodity if possible (e.g. gold). For perishable commodities, price differences between near and far delivery are not a contango. Different delivery dates are in effect entirely different commodities in this case, since fresh eggs today will not still be fresh in 6 months' time, 90-day treasury bills will have matured, etc.