* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download ECFS845

Syndicated loan wikipedia , lookup

International investment agreement wikipedia , lookup

Trading room wikipedia , lookup

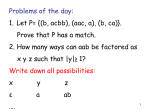

Private equity secondary market wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Beta (finance) wikipedia , lookup

Business valuation wikipedia , lookup

Land banking wikipedia , lookup

Financial economics wikipedia , lookup

Short (finance) wikipedia , lookup

Stock valuation wikipedia , lookup

Securities fraud wikipedia , lookup

Stock trader wikipedia , lookup

ECFS845 - Applied Portfolio Management Dimensional Fund Advisers – DFA Fund Client Part 1 – What are the major finance ideas and inventions employed by DFA? 1. Portfolio selection model (Harry Markowitz, 1952) Rather than seeking to track specific indexes, DFA creates its own indexes to provide more flexibility in how and when to buy or sell stocks. DFA focuses on diversification to reduce risk and seeks to minimise adverse stock selection by paying careful attention to ensure there is no negative private information known to the seller but not to the market. Consistent with Markowitz’s formal model of portfolio selection embodying diversification principles and the identification of an efficient set of portfolios based on the means and variances of stocks’ returns. 2. Investments and capital stucture (Merton Miller and Franco Modigliani, 1961) and tax management Miller and Modigliani Theorem essentially states that a firm’s value is unrelated to its dividend policy and dividend policy is an unreliable guide for stock selection. DFA seeks to increase after-tax returns by decreasing taxes though the reduction of stock dividends and the timing of stock sales to reduce capital gains taxes. 3. Capital asset pricing model (CAPM): single-factor asset pricing risk/return model (William Sharpe, 1964) The CAPM defines risk as volatility relative to market and serves as a theoretical model for evaluating risk and expected return of securities and portfolios. Along with this, there is an analysis of the covariance matrix of portfolio stocks to minimise residual variance. 4. Efficient Market Hypothesis (Eugene Fama, 1965) DFA believes in “passive” stock market investing which is based on the principle that the stock market is efficient and that over a given period, no one has the ability to consistently select stocks that would beat the market. Investors cannot identify superior stocks using fundamental analysis or price patterns. Even though DFA believes in efficient market hypothesis, it believes it can make more money by keeping transaction costs low to boost returns. This can be done through avoiding excessive trading such as selling stocks to long-term investors. Block trading also reduces liquidity costs. 5. Multi-factor asset pricing model (Eugene Fama and Kenneth French) Size effect: DFA launched a fund that invested passively in small-company stocks (US Micro Cap Portfolio) in 1981. This was based on the findings of the small cap anomaly by Rolf Banz who, in 1982-1983, found that small stocks had consistently outperformed large stocks from 1926 -1975. International size effect: Research also suggests that size effect exists in the UK and Japan which led to DFA’s introduction of international small stock funds. Value effect: DFA also focused on value stocks (low Price-Book [P/B] ratios). This was based on a series of previous academic research, including Basu (1980), Bhandari (1986), Rosenburg, Reid and Lanstein (1985) and Fama and French (1992, 1993). In 1992, Fama & French concluded that P/B ratio was the most powerful price variable for predicting stock returns and investors would need to also consider the P/B effect in addition to the size effect. Multi-factor asset pricing model: In 1993, Fama & French showed that beta risk along with the size effect and the value-growth effect explained a large common variation in stocks, this is known as the Fama & French Three Factor Model (Excess returns = α + 1.[E(Rm)-rf] + 2.small-big stocks + 3.value-growth stocks). The multifactor model is an attempt to improve on the previous CAPM. Along with Professor James Davis, Fama & French found that the P/B effect was robust during 1926-1962 and exists in every country studied. This led to DFA’s introduction of international value funds. 6. Focuses on sound academic research/empirical analyses to develop innovative ideas. 7. DFA focuses on independent research which only became more popular in 1990s. Part 2 – What factors drive DFA’s investing success and business performance? DFA’s investing success and business performance is driven by its: Overall investment philosophy (strategic tactics). Trading Techniques (operational tactics). Overall Investment Philosophy DFA is a firm believer in efficient markets, and that no one can beat the market in the long term. They understand the importance of diversification and thus their products incorporate a large selection of stocks, often replicating an existing index or an index which they created themselves. They follow a value adding passive investment strategy in that their products do not accurately track the index from which they were initially created. This provides them flexibility in trading as they are not forced to sell securities when the composition of the index changes; they trade when the prices are most favourable. These best-price outcomes, coupled with lower transaction costs, give way for lower fees for their products. They do not conduct any fundamental analysis, which also contributes to lower fees. DFA’s products are generally long term investments and their use of Registered Investment Advisors (RIA) as intermediaries between them and short term investors ensure low turnover of funds and effectively keeps out “hot money”. DFA engages in Academic Based Research. Their close ties with academia facilitate the flow of new and innovative ideas through to their investment practices. Notably many of DFA’s investment products are seen as reaping the benefits of efficient market anomalies e.g. Small Cap Funds, Deep Value Funds. Researchers are given some stake in the company so this ensures their research is sound and empirically tested. DFA established great transparency in their dealings by way of educating their RIA’s about the theories underlying their investment products so that they could sell it to the clients. The client in-turn provides invaluable feedback that DFA feeds back to researchers in enhancing the quality of their findings. Trading Techniques DFA believes in the ability of skilled trading techniques to contribute to profits even when the investment is passive. Whenever DFA want to buy securities, they wait for sellers to come to them rather than going to the open market and bidding up the price. This approach is beneficial for both parties. The market for Small Cap securities is generally quite illiquid so DFA serves as a market maker and ensuring securities were purchased at a discount. DFA also trades in blocks to avoid other trades in the same stock from driving down the price. Trading with trusted counterparties ensures they avoid the problem of adverse selection. If DFA ever had bad experiences with brokers they would blacklist them by placing their names in a “penalty box”. This practise was widely known in the investment community so counterparties never risked being anything other than transparent in their dealings. DFA show due diligence in their buying practices in that they avoid stocks of companies for which an announcement was due, and this ensures they are safe from negative surprise announcements. They also avoid companies where there are instances of insider sales. As a result of these strategies and tactics, DFA ensures they maximise their discounts, keep their transaction costs to a minimum and have well diversified portfolios. This has allowed them to provide low fee / high performance products for their clients. Part 3 – How could you combine DFA with your other investments? DFA is a deep value, Small Cap equity manager. Small Caps provide a riskier investment than Large Caps and are expected to outperform them over time. We would combine DFA with an investment in an indexed Large Cap fund (proportions optimised to maximize the portfolio’s Sharpe ratio). DFA would fit into our equities bucket which is benchmarked against the S&P 500 Index. We would rebalance the portfolio using futures, so that funds with DFA would be there as a long term investment. Fee discount for large investment would be required. After combining our investment managers we would closely monitor and manage the exposures to both (or more) portfolios. Being a sophisticated investor client, we are well aware of the cyclicality of markets, such as booms, busts and bubbles etc. As history has shown us, an exposure to small capitalised stocks/companies hurt performance during the 1980s and early 1990s, as well as significant underperformance of value oriented stocks during the ‘dot com’ boom of the late 1990s. During times where the market environment would not suit a particular investment style/exposure we would allocate more monies to other more appropriate investment manager(s). This will be done through Tactical Manager Allocation (TMA – but not specifically TAA), whereby we would tactically manage the weighting and thus exposure/contribution from each of the portfolio managers within our aggregate portfolio. Part 4 – Would you select DFA as your investment manager? Explain your answer. Commencing our analysis with a quote: “They have great funds, great disclosure, lots of deep thinking... but they have an attitude problem.” - Financial planner This quote came from a financial planner who was applying to be one of DFA’s Registered Investment Advisors (RIA), but was subsequently rejected. We believe that this quote sums up DFA quite well. Their products are backed by academia and are fundamentally sound. However, they are exclusive and extremely selective with whom they deal with. This is highlighted by their 96th ranking in the top 100 Firms Ranked by Worldwide Assets. There is no quest for DFA to seek additional volume, obviously preferring to focus on “quality and not quantity”. Firstly, let’s establish who WE are to put our decision into perspective. We are a large superannuation fund with around $1 billion in Funds Under Management. We are an active fund manager, but will also maintain a strategic position of 35% ($350 million) minimum at any one time in each of our investments (DFA and another large cap growth manager). This eliminates the prospect of investment being ‘hot money’ from DFA’s perspective. No fundamental analysis involved – firm believers of the Efficient Market Hypothesis. As a result, a lower fee structure for the reduced effort. We believe that experts such as DFA, with their research prowess would provide products with superior performance. We are focused on long term investments, especially with DFA, as we want exposure to the anomalies that DFA is trying to exploit. We like the amount of due diligence involved in DFA’s investment process. o Firstly, they generally would not buy stocks if there is a news announcement coming in the near future. o Secondly, DFA would look to avoid stocks that were likely to negatively surprise in the near future by doing a thorough investigation of a stock – examination of a company’s reports. o Finally, DFA minimise adverse selection by paying careful attention to its sellers and the nature of the stock blocks traded. Build relationships on trust and reputation, e.g. ‘Penalty Box’. We are impressed with DFA trading style and techniques to ensure long run optimisation in terms of transaction and market impact cost are kept to a minimum. As history and DFA’s track record shows (as well as the analysis of our group in previous questions): Value stocks outperform growth stocks over time (Value Risk Premium) and Small Cap stocks outperform Large Cap stocks (Small Cap Premium) over time. The final answer is that we would select DFA as our fund manager. Predominantly due to the fact that they value trust and focus on providing a high quality service to their clients with a relatively low fee structure. Being a superannuation fund with people’s savings, we see these features as of utmost importance.