* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download The Loanable Funds Market

Survey

Document related concepts

Quantitative easing wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Short (finance) wikipedia , lookup

Private equity secondary market wikipedia , lookup

Money market fund wikipedia , lookup

Mutual fund wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

Investment banking wikipedia , lookup

Socially responsible investing wikipedia , lookup

Stock trader wikipedia , lookup

Private money investing wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

Investment fund wikipedia , lookup

Transcript

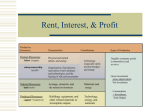

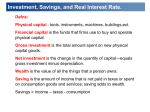

Chapter 26: Saving, Investment, and the Financial System The capitalistic economy ‘s dependence on the use of capital goods in producing output has been noted various times in previous chapters. In fact, the reliance on the extensive use of capital was identified as a source of significant growth for a number of wealthy, developed and economically viable nations. This chapter delves into the structure and mechanics of a system (the economy’s “loanable funds”) that finances and otherwise pays for needed business investment in capital goods. Special emphasis is placed on a number of financial institutions, such as the bond market, the stock market, banks, and mutual funds that help feed the so-called stock of loanable funds used to finance investment expenditures. Each of these can be characterized as either: 1) “Financial Markets” or 2) “Financial Intermediaries” The behaviors of the suppliers of loanable funds (saving households who desire to lend their unspent income) along with the factors that impact their saving activity are identified. The behaviors of those who demand loanable funds (households and firms who wish to borrow) along with the factors that influence their desires to borrow are also identified. Finally, a simplified interest rate determination model is constructed and the potential impact of government budget deficits is examined. More to follow………. Students should lay particular focus on the following key concepts: The Components of Financial Markets (The Bond Market and the Stock Market) The definition and specific characteristics of the bond market to include: 1) The definition of a bond 2) The concept of “debt finance” 3) A bond’s “term”; 4) The interest rate a bond pays (and how the length of the bond term affects the interest rate; 5) The “credit risk” associated with a bond and how that risk affects the bond interest and 6) The tax treatment of various bonds and how tax-related issues affect bond interest rates. The definition and specific characteristics of the stock market to include: 1) The definition of a stock 2) The concept of “equity finance” 3) A comparison of “stock risk” vs. “bond risk”: 4) How perception of a corporation’s future profitability affects the demand for a stock and therefore its stock’s price The Components of Financial Intermediaries (i.e. Banks and Mutual Funds) U.S. Banks are corporate entities (lending / depository institutions) that, in the eyes of the law, have a recognized existence separate and distinct from that of its owners. They accept bank customer deposits for which they pay depositors rates of interest. They then lend those deposits to borrowers at slightly higher rates of loan interest. As a general rule only corporations can sell stock or bonds in order to finance investment expenditure. Even smaller corporations with poor profit history might encounter difficulty in selling their stock. As such, smaller/poor performing corporations, sole proprietorships, and partnerships (all unable to sell stock) are faced with a last resort of bank loans to finance investment expenditures. Mutual Funds are institutions that sells “shares” in itself to the public and uses the proceeds to buy and manage portfolios or bundles of corporate stocks and bonds. Corporations who sell their stocks to mutual fund managers use stock sale proceeds to finance investment expenditures. The Loanable Funds Market represents the totality of funds that financial markets (stocks and bonds) and financial intermediaries (banks and mutual funds) channel or direct to borrowers (firms and households) to finance investment expenditures. Students should master the following concepts: 1) How saving (deposits in banks, purchases of stocks, purchases of bonds, and purchases of mutual funds) represents the “Supply of Loanable Funds”; 2) How and why the “Supply of Loanable Funds” curve is upward-sloping (i.e. how interest rates paid to savers affect the desire by save) NOTE WELL: There is an expanded definition of “INVESTMENT” that was actually mentioned briefly in a previous chapter that should be acknowledged to wit: “Investment during a given calendar year includes expenditures on new tools, machinery, and equipment (human-made tools used to produce or to sell goods and services), expenditures/purchases by firms on inventory, and expenditures on all types of new construction (to include business and residential construction); 3) How the demand for loanable funds is derived from funds used to finance investment expenditures, i.e. purchases by households (mortgage loans) and purchases of capital goods and new inventory by business firms and 4) How and why the “Demand for Loanable Funds” curve is downward-sloping (i.e. how the interest rates charged by lenders/banks on loans affects the volume of loan activity) Students should also understand how interest rates will “move” when the quantities of loanable funds made available by savers are greater than the quantities desired by borrowers for loans. Finally, students should also understand how interest rates “move” when the quantities of loanable funds desired by borrowers is greater than the quantities of loanable funds are greater than the volume of loanable funds made available by savers. In the case of the interest rate determination process students should understand how equilibrium interest rates tend to “equilibrate” the quantities of loanable funds by savers and borrowers. An Overview of U.S. Saving Patterns – Students Should Also Understand and Recognize: The U.S. record of saving Why, according to most economists, saving rates are so low. The impact of tax cut policies (i.e. tax cuts on interest income) on the desire/incentive to save AND on equilibrium interest rates An Overview of U.S. Investment Expenditure Patters – Students Should Also Understand and Recognize: The mechanics of an “investment tax credit” How an investment tax credit would affect: 1) the demand for loanable funds and why? And 2) investment expenditures and why? And 3) interest rates and saving levels and why? More to follow…… An Overview of U.S. Government Budget Deficits, How Those Deficits are “Financed” and the Impact of Those Deficits on Equilibrium Interest Rates in the Loanable Funds Market Students should clearly understand: The definition of a U.S. Federal government budget deficit and why it might exist How the U.S. government “finances” its yearly budget deficits How the economy-wide stock of loanable funds is affected when the U.S. Federal government finances those deficits through bond sales. How equilibrium interest rates in the loanable funds market are affected by U.S. government deficit spending policies and resulting borrowing How higher equilibrium interest rates in the loanable funds market impact private investment borrowing and spending by U.S. firms. Ultimately, how U.S. government deficit spending and how it is financed affects long-term U.S. growth.