LIQUIDITY

... - Can provide liquidity through maturing securities, sale of securities for cash, pledging securities as collateral Asset Securitization - Transformation of a pool of assets into cash - Involves the transfer or sale of on-balance sheet assets to a third party who issues asset backed securities that ...

... - Can provide liquidity through maturing securities, sale of securities for cash, pledging securities as collateral Asset Securitization - Transformation of a pool of assets into cash - Involves the transfer or sale of on-balance sheet assets to a third party who issues asset backed securities that ...

Wilson Kattelus

... Any unrealized gains or losses arising from fair value reporting are shown on the operating statement (statement of activities or statement of revenues, expenses and changes in fund net assets) ...

... Any unrealized gains or losses arising from fair value reporting are shown on the operating statement (statement of activities or statement of revenues, expenses and changes in fund net assets) ...

Fixed Assets - RMIT University

... – If the equipment or item purchase for an existing asset (provided it is capital in nature), the existing asset number should be clearly quoted on the PO request. • Capital expenditure incorrectly coded to operating. What should I do? – In order to transfer from operating expense to capital, first ...

... – If the equipment or item purchase for an existing asset (provided it is capital in nature), the existing asset number should be clearly quoted on the PO request. • Capital expenditure incorrectly coded to operating. What should I do? – In order to transfer from operating expense to capital, first ...

Liquidity-measuring

... quickly – either cash in a current account or an asset that can easily be turned into cash to pay bills • This availability of cash is compared to the known, upcoming bills to assess ‘liquidity’ • This information is found on the ‘balance sheet’ or ‘statement of financial position’ ...

... quickly – either cash in a current account or an asset that can easily be turned into cash to pay bills • This availability of cash is compared to the known, upcoming bills to assess ‘liquidity’ • This information is found on the ‘balance sheet’ or ‘statement of financial position’ ...

STS Capital Calibrations

... Our working assumption is that if this sequence of legislative change is followed, with capital calibrations for “best-in-class STS securitisations” being significantly increased for banks and not reduced for insurance companies, not only will the Commission’s goal not be achieved but the securitisa ...

... Our working assumption is that if this sequence of legislative change is followed, with capital calibrations for “best-in-class STS securitisations” being significantly increased for banks and not reduced for insurance companies, not only will the Commission’s goal not be achieved but the securitisa ...

Intangible assets

... International practices for long-lived assets are sometimes very different from those in the United States. Some of the key differences between IFRS and GAAP relate to the revaluation of tangible assets, investment property, capitalization of intangible development costs, and impairments ...

... International practices for long-lived assets are sometimes very different from those in the United States. Some of the key differences between IFRS and GAAP relate to the revaluation of tangible assets, investment property, capitalization of intangible development costs, and impairments ...

Chapter Seventeen

... A bank run is an unexpected increase in deposit withdrawals from a bank. Bank runs can be triggered by several economic events including (a) concern’s about solvency relative to other banks, (b) failure of related banks, and (c) sudden changes in investor preferences regarding the holding of nonbank ...

... A bank run is an unexpected increase in deposit withdrawals from a bank. Bank runs can be triggered by several economic events including (a) concern’s about solvency relative to other banks, (b) failure of related banks, and (c) sudden changes in investor preferences regarding the holding of nonbank ...

part 3: decision-makers in the financial system

... (i.e., CR - CE = surplus or deficit). Deficits generate a need for borrowing, while surpluses generate funds for lending in the financial system. For each of these sectors, income-expenditure statements, which show incomes (or revenues) and expenditures during a given period of time, and balance she ...

... (i.e., CR - CE = surplus or deficit). Deficits generate a need for borrowing, while surpluses generate funds for lending in the financial system. For each of these sectors, income-expenditure statements, which show incomes (or revenues) and expenditures during a given period of time, and balance she ...

Form 1139A - Statement of Assets and Liabilities Position

... This information is needed so that we can assess your total net value of assets required for the Business Innovation and Investment (Provisional) subclass 188 visa. Applicants under the Business Innovation Stream are required to provide 1 statement to evidence that the applicant and/or their spouse ...

... This information is needed so that we can assess your total net value of assets required for the Business Innovation and Investment (Provisional) subclass 188 visa. Applicants under the Business Innovation Stream are required to provide 1 statement to evidence that the applicant and/or their spouse ...

Bharadwaj Institute Pvt Ltd. Assignment on 9841537255 www

... Gross profit for the year ended 31st December, 2009 amounting to Rs.4,00,000. Closing stock of the year is Rs.10,000 more than the opening stock. Bills receivable amount to Rs.25,000. Bills payable amount to Rs.10,000. ...

... Gross profit for the year ended 31st December, 2009 amounting to Rs.4,00,000. Closing stock of the year is Rs.10,000 more than the opening stock. Bills receivable amount to Rs.25,000. Bills payable amount to Rs.10,000. ...

IDENTIFYING & MANAGING SYSTEMIC RISK

... • With the above sequence affecting many market players, booms and busts amplified • Current crisis – large aggregate maturity transformation by banks, investment banks and shadow banking sector: SIVs, Conduits funded long term investments with short term notes. Investment banks - value of outs ...

... • With the above sequence affecting many market players, booms and busts amplified • Current crisis – large aggregate maturity transformation by banks, investment banks and shadow banking sector: SIVs, Conduits funded long term investments with short term notes. Investment banks - value of outs ...

Citco Bank Canada Leverage Ratio Public Disclosure for Q1 2017

... CITCO BANK CANADA – LEVERAGE RATIO PUBLIC DISCLOSURE CITCO BANK CANADA As at Q1 2017 (in thousands of Canadian Dollars) ...

... CITCO BANK CANADA – LEVERAGE RATIO PUBLIC DISCLOSURE CITCO BANK CANADA As at Q1 2017 (in thousands of Canadian Dollars) ...

on one asset relative to alternative assets

... an asset or wether to buy one asset rather than another, an individual must consider the following factors: 1. Wealth, the total resources owned by the individual, including all assets 2. Expected return (the return expected over the next period) on one asset relative to alternative assets ...

... an asset or wether to buy one asset rather than another, an individual must consider the following factors: 1. Wealth, the total resources owned by the individual, including all assets 2. Expected return (the return expected over the next period) on one asset relative to alternative assets ...

Competency Standard

... Assessment Methods The following methods may be used to assess competency for this unit: ...

... Assessment Methods The following methods may be used to assess competency for this unit: ...

download

... Returns and Risk of Different Asset Classes • Measuring risk by probability of not meeting your investment return objective indicates risk of equities is small and that of T-bills is large because of their differences in expected returns • Focusing only on return variability as a measure of risk ig ...

... Returns and Risk of Different Asset Classes • Measuring risk by probability of not meeting your investment return objective indicates risk of equities is small and that of T-bills is large because of their differences in expected returns • Focusing only on return variability as a measure of risk ig ...

www.btaconf.kz

... 〇 In its interim report announced July 24 of this year, JSDA’s Working Group on Distributions of Securitized Products indicated the intention to formulate self-regulatory rules. ( Towards formulation of self-regulatory rules) A. A Unified Information Disclosure Format will be created to indicate the ...

... 〇 In its interim report announced July 24 of this year, JSDA’s Working Group on Distributions of Securitized Products indicated the intention to formulate self-regulatory rules. ( Towards formulation of self-regulatory rules) A. A Unified Information Disclosure Format will be created to indicate the ...

Optimal investment in current asset is part of the

... right amount of investment in current assets and appropriate level of short term financing. Excessive investment in current assets means lack of funds to invest elsewhere which will effect the liquidity aspect of the company, while too little investment means inability to service the growing demand ...

... right amount of investment in current assets and appropriate level of short term financing. Excessive investment in current assets means lack of funds to invest elsewhere which will effect the liquidity aspect of the company, while too little investment means inability to service the growing demand ...

An intangible asset

... 3 An intangible asset may only be revalued if it is part of an active market. An active market is one in which items traded are homogenous, willing buyers and sellers are available and prices are availableto the public. 4 Internally generated goodwill, brands, mastheads, publishing titles and custo ...

... 3 An intangible asset may only be revalued if it is part of an active market. An active market is one in which items traded are homogenous, willing buyers and sellers are available and prices are availableto the public. 4 Internally generated goodwill, brands, mastheads, publishing titles and custo ...

Innovation in the Asset Management Industry: Risk

... day=0 for the same asset. Non-trading thus artificially creates a smaller beta. Gompers-Lerner attempt to rectify with time series of returns as surrogate to actual trading using best estimate of change in price from observable data. More advanced approach would be a Brownian Bridge estimation model ...

... day=0 for the same asset. Non-trading thus artificially creates a smaller beta. Gompers-Lerner attempt to rectify with time series of returns as surrogate to actual trading using best estimate of change in price from observable data. More advanced approach would be a Brownian Bridge estimation model ...

Liquidity Coverage Ratio (NSFR)

... and that, in addition to ample capital, banks need appropriate liquidity buffers to manage ongoing demands of their clients and ...

... and that, in addition to ample capital, banks need appropriate liquidity buffers to manage ongoing demands of their clients and ...

FINANCING WORKING CAPITAL The financing of working capital is

... the risk involved in debt-financing is also high as the company is liable to pay the fixed interest periodically. Whereas in equity financing, the risk is comparatively lower than debt financing because there is no fixed obligation on the part of the company to pay periodically their dividends. If t ...

... the risk involved in debt-financing is also high as the company is liable to pay the fixed interest periodically. Whereas in equity financing, the risk is comparatively lower than debt financing because there is no fixed obligation on the part of the company to pay periodically their dividends. If t ...

Balance Mechanics and Macroeconomic Paradoxes

... if there is excess planned saving through revenue surpluses, there will be an excess supply of goods and services, labour, and/or a shortfall in capital income, which in case of debt instruments amounts to default decline in revenues increases risk of default link to other paradoxes ...

... if there is excess planned saving through revenue surpluses, there will be an excess supply of goods and services, labour, and/or a shortfall in capital income, which in case of debt instruments amounts to default decline in revenues increases risk of default link to other paradoxes ...

File

... Letter of Credit- Promise to make payment to a party upon presentation of a draft or bill. Standby Letter of Credit- guarantees that the bank will make funds available if the company cannot or doesn’t wish to meet a major financial obligation Reverse Repurchase Agreement- Corporate investment ...

... Letter of Credit- Promise to make payment to a party upon presentation of a draft or bill. Standby Letter of Credit- guarantees that the bank will make funds available if the company cannot or doesn’t wish to meet a major financial obligation Reverse Repurchase Agreement- Corporate investment ...

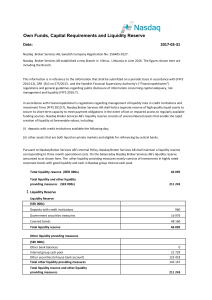

Own Funds, Capital Requirements and Liquidity Reserve

... 2014:12), CRR (EU) no 575/2013, and the Swedish Financial Supervisory Authority’s (“Finansinspektionen”) regulations and general guidelines regarding public disclosure of information concerning capital adequacy, risk management and liquidity (FFFS 2010:7). In accordance with Finansinspektionen's reg ...

... 2014:12), CRR (EU) no 575/2013, and the Swedish Financial Supervisory Authority’s (“Finansinspektionen”) regulations and general guidelines regarding public disclosure of information concerning capital adequacy, risk management and liquidity (FFFS 2010:7). In accordance with Finansinspektionen's reg ...