* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download The Use of New Economic Decision- Support Tools for - circle-2

General circulation model wikipedia , lookup

Climate resilience wikipedia , lookup

Politics of global warming wikipedia , lookup

Attribution of recent climate change wikipedia , lookup

Solar radiation management wikipedia , lookup

Climate engineering wikipedia , lookup

Media coverage of global warming wikipedia , lookup

Scientific opinion on climate change wikipedia , lookup

Climate governance wikipedia , lookup

Climate sensitivity wikipedia , lookup

Economics of climate change mitigation wikipedia , lookup

Climate change and agriculture wikipedia , lookup

Climate change in Tuvalu wikipedia , lookup

Citizens' Climate Lobby wikipedia , lookup

Public opinion on global warming wikipedia , lookup

Effects of global warming on Australia wikipedia , lookup

Effects of global warming on humans wikipedia , lookup

Surveys of scientists' views on climate change wikipedia , lookup

Years of Living Dangerously wikipedia , lookup

Climate change, industry and society wikipedia , lookup

Climate change and poverty wikipedia , lookup

IPCC Fourth Assessment Report wikipedia , lookup

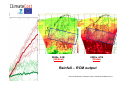

The Use of New Economic DecisionSupport Tools for Adaptation: A review of methods and applications, and guidance on applicability Paul Watkiss and Alistair Hunt Costs and Benefits of Adaptation Economic literature primarily uses scenario based impact assessment Focuses on technical options, where unit costs can be applied e.g. coastal costs per km of dyke, costs of irrigation per ha Adaptation options are assessed for one defined scenario at a time, using an if-then framework (predict and optimise). Using this approach adaptation appears highly beneficial/cost-effective But this doesn’t recognise ‘uncertainty’ Uncertainty can be defined in many ways, but the critical difference in economics is between risk (Prob*Mag) versus uncertainty (no probability) 2080s, A1B (Wettest) 2080s, A1B (Driest) Rainfall – RCM output Source Christensen, Goodess, Harris, Climatic and Watkiss, 2011 What happens when costs and benefits are this uncertain ? • Central tendency is not a useful concept • Not solved by moving to probability or expected values • Results are not helpful for decision making or decision makers • Noting uncertainty not a reason for inaction Change in EAD between the 2080s (2071-2100) and baseline period (1961-1990) for the A1B scenario based on LISFLOOD simulations driven by various regional climate models. Each plate represents the results for one of the 12 model combinations Feyen et al, 2011 Economic Decision Support The existing tools used in economic decision support and socio-economic evaluation / appraisal are not well suited for adaptation Cost-benefit analysis, cost-effectiveness analysis and multi-criteria analysis all problematic, particularly in relation to uncertainty Emerging new economic decision support tools better address uncertainty Real Option Analysis, Robust decision making, Portfolio analysis As part of FP7 work, looking into these methods, working with practical experts Testing (and cross-comparing) on practical adaptation case studies Real Option Analysis (ROA) A financial option gives the investor the right, but not the obligation, to acquire a financial asset in the future (with price reflected in option contract). Options Analysis (OA) helps investigate these decisions, i.e. of uncertainty. Same approaches provide insight for investment decisions in physical assets (hence ‘real’ options) under risk/uncertainty - Real Options Analysis (ROA) ROA relevant when option to invest in an asset, and can adjust timing based on changes in conditions or information, to improve the return on investment – whether to invest or wait. OR when phased projects with multiple stages, adjust the timing, adapt, expand or scale-back the project in response to external events as unfold (flexibility). Sounds useful ! Widely recommended for adaptation, but mis-understood. Many recommending ROA actually discussing adaptive pathways or decision trees! Approach Cash Flow ($) Immediate investment decision point Upper estimate of gross margin Expected (average) gross margin Lower estimate of gross margin Capital cost Now t=0 time t=Tp Now or never” investment option at t=0 Invest now €100m 50% Risk event High revenue €175m, net return = €175-100 = €75m Expected net return = 50%x €75m + 50% x -€25m = €25m 50% Decision point Wait Option to wait until after t=Tp, the expected time of a change that affects the investment 50% Risk event Low revenue €75m , net return = € 75-100 = - €25m High revenue €175m, net return = €175-100 = €75m Expected net return = 50%x €75m + 50% x €0m = €37.5m 50% Don’t invest, net return = €0m Application to Adaptation Works well when: Investment decision is irreversible (major infrastructure) and decision-maker has some flexibility over when to carry out the investment, When potential new and valuable information regarding the success of the investment. Where opportunity cost of waiting, e.g. adaption deficit or long build time (otherwise always wait) There are relevant decision points, and possible to derive an evaluation of possible outcomes with probabilities assigned to these different outcomes. Example UK Treasury (HMT, 2009) has produced guidance on climate change appraisal that recommends real option analysis Provides example to show how ROA can demonstrate higher NPV (expected value) from including flexibility with example of upgradeable sea wall However, highly simplified and does not reflect complexity of real world example -10 +25 Advantages/disadvantages Strengths - information on large investment decisions for adaptation, providing a way to assess in quantitative and economic terms A) the benefits of implementing now versus waiting. B) value of flexibility. Useful way to set out adaptation decisions (with decision trees) – providing a way to conceptualise adaptive management Disadvantages, small set of cases where the approach is likely to be applicable (most current examples are for SLR – as easiest area – difficult to apply other) High complexity, high data requirements, expert application, the need for probabilities, and the need to consider multiple risk points for climate change. Resource intensive, and will not be applicable for most studies because of resource limitations. TE2100 No adaptation presentation is complete without a Thames Estuary 2100 slide Based on a managed adaptive approach to ensure that the right investments are made at the right time. But misconception that TE2100 used ROA – it did not ! And that pathways are ROA – not the same thing ! Robust Decision Making Robust Decision Making (RDM) is a decision support tool that is used in situations of deep uncertainty, where little or no probabilistic information available Premised on the concept of “robustness”, i.e. minimising regret, rather than “optimality” such as with predict-then-act approaches A robust strategy is one that performs reasonably well - compared with alternatives - over a wide range of scenario futures Formal approach (RAND corporation) uses computer-guided modelling interface (Lempert et al, 2003: Groves and Lempert, 2007) and XLRM framework . Test across thousands or even millions of computer-generated future states But also application to climate model uncertainy (only) - Dessai 2007; Hallegatte, 2012 Formal RDM Analysis begins by structuring the problem (and performance measures), then propose alternative strategies Characterises the uncertainties, assigning values for each variable using stakeholder consultation / other Assesses each strategy over a wide range of computer generated scenarios (thousands or millions) Analyse performance measures indicating if pre-selected desirable outcomes have been achieved, i.e. to identify a robust, well performing strategy Summarise key trade-offs among promising strategies e.g. suggest one strategy over another as long as future precipitation likely to remain above threshold Groves et al, 2008 Case Study Lempert and Groves (2010) Southern California’s Riverside County Inland Empire Utilities Agency (IEUA) and Urban Water Management Plan (UWMP) Identify alternative strategies, using decision-tree framework within a Water Evaluation And Planning (WEAP) model environment Identify potentially significant uncertainties Adaptive strategies were presented using decision-tree framework Performance was measured using projected present value (PV) costs in USD billions against PV shortage costs. Findings - many local resource development options, including increasing efficiency and storm water capture, not only reduce vulnerability to climate change, but offer cheaper options in the future than acquiring more expensive imported supplies. Advantages/Disadvantages Good when future uncertainties are poorly characterised and probabilistic information is limited or not available, However, lack of quantitative probabilities with scenarios can make analysis a more subjective decision, influenced by stakeholders’ perception Formal approach very data and resource intensive, and requires expert application Useful for identifying early no regret options, but complex when move to multiple time frames and inter-linkages Most interest is in ‘light-touch’ approach, e.g. just climate projection uncertainty, but misses the issue of wider uncertainty Portfolio Theory and Analysis Evolved from financial markets and use of portfolios of financial assets to maximise the return on the investments subject to a given level of risk Principle is spreading investments over a range of asset types (diversification) spread risks at the same time, reducing dependence on a single asset. PA is a decision support tool that highlights the trade-off between the returns on an investment and the riskiness of that investment, i.e. helps in picking portfolios PA can help in selecting a range of options that, together, are effective over range of possible projected future climates (rather than one option that is best suited to one possible future climate) Advantages/Disadvantages Main strength - provides a structured way of assessing climate change adaptation whilst accounting for (climate change) uncertainty in a way that consideration of individual adaptation options does not allow. Returns can be measured widely: physical effectiveness, cost effectiveness, or economic efficiency Disadvantage relies on availability on effectiveness (return) and (co-variance) Requires probability, ranking of uncertainty (or else assumptions that different outcomes equally likely) Harder to assess effectiveness and co-variance for some impact/risk categories, e.g. where attribution to climate change is less straightforward, effectiveness of adaptation actions are not easily measured or identified. Additional complexity of option inter-dependence Some overall observations While powerful, all of these are technically complex approaches to apply They work well for specific applications – not all cases For formal application, large resources involved – and considerable expertise Likely to mean niche applications, where large potential costs are involved Unlikely to be generally applicable, i.e. not possible to download off the web Most interesting question is whether possible to take the general concepts and simplify for more general application, or use elements (e.g. decision trees) Help decision makers ‘muddle through’ complex decisions Guidance on when approaches useful – which techniques for different problems Economic decision making under uncertainty Decision Support Tool Brief Description Usefulness & limitations in climate adaptation context Real Options Analysis (ROA) ROA extends the principles of CBA to allow economic analysis of learning, delay and future option values, thus providing context to decisions under uncertainty. It can also provide economic analysis on the benefits of flexibility and value information that reduces the uncertainty relating to climate risks. Most useful for: -Large irreversible capital intensive investment, with potential for learning (especially when long decision/construction lifetime; Climate risk probabilities are known or range is bounded Informal ROA (decision trees) Informal application of the decision trees used in As above, but wider application due to ROA with formal economic appraisal (rather than less focus on probabilities, and economic formalised ROA analysis). option value. Portfolio Analysis (PA) PA allows an explicit trade-off to be made between the return – measured e.g. in net benefit terms (from CBA) – and the uncertainty of that return – measured by the variance – of alternative combinations (portfolios) of adaptation options, under alternative climate change projections. Robust Decision Making RDM quantifies the trade-offs implied by (RDM) adopting adaptation options that address possible vulnerabilities under future uncertainty, compared with other criteria such as economic efficiency, stress testing options against large numbers of future scenarios. Most useful when: -A number of adaptation actions are likely to be complementary in reducing climate risks. Most useful when: -Deep uncertainty. Scenarios of alternative climate, socioeconomic and vulnerability futures can be constructed, and data for their characterisation is available. Coming soon…..