Effect of Nonbinding Price Controls In Double Auction Trading

... 2. All subjects in these experiments had participated in at least one previous DA market experiment without price controls in which the induced supply and demand were characterized by parameters distinct from those reported below. 3. The induced values and costs for a typical experiment are shown in ...

... 2. All subjects in these experiments had participated in at least one previous DA market experiment without price controls in which the induced supply and demand were characterized by parameters distinct from those reported below. 3. The induced values and costs for a typical experiment are shown in ...

CE91 - MexDer

... Client’s position in other markets different from the Exchange and the Clearinghouse, in Underlying Assets or securities of the same type as the Underlying Asset or in other kinds of assets in which it is taking the hedging position. The Clearinghouse will, at its discretion, approve or deny a Clien ...

... Client’s position in other markets different from the Exchange and the Clearinghouse, in Underlying Assets or securities of the same type as the Underlying Asset or in other kinds of assets in which it is taking the hedging position. The Clearinghouse will, at its discretion, approve or deny a Clien ...

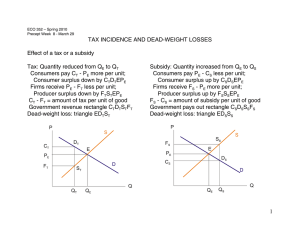

ECO352_Precept_Wk08.pdf

... EU consumer surplus loss = ½ (85+120) * (130-60) = 7175 EU producer surplus gain = ½ (145+40) * (130-60) = 6475 Note conflicting interests, typical in most international trade policy issues EU government revenue loss = (145-85) * (130-60) = 4200 Total EU loss = 7175 - 6475 + 4200 = 4900 This can be ...

... EU consumer surplus loss = ½ (85+120) * (130-60) = 7175 EU producer surplus gain = ½ (145+40) * (130-60) = 6475 Note conflicting interests, typical in most international trade policy issues EU government revenue loss = (145-85) * (130-60) = 4200 Total EU loss = 7175 - 6475 + 4200 = 4900 This can be ...

Consumer and Producer Surplus

... and losses as a result of resource allocation Emphasis on the MARKET demand – of those in the market there are some who are willing to pay higher prices than the market price ...

... and losses as a result of resource allocation Emphasis on the MARKET demand – of those in the market there are some who are willing to pay higher prices than the market price ...

Contango

Contango is a situation where the futures price (or forward price) of a commodity is higher than the expected spot price. In a contango situation, hedgers (commodity producers and commodity users) or arbitrageurs/speculators (non-commercial investors), are ""willing to pay more [now] for a commodity at some point in the future than the actual expected price of the commodity [at that future point]. This may be due to people's desire to pay a premium to have the commodity in the future rather than paying the costs of storage and carry costs of buying the commodity today.""The opposite market condition to contango is known as normal backwardation. ""A market is 'in backwardation' when the futures price is below the expected future spot price for a particular commodity. This is favorable for investors who have long positions since they want the futures price to rise.""The Commission of the European Communities (CEC & 2008 6) described backwardation and contango in relation to futures prices: ""The futures price may be either higher or lower than the spot price. When the spot price is higher than the futures price, the market is said to be in backwardation. It is often called 'normal backwardation' as the futures buyer is rewarded for risk he takes off the producer. If the spot price is lower than the futures price, the market is in contango.""The futures or forward curve would typically be upward sloping (i.e. ""normal""), since contracts for further dates would typically trade at even higher prices. (The curves in question plot market prices for various contracts at different maturities—cf. term structure of interest rates) ""In broad terms, backwardation reflects the majority market view that spot prices will move down, and contango that they will move up. Both situations allow speculators (non-commercial traders) to earn a profit.""A contango is normal for a non-perishable commodity that has a cost of carry. Such costs include warehousing fees and interest forgone on money tied up (or the time-value-of money, etc.), less income from leasing out the commodity if possible (e.g. gold). For perishable commodities, price differences between near and far delivery are not a contango. Different delivery dates are in effect entirely different commodities in this case, since fresh eggs today will not still be fresh in 6 months' time, 90-day treasury bills will have matured, etc.