Basics of US GAAP for Life Insurers - aktuariat

... • US GAAP accounting rules for insurance companies are formulated in different Statements of Financial Accounting Standards (SFAS or short FAS) – FAS 60, FAS 97 and FAS 120 are relevant for insurance product classification • FAS 60 (issued in 1982) contains the general principles of accounting for i ...

... • US GAAP accounting rules for insurance companies are formulated in different Statements of Financial Accounting Standards (SFAS or short FAS) – FAS 60, FAS 97 and FAS 120 are relevant for insurance product classification • FAS 60 (issued in 1982) contains the general principles of accounting for i ...

(IS) Y

... Xn = Exports minus imports 6.1 Exports, X: A country exports domestic goods and services X = Xo Autonomous exports, constant Gross exports are exogenous, largely determined by the level of income in foreign countries. HUỲNH VĂN THỊNH [email protected] ...

... Xn = Exports minus imports 6.1 Exports, X: A country exports domestic goods and services X = Xo Autonomous exports, constant Gross exports are exogenous, largely determined by the level of income in foreign countries. HUỲNH VĂN THỊNH [email protected] ...

On the Accuracy and Efficiency of IMF Forecasts: A Survey

... established analytical approaches with up-to-date data on forecasts and outturns and by developing new methodologies to help draw practical lessons for IMF forecasting. We find that the IMF forecasts developed for the World Economic Outlook are not consistently biased in one direction or the other, ...

... established analytical approaches with up-to-date data on forecasts and outturns and by developing new methodologies to help draw practical lessons for IMF forecasting. We find that the IMF forecasts developed for the World Economic Outlook are not consistently biased in one direction or the other, ...

Understanding National Accounts: Second Edition

... importance of a timely, reliable and comprehensive monitoring of economic activity and also pointed to directions for new developments and extensions in the accounts. National accounts provide the conceptual and actual tool to bring coherence to hundreds of statistical sources available in OECD coun ...

... importance of a timely, reliable and comprehensive monitoring of economic activity and also pointed to directions for new developments and extensions in the accounts. National accounts provide the conceptual and actual tool to bring coherence to hundreds of statistical sources available in OECD coun ...

CH 23 Finance Saving Investment

... E) expected future income, wealth, and default risk. Topic: The Market for Loanable Funds 36) Suppose a firm has an investment project which will cost $200,000 and result in $30,000 profit. The firm will not undertake the project if the interest rate is ________. A) greater than 5 percent B) greater ...

... E) expected future income, wealth, and default risk. Topic: The Market for Loanable Funds 36) Suppose a firm has an investment project which will cost $200,000 and result in $30,000 profit. The firm will not undertake the project if the interest rate is ________. A) greater than 5 percent B) greater ...

Global Innovation Index 2008-2009

... Therefore, more than ever, in the current global economic situation, policy makers and business leaders recognize the need to create an enabling environment to support the adoption of innovation and spread their benefits across all sectors of society. The importance of innovation readiness, especial ...

... Therefore, more than ever, in the current global economic situation, policy makers and business leaders recognize the need to create an enabling environment to support the adoption of innovation and spread their benefits across all sectors of society. The importance of innovation readiness, especial ...

Deficits And Debt

... why, even though the real budget deficit of the United States is much lower than the nominal deficit, there is still reason for concern about the deficit. ...

... why, even though the real budget deficit of the United States is much lower than the nominal deficit, there is still reason for concern about the deficit. ...

Economics for the IB Diploma

... • List of countries according to the World Bank’s classification system The World Bank classifies countries around the world according to their income levels, and this serves as a useful (though very rough and approximate) guide to classifying countries as economically more or less developed. • Li ...

... • List of countries according to the World Bank’s classification system The World Bank classifies countries around the world according to their income levels, and this serves as a useful (though very rough and approximate) guide to classifying countries as economically more or less developed. • Li ...

... for the first time in over a decade. To the continuing slow-down in major industrial countries in 1991 was added a sharp fall in output in the former Soviet Union, while the Eastern European economies did not show the hoped for resilience after undergoing wide-ranging economic reform. At the same ti ...

Indicators of Fiscal Impulse for New Zealand

... Nonetheless, Governments may also be concerned about macroeconomic stability and therefore the potential short-term impact of fiscal policy on aggregate demand. For example, strongly pro-cyclical fiscal policy could place additional pressure on monetary policy and lead to undesirable swings in inter ...

... Nonetheless, Governments may also be concerned about macroeconomic stability and therefore the potential short-term impact of fiscal policy on aggregate demand. For example, strongly pro-cyclical fiscal policy could place additional pressure on monetary policy and lead to undesirable swings in inter ...

chapter one - ResearchOnline@JCU

... The purpose of this thesis is to investigate the effects of the use of financial and operational hedging on foreign exchange rate exposure among Australian multinational corporations. Since the flotation of the Australian dollar at the end of 1983, Australian firms have become increasingly exposed t ...

... The purpose of this thesis is to investigate the effects of the use of financial and operational hedging on foreign exchange rate exposure among Australian multinational corporations. Since the flotation of the Australian dollar at the end of 1983, Australian firms have become increasingly exposed t ...

- Public Intelligence

... The sharp increase in fiscal deficits and public debt in most advanced and several developing economies has raised concerns about the sustainability of public finances and highlighted the need for a significant adjustment over the medium term. This paper assesses the usefulness of fiscal rules in su ...

... The sharp increase in fiscal deficits and public debt in most advanced and several developing economies has raised concerns about the sustainability of public finances and highlighted the need for a significant adjustment over the medium term. This paper assesses the usefulness of fiscal rules in su ...

LCcarG502_en.pdf

... The policy objectives feeing Caribbean countries in 1996 were remarkably similar across the broad spectrum of countries surveyed. They were essentially twofold and interrelated. The first objective was to apply those poUcy reforms which would enable their countries to interface more effectively in t ...

... The policy objectives feeing Caribbean countries in 1996 were remarkably similar across the broad spectrum of countries surveyed. They were essentially twofold and interrelated. The first objective was to apply those poUcy reforms which would enable their countries to interface more effectively in t ...

Macroeconomic Analysis of Causes and Effects of Remittances

... intra-European migration involved less than 1% of the total population of the EU4. Therefore, labour migration can be considered mostly as a phenomenon occurring between less developed and developed countries, with a growing importance of remittance inflows in the last decade. ...

... intra-European migration involved less than 1% of the total population of the EU4. Therefore, labour migration can be considered mostly as a phenomenon occurring between less developed and developed countries, with a growing importance of remittance inflows in the last decade. ...

Running on Empty: The Operating Reserves of US

... for transactional purposes, and a nonprofit with such cash in a bank account may be unable to use it as needed.5 A nonprofit may be able to convert other assets (such as inventories or receivables) into cash if necessary, but these other assets must also be unrestricted. As noted by Ramirez (2011), ...

... for transactional purposes, and a nonprofit with such cash in a bank account may be unable to use it as needed.5 A nonprofit may be able to convert other assets (such as inventories or receivables) into cash if necessary, but these other assets must also be unrestricted. As noted by Ramirez (2011), ...

The Effect of IMF Programs on Inequal

... not randomly assigned. Extant approaches addressing this problem rely on instrumental variables (IVs) that are likely to be related to the outcome through channels other than IMF programs and thus violate the exclusion restriction. To fill this gap, I employ a novel identification strategy for IMF p ...

... not randomly assigned. Extant approaches addressing this problem rely on instrumental variables (IVs) that are likely to be related to the outcome through channels other than IMF programs and thus violate the exclusion restriction. To fill this gap, I employ a novel identification strategy for IMF p ...

Flag - Malawi Investment and Trade Centre

... (AGOA) under which exports to the US enjoy duty and quota free status. Malawi produces a wide range of export products with tobacco, tea and sugar as the traditional export products accounting for over 80 per cent of Malawi’s domestic exports. However, as result of export diversification, a number o ...

... (AGOA) under which exports to the US enjoy duty and quota free status. Malawi produces a wide range of export products with tobacco, tea and sugar as the traditional export products accounting for over 80 per cent of Malawi’s domestic exports. However, as result of export diversification, a number o ...

Week 17 - Lancaster University

... go bankrupt – then they would not be able to pay off their debts in one year. So, if there is some chance that the final payment of €1060 will not be made, then financial investors will not be willing to pay €1000 for the bond, because they know they can earn 6% without risk by holding the debt of t ...

... go bankrupt – then they would not be able to pay off their debts in one year. So, if there is some chance that the final payment of €1060 will not be made, then financial investors will not be willing to pay €1000 for the bond, because they know they can earn 6% without risk by holding the debt of t ...

Principles of Macroeconomics

... 1.3 How Economists Use Theories and Models to Understand Economic Issues 1.4 How Economies Can Be Organized: An Overview of Economic Systems . . Chapter 2: Choice in a World of Scarcity . . . . . . . . . . . . . . . . . . . . . . 2.1 How Individuals Make Choices Based on Their Budget Constraint . . ...

... 1.3 How Economists Use Theories and Models to Understand Economic Issues 1.4 How Economies Can Be Organized: An Overview of Economic Systems . . Chapter 2: Choice in a World of Scarcity . . . . . . . . . . . . . . . . . . . . . . 2.1 How Individuals Make Choices Based on Their Budget Constraint . . ...

OpenStax College

... 1.3 How Economists Use Theories and Models to Understand Economic Issues 1.4 How Economies Can Be Organized: An Overview of Economic Systems . . Chapter 2: Choice in a World of Scarcity . . . . . . . . . . . . . . . . . . . . . . 2.1 How Individuals Make Choices Based on Their Budget Constraint . . ...

... 1.3 How Economists Use Theories and Models to Understand Economic Issues 1.4 How Economies Can Be Organized: An Overview of Economic Systems . . Chapter 2: Choice in a World of Scarcity . . . . . . . . . . . . . . . . . . . . . . 2.1 How Individuals Make Choices Based on Their Budget Constraint . . ...

Principles of Macroeconomics

... OpenStax learning resources are designed to be customized for each course. Our textbooks provide a solid foundation on which instructors can build, and our resources are conceived and written with flexibility in mind. Instructors can select the sections most relevant to their curricula and create a ...

... OpenStax learning resources are designed to be customized for each course. Our textbooks provide a solid foundation on which instructors can build, and our resources are conceived and written with flexibility in mind. Instructors can select the sections most relevant to their curricula and create a ...

... oil prices and declining interest rates had mixed effects in this region. These changes have put a premium on economic diversification and on flexibly responding to rapid shifts in the global economy. Most countries in the region continued to face an unfavourable external environment and difficult a ...

II. IMF Macroeconomic Policy Advice in the Financial Crisis

... sector efforts to deleverage rendered credit demand less sensitive to expansionary monetary policy, irrespective of its ability to maintain low interest rates or raise asset prices. By contrast, a large body of analysis, including from the IMF itself, indicated that fiscal multipliers would be eleva ...

... sector efforts to deleverage rendered credit demand less sensitive to expansionary monetary policy, irrespective of its ability to maintain low interest rates or raise asset prices. By contrast, a large body of analysis, including from the IMF itself, indicated that fiscal multipliers would be eleva ...

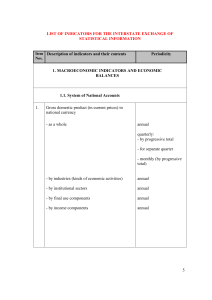

List of Indicators for the Interstate Exchange of Statistical Information

... 2.7.1.2.1. Provision of loan Loans provided to enterprises, organizations, banks and industrials by credit institutions short-term long-term Arrears on loans Loans provided to enterprises organizations, banks and individuals by commercial banks Loans provided to enterprises organizations, banks by N ...

... 2.7.1.2.1. Provision of loan Loans provided to enterprises, organizations, banks and industrials by credit institutions short-term long-term Arrears on loans Loans provided to enterprises organizations, banks and individuals by commercial banks Loans provided to enterprises organizations, banks by N ...

... severely affected. Some growth was achieved in the region’s least developed countries although there was no increase in the net inflow o f resources from abroad. Generating stronger stimuli for self-sustaining growth remains an important concern across the region, and improvements in the internation ...