* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download REITs - Bivio

Leveraged buyout wikipedia , lookup

Private equity in the 1980s wikipedia , lookup

Capital gains tax in Australia wikipedia , lookup

Interbank lending market wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Private equity secondary market wikipedia , lookup

Early history of private equity wikipedia , lookup

International investment agreement wikipedia , lookup

Mutual fund wikipedia , lookup

Stock trader wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

Investment banking wikipedia , lookup

Socially responsible investing wikipedia , lookup

Short (finance) wikipedia , lookup

Negative gearing wikipedia , lookup

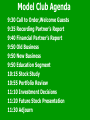

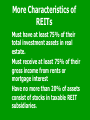

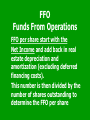

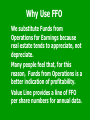

Model Club Agenda 9:30 Call to Order,Welcome Guests 9:35 Recording Partner’s Report 9:40 Financial Partner’s Report 9:50 Old Business 9:50 New Business 9:50 Education Segment 10:15 Stock Study 10:55 Portfolio Review 11:10 Investment Decisions 11:20 Future Stock Presentation 11:30 Adjourn Www.bivio.com/cinmic/ REITs Part 2 Real Estate Investment Trusts James Hurt Cincinnati Model Club (from material provided by Herb Barnett, Director, NAIC Computer Group) Where We Left Off Last Month Next month: Will discuss More about Investment Concerns Quarterly Data FFO vs. EPS More Characteristics of REITs Must have at least 75% of their total investment assets in real estate. Must receive at least 75% of their gross income from rents or mortgage interest Have no more than 20% of assets consist of stocks in taxable REIT subsidiaries. Investment Concerns Equity REITs own the properties. Mortgage REITs own a portfolio of mortgages. Hybrid REITs are a combination of the above. Investment Concerns Self-managed REITs are Equity REITs that also manage and operate the properties. Self-managed REITs tend to provide better total return and liquidity with less risk. REITs and Interest Rates The stock price of a REIT moves somewhat like a bond. As interest rates rise there is a downward pressure on the stock price of a REIT. EPS for Manufacturing Sales Minus Cost of Goods Sold Minus Overhead * Minus Taxes Equals Net Profit Net Profit divided by number of shares outstanding equals Earnings Per Share * Overhead includes depreciation and amortization FFO Funds From Operations FFO per share start with the Net Income and add back in real estate depreciation and amortization (excluding deferred financing costs). This number is then divided by the number of shares outstanding to determine the FFO per share Why Use FFO We substitute Funds from Operations for Earnings because real estate tends to appreciate, not depreciate. Many people feel that, for this reason, Funds from Operations is a better indication of profitability. Value Line provides a line of FFO per share numbers for annual data. Quarterly Data Value Line provides neither Revenues nor FFO for each quarter. Use the data in the 10Q that the company files with the SEC and calculate your Quarterly Revenues and FFO from those numbers. Quarterly Revenue Add Rental Income and Other Income to get Total Revenue Quarterly Revenue Rental Operations $191,350 Service Operations $11,435 Interest Income $1,508 Sale of Land $4,629 Total Revenues $207,572 Quarterly Funds from Operations Net Income $32,886 Depreciation & Amortization $52,397 Total $85,283 Divide this number by the number of diluted shares outstanding. Quarterly Funds from Operations Sometimes a company will give you the quarterly Funds from Operations in the 10Q. Dividing this number by the diluted shares outstanding may give you a more conservative amount. Conclusions A REIT is a different type of investment. Like Banks, you have to do some calculations on your own to understand a REIT. There will not be a lot of price appreciation in a REIT, you buy for the income.

![Public/SIC Education Presentations/REITS[1]](http://s1.studyres.com/store/data/012509441_1-4ac192bb5fd15c4b63c90980bf3e65d9-150x150.png)