Transfers and Servicing (Topic 860)

... either a single class having equity characteristics or multiple classes of interests, some having debt characteristics and others having equity characteristics. The cash collected from the portfolio is distributed to the investors and others as specified by the legal documents that established the ...

... either a single class having equity characteristics or multiple classes of interests, some having debt characteristics and others having equity characteristics. The cash collected from the portfolio is distributed to the investors and others as specified by the legal documents that established the ...

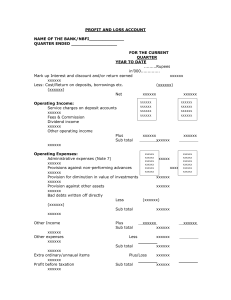

profit and loss account - State Bank of Pakistan

... Note: Dealing securities are marketable securities that are acquired and held with the intention of reselling them in the short term. Investment securities are acquired and held for yield or capital growth purposes and are usually held maturity 2. ADVANCE: Advances (Net of Provisions) Rupees in ‘000 ...

... Note: Dealing securities are marketable securities that are acquired and held with the intention of reselling them in the short term. Investment securities are acquired and held for yield or capital growth purposes and are usually held maturity 2. ADVANCE: Advances (Net of Provisions) Rupees in ‘000 ...

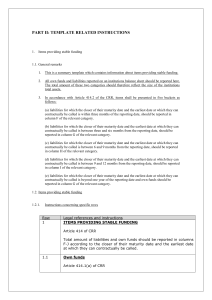

Comments Template QRT Assets final - eiopa

... EIOPA would like to thank Afa Sjukförsäkring, AFA Trygghetsförsäkring, AFA Livförsäkring, Audit&Consulting Services – Poland, AM Best, AMICE, ANIA Reinsurance Working Group, Association of British Insurers (ABI), Association of Financial Mutuals (AFM), AXERIA PREVOYANCE – AXERIA IARD – SOLUCIA, Barn ...

... EIOPA would like to thank Afa Sjukförsäkring, AFA Trygghetsförsäkring, AFA Livförsäkring, Audit&Consulting Services – Poland, AM Best, AMICE, ANIA Reinsurance Working Group, Association of British Insurers (ABI), Association of Financial Mutuals (AFM), AXERIA PREVOYANCE – AXERIA IARD – SOLUCIA, Barn ...

Statement of Financial Accounting Standards No. 140

... released from being the primary obligor under the liability either judicially or by the creditor. Therefore, a liability is not considered extinguished by an in-substance defeasance. This Statement provides implementation guidance for assessing isolation of transferred assets, conditions that constr ...

... released from being the primary obligor under the liability either judicially or by the creditor. Therefore, a liability is not considered extinguished by an in-substance defeasance. This Statement provides implementation guidance for assessing isolation of transferred assets, conditions that constr ...

Discussion Paper - Australian Prudential Regulation Authority

... APRA is proposing to require scenario analysis ADIs to provide monthly LCR data that is sufficiently detailed to allow the calculation of the LCR in all material currencies. APRA is also proposing that NSFR data be provided on a quarterly basis. APRA may request an ADI to provide the reports on a mo ...

... APRA is proposing to require scenario analysis ADIs to provide monthly LCR data that is sufficiently detailed to allow the calculation of the LCR in all material currencies. APRA is also proposing that NSFR data be provided on a quarterly basis. APRA may request an ADI to provide the reports on a mo ...

Historical cost measurement and the use of DuPont analysis by

... That is, changes in the historical cost bias in asset values affect the extent to which asset turnover forecasts are mispriced by investors. In additional analyses we first provide some preliminary international evidence to generalize our findings and to investigate the role of inflation, which, ba ...

... That is, changes in the historical cost bias in asset values affect the extent to which asset turnover forecasts are mispriced by investors. In additional analyses we first provide some preliminary international evidence to generalize our findings and to investigate the role of inflation, which, ba ...

Liquidity Squeeze, Abundant Funding and Macroeconomic Volatility

... buffers to self-insure against shocks affecting illiquid projects. Illiquid projects typically display a higher yield but are subject to liquidity shocks and then require reinvestment.5 To carry out reinvestment, entrepreneurs 1 Source: IMF-IFS. Liquid assets are the sum of reserves at the central ban ...

... buffers to self-insure against shocks affecting illiquid projects. Illiquid projects typically display a higher yield but are subject to liquidity shocks and then require reinvestment.5 To carry out reinvestment, entrepreneurs 1 Source: IMF-IFS. Liquid assets are the sum of reserves at the central ban ...

Pilot Measures for the Asset Management Services of Fund

... Article 21 To provide specific asset management services for several clients, an asset manager and a sales agency shall open a special-purpose sales and settlement account for the asset management plan at a commercial bank qualified for the sales of funds, a designated commercial bank engaging in th ...

... Article 21 To provide specific asset management services for several clients, an asset manager and a sales agency shall open a special-purpose sales and settlement account for the asset management plan at a commercial bank qualified for the sales of funds, a designated commercial bank engaging in th ...

Regulation and Market Liquidity - University of British Columbia

... A balanced view of the potential adverse welfare consequences of such provision is summarized in Duffie (2012): “The Agencies’ proposed implementation of the Volcker Rule would reduce the quality and capacity of market making services that banks provide to U.S. investors. Investors and issues of sec ...

... A balanced view of the potential adverse welfare consequences of such provision is summarized in Duffie (2012): “The Agencies’ proposed implementation of the Volcker Rule would reduce the quality and capacity of market making services that banks provide to U.S. investors. Investors and issues of sec ...

The Safety Trap - The Review of Economic Studies

... ERP: Duarte and Rosa (2015). The ERP is calculated as the first principal component of twenty models of the one-year-ahead equity risk premium. ...

... ERP: Duarte and Rosa (2015). The ERP is calculated as the first principal component of twenty models of the one-year-ahead equity risk premium. ...

Exploring the Dynamics of Global Liquidity

... or wholesale funding—matters. The crisis has also highlighted that financial structure does matter—especially in times of stress, in sharp contrast to the frictionless financial market hypothesis underlying modern monetary theory (Tirole, 2011). Approaches to liquidity measurement generally fall alo ...

... or wholesale funding—matters. The crisis has also highlighted that financial structure does matter—especially in times of stress, in sharp contrast to the frictionless financial market hypothesis underlying modern monetary theory (Tirole, 2011). Approaches to liquidity measurement generally fall alo ...

161128 APS 210 FINAL clean

... An ADI must design a set of early warning indicators to aid its daily liquidity risk management processes in identifying the emergence of increased risk or vulnerabilities in its liquidity risk position or potential funding needs. Such early warning indicators must be structured so as to assist in t ...

... An ADI must design a set of early warning indicators to aid its daily liquidity risk management processes in identifying the emergence of increased risk or vulnerabilities in its liquidity risk position or potential funding needs. Such early warning indicators must be structured so as to assist in t ...

Chapter 6.

... other instruments may also have risk transfer elements, these other instruments also provide financial or other resources. 6.6 Reserve assets are shown separately because they serve a different function and thus are managed in different ways from other assets. Reserve assets include a range of instr ...

... other instruments may also have risk transfer elements, these other instruments also provide financial or other resources. 6.6 Reserve assets are shown separately because they serve a different function and thus are managed in different ways from other assets. Reserve assets include a range of instr ...

Co-investments in funds of funds and separate accounts

... co-investment deals, including improved net return and accelerated capital deployment. Because coinvesting is done either free of management fee and carried interest, or at substantially reduced rates, the LP will, by definition, improve its net investment returns relative to a programme that invest ...

... co-investment deals, including improved net return and accelerated capital deployment. Because coinvesting is done either free of management fee and carried interest, or at substantially reduced rates, the LP will, by definition, improve its net investment returns relative to a programme that invest ...

IPSAS 26 Impairment of Cash-Generating Assets

... a commercial return. An asset generates a commercial return when it is deployed in a manner consistent with that adopted by a profit-oriented entity. Holding an asset to generate a “commercial return” indicates that an entity intends to (a) generate positive cash inflows from the asset (or from the ...

... a commercial return. An asset generates a commercial return when it is deployed in a manner consistent with that adopted by a profit-oriented entity. Holding an asset to generate a “commercial return” indicates that an entity intends to (a) generate positive cash inflows from the asset (or from the ...

Government Guarantees and Fiscal Risk, April 1, 2005

... documents, fiscal reports and financial statements. In this connection, the paper proposes a set of comprehensive disclosure requirements for guarantees. The potential fiscal costs associated with guarantees argue in favor of carefully controlling them with a view to managing fiscal risk. Centralize ...

... documents, fiscal reports and financial statements. In this connection, the paper proposes a set of comprehensive disclosure requirements for guarantees. The potential fiscal costs associated with guarantees argue in favor of carefully controlling them with a view to managing fiscal risk. Centralize ...

Liquidity Hoarding - Federal Reserve Bank of New York

... the average daily volume in the overnight unsecured interbank market halved. Ashcraft et al. (2008) use data on intraday account balances held by banks at the Federal Reserve and Fedwire interbank transactions for a sample of approximately 700 banks that ever lend or borrow during the period Septemb ...

... the average daily volume in the overnight unsecured interbank market halved. Ashcraft et al. (2008) use data on intraday account balances held by banks at the Federal Reserve and Fedwire interbank transactions for a sample of approximately 700 banks that ever lend or borrow during the period Septemb ...

Endogenous Liquidity and Contagion

... connotations, it is a bit odd that more attempts have not been made to analyze and reconcile these various aspects within one equilibrium model. Some well-known attributes of liquidity are depth (the market impact of a trade), breadth (the size of bid-ask spreads, also referred to as tightness), vol ...

... connotations, it is a bit odd that more attempts have not been made to analyze and reconcile these various aspects within one equilibrium model. Some well-known attributes of liquidity are depth (the market impact of a trade), breadth (the size of bid-ask spreads, also referred to as tightness), vol ...

Download attachment

... ownership of the underlying assets is limited. Tamweel Sukuk Limited (TSL) is an SPV incorporated in the Cayman Islands and created to issue sukuk trust certificates to investors to acquire a pool of Shariah-compliant assets from the mortgage finance company, Tamweel. TSL, as trustee, will acquire t ...

... ownership of the underlying assets is limited. Tamweel Sukuk Limited (TSL) is an SPV incorporated in the Cayman Islands and created to issue sukuk trust certificates to investors to acquire a pool of Shariah-compliant assets from the mortgage finance company, Tamweel. TSL, as trustee, will acquire t ...

Global Financial Systems Chapter 4 Liquidity

... • A firm that is insolvent is bankrupt • Illiquidity is where assets minus liabilities is positive, but ...

... • A firm that is insolvent is bankrupt • Illiquidity is where assets minus liabilities is positive, but ...

The structure and economic significance of government guarantees

... causes. For example, Finland has used government guarantees to promote its exports (particularly to United States and Germany), as well as for domestic operations of SMEs through Finnvera (a state-owned financing company that is the official export credit agency for Finland). Guarantees were also is ...

... causes. For example, Finland has used government guarantees to promote its exports (particularly to United States and Germany), as well as for domestic operations of SMEs through Finnvera (a state-owned financing company that is the official export credit agency for Finland). Guarantees were also is ...

strategic asset allocation

... significant fraction of the investor’s portfolio without seriously affecting the portfolio’s liquidity ...

... significant fraction of the investor’s portfolio without seriously affecting the portfolio’s liquidity ...

Speculation and Risk Sharing with New Financial Assets

... diversi…cation and the sharing of risks.1 However, this view does not take into account that new assets are often associated with much uncertainty, especially because they do not have a long track record. Belief disagreements come as a natural by-product of this uncertainty and change the implicatio ...

... diversi…cation and the sharing of risks.1 However, this view does not take into account that new assets are often associated with much uncertainty, especially because they do not have a long track record. Belief disagreements come as a natural by-product of this uncertainty and change the implicatio ...

Implementing Basel III capital reforms in Australia

... investors. Moreover, banking institutions provide critical services to consumers, small and medium-sized enterprises, large corporate firms and governments, which rely on banks to conduct their daily business, both at a domestic and international level. One of the main reasons the global financial c ...

... investors. Moreover, banking institutions provide critical services to consumers, small and medium-sized enterprises, large corporate firms and governments, which rely on banks to conduct their daily business, both at a domestic and international level. One of the main reasons the global financial c ...

Annex VI

... issued or guaranteed by BIS, IMF, EC, or MDBs Total securities with a 0% risk weight issued or guaranteed by BIS, IMF, EC, or MDBs, which institutions identify themselves as ‘extremely high liquidity and credit quality’ as referred to in Article 404, should be reported in columns F-J according to th ...

... issued or guaranteed by BIS, IMF, EC, or MDBs Total securities with a 0% risk weight issued or guaranteed by BIS, IMF, EC, or MDBs, which institutions identify themselves as ‘extremely high liquidity and credit quality’ as referred to in Article 404, should be reported in columns F-J according to th ...