Mechanics of Futures Markets

... Opening and Closing Futures Position An investor could instruct a broker to buy for exp. one October oil futures contract. There is period of time during the delivery month when delivery can be made. Trading usually ends some time during the delivery period. The party with the short position choose ...

... Opening and Closing Futures Position An investor could instruct a broker to buy for exp. one October oil futures contract. There is period of time during the delivery month when delivery can be made. Trading usually ends some time during the delivery period. The party with the short position choose ...

Name - White Plains Public Schools

... In 2004 there were 520 8th Graders in Highlands. In 2005, there were only 470 8th Graders in Highlands. Find the percent of change in the number of students at Highlands. ...

... In 2004 there were 520 8th Graders in Highlands. In 2005, there were only 470 8th Graders in Highlands. Find the percent of change in the number of students at Highlands. ...

IRRI-6 Weekly

... Rice shall be delivered in new or old, good condition 100 Kg Polypropylene woven sacs. The bags should not be torn from any side and should be machine stitched. No tare allowance will be applicable. Karachi or Port Qasim at Exchange approved and designated warehouses. The Exchange will notify in adv ...

... Rice shall be delivered in new or old, good condition 100 Kg Polypropylene woven sacs. The bags should not be torn from any side and should be machine stitched. No tare allowance will be applicable. Karachi or Port Qasim at Exchange approved and designated warehouses. The Exchange will notify in adv ...

Marketing plan Powerpoint

... • What is my breakeven and how much profit do I need? • When do I need income to meet obligations? How much? • What is the seasonal price swing and the basis for each commodity? • Where is my commodity? Will it have to be hauled or is it in storage? • What buyer will work with me to implement my mar ...

... • What is my breakeven and how much profit do I need? • When do I need income to meet obligations? How much? • What is the seasonal price swing and the basis for each commodity? • Where is my commodity? Will it have to be hauled or is it in storage? • What buyer will work with me to implement my mar ...

Volatility and Risk Management

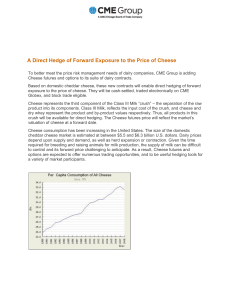

... even establishing a processing margin protects them against adverse price moves from the level at which they fixed the price or margin. That may achieve important risk management objectives such as the ability to service debt, meet key financial targets or secure financing for expansions. However, f ...

... even establishing a processing margin protects them against adverse price moves from the level at which they fixed the price or margin. That may achieve important risk management objectives such as the ability to service debt, meet key financial targets or secure financing for expansions. However, f ...

Lecture 3

... Inland farmers came to east coast to sell their grain to dealers who, in turn, shipped it all over the country. Too much supply right after the harvest. Unpurchased crops were left to rot. In the off-season price became too high when crops were unavailable. Not good for both the farmers and the deal ...

... Inland farmers came to east coast to sell their grain to dealers who, in turn, shipped it all over the country. Too much supply right after the harvest. Unpurchased crops were left to rot. In the off-season price became too high when crops were unavailable. Not good for both the farmers and the deal ...

Contango

Contango is a situation where the futures price (or forward price) of a commodity is higher than the expected spot price. In a contango situation, hedgers (commodity producers and commodity users) or arbitrageurs/speculators (non-commercial investors), are ""willing to pay more [now] for a commodity at some point in the future than the actual expected price of the commodity [at that future point]. This may be due to people's desire to pay a premium to have the commodity in the future rather than paying the costs of storage and carry costs of buying the commodity today.""The opposite market condition to contango is known as normal backwardation. ""A market is 'in backwardation' when the futures price is below the expected future spot price for a particular commodity. This is favorable for investors who have long positions since they want the futures price to rise.""The Commission of the European Communities (CEC & 2008 6) described backwardation and contango in relation to futures prices: ""The futures price may be either higher or lower than the spot price. When the spot price is higher than the futures price, the market is said to be in backwardation. It is often called 'normal backwardation' as the futures buyer is rewarded for risk he takes off the producer. If the spot price is lower than the futures price, the market is in contango.""The futures or forward curve would typically be upward sloping (i.e. ""normal""), since contracts for further dates would typically trade at even higher prices. (The curves in question plot market prices for various contracts at different maturities—cf. term structure of interest rates) ""In broad terms, backwardation reflects the majority market view that spot prices will move down, and contango that they will move up. Both situations allow speculators (non-commercial traders) to earn a profit.""A contango is normal for a non-perishable commodity that has a cost of carry. Such costs include warehousing fees and interest forgone on money tied up (or the time-value-of money, etc.), less income from leasing out the commodity if possible (e.g. gold). For perishable commodities, price differences between near and far delivery are not a contango. Different delivery dates are in effect entirely different commodities in this case, since fresh eggs today will not still be fresh in 6 months' time, 90-day treasury bills will have matured, etc.