* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download FINANCING WORKING CAPITAL The financing of working capital is

Syndicated loan wikipedia , lookup

Federal takeover of Fannie Mae and Freddie Mac wikipedia , lookup

Debtors Anonymous wikipedia , lookup

Debt settlement wikipedia , lookup

Financial economics wikipedia , lookup

Shadow banking system wikipedia , lookup

Asset-backed commercial paper program wikipedia , lookup

Household debt wikipedia , lookup

Business valuation wikipedia , lookup

Early history of private equity wikipedia , lookup

Investment fund wikipedia , lookup

Interbank lending market wikipedia , lookup

Private equity secondary market wikipedia , lookup

Securitization wikipedia , lookup

Government debt wikipedia , lookup

Private equity wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Systemic risk wikipedia , lookup

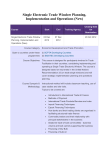

FINANCING WORKING CAPITAL The financing of working capital is of utmost important. What portion of current assets should be financed by current liabilities? What portion should be financed by long-term resources? Decisions on these questions will determine the financing mix. Approaches to financing mix: There are 3 basic approaches to determine an appropriate financing mix. They are a. Hedging or Matching approach. b. Conservative approach. c. Trade-off between the above two. a. Hedging approach: The term hedging can be said to refer to a process of matching maturities of debt with the maturities of financial needs. According to this approach, the maturity of the sources of funds should match the nature of the assets to be financed. For the purpose of analysis, the assets can be broadly classified into two classes: 1. Those assets which are required in a certain amount for a given level of operation and hence do not vary over time 2. Those assets which fluctuate over time The hedging approach suggests that the long-term funds should be used to finance the fixed portion of current assets requirements. Purely temporary requirements, i.e., the seasonal variations over and above the permanent financing needs should be appropriately financed with short-term funds. b. Conservative approach: This approach suggests that the estimated requirements of total funds should be met from long-term sources; the use of short-term funds should be restricted to only emergency situations or when there is an unexpected outflow of funds. c. Aggressive approach: This approach uses more of short-term funds to finance even the permanent current assets. The following chart gives a summary of the relative costs and benefits of the three different approaches: Hedging Approach Liquidity Moderate Profitability Moderate Risk Moderate Factors Conservative Approach More Less Less Aggressive Approach Less More More The risk preferences of the management shall decide the approach to be adopted. The risk-neutral will adopt the hedging approach, the risk averse the conservative approach and the risk seekers will adopt the aggressive approach. Debt Vs Equity Debt financing involves both short-term debt and long-term debt and equity financing involves only long-term financing. The financing mix of the working capital depends upon the risk preferences of the management. Cost of different type of funds, the long-term and short-term, the return on different type of current assets, risk-bearing ability of the concern, liquidity, levels etc., have to be considered to decide the financing of working capital. Debt financing involves fixed interest rates and allowed as an expense for tax purposes. But the risk involved in debt-financing is also high as the company is liable to pay the fixed interest periodically. Whereas in equity financing, the risk is comparatively lower than debt financing because there is no fixed obligation on the part of the company to pay periodically their dividends. If the company has sufficient profits, they can decide to pay dividends. They may even decide to retain their earnings to finance future requirements. But the cost of financing through equity would be higher as they are not allowed as an expense for tax purposes. Companies adopting hedging approach would optimally use long-term funds to finance fixed portion of current assets requirement. In manufacturing companies there may be requirement to always maintain some amount of inventory in raw materials or finished goods to ensure smooth production and business. This fixed portion of current assets may be financed through either debt or equity after evaluating the costs of both types of financing. Whereas, other temporary current assets may be financed through current liabilities or short-term funds like bank-overdraft, short-term loans, accounts payable etc. Companies adopting aggressive approach may finance even the fixed portion of their current assets through short-term funds or may take risk by financing through accounts or notes payables. Companies adopting conservative approach will take less risk and finance even their temporary portion of current assets through long-term sources of finance and especially equity to lesser the risk. Thus, we can say that the risk preference of the company management decides the financing mix of working capital. SOURCE: http://www.tutorsonnet.com/homework_help/working_capital_management/debt_vs_equity_ online_tutoring.htm