* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Limited Liability Partnership

Security (finance) wikipedia , lookup

Private money investing wikipedia , lookup

Hedge (finance) wikipedia , lookup

Special-purpose acquisition company wikipedia , lookup

Investment fund wikipedia , lookup

History of private equity and venture capital wikipedia , lookup

Stock exchange wikipedia , lookup

Short (finance) wikipedia , lookup

Private equity wikipedia , lookup

Leveraged buyout wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Stock selection criterion wikipedia , lookup

Private equity secondary market wikipedia , lookup

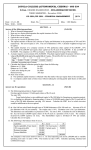

Long Term Sources of Finance FORMS OF BUSINESS OWNERSHIP Sole proprietorship Decision-making is simple Can be set up easily & inexpensively The owner receives all income from business. Income is taxed at only one level (that of the owner). Subject to few regulations Unlimited liability. Limited life of the proprietorship The business has limited access to additional funds. Partnership The general partners are decision-makers. The owners (the partners) divide income according to partnership agreement. Income is taxed once. Set up with ease Few government regulations Unlimited liability for each partner. A limited life of partnership. Limited access to additional funds. Corporation The separation of ownership and decision-making. Distinct legal entity Limited liability The business enterprise has a life in perpetuity Access to additional funds through the sale of new share of stock. Income is distributed according to proportionate ownership. Double taxation on income Regulated by Companies Act Corporation Private Company Minimum 2 persons Maximum Shareholders 50 Public subscription not allowed Restricted rights to transfer shares Promoters enjoy unchallenged control over the firm Firms ability to raise capital is limited Public Company Minimum 7 persons Unlimited Shareholders Public subscription allowed Free transfer of shares Firm can raise substantial funds Cumbersome procedure for Formation • Public Company is the most appropriate form of organisation as – Limited liability – Enormous growth potential – Free and easy transferability of shares Limited Liability Partnership • Limited Liability Partnership form of business has been introduced in India in Dec 2008 • Limited liability of partners. • This form is suitable for small and medium enterprises, service providers, doctors, CAs, lawyers etc. to limit liability and yet have the flexibility of a partnership structure. Limited Liability Partnership Features• Liability of the partners would be limited to the agreed contribution of partners. • Partners would not be liable for independent and unauthorized actions of other partners. • Name of an LLP must end with the words ‘LLP’ • LLPs can have individual, body corporates, including other LLPs, foreign LLPs and Indian as well as foreign companies as partners • No upper limit on maximum number of partners. • The mutual rights and duties of partners shall be governed by an agreement between the partners. Limited Liability Partnership • LLP will have perpetual succession. • The rights of a partner to share the profits and losses are transferable. • LLP will maintain annual accounts • LLP will not be subject to Company Law • Other entities such as firms, companies etc. can convert to LLP. Sources of long term finance • • • • • Retained Earnings Equity Capital Debenture Capital Preference Capital Term Loans Retained Earnings • Retained earnings are profit after tax and dividend. • Internal Source of Finance From Company’s point of view Advantages • Readily available • No additional expenses to raise • No dilution of control Disadvantages • Limited Fund • Opportunity cost is high. Because, it represents the dividends foregone by the shareholders. Shareholder’s Point of view Advantages • Convenient as no hassle of reinvesting. Disadvantages • Lower dividend Debenture Capital • Debentures are instruments for raising long term debt capital • Characteristics Trustee – Bank , Institution, Insurance Company Appointed through a Deed Security – Secured by a charge on assets present and future assets Debenture Redemption Reserve Coupon Rate / Interest Rate - Fixed or floating Maturity Period – fixed maturity period Convertible and Non convertible Evaluation Company’s point of view Upside • • Post tax cost of debentures is lower than shares No dilution of control Downsides • Obligatory payment Investor’s point of view Upside • Stable earnings • Secured Investment Downside • Interest is Fully taxable in the hands of investors • No right to vote Equity Capital • Represents ownership capital • Enjoys the rewards and bear the risks Some Terms • Authorized capital is the amount of capital that a company can potentially issue, as per its memorandum. • The amount offered by the company to the investors is called the Issued Capital. • The part of issued capital which has been subscribed to by the investors represents the Subscribed Capital. • The actual amount paid up by the investors is called the Paid-up Capital. Equity Capital Authorised Capital Say: 10,00,000 Equity Shares of Rs.10 each Issued capital Say :5,00,000 Equity Shares of Rs.10 each Subscribed Capital Say :4,00,000 Equity Shares of Rs.10 each Paid up Capital Say :4,00,000 Equity Shares of Rs.5 each Par Value Face value of the share The stated value on a stock certificate is called the par value. The par of equity shares is generally Rs. 10, or Rs. 100. Issue Price The issue price is the price at which the equity share is issued. –Generally par and issue price are same for new companies When issue price exceeds the par value, the difference is referred as share premium Market Price is the price at which the share is traded in the stock market • Contributed Surplus Usually refers to amounts of directly contributed equity capital in excess of the par value – For example, suppose 1,000 shares of common stock having a par value of Rs.1 each are sold to investors for Rs. 8 per share. The contributed surplus would be (8 – 1) × 1,000 = Rs. 7,000 Rights and position of equity Shareholders • Right to Control – Elect the board – Lack effective control • Right to Income = Profit After Tax – Income of the shareholder is called Dividend – as recommended by the Board – unchallengeable • Pre-emptive right on pro rata basis • Right in liquidation – Residual claim over assets of the firm • Pradhan enterprises has 1,000,000 outstanding equity shares with a par value of Rs.10 and a market value of Rs.20 .The firm plans to issue 500,000 additional equity shares at a price of Rs.12 per share .The market value per share after this issue is expected to drop to Rs.17.33. Now if a shareholder has 100 shares, his financial situation with respect to Pradhan’s equity when he exercises the preemptive rights and when he does not exercise the preemptive rights would be as shown below: Takes Pre-emptive Rights No Pre-emptive Rights Value of initial holding( 20 * 100) Value of initial holding( 20 * 100 = 2000 = 2000 Additional Subscription (12 * 50) = 600 Additional Subscription = 0 Value of equity holding after the additional Issue (17.33 * 150) = 2600 Value of equity holding after the additional Issue (17.33 * 100) =1733 Expected Price = 100*20 + 50*12 = 17.33 150 Evaluation Company’s point of view • Positives • Permanent Capital- no liability for repayment • Dividend Non obligatory • Enhances Creditworthiness Negatives • Investors expect High rate of return/ high cost of capital • Issue cost quite high – Underwriting commission, brokerage costs, publicity cost etc • Dilution of control Shareholder’s point of view Positives • Limited liability • High rewards • Equity dividend exempted from tax Negatives • No say in Dividend matters • Residual claim to income & assets • Risky investment- wide fluctuations in price Preference Capital • A hybrid form of financing- It has some features of Equity and some features of Debentures • Dividend rate is fixed -Not an obligatory payment but dividends get accumulated • Preference dividend is paid out of profit after tax – Not a Tax-deductible payment • • • • Preference over equity shareholders No voting power Convertible into equity Redeemability Evaluation Company’s point of view Upside • • • • No legal obligation to pay dividend No dilution of control Enhances creditworthiness No collateral security Downside • Pay dividend Tax • No tax advantage • Skipping of dividend adversely affects corporate image Shareholder’s point of view Upside • Stable dividend • Dividend exempted from income tax Downside • Can not enforce payment of dividend • Modest returns Term Loans • A source of Debt Finance – – for a period more than a year – For financing Fixed Assets and Working Capital FeaturesSecurity- The borrowing is secured. The assets financed with the loan are termed as Prime Security and other assets of the firm may serve as Collateral securities. Interest- Interest is a fixed obligation. Rate is fixed or floating. Evaluation Company’s point of view Upside • Interest is tax deductible • No dilution of control Down sides • Obligatory payments Lender’s point of view • Fixed Income • Secured loans • No right to vote