* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Current Assets

Debtors Anonymous wikipedia , lookup

Security interest wikipedia , lookup

Financialization wikipedia , lookup

Floating charge wikipedia , lookup

Federal takeover of Fannie Mae and Freddie Mac wikipedia , lookup

Investment management wikipedia , lookup

Present value wikipedia , lookup

Investment fund wikipedia , lookup

Business valuation wikipedia , lookup

Balance of payments wikipedia , lookup

Stock valuation wikipedia , lookup

Asset-backed commercial paper program wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Stock selection criterion wikipedia , lookup

Securitization wikipedia , lookup

Mergers and acquisitions wikipedia , lookup

Global saving glut wikipedia , lookup

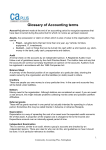

Terms on the Balance Sheet – Definitions and Issues Nursery Management Understanding and Managing Finance Balance Sheet Terms This section looks at some of the terms on the balance sheet, how they are defined, and the kinds of items which are included. » Fixed Assets » Current Assets » Current Liabilities » Long-Term Liabilities Assets Items that a business owns and have an identified value » For example computers or the value of the building if the freehold is owned by the business Fixed Assets These are items owned and used by the organisation on a long-term basis Tangible Assets = equipment, buildings, land Intangible Assets = brands, logos, patents, goodwill Goodwill = quality of workforce, reputation, management, location, relationship with customers. Goodwill only tends to be included when purchased at an agreed price Fixed Assets are normally valued at Cost less Depreciation (The amount lost through ‘wear & tear’). Current Assets These are Items which can easily be converted into cash (e.g. cash, stock, debtors) Generally listed in the order in which they can be converted into cash Valued at cost or market price (whichever is the lower) Often includes “Provision for loss” (safeguard against unsold goods or bad debts) and Prepayments (items which have been paid for in advance) The cyclic nature of current assets Current assets are cyclic; there is movement between the cash, stock, and debtors items. The stock is used eg to feed the children Trade Debtors (parents) pay for the food in their feees The Cash is used to buy more stock. Stock Cash Trade debtors Current liabilities Current Liabilities (claims) - debts which the organisation is likely to have to pay within one year Examples include creditors, bank overdraft, loan interest due in next 12 months, tax, dividends owed to shareholders. Long-term liabilities Long-term Liabilities (Fixed Liabilities) - debts which the organisation will not have have to pay within one year Examples include hire purchase loans, mortgage and long-term bank loans Shareholders Funds This is the most permanent form of funding, often called the shareholder’s Claim, but sometimes classed as a “Liability”, Issued Share Capital - value of shares actually issued Authorised Share Capital - value of shares company may legally issue Retained Profit (or Earned Surplus) - profit left after all deductions have been made Capital Surplus - money earned on disposal of Fixed Assets Capital employed - all the capital put into the business (share capital, long-term loans, retained profit) Revision Questions Discuss the following: How far does the balance sheet tell us about how much an organisation is worth? What is the main difference between Fixed and Current Assets? Why is money input into the organisation by shareholders shown as a liability? Revision Questions -Solutions The final amount on either side of the balance tells us how much a company is currently valued at. Current Assets – we could get the money almost immediately with minimum fuss. Fixed assets would take some time and be very disruptive. The share capital is an amount invested in the company by shareholders, and so is owed to them.