* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download AAA Video Games EIS Fund

Private equity in the 2000s wikipedia , lookup

Special-purpose acquisition company wikipedia , lookup

Capital gains tax in the United States wikipedia , lookup

Private equity wikipedia , lookup

Stock trader wikipedia , lookup

Private equity secondary market wikipedia , lookup

Investment banking wikipedia , lookup

Corporate venture capital wikipedia , lookup

Negative gearing wikipedia , lookup

Capital gains tax in Australia wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

International investment agreement wikipedia , lookup

Investor-state dispute settlement wikipedia , lookup

Mutual fund wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

Early history of private equity wikipedia , lookup

Socially responsible investing wikipedia , lookup

Private money investing wikipedia , lookup

AAA Video Games EIS Fund

INFORMATION MEMORANDUM > 2016/17

INFORMATION MEMORANDUM

CONTENTS

IMPORTANT INFORMATION

4

PARTIES

6

PART 1 > SUMMARY

7

PART 2 > INVESTMENT OPPORTUNITY 9

PART 3 > THE MANAGER AND THE GAMES ADVISERS

16

PART 4 > PORTFOLIO STRUCTURE, OFFER DETAILS AND FEES

18

PART 5 > RISK FACTORS

21

PART 6 > TAX BENEFITS

25

PART 7 > MECHANICS OF THE FUND

28

PART 8 > DEFINITIONS

29

PART 9 > FUND MANAGEMENT AGREEMENT

32

3

• AAA VIDEO GAMES EIS FUND

4

[This page intentionally left blank ]

INFORMATION MEMORANDUM

IMPORTANT INFORMATION

THIS NOTICE IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION

If you are in any doubt about the content of this Information Memorandum (Information Memorandum) and/or any

action you should take, you are strongly recommended to seek advice immediately from an independent financial

adviser authorised under the Financial Services and Markets Act 2000 (FSMA) who specialises in advising on

investment opportunities of this type. Nothing in this Information Memorandum constitutes investment, tax, legal or

other advice by Daedalus Partners LLP (Daedalus or the Manager) or the Games Advisers and your attention is drawn

to the section headed “Risk Factors” on page 21. An investment in the AAA Video Games EIS Fund (the Fund) will not

be suitable for all recipients of this Information Memorandum.

This Information Memorandum constitutes a financial promotion pursuant to Section 21 of the FSMA and is issued by

Daedalus Partners LLP, 4th Floor, 59 Grosvenor Street, London W1K 3HZ, registered in England and Wales as a limited

liability partnership with the registered number OC365551 and authorised and regulated by the Financial Conduct

Authority in the United Kingdom with firm reference number 564221. The Manager is unable to give investment or

taxation advice or to advise on the suitability and appropriateness of the Fund.

This document has been approved by Daedalus for distribution to potential investors who are existing clients of FCAauthorised firms that will have confirmed that an investment in non-readily realisable securities is suitable for them in

accordance with COBS 4.7.8 (2), or persons who meet the criteria for being a professional client in accordance with

COBS 3.5. By accepting this Information Memorandum, the recipient represents and warrants to the Manager that he/

she is a person who falls within one of the above categories in respect of whom the Manager has approved it as a

financial promotion. This Information Memorandum is not to be disclosed to any other person or used for any other

purpose. Any other person who receives this document should not rely on it.

The Manager has taken all reasonable care to ensure that the facts stated in this Information Memorandum are true

and accurate in all material respects and that there are no material facts in respect of which omission would make any

statement, fact or opinion in this Information Memorandum misleading. Delivery of this Information Memorandum shall

not give rise to any implication that there has been no change in the facts set out in this Information Memorandum

since the date hereof or that the information contained herein is correct as of any time subsequent to such date. The

Manager accepts responsibility accordingly. This document is not intended to constitute a recommendation or provide

advice of any sort to any prospective investor.

Any references to tax laws or rates in this Information Memorandum are subject to change. Past performance is not

a guide to the future performance and may not be repeated. The value of your investment can go down as well

as up and you may not get back the full amount invested. You should consider an investment in the Fund as a

medium to long-term investment. Investments made by the Fund are likely to be illiquid.

No person has been authorised to give any information or to make any representation concerning the Fund other

than the information contained in this Information Memorandum or in connection with any material or information

referred to in it and, if given or made, such information or representation must not be relied upon. This Information

Memorandum does not constitute an offer to sell or a solicitation of an offer to purchase securities and, in particular,

does not constitute an offering in any state, country or other jurisdiction where, or to any person or entity to which an

offer or sale would be prohibited.

This Information Memorandum contains information relating to an investment in the Fund. An investment may only be

made on the basis of this Information Memorandum and the Fund Management Agreement. All statements of opinion

or belief contained in this Information Memorandum and all views expressed and statements made regarding future

events represent the Manager’s own assessment and interpretation of information available to them as at the date

of this Information Memorandum. No representation is made, or assurance given, that such statements or views are

correct or that the objectives of the Fund will be achieved. Prospective investors must determine for themselves what

reliance (if any) they should place on such statements or views and no responsibility is accepted by the Manager in

respect thereof.

5

• AAA VIDEO GAMES EIS FUND

PARTIES

Fund Manager

Daedalus Partners LLP

59 Grosvenor Street

London

W1K 3HZ

EIS Tax Adviser

Olswang LLP

90 High Holborn

London

WC1V 6XX

Fund Administrator & Custodian

Woodside Corporate Services Limited

4th Floor

50 Mark Lane

London

EC3R 7QR

6

Nominee

WCS Nominees Ltd

4th Floor

50 Mark Lane

London

EC3R 7QR

INFORMATION MEMORANDUM

PART 1 > SUMMARY

The following is a summary of the key points pertaining to the opportunity for subscription to the Fund and should be

read in conjunction with the full text of this Information Memorandum.

Investment Opportunity

Key Features of the Fund

The AAA Video Games EIS Fund (the “Fund”) will invest in

EIS qualifying businesses engaged in the development and

exploitation of video games based on globally renowned

Entertainment Franchises.

•Potential for significant uncapped returns

Investment risk will be partially diversified through the

Fund’s investment across a range of companies (each a

“Company”) with each Investor receiving a pro-rata interest

in each Company.

•

•The Manager and Games Advisers are both highly

experienced in the video games sector

•

Careful management of downside risk through:

-creating games based on successful, wellestablished Entertainment Franchises;

-securing minimum guaranteed revenue streams

via commercial publishing arrangements with

major global video games distributors;

-securing attractive UK video game production

tax credits; and

-further downside protection resulting from the tax

benefits of the Enterprise Investment Scheme.

Investment risk will be further mitigated by each Company

securing minimum guaranteed revenues from a major

global video game distributor and video game production

tax credits, which should collectively be worth 70% of each

Company’s video game development budget.

The Fund will be managed by Daedalus Partners LLP, an

award-winning Fund Manager with extensive experience of

the software entertainment sector, having invested in more

than 70 individual video game businesses since 2013.

The Companies will be carefully selected for their ability to

deliver an attractive risk/return profile through a combination

of exploiting high quality, well-known intellectual property

and entering into commercial exploitation deals with major

international video games publishers.

All proceeds of the Fund are intended to be deployed into

EIS Qualifying Shares during the 2016/17 tax year, with

HMRC advance assurance secured prior to any investment.

Benefits of the EIS

The Enterprise Investment Scheme (“EIS”) comprises

a variety of tax benefits available to UK tax paying

individuals, subject to investments complying with the

relevant conditions and requirements. The tax benefits

include:

•

30% income tax relief on investments of up to

£1,000,000 per tax year, reducing the net cost of

investment to 70p per £1

•Unlimited Capital Gains Tax deferral

•No Capital Gains Tax payable on gains realised on

the disposal of the investment if held for a minimum

of 3 years

Success-based fee structure

Costs

•Each Company will pay a one-off Evaluation Fee to

the Manager equivalent to 2% of the capital invested

(or 5% in respect of Professional Investors) plus

a fixed Annual Monitoring Fee of 1%. The Annual

Monitoring Fee will be deferred until the Investors

in the Fund have recovered at least 100% of their

investment.

•Annual Custodian Fees up to a maximum of 0.3%,

charged to the Companies.

•

A Performance Fee equivalent to 20% of any

distributions (or amounts realised/payable) to the

EIS shareholders of each Company, subject to the

Investors in the Fund first receiving 110p per 100p

invested (ignoring any EIS tax reliefs) across the

portfolio. The Performance Fee increases to an

amount up to 45% once the Investors have received

200p per 100p invested across the portfolio.

•

The above Performance Fee will be calculated

at the aggregate level of the Fund, not on a

Company by Company basis.

•Tax relief on shares disposed at a loss. This means

that a 45% taxpayer with sufficient income in the year

of disposal may reduce their capital at risk to 38.5p

per £1 invested

•Reasonable third party expenses incurred by, and

costs of, the Manager and its affiliates in managing,

administering and providing services to the Fund

and its investments may be charged to the Fund or

the Companies.

•100% relief from inheritance tax for investments held

for more than 2 years, or immediately if investment

qualifies as replacement property

Offer Details

How to Apply

After reading the Information Memorandum and

Fund Management Agreement please complete the

Application Form and send to Woodside Corporate

Services, 4th Floor, 50 Mark Lane, London, EC3R 7QR.

1 Subject to the Manager’s discretion to extend or shorten the close date.

2 Subject to the Manager’s discretion to accept lower amounts.

3 Subject to the Manager’s discretion to increase the Fund size

•

Closing Date: 31 March 20171

•

Minimum Investment: £10,0002

•

Minimum Fund Size: £8 million

•

Maximum Fund Size: £15 million3

7

• AAA VIDEO GAMES EIS FUND

Risks

Investment in the Fund involves a high degree of risk. Past performance is not a guide to future performance

and may not be repeated. The value of investments can go down as well as up and you could lose part or all

of your capital invested. You should consider the Fund to be a medium to long term investment and that the

investments made by the Fund are likely to be illiquid. Investors are strongly advised to seek independent

legal, financial and tax advice before making a decision to invest.

Full details of the risk factors and associated mitigation strategies can be found in Part 5 of this Information Memorandum.

8

INFORMATION MEMORANDUM

PART 2 > INVESTMENT OPPORTUNITY

1.Summary

The AAA Video Games EIS Fund offers Investors access to EIS qualifying companies creating and exploiting high

profile video games via major international publishers, with each title based on a globally recognisable film, television,

book or social media franchise (“Entertainment Franchise”).

Each Investor will receive a pro-rata interest in each Company (and together, “Companies”) into which the Fund invests.

Daedalus Partners LLP specialises in the design, implementation and management of alternative investment

opportunities, principally across the video games & interactive entertainment, media, leisure and telecoms sectors.

The Manager currently manages £110 million of investments which qualify for the benefits of the Enterprise Investment

Scheme (“EIS”) and £30 million qualifying for the benefits under the Seed Enterprise Investment Scheme (“SEIS”).

The Fund will benefit from the extensive knowledge, experience and network of industry relationships of both the

Manager and Games Advisers. The Manager has invested capital into over 70 companies operating in the video games

sector and in that time has built up a large network of games developers, publishers and other industry contacts.

The Games Advisers consists of a creative team headed by a major video games producer, manager and creative

director who has held senior management posts at Sony Computer Entertainment, Eidos, Disney Interactive and The

Imaginarium Studios.

The Manager is seeking to raise up to £15 million of capital for the Fund, which is expected to close on 31 March 2017.

2. Investment Objective

The Fund aims to invest in a portfolio of Companies with the objective of maximising potential returns while managing

risk for Investors. The Fund will target specific platforms within the video games sector, namely businesses focusing

on the development of premium digital titles for console and PCs, as opposed to mobile devices. An investment

opportunity exists to create new games based upon high profile Entertainment Franchises from the world of film,

television, books and social media.

A principle benefit of developing a game backed by recognised IP is that, in contrast to an entirely new concept,

publishers are better able to forecast expected revenues due to the existence of an established and quantifiable fan

base and past sales data. Publishers are therefore more willing to support developers of such titles through guaranteed

minimum revenue arrangements and more favourable commercial terms. In addition, one of the major risks associated

with the release of a new game, that of achieving visibility in a highly crowded marketplace, is materially reduced with

an Entertainment Franchise-led title, thereby helping to reduce promotional costs and increase profits.

Thus, each Company in the Fund is expected to benefit from a carefully blended revenue model involving a mix of

minimum guaranteed revenues from major games publishers or distributors, the UK video game production tax credit

and unit sales. The Manager believes that this model offers an attractive risk profile as it should allow each Company to

more accurately forecast a base level of revenue, whilst offering scope for further uncapped upside potential. In order

to achieve this profile, the Manager has identified a suite of Minimum Criteria (see page 13 “Minimum Criteria”), which

must be met prior to each Company committing to a project.

3. Industry Overview

The Manager believes that there are a number of compelling and complementary trends making an investment in the

software entertainment sector especially timely. Video games are increasingly embedded in culture and society across

the world and are a top entertainment medium, selling more at retail and via digital distribution in 2013 than home

video, and over twice as much as music. Broadly, the video games industry is split into 2 distinct segments:

PC and Console

Traditional gaming, by far and away the largest of share of total gaming revenues at 72%, comprises paid for titles on

powerful PC and games console machines. This includes physical (disc-based) game sales at retail (both physical and

9

• AAA VIDEO GAMES EIS FUND

online retailers) and digital download sales (through platforms such as Steam, Good Old Games and Origin for PCs,

and the PlayStation Store, Xbox Games Store and Nintendo eShop for consoles).

Mobile (Social / Casual)

Social/casual gaming revenues includes those titles monetising through in app-purchases, advertising and paid

downloads on tablets and smartphones, alongside internet browser based games.

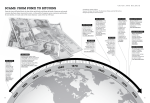

4. Global Video Games Market

(Revenues $bn)

100

90

80

70

60

50

40

30

20

10

10

0

2010201120122013201420152016201720182019

PC

Console

Social/casual

The global video game market was worth $71.27bn in 2015 and is anticipated to rise by an average 4.8% a year to

$90.07bn by 20204.

This year sees the release of the first high-end consumer-ready virtual reality (VR) headsets from Oculus, Sony, and

HTC, with others set to follow. While these will initially be the preserve of serious gamers, requiring a US$600 headset

plus a US$1,000–US$1,500 gaming desktop (or a PS4 in Sony’s case), the quality of the experience such devices offer

will set the scene for a wider consumer sales drive in 2017 and 2018. However the content-based business models

for VR devices will take longer to develop – and significant revenues in this space are not expected to arrive until 2018

and beyond.

In contrast, VR on mobile devices (with cheaper headsets) have become mainstream in 2016. Google and Samsung

(along with others) are selling or giving away adapters, enabling anyone with a new smartphone and even a passing

interest in mobile VR an opportunity to try it. The experiences on offer for these mobile headsets will be limited compared

with Oculus Rift or Sony Morpheus, but VR video and simple gameplay still work surprisingly well (although battery life,

overheating, connectivity and the “lag” associated with “VR nausea” are still problematic).

The UK is widely acknowledged as a world-class location for the development of entertainment content boasting a

deep and highly qualified talent pool of over 30,000 people, amongst the finest games studios in the world, technical

as well as creative excellence, an ongoing ability to produce products that sell well internationally and the creativity to

originate innovative intellectual property. It is home to renowned businesses that have developed billion dollar gaming

franchises such as Grand Theft Auto (the fastest selling entertainment product of all time), Sniper Elite, Batman and

Lego, whilst contributing £1.12bn annually to UK GDP5.

4 PwC Media & Entertainment Outlook 2014-2018

5 TIGA

INFORMATION MEMORANDUM

The Manager believes that attractive investment opportunities will continue to exist, driven by fast evolving consumer

behaviour, technological advancements in developer tools and government policy. Further, the means by which

consumers can now engage with entertainment applications is also rapidly changing. There is a continually evolving

suite of digital hardware technologies available to end users with a different gaming experience and levels of

interactivity – be it a PC, console, tablets and smartphones or virtual reality headsets.

Traditional gaming, in the form of titles for PC and console devices, continues to show remarkable strength underpinned

by the development of new ways to play games, alternate business models and a shift from physical to digital products.

Total console games revenue was $26.34bn in 2015, having recovered from the impact of both the recession in major

console markets (US, UK, Spain and Japan) and the classic slump in spending that occurs every time there is a

generation shift in hardware (e.g. from Xbox to Xbox 360 to Xbox One). In the PC segment, the ongoing growth of the

massive online/micro-transaction market remained the principle driver, with this business model benefiting from having

true global appeal compared to digital game stores, and embracing all PC owners rather than just the small proportion

with gaming spec-PCs and higher spending power. The advent of both PC-based cloud gaming services and the rising

popularity of e-sports has also helped.

Technological changes continue to remove industry barriers to entry by reducing costs and disaggregating traditional

parts of the value chain. Consequently, even the most modest of investments can now comfortably deliver an entirely

original, and highly playable, game that can played globally.

5. Investment Focus on Console and PC Games

Mobile gaming has become an exceptionally crowded and competitive marketplace over recent years. Recent figures

from Pocketgamer show that the number of games on Apple’s App Store has swelled from 45,000 to over 655,000

over the last 8 years. Indeed, during the first 6 months of 2016, there were an average of 716 new games submitted to

the App Store every day. This, coupled with the fact that the majority of games are either free-to-play or priced below

$3/unit, makes it very difficult for developers to make money unless a major publisher has the confidence to spend

significant sums on risky user-acquisition campaigns in order to drive chart visibility and ensuing sales.

Mobile games are also much cheaper to produce than console and PC titles, as smartphone and tablet devices are far

less powerful and so the games themselves must be smaller and less sophisticated. Meanwhile, licenced developer

tools, such as Unity 3D and the Unreal Engine, which can provide the core components that comprise a game engine,

have made the process of creating games from scratch much quicker and straightforward. As a result, the barriers to

entry into the mobile developer space are very low.

To compound it all, mobile games typically target “casual players” who by their very nature are less likely to be loyal to a

particular series or category of game, apart from a small handful of exceptions. In fact, according to internet strategist,

Michael Wolf, the top 10 grossing mobile games account for 25% of total global mobile sales, while just 0.19% of

players contribute 48% of all mobile game revenues. Taking together all of the aforementioned factors, the merits of

investing in the mobile gaming sector have waned significantly.

Contrastingly, players of console and PC games are used to paying for new content, with high quality titles generally

commanding an initial retail price of between $40 - $60 and indie (independently developed) games around the $30 $40 mark. Therefore, games released in this segment of the market do not require the same unit volumes that a typical

mobile app might in order to generate meaningful revenues. It is unsurprising, therefore, that revenues from PC and

console video games represent over 72% of the overall global video games market in 2016.

Furthermore, technological advances in gaming hardware have changed the outlook for PC and console gamers. The

development of virtual reality headsets such as the Oculus Rift, PlayStation VR, Samsung’s Gear VR and HTC Vive all

offer the next evolution in immersive gaming. With Christmas 2016 set to be the launch pad for these VR platforms, this

presents a huge future growth opportunity for game developers to create suitable content to nurture the “VR” market

over the coming years.

In common with the mobile market, the PC and console sector is dominated by a handful of large studios focusing

on blockbuster franchise titles: Activision Blizzard, Electronic Arts, ZeniMax, Take Two Interactive, Square Enix, Capcom

and Konami. It is not unheard of for these studios to regularly produce games costing in excess of $100 million and to

support the release with an equivalent level of marketing expenditure. For example, Grand Theft Auto V from Take Two

8 http://store.steampowered.com/stats/ - February 2016

9 PwC Media & Entertainment Outlook 2013-2017

10 ibid

11

• AAA VIDEO GAMES EIS FUND

had a reported production budget of $137 million and the 2013 launch was accompanied by a promotional campaign

amounting to $128 million – yet the game broke industry records grossing $800 million from 11.2 million copies on its

first day of release, and to date has sold 65 million units worldwide.

The risks of investing in entirely new gaming concepts are very high, which is why the efforts of the large studios are

primarily directed towards sequels of in-house gaming franchises (Call of Duty, Grand Theft Auto, Assassin’s Creed,

Battlefield). In the past, these same studios might have partnered with owners of well-known entertainment properties

(Harry Potter, James Bond, Lord of the Rings), and while this occasionally still is the case (Lego, Batman), the incidences

are becoming fewer and far between as self-developed, established brands prove more financially lucrative to them. It

therefore befalls the indie sector, with budgets typically ranging from $0.5m - $2m mark, to focus on the development of

new intellectual properties and run the material risk of failing to either deliver the game or generate enough awareness

amongst players in this more fragmented, and competitive, end of the PC and console market.

6. Target Projects

The Manager and the Games Advisers believe they have identified a potentially highly lucrative sub sector of the PC

and console video games development market. The strategy will be to specifically invest in Companies developing

games with a production cost of approximately $5million that are based upon globally renowned film, television, book

or social media franchises and which can substantiate projected digital sales of 1 million units and above.

The advantages of this approach are:

•Development costs have decreased dramatically over the past decade, with the advances in middleware tools

and motion capture technology meaning that the proposed production budgets should deliver games of a much

higher aesthetic quality than indie (independently developed) projects, while also benchmarking well against high

profile titles;

•Players of PC and console games are used to paying for games, unlike those in the mobile market, which places

much less pressure on unit volumes to recoup costs and yield profits;

12

•By building the game around a successful Entertainment Franchise, this significantly reduces the associated

marketing costs and performance risks, thereby making the title much more attractive to major global publishers,

especially if it can be timed to coincide with the release of the next film or television season;

•Currently, entertainment licensors such as the large Hollywood studios are more focused on the mobile gaming

market and therefore, the cost of acquiring a license for PC and console developments is relatively low compared

with historically;

•With an existing audience attached to the franchise, it should be possible to negotiate prior to production presales or minimum guarantee arrangements with potential distribution partners of the game, thereby assisting with

the overall management of risk; and

•Licensors of high profile intellectual properties will only entrust these valuable assets to teams possessing proven

track records of delivery and success, which is an attractive barrier to entry.

Through their extensive network of industry contacts and relationships, both the Manager and Games Advisers are very

confident of identifying a strong pipeline of businesses undertaking development projects that accord with the specific

profile described above.

7.Revenues

Each Company will look to earn income through a combination of the following revenue sources:

•Contractual commitments from buyers, such as major video game publishers or distributors, entered into before

commencement of the video game development, to purchase the distribution rights to the game from the Company

(minimum guaranteed revenues);

•Government-backed incentives and subsidies designed to encourage the growth of the UK video games industry.

For example, the Video Games Tax Relief (VGTR), which was introduced on 1 April 2014 allows UK based video

game development companies to claim an additional tax deduction, based on their qualifying expenditure on the

relevant video game, effectively reducing their development costs; and

•Exploitation rights over and above any minimum guaranteed revenues, offering the potential for significant,

uncapped upside.

By targeting video game developments which benefit from licensing established IP, Companies will be able to maximise

minimum guaranteed revenues and better assess the future potential commercial prospects of the game.

INFORMATION MEMORANDUM

8. Minimum criteria

Each Company in the Fund will be engaged in the development and exploitation of high quality video games for

the PC and console market and be backed by a major publisher or distributor.

Before a Company receives any investment from the Fund, the Manager and Games Advisers must be satisfied

that it will adhere to the following Minimum Criteria in respect of each project it undertakes:

(a) Minimum guaranteed revenues contractually agreed with a publisher or distributor equivalent to at least 50%

of its project development and exploitation budget;

(b) Relevant qualifying conditions will be met to secure further economic incentives equivalent to at least 20%

of its total development budget (or a combination of (a) and (b), collectively equivalent to at least 70% of the

total budget);

(c) Independently sourced sales estimates equal to at least 2x the total development and exploitation budget;

(d) Retention by the Company of any rights to future revenues or to further exploit the video game beyond the

minimum guaranteed revenues; and

(e) Retention by the Company of sole exploitation rights of the video game.

Each Company will have a minimum of three Directors. A commitment to develop a game can only be made with

unanimous agreement that the proposed development meets the above Minimum Criteria.

Within each Company, one of its Directors will be a representative of the Manager, one Director will be appointed on

behalf of the Games Advisers and a third party Director will be independent of the Manager and Games Advisers.

All Directors must approve all due diligence before committing the Company to each development.

Investments will only be made into Companies which have received advance assurance from HMRC that they

should qualify for the tax reliefs under the EIS.

9. Investment Policy

The Manager intends to work closely with the Games Advisers, who will be responsible for identifying and

initially evaluating prospective Companies, including analysis of their targeted video game productions, for

recommendation to the Manager. The Games Advisers will also oversee the Companies alongside the Manager

once the Fund has invested in them.

The Fund intends to deploy its capital across at least two (up to a maximum of three) individual Companies which

meet the Minimum Criteria, subject to a maximum investment of £5,000,000 per Company. The amount invested

by the Fund into each Company may not be split equally and may vary according to the capital requirements of

each Company.

Each Company will adopt a similar target business model, but will carry on its own trade independently, thus

delivering its own unique risk/reward profile and assisting in the diversification of risk.

10.Financial Illustration

It is anticipated that Investors’ returns from the Fund will be derived predominantly through a realisation of shares

in each Company after three years (the Minimum Period). Following the expiry of the expected Minimum Period of

trade, the Manager will consider all options available to maximise the value of the Fund’s portfolio.

Investors should be aware that the Fund will be invested in unquoted companies and consequently, the shares are

likely to be highly illiquid, since there is currently no active market in such securities. For illustrative purposes, it

has been assumed that a disposal of the Fund’s investments occurs three years and six months after the Closing

Date.

The Financial Illustration shown overleaf is net of all related fees, charges, expenses and taxes and are contingent

on the number, size and performance of the video games completed by each Company over a three and a half

year timeframe.

13

• AAA VIDEO GAMES EIS FUND

Summary Financial Illustrations

Target Return (£)

Cost of Investment

100,000

Less Income Tax Relief at 30%

(30,000)

Net cost of Investment

70,000

Investment Return

125,000

Total Return including EIS Tax Relief

155,000

Total Return on Net Investment

79%

Average Annual Return (3.5 years)

22%

Average Gross Equivalent Annual Return (assuming a 45% taxpayer)

41%

The above returns are set out for illustrative purposes only and are not a reliable indicator of future

performance. The Fund will be invested in small companies and an Investor may not receive any Investment

Proceeds and may lose the entirety of their investment.

Investors’ attention is drawn to the information set out in the front of this Information Memorandum and the

“Risk Factors” section in Part 5 of this Information Memorandum.

11.Monitoring of Investments

14

The Manager and Games Advisers will play an active role in monitoring and managing the performance of the Companies

and in ensuring that the rights and interests of the Fund are appropriately preserved and exercised, where applicable.

To achieve this, one or more of the Games Advisers will be appointed to the board of each of the Companies as a condition

of investment being made by the Fund. This will enable the Manager, via the Games Advisers, to directly influence the

principal operating and strategic decisions of the business to ensure that they accord with the mandate of the Fund.

Through the Fund, each of the Companies will gain access to a team of qualified individuals experienced in production

strategy, finance and operations, all of which are essential inputs for the Companies’ success and are provided without

the costs of paying external consultants or hiring equivalent staff. This frees up each of the Companies’ Directors and

wider management teams or staff to focus precisely on where they add the most value, which is utilising their specialist

expertise and knowledge to create and exploit new video games.

12.Tax Reliefs

An investment in the Fund is expected to benefit from the tax advantages offered by the EIS. Shareholders in EIS qualifying

companies can, depending upon their individual circumstances, enjoy some or all of the following benefits:

•30% income tax relief, reducing the initial cost of investment to 70p per 100p invested. Relief may be claimed in

the financial year in which the Fund invests in EIS Qualifying Shares. Alternatively an Investor may elect to treat EIS

Qualifying Shares as though subscribed for in the previous financial year;

•Exemption from capital gains tax (CGT) on gains made from the disposal of EIS shares, provided that income tax

relief has been claimed and retained in respect of those shares, and the shares have been held for a minimum of

3 years;

•Unlimited CGT deferral on capital gains realised in the three years prior to, or up to 12 months after, subscription for

shares, up to the amount subscribed;

•Income tax or CGT relief for any loss (net of the initial income tax relief obtained) made on the disposal of EIS shares,

either in the year of the loss or the previous tax year; and

•Business Relief from inheritance tax (IHT Relief) if shares are held at the date of IHT charge providing the shares have

been held by the Investor for more than two years while each company is trading. There is no limit on the amount of

investment qualifying for this exemption.

INFORMATION MEMORANDUM

The maximum amount of income tax relief which a Shareholder may claim by virtue of investment in EIS qualifying

companies is £1,000,000 in the current tax year. There is no limit to the amount of gains that can be deferred for CGT

purposes.

The above section provides only a brief summary of the tax reliefs available under the EIS. A more detailed explanation

of the tax advantages and conditions can be found in Part 6.

13.Liquidity

Each Investor will have an interest in the Fund that is pro-rata to the investment they make. The Fund will use the

investment proceeds to subscribe for EIS Qualifying Shares in unquoted companies, where there will be no active

market. As such, Investors will most likely be dependent upon a realisation of the Fund investments by the Manager to

redeem their investments. The Manager will consider options for realising value from the Fund portfolio, and returning

funds to Investors, from the end of the Minimum Period onwards. The investment into the Companies is not expected

to be readily marketable or realisable and an investment in the Fund should be considered illiquid.

14.Target Market

This opportunity is likely to be appropriate for individuals looking for a medium to long term investment and whose

personal circumstances allow them to access the EIS Reliefs, such that they are able to avail themselves of income tax

relief and/or capital gains deferral relief. The minimum investment in the Fund is £10,000.

15

• AAA VIDEO GAMES EIS FUND

PART 3 > THE MANAGER

AND THE GAMES ADVISERS

The Manager

Daedalus Partner LLP is the Manager and consists of:

Gavin Harrison - Investment Manager

Gavin co-founded Daedalus in 2011, and is responsible for the implementation and management of investments

predominantly in the Software Entertainment sector. Since 2013, Gavin has overseen investments into more than 70

independent video games across mobile, PC and console platforms, with a number of these titles being picked by

major international distributors such as Electronic Arts, Square Enix, Sony Entertainment, Green Man Gaming, Touch

Press and Team 17.

Prior to forming Daedalus, Gavin was extensively involved in originating and structuring a wide range of media, real

estate and renewable energy investments, including EIS qualifying investments. He has also worked as a Finance

Controller for a number of film and music businesses and began his career at Arthur Andersen advising large financial

services clients. Gavin is a Fellow of the Institute of Chartered Accountants in England and Wales and holds the

Investment Management Certificate.

Stephen Norton

16

Stephen co-founded Daedalus in 2011 and is responsible for origination and financial evaluation of new investment

opportunities. Stephen is currently responsible for Daedalus’ fund investments in the Telecoms, Bandwidth, Real Estate

and Restaurants sectors. Prior to forming Daedalus, Stephen was the Chief Operating Officer of a leading alternative

investment firm. He has also worked as the Head of Finance at FilmFour and held a number of senior posts at Channel

4 Television. Stephen is a qualified chartered accountant and holds an MBA from CASS Business School and is a

chartered member of the Chartered Institute of Securities and Investment.

Nick Astaire

Nick has over 15 years’ experience in the financial services industry, having originally qualified as a stockbroker and

has worked for the last 10 years in structured investments, with particular focus in the media, real estate and smaller

company sectors. Prior to joining Daedalus, Nick was one of the founding partners of an alternative investment boutique

that funded over £350m of investments between 2009 and 2014. Nick holds the Investment Management Certificate.

Anna Long

Anna has over 8 years’ experience in the legal and financial services industry and prior to joining Daedalus was at a

leading alternative investment firm. Anna has overseen investments in Media, Telecoms and the Leisure sectors. Anna

is a Law graduate from King’s College London and holds the Investment Management Certificate.

INFORMATION MEMORANDUM

THE GAMES ADVISERS

The Games Advisers are:

Martin Alltimes

Martin is an interactive creative, business development and video game production executive who has developed

award-winning studios and has been responsible for a string of critically-acclaimed and highly successful original

content and AAA video game titles over the past 19 years. Martin began his career at Sony Computer Entertainment

Europe, where he developed, sourced and signed AAA franchises including ‘Killzone’ (Guerilla Games) and ‘WRC

Rally’ (Evolution Studios). Martin then joined Eidos, the global games giant now better known as Square Enix, where

he spearheaded the company’s EMEA-based external development initiatives. Under his leadership, the business

generated over 10 titles including ‘Just Cause’, the company’s most successful new IP in the last 10 years. More

recently, as VP of Emerging Properties at Disney Interactive, Martin built the console group’s ‘Free-to-Play’ business

from the ground up, and drove the acquisition of award-winning studios.

Barry O’Neill

Barry has a 10 year track record in the games industry and specialises in value maximization of video game rights,

originally having co-founded Upstart Games, the Tokyo, New York and Dublin based mobile games publisher. Upstart

Games was sold in 2006 for $15M USD, delivering a return exceeding 3x for its original investors. Barry is currently the

Chairman of Games Ireland and CEO of Touch Press Inc., a new venture which incorporates StoryToys (where he was

founder and CEO), Amplify and Touchpress apps. StoryToys is a leading developer and publisher of a series of iPad

interactive book-apps based on the Brothers Grimm fairy tales and well known children's characters such as Elmo,

Chugginton and The Very Hungry Caterpillar. The merger represents an unprecedented investment in educational

games, apps and reference content. Touch Press Inc’s Series A round was led by an investment vehicle backed by

Emerson Collective, which is founded and run by Laurene Powell Jobs, the widow of Steve Jobs.

Prior to this, Barry headed up Japanese games giant Namco Bandai’s European “networks” business. While there, he

spearheaded the development and launch of high profile content such as PAC-MAN, Dr. Kawashima and Tekken on to

new platforms including Facebook, iPhone, Android and PlayStation Network.

17

• AAA VIDEO GAMES EIS FUND

PART 4 > PORTFOLIO STRUCTURE,

OFFER DETAILS AND FEES

1. Portfolio Structure

The Fund is an alternative investment fund (AIF), pursuant to the EU Alternative Investment Fund Managers Directive

(AIFMD). The Fund has been structured as an “unapproved investment fund” for the purposes of the EIS legislation,

but is not a separate legal entity in its own right. Rather, each Investor adheres to the Fund Management Agreement

attached to this Information Memorandum. The Fund does not constitute a collective investment scheme nor a nonmainstream pooled investment, by virtue of meeting the definition in paragraph 2 of the Schedule to the Financial

Services and Markets Act 2000 (Collective Investment Schemes) Order 2001.

The proceeds of the Fund will be aggregated for the purposes of making investments and the Manager will use these

monies to subscribe for shares in Companies on their behalf. Consequently, Investors will hold, and be the beneficial

owners of, EIS Qualifying Shares in each Company pro-rata to their subscriptions to the Fund. The Manager will be

responsible for discretionary decisions in relation to the selection of, and exercising the rights in relation to, such

investments. An Investor will not be able to require of the Manager to dispose of his or her interest in a Company prior

to realisation of the Fund's overall holding. However, the Manager may, at its absolute discretion have regard to any

requests made to it by Investors to liquidate any individual shareholdings in the Fund (but such termination may result

in a loss of income tax and capital gains tax deferral).

2.Subscriptions

18

The minimum individual subscription in the Fund is £10,000. While there is no limit on the maximum investment into the

Fund, it should be noted that an investor may only claim EIS income tax relief (at 30%) on EIS Qualifying investments

of up to £1,000,000 in any single tax year. Each spouse has his or her own annual limit and they are not aggregated.

The limit applies to the aggregate EIS investments made by an Investor within the tax year. The Fund intends to make

investments in EIS Qualifying Companies during the 2016/17 tax year. An Investor should be entitled to elect to treat

part or all of their investment as if made in the 2015/16 tax year, and therefore to claim income tax relief on subscriptions

to the Fund of up to £2,000,000 in respect of EIS investments.

If the amount of an Investor’s subscription is such that his or her pro-rata beneficial interest in a Company amounts to

more than 30% of the capital, voting rights or assets on a winding up, he or she will be “connected” with the Company

and will, therefore, not be entitled to income tax relief in respect of that investment. There is no limit on the value of

assets qualifying for Inheritance Tax Relief.

The minimum Fund size necessary to proceed is £8,000,000. The maximum Fund size is £15,000,000, subject to the

discretion of the Manager to increase this amount.

3.Withdrawals

Investors are not permitted to make a partial withdrawal of their investment from the Fund. At the sole discretion of the

Manager, an Investor may be permitted to make an early withdrawal of his or her investment from the Fund, provided

that he or she does so in full. Early withdrawal will result in termination of the Fund Management Agreement, in which

case the relevant Investor’s investments (whether EIS Qualifying Shares and/or cash), will be transferred into the

Investor’s name. However, if a disposal of EIS Qualifying Shares occurs before the end of the Minimum Period, that

Investor would have to repay the initial income tax relief and any deferred capital gains would be brought back into

charge. The Manager’s entitlement to the Performance Fee will survive any withdrawal.

The Manager will have a lien on all assets being withdrawn by an Investor and will be entitled to dispose of some or

all of the same and apply the proceeds in discharging such Investor’s liability to the Manager in respect of damages

or accrued but unpaid fees. The balance of any sale proceeds and control of any remaining investments will then be

passed to the Investor.

INFORMATION MEMORANDUM

4. Realisation Strategy

To qualify for EIS Reliefs, Investors must hold the Qualifying Shares acquired by the Manager for at least three years.

The Manager anticipates that all subscription proceeds will be deployed, and Qualifying Shares issued, during the

2016/17 tax year.

Assuming that all investments can be realised, the Fund has a target life of three years, but there can be no guarantee

of this and so Investors should consider the Fund a medium to long term investment. The Manager will pursue a

strategy of maximising returns for Investors when considering the value and timing of Qualifying Share disposals. Post

realisation of the Qualifying Shares in each Company, the net proceeds will be paid to Investors. Consequently, it is

possible that Investors will receive distributions from the Fund over a period of time.

5. Offer Details

Closing Date*

31 March 2017

Minimum Fund Size £8,000,000

Maximum Fund Size

£15,000,000

* Subject to the Manager’s discretion to extend the Closing Date and to extend the Maximum Fund size.

6. How to Apply

Once you have read the Information Memorandum and Fund Management Agreement, please complete the

Application Form which accompanies this Information Memorandum and send it to: Woodside Corporate Services

Limited, 4th Floor, 50 Mark Lane, London, EC3R 7QR. You will need to include as part of your application (i) the

supporting identification documentation as requested therein; and (ii) a cheque made out to “WCSL AAA Video Games

Client Acc”, to arrive no later than 27 March 2017 or, in the case of payment by bank transfer, to clear no later than 31

March 2017 in the Custodian’s client bank account.

7. Right of Cancellation

An Investor may exercise a right to cancel his or her Fund Management Agreement by notification to the Manager

within 14 days of the Manager receiving the Investor’s Application Form provided that their money has not already been

committed to investment. This should be done by a cancellation notice sent to Woodside Corporate Services as set out

in this document. For convenience, a cancellation notice form is provided at the end of this Information Memorandum.

On exercise of the Investor’s right to cancel, the Manager shall refund any monies paid to the Fund by the Investor, less

any charges the Manager has already incurred for any services undertaken in accordance with the Fund Management

Agreement (but not any initial fees paid to the Manager).

The Custodian is obliged to hold investment monies until satisfactory completion of checks under the Money Laundering

Regulations 2007 (as amended from time to time). The Investor will not be entitled to interest on monies refunded

following cancellation.

The right to cancel under the FCA rules does not give an Investor the right to cancel, terminate or reverse any particular

investment transaction executed for their account before cancellation takes effect.

The Manager reserves the right to treat as valid and binding any application not complying fully with the terms and

conditions set out in this Information Memorandum. In particular, but without limitation, the Manager may accept

applications made otherwise than by completion of an Application Form where the Investor has agreed in some

other manner acceptable to the Manager to apply in accordance with this Information Memorandum and the Fund

Management Agreement.

19

• AAA VIDEO GAMES EIS FUND

8. Charges and Fees

The following fees will be chargeable to each Company by the Manager (or Associate thereof) in respect of the Fund.

Fund Management Fees

Evaluation FeeA one-off initial fee of 2% of the amount invested in each Company by the Fund (or 5% in

respect of Professional Investors) is charged by the Manager on the date of subscription to each

Investee Company.

Annual Monitoring

Fee

An annual fixed fee of 1% (for a maximum of 3 years) is charged by the

Manager to each Company with payment deferred until Investors have recovered

100% of their investment.

Custodian FeeAnnual Custodian fees will be charged by the Manager to each Company monthly in arrears.

The Custodian Fee will be an amount up to 0.3% of the total subscriptions to the Fund.

Performance Fee

20

n amount equivalent to a 20% share of any distributions (or amounts payable or realised) to

A

the EIS shareholders in each Company, subject to the Investors in the Fund first receiving back

110p per 100p invested. The Performance Fee shall increase to a level of up to 45% once each

Investor has received an amount equal to 200p per 100p subscribed. The Performance Fee will

be calculated at the aggregate level of the fund, NOT on a Company by Company basis.

Performance Fees shall either be payable from proceeds realised by the Fund or alternatively, through an economically

equivalent holding of ordinary shares in the relevant Companies. All fees and costs are exclusive of VAT, which will

be charged where applicable. As a result of the fee structure, the Manager and the Games Advisers believe that their

interests and those of the Companies’ wider management teams are fully aligned with those of the Investors. For the

Manager or the Games Advisers to financially benefit to a significant degree from the envisaged arrangements, the

Fund must first, in priority, have yielded distributions or value for Investors of 110p per 100p invested (ignoring any

tax reliefs).

Other Investee Company Charges

The Manager or any affiliated entity shall be entitled to recover reasonable third-party expenses incurred in managing,

administering and servicing the Fund and the Companies including legal, accounting, company secretarial, taxation,

audit, insurance, administration, directors’ fees, transaction and all other associated costs.

Any costs incurred on investments that do not proceed will be borne by the Manager.

INFORMATION MEMORANDUM

PART 5 > RISK FACTORS

Investors must carefully consider all of the information contained in this Information Memorandum and whether an

investment in the Fund constitutes a suitable investment for them in light of their personal circumstances, tax position

and the financial resources available to them. The Fund will be investing in unquoted, high risk companies and may

not be suitable for all types of investor. Potential Investors are, therefore, strongly recommended to seek independent

financial and tax advice from a suitably qualified professional adviser before undertaking an investment in the Fund.

If in any doubt whatsoever, an Investor should not proceed.

This section details the material risk factors that the Manager and the Games Advisers believe could adversely impact

an investment in the Fund or the availability of tax reliefs to Investors. If any of the following circumstances or events

arises, the financial position and/or results of the Fund could be materially and adversely affected; as could the

availability of tax reliefs to Investors. In such circumstances, Investors could lose all or part of their investment.

Additional risks and uncertainties not presently known, or that are deemed to be immaterial, may also have an adverse

effect on the Fund and the risks described below do not represent an exhaustive list of risks factors.

1. Investment Risks

•The value of Qualifying Shares and income from them can go down as well as up. An Investor may not get back the

full amount invested and may, therefore, lose some or all of their investment.

•Assumptions, projections, intentions, illustrations or targets included within this Information Memorandum cannot

and do not constitute a definitive forecast of how the Fund and/or its investments will perform, but have been

prepared on assumptions that the Manager and Games Advisers consider to be commercially reasonable.

•All investments of the Fund will be in small, unquoted trading companies. Such companies generally have a very

high risk profile and may not produce the anticipated returns, which could affect an Investor’s ability to realise his or

her initial investment. There may be difficulty in disposing of such investments at a reasonable price and, in some

circumstances it may be difficult to sell them at any price even after holding the Qualifying Shares for the Minimum

Period. Investments made by the Fund are unlikely to be readily realisable.

•Investor returns will be reliant on the commercial performance of the Companies, the contractual terms entered

into with transaction counterparties and advisers, the financial health and performance of such contractual parties,

fluctuations in currency rates applicable to counterparty jurisdictions, changes in technology and, to a lesser extent,

the level of bank base rates from time to time.

•The performance of the Fund is contingent on the Manager and the Games Advisers being able to identify suitable

Companies which carry on, and continue to carry on, an EIS Qualifying Trade for the Minimum Period. There is no

guarantee that the objectives of the Fund will be met.

•The Manager intends to invest the Fund across a portfolio of Companies following consultation with the Games

Advisers. However, there is a risk that the Fund’s investments may still be relatively concentrated and the total return

to Investors may therefore be adversely affected by the unfavourable performance of a small number of Companies.

•The Companies will typically have small management teams and therefore will be dependent to a large degree on

the abilities and experience of a small number of people.

•In the event that the maximum size of the Fund is not raised, there may be less opportunity to diversify investments

across a range of different projects, which may increase the volatility of returns. If the £8,000,000 minimum size

of the Fund is not reached by the Target Closing Date, the Fund may not proceed and Investors’ monies may be

returned without interest.

•Each Investor should note that it is possible that other taxes or costs arise for the Investor in connection with its

investment in the Fund that are not paid via, or imposed by, the Manager.

•It may not be possible to meet the investment timetable, which would delay the availability of EIS Relief, or could

result in funds being returned to Investors, such that EIS Relief would not be obtained in respect of this part of the

Investor’s subscription. Delays to the investment timetable could cause certain Investors to lose the opportunity to

obtain income tax relief available during the 2015/16 tax year. Similarly, investors may not be able to obtain capital

gains tax deferral.

•The returns accruing to the Fund by way of holdings of cash deposits or money market funds will principally be

affected by fluctuations of interest rates. However, the latter are also influenced by changes in credit risk, interest

rate risk and currency risk.

21

• AAA VIDEO GAMES EIS FUND

2. Taxation Risks

•Prospective investors should be aware that the various tax benefits described in this Information Memorandum

are based on the Manager’s understanding of the existing tax legislation and HMRC practice. Such interpretation

may be incorrect and it is possible that tax legislation may change in the future which would adversely affect the

performance of the Fund and/or the economic position of the investor.

•The amount of EIS Relief an investor may gain from subscription to the Fund depends on their own personal

circumstances. Therefore, EIS Relief may not be available to all investors and/or may be lost by investors in certain

circumstances.

•Tax law is complex and investors should seek independent tax advice to determine and understand the suitability

of investing in the Fund and any effect that this may have on their own position generally.

•The Manager will take all reasonable steps to obtain HMRC advance assurance that EIS Relief will be available

for all investments made by the Fund, but no guarantee can be given that this will be granted. Further, tax relief

could subsequently be withdrawn or modified in certain circumstances and neither the Manager nor the Custodian

accepts any liability for any loss or damages suffered by an investor or other person as a consequence of such

relief being denied or withdrawn or reduced.

•An Investor may lose some or all of the tax benefits derived under the EIS if they fail to comply with the relevant

legislation. Such situation might arise, for example, if an Investor ceases to be UK tax resident during the Minimum

Period or an Investor receives value from a Company, other than by way of an ordinary dividend, in the period

commencing one year prior to the issue of Qualifying Shares to the Fund to the end of the Minimum Period.

22

•An Investor whose pro-rata beneficial interest in a Company amounts to more than 30% of the capital, voting

rights or assets on a winding up will deemed to be “connected” for the purposes of the EIS legislation and in such

circumstances will not be entitled to claim income tax relief in relation to that investment. Since investment will be

through the Fund, this limit should only be breached where an investor holds a greater than 30% interest in the

Fund.

•Provided that the Fund’s capital is fully invested by 5 April 2017, Investors should be able to claim income tax relief

for the tax year 2016/17, or/and elect to treat part or all of their investment as having been made in the 2015/16 tax

year, enabling a claim for income tax relief to be made in that year. While the Manager will take all reasonable steps

to ensure that the Fund’s capital is fully invested by 5 April 2017, it cannot guarantee that this will be achieved. In

the event that investments may not be made until 2017/18, this would eliminate the ability to claim income tax relief

in respect of 2015/16 under the carry-back provisions, although a claim in respect of the 2016/17 tax year would

be possible via carry-back.

•If a Company fails to meet the EIS qualifying requirements, whether through the actions taken by the Company

or otherwise, and for the avoidance of doubt, this would include where a Company ceases to carry on an EIS

Qualifying Trade or if there is any disposal of EIS Qualifying Shares during the Minimum Period, (i) Investors may,

as a result, be required to repay any income tax relief received on a particular investment (along with any related

interest); (ii) a liability to CGT may arise on the subsequent disposal of the relevant EIS Qualifying Shares; and (iii)

Investors may lose any benefit of capital gains tax deferral achieved as a result of their investment.

•While the Manager and the Games Advisers will require various safeguards to be provded against this risk, the

Manager and the Games Advisers cannot guarantee that all Companies will retain their qualifying status.

•The Manager retains the absolute discretion to realise EIS Qualifying investments at any time, which may be earlier

than the minimum 3 year holding period. As such, Investors may lose the tax reliefs relating to that investment.

•Companies must employ all of the EIS funding they raise in their Qualifying Trade within two years of issuing the

relevant EIS Qualifying Shares. Failure to employ the funds within this time limit would be a breach of the EIS rules

and result in a withdrawal of tax relief on that investment.

•Companies must submit an EIS 1 form to claim that it is a Qualifying EIS Company and therefore, to establish that

EIS Relief can be claimed by Investors. This can only be done when the Company has carried on the qualifying

trade for at least four months.

INFORMATION MEMORANDUM

3. Risks Relating to the Investments

•It is possible that the budgeted costs of a video game project may overrun. As part of risk mitigation

measures, each Company will be expected to incorporate a commercial allocation for contingency

events, as well ensure that any relevant insurance policies, indemnities and warranties clauses have been

negotiated, where appropriate.

•If a Company does not complete a video game to the specifications required by a publisher or distributor

for commercial exploitation this could adversely impact the revenue earned. In order to mitigate this risk,

both the Manager and the Games Advisers will closely monitor the production of each Company’s video

game project on an ongoing basis.

•It is possible that a publisher could become insolvent at any time during the production and exploitation of a

Company’s video game. This could potentially result in a Company failing to receive any minimum guarantee

and/or future royalties from the sale of the game. The Manager and the Games Advisers will seek to ensure

that Companies negotiate and contract with only reputable publishers in order to mitigate this risk.

•The video games production tax credit (VGTR) came into effect by way of the 2014 Finance Bill enacted

by the UK government. While there is no reason to believe that the legislation will be withdrawn in the

foreseeable future, especially as the UK video game sector contributes £1.1 billion to GDP and £471 million

in tax revenues, as with all industries benefitting from tax incentives this is a possibility should government

finances necessitate cut backs.

•The nature of the industry, and the fact that each Company will be a small, start-up enterprise, gives

rise to an inherently volatile environment for businesses operating in the video game sector. However,

as described herein, each Company will be expected to address these risks by targeting projects that

incorporate recognised franchises/brands which should benefit from an established fan-base and more

predictable market. Where possible, each Company intends to release its video game(s) to coincide with

the release of the corresponding film franchise, in order to maximise commercial marketing momentum.

•Where income from a video game project is reinvested by a Company on similar terms, the same aforementioned

risks are likely to apply to these additional activities.

•In order to mitigate any exchange rate risk associated with a Company’s revenue entitlements and expenditure

obligations, it is anticipated that the Company will ensure that receipts and costs are settled in sterling or appropriate

hedging arrangements are implemented.

4. Staff Turnover

The success of each Company will depend in part upon the performance of its employees. Although some staff

turnover is inevitable, the loss of any key member of the management team could have a material adverse effect on

performance.

5. Realisation Risk

The forecast returns for investors are based on the assumptions regarding a value being realised within 3 to 4 years.

Delays in the production or release of a video game may result in the Fund being unable to achieve an exit within this

timescale and the projected returns may not be achieved.

6. Financial Services Compensation Scheme

Both the Manager and Custodian are covered by the Financial Services Compensation Scheme. Investors may be

entitled to compensation from the scheme if wither the Manager or the Custodian cannot meet their obligations, as

described in greater detail in the Fund Management Agreement.

Funds will be placed on deposit by the Custodian at the Investors’ own risk and neither the Manager, nor any person

engaged by either of them to hold such funds as receiving agent or otherwise (Deposit Holder), nor any director or

officer of any of them, will be liable to any Investor in the event of an insolvency of any bank with which such funds are

deposited, nor in the event of any restriction on the ability of any Deposit Holder to withdraw funds from such bank for

reasons beyond the reasonable control of any of them.

23

• AAA VIDEO GAMES EIS FUND

7. Forward Looking Statements

This Information Memorandum includes statements that are (or may be deemed to be) “forward-looking statements”.

These forward-looking statements can be identified by the use of forward-looking terminology including the terms

“believes”, “continues”, “expects”, “intends”, “may”, “will”, “would” or “should” or, in each case, their negative or other

variations or comparable terminology. These forward-looking statements include all matters that are not historical

facts. Forward-looking statements involve risk and uncertainty because they relate to future events and circumstances.

Forward-looking statements contained in this Information Memorandum based on past trends or activities should not

be taken as a representation that such trends or activities will continue in the future. Subject to any requirement under

applicable laws and regulations, the Manager undertakes to update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise. Investors should not place undue reliance on “forwardlooking statements”, which speak only as of the date of this Information Memorandum.

24

INFORMATION MEMORANDUM

PART 6 > TAX BENEFITS

The summary below provides an indicative guide to the tax implications stemming from an investment in the Fund and

is based on current understanding of UK tax law and practice. It does not set out all of the rules or regulations that must

be adhered to and should not be interpreted as the provision of tax, legal or financial advice. Investors are strongly

recommended to seek independent professional advice on the tax consequences of acquiring, holding and disposing

of EIS Qualifying Shares before proceeding with an investment into the Fund.

The Fund has been structured to enable Investors to claim EIS Relief as well as IHT reliefs on the amount of their

subscription, as described below. The amount and timing of these reliefs will depend on the individual circumstances

of each Investor and may be subject to change in the future. The illustrations included in this section are for indicative

purposes only and should not be construed as forecasts or projections of the likely performance of the Fund.

In order to access the tax reliefs described it is necessary to be a UK taxpayer and subscribe for EIS Qualifying Shares.

The summary below gives only a brief outline of the available tax reliefs and assumes that an Investor is an additional

rate taxpayer.

1. EIS Reliefs

Income Tax Relief

Qualifying Investors can claim income tax relief of up to 30% on the amount subscribed for EIS Qualifying Shares,

subject to the aggregate maximum annual limit of £1,000,000.

Income tax relief is given by way of a reduction in an Investor’s tax liability for the tax year in which the Fund makes

investments in the respective Companies, which is expected to be 2016/17. However, an Investor may elect to have part

or all of an issue of shares treated as though acquired in the tax year preceding that in which the shares were actually

acquired, and may make a claim for tax relief in that preceding period, subject to the maximum annual investment limit

for that earlier tax year.

The total income tax relief claimed cannot exceed an amount which reduces the Investor’s liability to nil.

Income Tax Relief

(£)

Gross Investment in Qualifying Shares

10,000

Less Income Tax Relief @ 30%

(3,000)

Net Cost of Investment

7,000

Capital Gains Tax Deferral

If an investor has disposed of an asset resulting in a chargeable gain, CGT on all or part of that gain may be deferred

by making a claim for relief on an investment in EIS Qualifying Shares. CGT deferral is available on capital gains which

have arisen in the three years preceding, or up to one year after, the issue of EIS Qualifying Shares. The CGT will be

deferred for the life of the investment period and will be brought back into charge on a disposal of those EIS Qualifying

Shares, unless the Investor chooses roll the gain into another EIS Qualifying investment. Capital gains realised on or

after 3rd December 2014 which qualified for Entrepreneur’s Relief may be reinvested in EIS Qualifying Shares and will

still remain eligible for Entrepreneur’s Relief when the deferred gain is realised.

Capital Gains Disposal Relief

Where an Investor has received EIS income tax relief (which has not subsequently been withdrawn) on the cost of

the Qualifying Shares, and the EIS Qualifying Shares are disposed of through the Fund after the Minimum Period any

capital gains are free from CGT. If no claim to income tax relief is made, then any subsequent disposal of the shares

will not qualify for exemption from CGT.

Capital Gains Disposal Relief

(£)

Disposal Value After Three Years

11,000

Less Original Cost

(10,000)

Tax-Free Gain

1,000

25

• AAA VIDEO GAMES EIS FUND

Share Loss Relief

Any capital losses realised on the disposal of EIS Qualifying Shares (net of income tax relief attributable to the

investment) qualify for share loss relief. The amount of the net loss may be set off against capital gains in the tax year

of disposal or carried forward for relief against future capital gains. Alternatively, an Investor may elect to set off the net

loss against income arising in the tax year of the disposal or the previous tax year. In the case where no proceeds are

received on disposal of the EIS Qualifying Shares, the net loss after tax on an investment of £10,000 may be as follows:

Share Loss Relief

(£)

Disposal Value of EIS Qualifying Shares

Nil

Original Cost of EIS Qualifying Shares

(10,000)

Income Tax Relief @ 30%

3,000

Loss net of Income Tax Relief @ 30%

Tax Relief @ 45%

Net Loss after Tax

(7,000)

3,150

(3,850)

2. Inheritance Tax Relief

On the basis that investments undertaken by the Fund will be in EIS Qualifying Companies, this should mean that

Qualifying Shares will constitute “Relevant Business Property” (as defined in IHTA). Provided the Qualifying Shares are

held for a period of not less than two years they should qualify for 100% Business Relief, which would reduce any IHT

liability arising on transfer of the Qualifying Shares to nil. Even if the Investor dies within the two year period and his or

her spouse inherits the Qualifying Shares, the holding period of both the Investor and the spouse are combined in order

to determine whether the two year holding period condition has been satisfied on death of the spouse. On disposal of

Qualifying Shares, entitlement to Business Relief in respect of that investment ceases.

26

3. EIS Rules

There are a number of conditions to be met. These fall into two categories – those which must be met throughout the

Minimum Period commencing with the issue of the shares, and those which must be met at the time the EIS shares are

issued. Some (but not all) of the relevant conditions are set out below.

Minimum Period Conditions

The Company must, throughout the Minimum Period:

•not be under the control of another company or control another company other than a qualifying subsidiary (nor can

there be arrangements for the Company to be under the control of another company or control another company

other than a qualifying subsidiary);

•either be a company which exists wholly for the purpose of carrying on a qualifying trade or a parent company of a

group which does not consist wholly or as to a substantial part in the carrying on of non-qualifying activities;

•carry on the new qualifying trade, prepare to carry on that trade or carry out research and development activities

from which a new qualifying trade will be derived or from which a new qualifying trade will benefit either itself or

through a 90% subsidiary; and

•

have a permanent establishment in the UK.

Issuing Conditions Unquoted

The Company must be unquoted and there must be no arrangements in place for it to cease to be unquoted.

Gross Assets

A Company that issues EIS Qualifying Shares may not have gross assets of more than £15,000,000 immediately before

it receives a subscription for eligible shares and must have no more than £16,000,000 immediately afterward.