* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download SIS Performance versus Benchmark to 31 March 2016

Individual Savings Account wikipedia , lookup

Private equity secondary market wikipedia , lookup

Private equity wikipedia , lookup

Pensions crisis wikipedia , lookup

Present value wikipedia , lookup

Investor-state dispute settlement wikipedia , lookup

Beta (finance) wikipedia , lookup

Credit rationing wikipedia , lookup

International investment agreement wikipedia , lookup

Interest rate wikipedia , lookup

Interbank lending market wikipedia , lookup

Early history of private equity wikipedia , lookup

Internal rate of return wikipedia , lookup

Fund governance wikipedia , lookup

Land banking wikipedia , lookup

Stock selection criterion wikipedia , lookup

Rate of return wikipedia , lookup

Modified Dietz method wikipedia , lookup

Corporate finance wikipedia , lookup

Global saving glut wikipedia , lookup

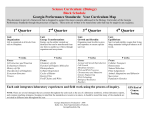

FUNDS M A N AG E M E NT SE RVICE QUARTERLY INVESTMENT REPORT 31 March 2016 Quarterly Investment Report, 31 March 2016 Produced by P U B LI C TR U S TE E GPO Box 1338 Adelaide South Australia 5001 T 08 8226 9200 | F 08 8226 9350 Country freecall 1800 673 119 (landline only) www.publictrustee.sa.gov.au Quarterly Investment Report, 31 March 2016 This Quarterly Investment Report presents the results of the Public Trustee’s Funds Management Service performance and commentary for the quarter ended 31 March 2016. Public Trustee is a statutory entity founded in 1881. At the end of the March 2016 quarter, it had approximately $913m in funds under management. Public Trustee’s Funds Management Service has a distinguished record of high quality, proven and consistent investment performance. We are proud of our long-standing reputation for trust and reliability, and the vital role we play for our customers and their financial affairs. Investment markets were quiet volatile for the March quarter. January and February were generally poor months for shares whilst defensive assets like global bonds performed well. In March we saw a reversal, with shares rising and global bonds retreating. Overall Public Trustee’s investments continue to perform well and use of active fund managers with a bias towards high quality and defensive style investments has been beneficial. Pleasingly, all investment strategies are outperforming their standard industry benchmarks over 1,3 and 5 years. SIS Performance versus Benchmark to 31 March 2016 Cash benchmark variance Last 3 months 0.54% 0.33% 0.21% Last 12 months 2.24% 1.22% 1.02% Capital Stable benchmark variance 0.29% 0.60% -0.31% Balanced benchmark variance Performance* 3 years 5 years 2.79% 1.57% 1.22% 3.56% 2.23% 1.33% 0.86% -0.40% 1.26% 4.89% 4.28% 0.61% 5.46% 4.98% 0.48% -0.10% -0.03% -0.07% -0.23% -2.30% 2.07% 7.05% 6.27% 0.78% 7.24% 6.70% 0.54% Growth benchmark variance -0.92% -1.06% 0.14% -1.47% -4.07% 2.60% 8.38% 7.24% 1.14% 8.14% 7.15% 0.99% Equities benchmark variance -3.17% -3.37% 0.20% -4.67% -7.53% 2.86% 9.77% 8.44% 1.33% 8.72% 7.33% 1.39% *After fees During the March quarter Public Trustee continued to allocate more investment funds into unlisted property and infrastructure. These changes will assist to reduce the volatility of the funds and aims to enhance the income returns for our customers. If you would like to add to your portfolio, you may do so at any time. Please contact Elaine Pringle (08) 8226 1746 for more information. Debra Contala Public Trustee 11 May 2016 Quarterly Investment Report, 31 March 2016 Market Overview Global Concerns continued regarding global growth during the quarter, particularly in China. The Federal Reserve (Fed) put any further increase in US interest rates on hold, after fears of a slowdown in China and collapsing oil prices which hit record lows. Security was also a concern for European markets in the wake of the Brussels terrorist attacks in March. In addition, the European Central Bank (ECB) announced additional stimulus measures, including rate cuts. Australia The Reserve Bank of Australia (RBA) kept official interest rates on hold at 2.00%. The Australian Dollar appreciated against all major currencies during the March quarter, finishing at $0.765US. Share Markets Performance was subdued in the first quarter of 2016. The Australian Share market had a volatile first half of the quarter, before recovering during the last half of the quarter. Australian shares (S&P/ASX 300) closed slightly lower for the quarter down 2.6%. Key Developments Key developments over the quarter were: Share markets have been volatile; Appreciation of the Australian Dollar; Sharp falls in commodity prices; and US interest rates on hold. Since 1990, funds invested through Public Trustee Common Funds have grown from $160 million to $913 million today. Quarterly Investment Report, 31 March 2016 Cash Investment Strategy The Reserve Bank kept official interest rates on hold during the quarter at 2.00%. The fund’s return of 0.54% for the quarter was above the benchmark return by 0.21%. The strategies 3 and 5 year returns remain at 2.79% and 3.56%, which are 1.22% and 1.33% respectively ahead of benchmark. Crediting Rate: The investment return for this fund is calculated daily, based on the net earnings of the fund. The average crediting rate for the quarter was 2.16%, and the daily rate at 31 March 2016 was 2.20%. Fund size: $350 million. Objective: Funds assigned to the cash investment strategy are invested in the Public Trustee's Cash Common Fund. The objective of the Cash Common Fund is the preservation of capital. The strategy is intended for investors who are seeking secure returns at prevailing short term interest rates. Capital Stable Investment Strategy The strategy’s return for the quarter was 0.29% underperforming the benchmark return by 0.31%. The strategy’s 3 year and 5 year returns of 4.89% and 5.46% are 0.61% and 0.48% respectively ahead of benchmark. . Fund size: $74 million. Cash 19% Australian Shares 11% Overseas Shares 7% Overseas Fixed Int 12% Short Term Fixed Int 28% *Annualised **Index return on Strategic Asset Allocation Objective: The objective of this strategy is to achieve a higher return than cash by strategically allocating 26.5% of the funds in growth assets and the balance in fixed interest and cash. It is suitable for investors who are seeking higher returns than cash over time and are prepared to accept a slight increase in risk in terms of downward movements in the value of their capital from time to time. Property 8% Long Term Fixed Int 15% Quarterly Investment Report, 31 March 2016 Balanced Investment Strategy Overseas Fixed Int 11% Short Term Fixed Int 9% The strategy’s return for the quarter was -0.10% underperforming the benchmark return by 0.07%. The strategy’s 3 year and 5 year returns of 7.05% and 7.24% are 0.78% and 0.54% respectively ahead of benchmark. Long Term Fixed Int 24% Fund size: $205 million. Performance Cash 5% Quarter % 1 year % 3 year %* 5 year%** Return (after fees) -0.10% -0.23% 7.05% 7.24% Benchmark** -0.03% -2.30% 6.27% 6.70% Difference -0.07% 2.07% 0.78% 0.54% Australian Shares 21% Overseas Shares 14% Property 16% *Annualised **Index return on Strategic Asset Allocation Objective: The objective of this strategy is to gain a higher return by strategically allocating 52.5% of the funds in growth assets and the balance in fixed interest and cash. It is suitable for medium term investors who seek higher returns and are prepared to accept some volatility in the value of the funds invested. Overseas Short Term Fixed Int 6% Cash 5% Fixed Int 5% Growth Investment Strategy The strategy’s return for the quarter was -0.92%. This outperformed the benchmark by 0.14%. The strategy’s 3 year and 5 year returns remain at 8.38% and 8.14%, which are 1.14% and 0.99% ahead of benchmark. Long Term Fixed Int 14% Property 16% Fund size: $210 million. Performance Quarter % 1 year % 3 year %* 5 year%** Return (after fees) -0.92% -1.47% 8.38% 8.14% Benchmark** -1.06% -4.07% 7.24% 7.15% 0.14% 2.60% 1.14% 0.99% Difference Australian Shares 32% *Annualised **Index return on Strategic Asset Allocation Objective: The objective of this strategy is to attain high long term returns in excess of inflation. It has a 71.5% strategic allocation to growth assets and the balance in fixed interest and cash. It is suitable for long term investors who are prepared to accept high volatility in the value of the funds invested. Overseas Shares 22% Quarterly Investment Report, 31 March 2016 Equities Investment Strategy Overseas Shares 42% The strategy’s return for the quarter was -3.17%, which outperformed the benchmark by 0.20%. The strategy’s 3 year and 5 year returns remain at 9.77% and 8.72%, which are 1.33% and 1.39% respectively ahead of benchmark. Fund size: $75 million. Performance Quarter % 1 year % 3 year %* 5 year%** Return (after fees) -3.17% -4.67% 9.77% 8.72% Benchmark** -3.37% -7.53% 8.44% 7.33% 1.33% 1.39% Difference 0.20% 2.86% *Annualised ** Index return on Strategic Asset Allocation Objective: The equities strategy offers 100% exposure to the world’s share markets. Over the long term, it offers the prospects of high returns but with the likelihood that capital values will fluctuate broadly in line with the fortunes of the share markets. Typically, this strategy may be used as a return booster in conjunction with one of the other investment strategies. The objective of this strategy is to gain exposure to both domestic and overseas share markets. This strategy has a 55/45 strategic allocation to the two markets respectively. NB: All the above investment strategies are exercised through investment in one, or a combination of, the Public Trustee Common Funds. The investment returns presented in this quarterly report relate to past performances and must not be taken to imply that this predicts future returns of the funds. The information and opinions contained in this report have been compiled or are arrived at by Public Trustee from sources believe to be reliable, but no representation or warranty, expressed or implied, is made as to their accuracy, completeness or correctness. The information in this report is of a general nature. Public Trustee strongly recommends that you contact the Office to discuss your particular circumstances. Public Trustee does not accept any liability whatsoever for any direct or consequential loss arising from any usage of information herein contained. Australian Shares 58% PUBLIC TRUSTEE GPO Box 1338 Adelaide South Australia 5001 T 08 8226 9200 | F 08 8226 9350 Country freecall 1800 673 119 | www. publictrustee.sa.gov.au