Financial Assets

... compounded interest rate I receive is equal to … The Net Present Value of 100 euros that I will be receiving in three years time calculated at a 10% compounded yearly is… (show calc) When interest rates increase the price of a fixed coupon bond increase/decrease/no change. Why? If interest rates are ...

... compounded interest rate I receive is equal to … The Net Present Value of 100 euros that I will be receiving in three years time calculated at a 10% compounded yearly is… (show calc) When interest rates increase the price of a fixed coupon bond increase/decrease/no change. Why? If interest rates are ...

Chapter 1 - Practice Questions 1. Financial assets

... C) contribute to the country's productive capacity both directly and indirectly D) do not contribute to the country's productive capacity either directly or indirectly E) are of no value to anyone 2. The net wealth of the aggregate economy is equal to the sum of _________. A) all financial assets B) ...

... C) contribute to the country's productive capacity both directly and indirectly D) do not contribute to the country's productive capacity either directly or indirectly E) are of no value to anyone 2. The net wealth of the aggregate economy is equal to the sum of _________. A) all financial assets B) ...

TMA Europe Conference will be held at the Landmark Hotel

... Bond market rapidly filling the lending void Down cycle prolonged by not taking pain early Overall drag on economic growth ...

... Bond market rapidly filling the lending void Down cycle prolonged by not taking pain early Overall drag on economic growth ...

Module2.3

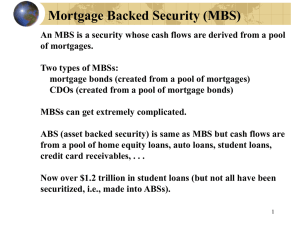

... ABS (asset backed security) is same as MBS but cash flows are from a pool of home equity loans, auto loans, student loans, credit card receivables, . . . Now over $1.2 trillion in student loans (but not all have been ...

... ABS (asset backed security) is same as MBS but cash flows are from a pool of home equity loans, auto loans, student loans, credit card receivables, . . . Now over $1.2 trillion in student loans (but not all have been ...

Public-private partnerships (PPPs) are complex, long

... services either to the government unit or to the general public on behalf of the public unit. Public-private partnership recorded off-balance sheet of government means that the assets are not considered as economically owned by government and the gross-fixed capital formation is not recorded as an e ...

... services either to the government unit or to the general public on behalf of the public unit. Public-private partnership recorded off-balance sheet of government means that the assets are not considered as economically owned by government and the gross-fixed capital formation is not recorded as an e ...

Assessment of alternative international monetary regimes

... Between 2007:4 and 2009:1, Net Foreign Assets drop by about USD 2.9 tr. US liabilities held up well (US issuer of the reserve currency, safe haven) and risky assets plummeted. A deterioration in the Net Foreign Asset position is a wealth transfer to the rest of the world. Similar to an insurance pay ...

... Between 2007:4 and 2009:1, Net Foreign Assets drop by about USD 2.9 tr. US liabilities held up well (US issuer of the reserve currency, safe haven) and risky assets plummeted. A deterioration in the Net Foreign Asset position is a wealth transfer to the rest of the world. Similar to an insurance pay ...

Credit_Crisis_and_the_Future_ of_ Accounting

... • Securitization market: This market is CLOSED • 85% of mortgages were funded through the securitization market in the better part of this decade. The seizure of this market has also severely impacted liquidity in credit card markets, student loans, corporate finance amongst others ...

... • Securitization market: This market is CLOSED • 85% of mortgages were funded through the securitization market in the better part of this decade. The seizure of this market has also severely impacted liquidity in credit card markets, student loans, corporate finance amongst others ...

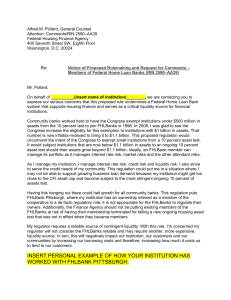

Alfred M. Pollard, General Counsel Attention: Comments/RIN 2590

... assets from the 10 percent test to join FHLBanks in 1998. In 2008, I was glad to see the Congress increase the eligibility for this exemption to institutions with $1 billion in assets. That number is now inflation-indexed to bring it to $1.1 billion. This proposed regulation would circumvent the int ...

... assets from the 10 percent test to join FHLBanks in 1998. In 2008, I was glad to see the Congress increase the eligibility for this exemption to institutions with $1 billion in assets. That number is now inflation-indexed to bring it to $1.1 billion. This proposed regulation would circumvent the int ...

Presentation - British Institute of International and Comparative Law

... adequate remuneration for the State, at least equivalent to the remuneration of State capital; coverage of the losses incurred from the valuation of the assets at real-economic-value by the bank benefiting from the scheme; aligning incentives for banks to participate in asset relief with public poli ...

... adequate remuneration for the State, at least equivalent to the remuneration of State capital; coverage of the losses incurred from the valuation of the assets at real-economic-value by the bank benefiting from the scheme; aligning incentives for banks to participate in asset relief with public poli ...

Lecture slides

... • The trigger: The issuance of risky assets, with undervaluation of risk. Subprime mortgages. Causes? Large world demand for safe assets, and bad regulation. • The determinants of amplification. – Complexity and opacity of assets on balance sheets of financial institutions, so low liquidity. Causes? ...

... • The trigger: The issuance of risky assets, with undervaluation of risk. Subprime mortgages. Causes? Large world demand for safe assets, and bad regulation. • The determinants of amplification. – Complexity and opacity of assets on balance sheets of financial institutions, so low liquidity. Causes? ...

The Federal Reserve extended through October 30, 2009, its

... for which the borrower serves as the sponsor and pledge that paper under this facility Because bank holding companies and state member banks will bear no credit or market risk in their holdings of ABCP under this facility, the holdings will not be assessed any regulatory capital charge. – Risk trans ...

... for which the borrower serves as the sponsor and pledge that paper under this facility Because bank holding companies and state member banks will bear no credit or market risk in their holdings of ABCP under this facility, the holdings will not be assessed any regulatory capital charge. – Risk trans ...

Developments and Issues in the Canadian Market

... in the multi-seller ABCP issuance programs that they sponsor. The question of how much exposure is to be brought onto their balance sheets (i.e., consolidated) may depend in part upon the amount of credit-risk protection embedded in any liquidity enhancements provided by the sponsoring bank. It seem ...

... in the multi-seller ABCP issuance programs that they sponsor. The question of how much exposure is to be brought onto their balance sheets (i.e., consolidated) may depend in part upon the amount of credit-risk protection embedded in any liquidity enhancements provided by the sponsoring bank. It seem ...

Asset-Backed Commercial Paper

... The rise in securitisation has led to the growth of short-term instruments backed by the cash flows from other assets, known as asset-backed commercial paper (ABCP). Securitisation is the practice of using the cash flows from a specified asset, such as residential mortgages, car loans or commercial ...

... The rise in securitisation has led to the growth of short-term instruments backed by the cash flows from other assets, known as asset-backed commercial paper (ABCP). Securitisation is the practice of using the cash flows from a specified asset, such as residential mortgages, car loans or commercial ...

Hvordan den perfekte storm væltede de finansielle markeder

... Egypt. And Joseph went out from before the face of Pharaoh and went through all the land of Egypt. Now in the seven good years the earth gave fruit in masses. And Joseph got together all the food of those seven years, and made a store of food in the towns: the produce of the fields round every town ...

... Egypt. And Joseph went out from before the face of Pharaoh and went through all the land of Egypt. Now in the seven good years the earth gave fruit in masses. And Joseph got together all the food of those seven years, and made a store of food in the towns: the produce of the fields round every town ...