* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Share price performance

Business valuation wikipedia , lookup

Investment management wikipedia , lookup

Financial economics wikipedia , lookup

Credit rating agencies and the subprime crisis wikipedia , lookup

Investment fund wikipedia , lookup

Geneva Securities Convention wikipedia , lookup

Securitization wikipedia , lookup

Global saving glut wikipedia , lookup

Financialization wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Amman Stock Exchange wikipedia , lookup

Short (finance) wikipedia , lookup

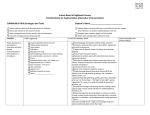

l Equity Research l Singapore l Oil Equipment & Services - Emerging Companies 16 January 2013 CSE Global Improving confidence We reiterate our Outperform rating on CSE Global (CSE) with a price target of SGD 1.00, offering 28% potential upside. We cut our 2012E and 2013E EPS by 19% and 10%, respectively, to account for management‟s lower guidance but we believe CSE‟s new order wins should boost investor confidence in the company. We value CSE Global based on a Gordon Growth Model and our price target translates to 9x 2013E PER. CSE offers an attractive yield of 5.4% (2013E). Management delivered Australian LNG project as guided. CSE announced a series of new order wins that started in early October 2012. Most important of these is an Australian LNG project, which management has been guiding for some time. The contract involves a telecommunications system for an LNG facility in Australia with a total contract value of about SGD 70mn. Management has advised that it is bidding for a similarly valued additional LNG project in Australia. We are optimistic that CSE can secure this additional LNG contract. CSE invests jointly with its founder for Power Diesel. CSE acquired a 66% stake in Power Diesel Engineering Pte Ltd (Power Diesel) in November 2012, jointly with CSE‟s founder, Mr. Tan Mok Koon, who takes 32% stake (remaining 2% stock with Mr. Vivek Dixit). Mr Tan is the non-executive deputy chairman of CSE Global and part of the company‟s executive committee. We would prefer CSE to not co-invest with a director as it raises questions regarding the executive‟s commitment to the listco. However, we note that Mr. Tan and CSE are co-investing at the same time and at the same price, and Mr. Tan‟s interest in Power Diesel should incentivise him to grow the business. Mr. Tan has also stepped down as Group Managing Director since January 2011 and is no longer involved in CSE‟s day-to-day operations. Valuations. CSE is currently trading on 7.x 2013E PER, with a 5.4% yield (2013E). We value the stock on a Gordon Growth Model, using conservative assumptions of equity beta of 1.25 and long-term growth of 0% to incorporate a potential higher risk with this stock. Over the next three-to-five years, we believe significant potential exists in CSE‟s UK healthcare, Australia and environmental businesses. OUTPERFORM (unchanged) PRICE as of 16 Jan 2013 PRICE TARGET SGD 0.79 SGD 1.00 Bloomberg code Reuters code CSE SP CSES.SI Market cap 12-month range SGD 405mn (USD 331mn) SGD 0.69 - 0.98 EPS adj. est. change 2012E Year-end: December Sales (SGD mn) EBITDA (SGD mn) EBIT (SGD mn) Pre-tax profit (SGD mn) Net profit adj. (SGD mn) FCF (SGD mn) EPS adj. (SGD) DPS (SGD) Book value/share (SGD) EPS growth adj. (%) DPS growth (%) EBITDA margin (%) EBIT margin (%) Net margin adj. (%) Div. payout (%) Net gearing (%) ROE (%) ROCE (%) EV/sales (x) EV/EBITDA (x) PBR (x) PER adj. (x) Dividend yield (%) -18.6% 2011 457 69 63 62 28 (16) 0.05 0.02 0.40 -48.8 -50.0 15.0 13.9 6.0 20.9 34.6 24.7 29.2 1.3 8.7 1.9 20.3 1.8 2013E 2012E 532 83 78 74 45 7 0.09 0.04 0.46 61.5 111.6 15.6 14.7 8.5 40.0 27.2 24.9 34.5 0.9 5.7 1.7 9.1 5.4 -9.7% 2013E 535 83 78 73 55 58 0.11 0.04 0.53 22.0 -0.1 15.6 14.6 10.3 40.0 10.6 21.5 29.9 0.8 5.2 1.5 7.4 5.4 2014E 558 96 90 85 64 53 0.12 0.05 0.60 16.1 16.1 17.1 16.0 11.4 40.0 0.3 21.9 30.1 0.7 4.3 1.3 6.4 6.2 Source: Company, Standard Chartered Research estimates Share price performance 1.65 0.65 Jan-12 Apr-12 CSE Global Share price (%) Ordinary shares Relative to index Relative to sector Major shareholder Free float Average turnover (USD) Jul-12 Oct-12 Jan-13 STRAITS TIMES INDEX (rebased) -1 mth -3 mth -12 mth -1 -10 -16 -2 -15 -27 Fidelity Management & Research (13.2%) 46% 378,852 Source: Company, FactSet Stephen Hui [email protected] +65 6596 8514 Important disclosures can be found in the Disclosures Appendix CSE SP All rights reserved. Standard Chartered Bank 2013 SGD 0.79 SGD 1.00 http://research.standardchartered.com CSE Global l 16 January 2013 Operational update We believe CSE‟s recent order wins should improve investor confidence in management‟s ability to deliver on growth. We expect new orders to improve in 2013 with growth of 15% YoY. Recent order wins CSE has announced three orders as part of the Inpex LNG project, which we estimate as valued at SGD 70mn CSE Global has won new contracts worth SGD 100.6mn since June 2012. Four of these orders were placed this year, with the most recent being its third telecommunications order as part of the Inpex LNG project in Australia and a contract in the UK defence sector. Fig 1: CSE Global order wins since June 2012 Date of announcement Order size (SGD mn) Description 7 January 2013 26 Third telecommunications order as part of Inpex LNG project in Australia, and a new project with UK defence sector 3 January 2013 5.6 Implementation of the new Oceano Administration System at a hospital, and a supply contract for RiO Care Record System at a large community trust, both in the UK 9 November 2012 36 Order to engineer, procure and construct a telecommunications system for an LNG facility in Australia, and a contract to engineer, procure and install two molybdenum roaster hearths in the USA 1 October 2012 33 Order to engineer, procure and construct a telecommunications system for an LNG offshore facility in Australia, and two mental health projects in the UK Source: Company Acquisition of Power Diesel CSE co-invested in Power Diesel, along with its founder, Tan Mok Koon CSE Global collaborated with its founder Tan Mok Koon and Vivek M Dixit to acquire Power Diesel. Key details of the acquisition are: Description: Power Diesel, registered in Singapore, was founded in 2004. The company provides sales and service of diesel engine parts, primarily servicing the Oil and Gas industries. Acquisition price and valuation: SGD 9.5mn in cash. For annualised 10-months ending 31 October 2012, Power Diesel had earnings of SGD 2.6mn (SGD 2.2mn for 10-months ending 31 October 2012). The acquisition price translates to 3.6x annualised earnings and about 2x price-to-book. Shareholding: CSE, Mr. Tan and Mr. Vivek will own 66%, 32% and 2%, respectively with risk and rewards in proportion to their respective holdings. Rationale: Management believes significant synergies exist between Power Diesel and CSE‟s business. For example, CSE believes it can target Power Diesel‟s existing customers for services in the automation sector. l Equity Research l 2 CSE Global l 16 January 2013 New orders should accelerate in 2013 2012 was a difficult year for CSE – we estimate new orders fell 9% YoY in the year. However, as it secured orders as part of the Inpex LNG project and due to the potential for an additional LNG project, we think new orders will improve in 2013E. We forecast new order growth of 15% YoY in 2013E Fig 2: CSE Global orderbook (2011-2015E) 2011 2012E 2013E 2014E 2015E 373 331 349 392 415 82 63 51 43 38 455 394 400 435 453 15% -13% 1% 9% 4% 513 462 531 584 631 6 10 10 10 10 519 472 541 594 641 Outstanding orderbook Oil & gas, infrastructure and mining Healthcare Growth % New orders Oil & gas, infrastructure and mining Healthcare Total new orders Growth Oil & gas, infrastructure and mining Healthcare Total new orders 30% -10% 15% 10% 8% -93% 56% 0% 0% 0% 6% -9% 15% 10% 8% Source: Company, Standard Chartered Research estimates l Equity Research l 3 CSE Global l 16 January 2013 Valuations CSE is currently trading on 7x 2013E PER with an attractive dividend yield of 5.4%. We value CSE using the Gordon Growth Model with a 12-month price target of SGD 1.00/share, offering 28% potential upside. Gordon Growth Model Our GGM-based price target offers a potential 28% upside We arrive at a fair value of SGD 1.00/share for CSE Global based on our valuation that uses the Gordon Growth Model, conservatively assuming 0% long-term growth rate. Fig 3: Valuation – Gordon growth model Gordon growth model ROE 20.2% Long-term growth 0% Risk-free rate 2.3% Equity risk premium 6.6% Equity beta 1.25 Cost of equity 10.6% Implied PBR (x) 1.92 Book value per share in 2012E (SGD) 0.52 Price target (SGD) 1.00 Potential upside/downside 28% Implied PER 2013E (x) 9.48 Source: Standard Chartered Research estimates Peer comps CSE Global is currently trading at 7x 2013E PER. There is no direct comparable for the stock but Singapore listed offshore companies are trading on average at 12x 2013E PER. Fig 4: Peer comparison Price target 3M avg value traded Last (LCY) (USD mn) (USD mn) FYE Price Market cap PER (x) 3 year EPS PEG 2012E 2013E 2014E CAGR 3 years Last Div. reported yield % ROCE EV/EBITDA (x) Name Ticker Rating (LCY) 2011 2012E 2013E 2012E (%) CSE Global Ltd CSE SP OP 1.00 0.79 331 0.36 12/11 9.1 7.4 6.4 31.8 0.2 6.8 5.6 5.6 5.4 10.5 Keppel Corp KEP SP OP 12.80 11.08 16,272 34.86 12/11 10.2 12.5 11.6 4.4 2.6 12.7 10.0 11.8 4.0 16.7 SembCorp Marine SMM SP OP 5.40 5 8,117 19.47 12/11 19.5 15.2 12.7 3.9 3.2 11.0 13.5 10.3 3.2 29.5 Cosco Corp Singapore COS SP UP 0.70 0.99 1,802 5.55 12/11 16.0 14.2 NA -100.0 NA 8.7 8.6 8.0 2.2 7.1 Ezra Holdings EZRA SP IL 1.20 1.22 971 7.17 08/12 27.0 16.6 12.0 28.3 0.4 12.9 12.0 9.9 0.0 4.6 Boustead Singapore BOCS SP OP 1.26 1.12 466 0.20 03/12 10.1 11.3 10.2 1.9 5.4 5.2 5.4 4.9 4.5 21.5 Ezion Holdings EZI SP OP 1.88 1.86 1,380 14.24 12/11 24.9 14.2 10.4 35.6 0.3 33.2 17.9 9.5 0.5 15.8 CH Offshore CHO SP NR 0.50 288 0.25 06/12 9.8 8.5 NA 0.0 NA 4.7 4.1 NA 6.6 13.5 Swiber Holdings SWIB SP NR 0.67 334 1.46 12/11 10.3 7.7 5.9 21.2 0.3 11.4 10.8 8.5 1.5 5.7 PEC PEC SP NR 0.69 144 0.27 06/12 13.0 11.5 NA 0.0 NA 2.4 2.1 NA 2.8 6.2 15.7 12.4 10.5 2.0 11.4 9.4 9.0 2.8 13.4 Singapore peers Average Source: Companies, Bloomberg, Standard Chartered Research estimates l Equity Research l 4 CSE Global l 16 January 2013 Historical valuations CSE has, on average, traded at PER 9x one-year forward over the past five years. The shares traded as low as PER 3x one-year forward in March 2009 and as high as PER 15x one-year forward in January 2011. Fig 5: CSE Global PER band SGD 2.00 1.80 1.60 1.40 1.20 1.00 0.80 0.60 0.40 0.20 0.00 Jan-08 15x 9x 3x Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 Source: Standard Chartered Research estimates l Equity Research l 5 CSE Global l 16 January 2013 Income statement (SGD mn) Year-end: Dec Sales Gross profit SG&A Other income Other expenses EBIT Net interest Associates Other non-operational Exceptional items Pre-tax profit Taxation Minority interests Cash flow statement (SGD mn) 2010 448 167 (96) 4 (3) 72 (5) 1 68 (16) 0 2011 457 166 (105) 5 (3) 63 (3) 1 62 (12) (0) 2012E 532 160 (120) 5 34 78 (5) 0 74 (18) (0) 2013E 535 166 (122) 5 29 78 (5) 0 73 (18) (0) 2014E 558 179 (127) 5 33 90 (4) 0 85 (21) (0) Net profit 52 49 55 55 64 Net profit adj. EBITDA 52 76 28 69 45 83 55 83 64 96 0.10 0.10 0.04 501 0.10 0.05 0.02 516 0.11 0.09 0.04 521 0.11 0.11 0.04 521 0.12 0.12 0.05 521 Year-end: Dec Cash Short-term investments Accounts receivable Inventory Other current assets Total current assets 2010 58 79 120 2 260 2011 54 106 136 3 299 2012E 59 138 157 3 358 2013E 95 132 157 3 388 2014E 123 138 164 3 428 PP&E Intangible assets Associates and JVs Other long-term assets Total long-term assets 15 76 8 7 107 25 103 9 15 153 28 103 0 15 146 31 102 0 15 148 33 101 0 15 149 Total assets 366 452 504 536 578 Short-term debt Accounts payable Other current liabilities Total current liabilities 32 74 34 141 124 63 56 242 124 77 59 259 124 76 59 258 124 78 59 261 27 4 0 30 0 5 0 5 0 5 0 5 0 5 0 5 0 5 0 5 Total liabilities 171 248 264 264 267 Shareholders‟ funds Minority interests 195 0 204 0 239 0 272 0 311 0 Total equity 195 204 239 272 311 Total liabilities and equity 366 452 504 536 578 Net debt (cash) Year-end shares (mn) 1 511 71 516 65 516 29 516 1 516 EPS (SGD) EPS adj. (SGD) DPS (SGD) Avg fully diluted shares (mn) Balance sheet (SGD mn) Long-term debt Convertible bonds Deferred tax Other long-term liabilities Total long-term liabilities Year-end: Dec EBIT Depreciation & amortisation Net interest Tax paid Changes in working capital Others Cash flow from operations 2010 72 3 (3) (16) 8 (7) 58 2011 63 5 (3) (18) (49) (6) (7) 2012E 78 5 (5) (18) (36) (10) 14 2013E 78 5 (5) (18) 5 0 65 2014E 90 6 (4) (21) (9) 0 61 Capex Acquisitions Disposals Others Cash flow from investing (4) (18) 0 0 (22) (9) (40) 1 0 (48) (7) 0 21 0 14 (7) 0 0 0 (7) (7) 0 0 0 (7) Dividends Issue of shares Change in debt Other financing cash flow Cash flow from financing (18) 0 (50) 38 (30) (21) 6 65 0 51 (22) 0 0 0 (22) (22) 0 0 0 (22) (25) 0 0 0 (25) 6 (3) 54 (4) (1) (16) 6 0 7 36 0 58 28 0 53 2010 2011 2012E 2013E 2014E 37.4 16.9 16.2 11.7 23.5 10.6 20.2 14.2 5.2 14.3 36.4 15.0 13.9 6.0 19.7 2.0 -5.9 -8.6 -48.8 -50.0 30.0 15.6 14.7 8.5 25.0 16.4 11.6 10.5 61.5 111.6 31.0 15.6 14.6 10.3 25.0 0.6 -0.1 -0.1 22.0 -0.1 32.0 17.1 16.0 11.4 25.0 4.3 16.1 16.1 16.1 16.1 31.6 33.9 1.3 0.8 0.7 145.3 64.7 88.1 24.7 29.2 1.1 -0.1 0.5 160.6 74.1 86.1 24.9 34.5 1.1 0.2 0.6 143.5 84.0 68.3 21.5 29.9 1.0 0.8 0.6 155.2 92.2 75.3 21.9 30.1 1.0 0.7 0.7 154.5 88.1 74.0 Leverage ratios Net gearing (%) Debt/capital (%) Interest cover (x) Debt/EBITDA (x) Current ratio (x) 0.3 14.9 1.8 34.6 15.8 1.2 27.2 14.4 1.4 10.6 14.4 1.5 0.3 16.4 1.6 Valuation EV/sales (x) EV/EBITDA (x) EV/EBIT (x) PER (x) PER adj. (x) PBR (x) Dividend yield (%) 1.2 7.0 7.4 9.6 9.6 3.4 4.0 1.3 8.7 9.4 11.3 20.3 1.9 1.8 0.9 5.7 6.1 7.4 9.1 1.7 5.4 0.8 5.2 5.6 7.4 7.4 1.5 5.4 0.7 4.3 4.6 6.4 6.4 1.3 6.2 Change in cash Exchange rate effect Free cash flow Financial ratios and other Year-end: Dec Operating ratios Gross margin (%) EBITDA margin (%) EBIT margin (%) Net margin adj. (%) Effective tax rate (%) Sales growth (%) Net income growth (%) EPS growth (%) EPS growth adj. (%) DPS growth (%) Efficiency ratios ROE (%) ROCE (%) Asset turnover (x) Op. cash/EBIT (x) Depreciation/capex (x) Inventory days Accounts receivable days Accounts payable days Source: Company, Standard Chartered Research estimates l Equity Research l 6 CSE Global l 16 January 2013 Disclosures appendix The information and opinions in this report were prepared by Standard Chartered Bank (Hong Kong) Limited, Standard Chartered Bank Singapore Branch, Standard Chartered Securities (India) Limited, Standard Chartered Securities Korea Limited and/or one or more of its affiliates (together with its group of companies, ”SCB”) and the research analyst(s) named in this report. THIS RESEARCH HAS NOT BEEN PRODUCED IN THE UNITED STATES. Analyst Certification Disclosure: The research analyst or analysts responsible for the content of this research report certify that: (1) the views expressed and attributed to the research analyst or analysts in the research report accurately reflect their personal opinion(s) about the subject securities and issuers and/or other subject matter as appropriate; and (2) no part of his or her compensation was, is or will be directly or indirectly related to the specific recommendations or views contained in this research report. On a general basis, the efficacy of recommendations is a factor in the performance appraisals of analysts. Where “disclosure date” appears below, this means the day prior to the report date. All share prices quoted are the closing price for the business day prior to the date of the report, unless otherwise stated. Recommendation and price target history for CSE Global SGD 1.92 3 2 1.67 4 1 1.42 5 6 7 8 1.17 9 0.92 0.67 Feb-10 May-10 Aug-10 Date 1 21 Oct 10 Recommendation Nov-10 Feb-11 May-11 Aug-11 Price target Date Nov-11 Recommendation Feb-12 May-12 Aug-12 Price target Date Nov-12 Recommendation Feb-13 Price target OUTPERFORM 1.34 4 24 May 11 OUTPERFORM 1.74 7 14 Nov 11 OUTPERFORM 1.21 2 15 Nov 10 OUTPERFORM 1.58 5 12 Aug 11 OUTPERFORM 1.31 8 29 Feb 12 OUTPERFORM 1.10 3 5 Jan 11 1.92 6 12 Oct 11 1.24 9 16 Aug 12 OUTPERFORM 1.03 OUTPERFORM OUTPERFORM Source: FactSet prices, SCB recommendations and price targets Recommendation Distribution and Investment Banking Relationships % of covered companies currently assigned this rating % of companies assigned this rating with which SCB has provided investment banking services over the past 12 months OUTPERFORM 55.7% 13.0% IN-LINE 34.6% 14.9% 9.7% 3.3% UNDERPERFORM As of 31 December 2012 Research Recommendation Terminology Definitions The total return on the security is expected to outperform the relevant market index by 5% or more over the next 12 months The total return on the security is not expected to outperform or underperform the relevant market IN-LINE (IL) index by 5% or more over the next 12 months The total return on the security is expected to underperform the relevant market index by 5% or UNDERPERFORM (UP) more over the next 12 months OUTPERFORM (OP) SCB uses an investment horizon of 12 months for its price targets. Additional information, including disclosures, with respect to any securities referred to herein will be available upon request. Requests should be sent to [email protected]. Global Disclaimer: Standard Chartered Bank and/or its affiliates ("SCB”) makes no representation or warranty of any kind, express, implied or statutory regarding this document or any information contained or referred to in the document. The information in this document is provided for information purposes only. It does not constitute any offer, recommendation or solicitation to any person to enter into any transaction or adopt any hedging, trading or investment strategy, nor does it constitute any prediction of likely future movements in rates or prices or represent that any such future movements will not exceed those shown in any illustration. The stated price of the securities mentioned herein, if any, is as of the date indicated and is not any representation that any transaction can be effected at this price. While all reasonable care has been taken in preparing this document, no responsibility or liability is accepted for errors of fact or for any opinion expressed herein. The contents of this document may not be suitable for all investors as it has not been prepared with regard to the specific investment objectives or financial situation of any particular person. Any investments discussed may not be suitable for all investors. Users of this document should seek professional advice regarding the appropriateness of investing in any securities, financial instruments or investment strategies referred to in this document and should understand that statements regarding future prospects may not be realised. Opinions, forecasts, assumptions, estimates, derived valuations, projections, and price target(s), if any, contained in this document are as of the date indicated and are subject to change at any time without prior notice. Our recommendations are under constant review. The value and income of any of the securities or financial instruments mentioned in this document can fall as well as rise and an investor may get back less than invested. Future returns are not guaranteed, and a loss of original capital may be incurred. Foreign-currency denominated securities and financial instruments are subject to fluctuation in exchange rates that could have a positive or adverse effect on the value, price or income of such securities and financial instruments. Past performance is not indicative of comparable future results and no representation or warranty is made regarding future performance. While we endeavour to update on a reasonable l Equity Research l 7 CSE Global l 16 January 2013 basis the information and opinions contained herein, there may be regulatory, compliance or other reasons that prevent us from doing so. Accordingly, information may be available to us which is not reflected in this material, and we may have acted upon or used the information prior to or immediately following its publication. SCB is not a legal or tax adviser, and is not purporting to provide legal or tax advice. Independent legal and/or tax advice should be sought for any queries relating to the legal or tax implications of any investment. SCB, and/or a connected company, may have a position in any of the securities, instruments or currencies mentioned in this document. SCB and/or any member of the SCB group of companies or its respective officers, directors, employee benefit programmes or employees, including persons involved in the preparation or issuance of this document may at any time, to the extent permitted by applicable law and/or regulation, be long or short any securities or financial instruments referred to in this document and on the website or have a material interest in any such securities or related investment, or may be the only market maker in relation to such investments, or provide, or have provided advice, investment banking or other services, to issuers of such investments. SCB has in place policies and procedures and physical information walls between its Research Department and differing public and private business functions to help ensure confidential information, including „inside‟ information is not disclosed unless in line with its policies and procedures and the rules of its regulators. Data, opinions and other information appearing herein may have been obtained from public sources. SCB makes no representation or warranty as to the accuracy or completeness of such information obtained from public sources. You are advised to make your own independent judgment (with the advice of your professional advisers as necessary) with respect to any matter contained herein and not rely on this document as the basis for making any trading, hedging or investment decision. SCB accepts no liability and will not be liable for any loss or damage arising directly or indirectly (including special, incidental, consequential, punitive or exemplary damages) from use of this document, howsoever arising, and including any loss, damage or expense arising from, but not limited to, any defect, error, imperfection, fault, mistake or inaccuracy with this document, its contents or associated services, or due to any unavailability of the document or any part thereof or any contents or associated services. This material is for the use of intended recipients only and in any jurisdiction in which distribution to private/retail customers would require registration or licensing of the distributor which the distributor does not currently have, this document is intended solely for distribution to professional and institutional investors. Country-Specific Disclosures - If you are receiving this document in any of the countries listed below, please note the following: United Kingdom and European Economic Area: Standard Chartered Bank is authorised and regulated in the United Kingdom by the Financial Services Authority. This communication is not directed at Retail Clients in the European Economic Area as defined by Directive 2004/39/EC. Nothing in this document constitutes a personal recommendation or investment advice as defined by Directive 2004/39/EC. Australia: The Australian Financial Services Licence for Standard Chartered Bank is Licence No: 246833 with the following Australian Registered Business Number (ARBN: 097571778). Australian investors should note that this document was prepared for “wholesale clients” only within the meaning of section 761G of the Australian Corporations Act 2001 (Act) and the Corporations Regulations. This document is not directed at persons who are “retail clients” as defined in the Australian Corporations Act 2001. Brazil: SCB disclosures pursuant to the Securities and Exchange Commission of Brazil (“CVM”) Instruction 483/10: This research has not been produced in Brazil. The report has been prepared by the research analyst(s) in an autonomous and independent way, including in relation to SCB. THE SECURITIES MENTIONED IN THIS DOCUMENT HAVE NOT BEEN AND WILL NOT BE REGISTERED PURSUANT TO THE REQUIREMENTS OF THE SECURITIES AND EXCHANGE COMMISSION OF BRAZIL AND MAY NOT BE OFFERED OR SOLD IN BRAZIL EXCEPT PURSUANT TO AN APPLICABLE EXEMPTION FROM THE REGISTRATION REQUIREMENTS AND IN COMPLIANCE WITH THE SECURITIES LAWS OF BRAZIL. Hong Kong: This document, except for any portion advising on or facilitating any decision on futures contracts trading, is being distributed in Hong Kong by, and is attributable to, Standard Chartered Bank (Hong Kong) Limited which is regulated by the Hong Kong Monetary Authority. India: This document is being distributed in India by Standard Chartered Securities (India) Limited which is a SEBI registered broker and a member of the Bombay Stock Exchange Limited and The National Stock Exchange of India Limited. Korea: This document is being distributed in Korea by, and is attributable to, Standard Chartered Securities Korea Limited which is regulated by the Financial Supervisory Service. Singapore: This document is being distributed in Singapore by Standard Chartered Bank Singapore Branch only to accredited investors, expert investors or institutional investors, as defined in the Securities and Futures Act, Chapter 289 of Singapore. Recipients in Singapore should contact Standard Chartered Bank Singapore Branch in relation to any matters arising from, or in connection with, this document. South Africa: SCB is licensed as a Financial Services Provider in terms of Section 8 of the Financial Advisory and Intermediary Services Act 37 of 2002. SCB is a Registered Credit Provider in terms of the National Credit Act 34 of 2005 under registration number NCRCP4. United States: Except for any documents relating to foreign exchange, FX or global FX, Rates or Commodities, distribution of this document in the United States or to US persons is intended to be solely to major institutional investors as defined in Rule 15a-6(a)(2) under the US Securities Act of 1934. All US persons that receive this document by their acceptance thereof represent and agree that they are a major institutional investor and understand the risks involved in executing transactions in securities. Any US recipient of this document wanting additional information or to effect any transaction in any security or financial instrument mentioned herein, must do so by contacting a registered representative of Standard Chartered Securities (North America) Inc., 1095 Avenue of the Americas, New York, N.Y. 10036, US, tel + 1 212 667 0700. WE DO NOT OFFER OR SELL SECURITIES TO U.S. PERSONS UNLESS EITHER (A) THOSE SECURITIES ARE REGISTERED FOR SALE WITH THE U.S. SECURITIES AND EXCHANGE COMMISSION AND WITH ALL APPROPRIATE U.S. STATE AUTHORITIES; OR (B) THE SECURITIES OR THE SPECIFIC TRANSACTION QUALIFY FOR AN EXEMPTION UNDER THE U.S. FEDERAL AND STATE SECURITIES LAWS NOR DO WE OFFER OR SELL SECURITIES TO U.S. PERSONS UNLESS (i) WE, OUR AFFILIATED COMPANY AND THE APPROPRIATE PERSONNEL ARE PROPERLY REGISTERED OR LICENSED TO CONDUCT BUSINESS; OR (ii) WE, OUR AFFILIATED COMPANY AND THE APPROPRIATE PERSONNEL QUALIFY FOR EXEMPTIONS UNDER APPLICABLE U.S. FEDERAL AND STATE LAWS. © Copyright 2013 Standard Chartered Bank and its affiliates. All rights reserved. All copyrights subsisting and arising out of all materials, text, articles and information contained herein is the property of Standard Chartered Bank and/or its affiliates, and may not be reproduced, redistributed, amended, modified, adapted, transmitted in any form, or translated in any way without the prior written permission of Standard Chartered Bank. Click here to download the Standard Chartered Research app for iPad l Equity Research l 8