(Platts) Crack Spread (1000mt) BALMO Futures

... SCOPE The provisions of these Rules shall apply to all futures contracts bought or sold on the Exchange for cash settlement based on the Floating Price. ...

... SCOPE The provisions of these Rules shall apply to all futures contracts bought or sold on the Exchange for cash settlement based on the Floating Price. ...

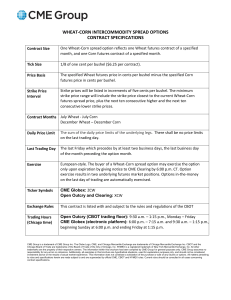

Wheat-Corn Intercommodity Spread Options Contract

... The last Friday which precedes by at least two business days, the last business day of the month preceding the option month. ...

... The last Friday which precedes by at least two business days, the last business day of the month preceding the option month. ...

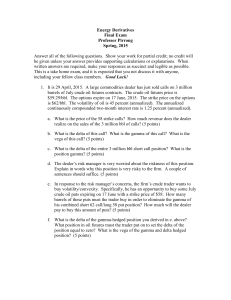

Risk Management

... barrels of July crude oil futures contracts. The crude oil futures price is $59.29/bbl. The options expire on 17 June, 2015. The strike price on the options is $62/bbl. The volatility of oil is 45 percent (annualized). The annualized continuously compounded two-month interest rate is 1.25 percent (a ...

... barrels of July crude oil futures contracts. The crude oil futures price is $59.29/bbl. The options expire on 17 June, 2015. The strike price on the options is $62/bbl. The volatility of oil is 45 percent (annualized). The annualized continuously compounded two-month interest rate is 1.25 percent (a ...

Presentation - NCDEX Institute of Commodity Markets and Research

... Commitment to reform lacking in rest ...

... Commitment to reform lacking in rest ...

Get the flexibility to determine a futures price without

... price without committing to a basis. What is it? A fixed futures contract allows you to fix the futures price on a quantity of grain and leave the basis open. ...

... price without committing to a basis. What is it? A fixed futures contract allows you to fix the futures price on a quantity of grain and leave the basis open. ...

Contango

Contango is a situation where the futures price (or forward price) of a commodity is higher than the expected spot price. In a contango situation, hedgers (commodity producers and commodity users) or arbitrageurs/speculators (non-commercial investors), are ""willing to pay more [now] for a commodity at some point in the future than the actual expected price of the commodity [at that future point]. This may be due to people's desire to pay a premium to have the commodity in the future rather than paying the costs of storage and carry costs of buying the commodity today.""The opposite market condition to contango is known as normal backwardation. ""A market is 'in backwardation' when the futures price is below the expected future spot price for a particular commodity. This is favorable for investors who have long positions since they want the futures price to rise.""The Commission of the European Communities (CEC & 2008 6) described backwardation and contango in relation to futures prices: ""The futures price may be either higher or lower than the spot price. When the spot price is higher than the futures price, the market is said to be in backwardation. It is often called 'normal backwardation' as the futures buyer is rewarded for risk he takes off the producer. If the spot price is lower than the futures price, the market is in contango.""The futures or forward curve would typically be upward sloping (i.e. ""normal""), since contracts for further dates would typically trade at even higher prices. (The curves in question plot market prices for various contracts at different maturities—cf. term structure of interest rates) ""In broad terms, backwardation reflects the majority market view that spot prices will move down, and contango that they will move up. Both situations allow speculators (non-commercial traders) to earn a profit.""A contango is normal for a non-perishable commodity that has a cost of carry. Such costs include warehousing fees and interest forgone on money tied up (or the time-value-of money, etc.), less income from leasing out the commodity if possible (e.g. gold). For perishable commodities, price differences between near and far delivery are not a contango. Different delivery dates are in effect entirely different commodities in this case, since fresh eggs today will not still be fresh in 6 months' time, 90-day treasury bills will have matured, etc.