ECONOMIC GOALS

... 3. Decisions are made by the federal open market committee. 4. Interest rates have increased by .0075 within the last year. 5. The effect will be to slow down the rate of growth of output. 6. The effect will be felt on durable goods because their purchase is interest rate sensitive. 7. A reduction i ...

... 3. Decisions are made by the federal open market committee. 4. Interest rates have increased by .0075 within the last year. 5. The effect will be to slow down the rate of growth of output. 6. The effect will be felt on durable goods because their purchase is interest rate sensitive. 7. A reduction i ...

Jamaica_en.pdf

... The world economic crisis has seriously exacerbated Jamaica’s already dire economic situation and the government is in negotiation with the International Monetary Fund (IMF) for an agreement in the amount of US$ 1.2 billion, or 10% of the country’s GDP. Underlying these difficulties are chronic fisc ...

... The world economic crisis has seriously exacerbated Jamaica’s already dire economic situation and the government is in negotiation with the International Monetary Fund (IMF) for an agreement in the amount of US$ 1.2 billion, or 10% of the country’s GDP. Underlying these difficulties are chronic fisc ...

END - University of Victoria

... 11. If the current yen-to-dollar exchange rate (for example, 200 yen per dollar) is above a fixed exchange rate set by the Bank of Canada (for example, 150 yen per dollar), arbitragers can make profits by: a. buying yen in foreign exchange markets and selling them to the Bank of Canada; b. buying ye ...

... 11. If the current yen-to-dollar exchange rate (for example, 200 yen per dollar) is above a fixed exchange rate set by the Bank of Canada (for example, 150 yen per dollar), arbitragers can make profits by: a. buying yen in foreign exchange markets and selling them to the Bank of Canada; b. buying ye ...

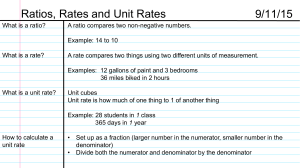

Ratios, Rates, and Unit Rates Ratios, Rates and Unit Rates

... Ratios, Rates and Unit Rates (cont.) Example: 657 Meeker students in 3 grades 657 Meeker students ...

... Ratios, Rates and Unit Rates (cont.) Example: 657 Meeker students in 3 grades 657 Meeker students ...

Surviving a currency crisis

... financials in stronger currencies such as the US dollar or euro. However, the risks facing businesses in times of currency volatility extend beyond these aspects, often into areas that are not immediately obvious. Businesses could be affected even if they don’t trade overseas. They need to be aware ...

... financials in stronger currencies such as the US dollar or euro. However, the risks facing businesses in times of currency volatility extend beyond these aspects, often into areas that are not immediately obvious. Businesses could be affected even if they don’t trade overseas. They need to be aware ...

ch01 - Class Index

... indexes, on metals, interest rates, or on futures contracts Futures contracts trade on products such as ...

... indexes, on metals, interest rates, or on futures contracts Futures contracts trade on products such as ...

Chapter 3

... The Greek/EU Debt Crisis • The EU established exchange rate stability and financial integration with the adoption of the euro but each country gave up monetary independence. • However, each country still controls its own fiscal policy and sovereign debt is denominated in euros and thus impacts the ...

... The Greek/EU Debt Crisis • The EU established exchange rate stability and financial integration with the adoption of the euro but each country gave up monetary independence. • However, each country still controls its own fiscal policy and sovereign debt is denominated in euros and thus impacts the ...

What Is a Purchasing Power Parity?

... is that each has its own currency. The situation is further complicated because each country’s economic structure and stage of development may lead to price level differences as well. The System of National Accounts provides the framework for every country and economy to provide consistent measures ...

... is that each has its own currency. The situation is further complicated because each country’s economic structure and stage of development may lead to price level differences as well. The System of National Accounts provides the framework for every country and economy to provide consistent measures ...

Circular Flow

... • The balance of payments must balance—that is, Current Account + Financial Account = 0 • If there is a current account deficit, then there must be a financial account surplus that exactly offsets that deficit. – If we buy more goods and services from foreigners than they buy from us, we have to bor ...

... • The balance of payments must balance—that is, Current Account + Financial Account = 0 • If there is a current account deficit, then there must be a financial account surplus that exactly offsets that deficit. – If we buy more goods and services from foreigners than they buy from us, we have to bor ...

International Trade

... Exchange rates are very important to people involved in international trade, tourism, and investment. That is why changes in the rates are posted daily and experts are hired to predict possible changes in the future. ...

... Exchange rates are very important to people involved in international trade, tourism, and investment. That is why changes in the rates are posted daily and experts are hired to predict possible changes in the future. ...

Economics - APAblog.org

... to work but do not have a job during a given period of time Participation Rate: A measure of the active portion of an economy's labor force. The participation rate refers to the number of people who are either employed or are actively looking for work. ...

... to work but do not have a job during a given period of time Participation Rate: A measure of the active portion of an economy's labor force. The participation rate refers to the number of people who are either employed or are actively looking for work. ...

Mexican Financial Crisis - Department of Biological Sciences

... They learned not to overvalue their currency for fear of another great devaluation and start floating exchange rate ...

... They learned not to overvalue their currency for fear of another great devaluation and start floating exchange rate ...

Midterm answers

... and the long-term financial account has debits exceeding credits by $30, then the country’s balance on current account is (a) $-120. (b) $-90. (c) $-75. (d) $-60. 19. The multiplier (∆Y /∆I) is smaller in a model with imports and exports because ...

... and the long-term financial account has debits exceeding credits by $30, then the country’s balance on current account is (a) $-120. (b) $-90. (c) $-75. (d) $-60. 19. The multiplier (∆Y /∆I) is smaller in a model with imports and exports because ...

THE CONTINENTAL ECONOMICS INSTITUTE The world economy

... euro and the Chinese yuan have been weak. See US dollar index, euro exchange rate (dollars per euro) and yuan exchange rate (yuan per dollar) below: ...

... euro and the Chinese yuan have been weak. See US dollar index, euro exchange rate (dollars per euro) and yuan exchange rate (yuan per dollar) below: ...

Lecture 2 (POWER POINT)

... Exchange Rate Markets: Brief Introduction • A spot contract is a binding commitment for an exchange of funds, with normal settlement and delivery of bank balances following in two business days (one day in the case of North American currencies). • A forward contract, or outright forward, is an agre ...

... Exchange Rate Markets: Brief Introduction • A spot contract is a binding commitment for an exchange of funds, with normal settlement and delivery of bank balances following in two business days (one day in the case of North American currencies). • A forward contract, or outright forward, is an agre ...

Trade, Exchange Rates, and Public Policy

... changes in foreign capital if it is supported by sound domestic fiscal policy, relatively low foreign debt to GDP, and substantial foreign reserves. Without these supports, however, the country would need capital controls or face the possibility of a “run” on its currency if speculators believed tha ...

... changes in foreign capital if it is supported by sound domestic fiscal policy, relatively low foreign debt to GDP, and substantial foreign reserves. Without these supports, however, the country would need capital controls or face the possibility of a “run” on its currency if speculators believed tha ...

DOC

... a) Is the price at which the bank is willing to sell a unit of foreign currency b) Is the price that the bank is willing to pay for a unit of foreign currency c) Is synonymous with the spread rate d) None of the above ...

... a) Is the price at which the bank is willing to sell a unit of foreign currency b) Is the price that the bank is willing to pay for a unit of foreign currency c) Is synonymous with the spread rate d) None of the above ...

United States

... Exchange Rate Markets: Brief Introduction • A spot contract is a binding commitment for an exchange of funds, with normal settlement and delivery of bank balances following in two business days (one day in the case of North American currencies). • A forward contract, or outright forward, is an agre ...

... Exchange Rate Markets: Brief Introduction • A spot contract is a binding commitment for an exchange of funds, with normal settlement and delivery of bank balances following in two business days (one day in the case of North American currencies). • A forward contract, or outright forward, is an agre ...

Monetary Policy - Diocesan College

... Is the economy growing or shrinking? Interest rates can either stimulate or decrease economic activity. Consumer confidence and business confidence Large impact on how much consumers spend & businesses invest. Growth of wages Higher wages can lead to inflation. Exchange rates A weaker exchange rat ...

... Is the economy growing or shrinking? Interest rates can either stimulate or decrease economic activity. Consumer confidence and business confidence Large impact on how much consumers spend & businesses invest. Growth of wages Higher wages can lead to inflation. Exchange rates A weaker exchange rat ...

Real Exchange Rate

... Real Exchange Rate This suggests that firms should primarily be concerned with changes in the real value of their dollar in foreign country. That is, the inflation-adjusted, or real, exchange rate: ...

... Real Exchange Rate This suggests that firms should primarily be concerned with changes in the real value of their dollar in foreign country. That is, the inflation-adjusted, or real, exchange rate: ...

exchange_rate_determination

... This may drive the currency lower, if markets expect further interventions, leading to an inflation-devaluation cycle. Sterilization in this case is not likely to work because investors will simply absorb the increased supply of domestic securities without depreciating the dollar. P.V. Viswanath ...

... This may drive the currency lower, if markets expect further interventions, leading to an inflation-devaluation cycle. Sterilization in this case is not likely to work because investors will simply absorb the increased supply of domestic securities without depreciating the dollar. P.V. Viswanath ...

seminsar_Mar10_Bhanupong

... of Thailand (SET) from 30% to 25% for three accounting years Corporate income tax cut for existing companies in the SET from 30% to 25% for profit below Bt300 million for three accounting years Depreciation allowance for machinery and equipment related to productions and services at 40% of costs ...

... of Thailand (SET) from 30% to 25% for three accounting years Corporate income tax cut for existing companies in the SET from 30% to 25% for profit below Bt300 million for three accounting years Depreciation allowance for machinery and equipment related to productions and services at 40% of costs ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.